Executive Summary

Strategic analysis entails research to explore the environment under which an organization operates. It is an effective method of testing the efficiency and effectiveness of an organization’s strategies. This paper discusses strategic analysis and its importance to organizations. A case study is done on Arabtec to apply the theory of strategic analysis. The tools used in strategic analysis such as PESTEL, SWOT, internal capabilities, and VRIO among others are all applied in this case study. The information needed to conduct this study is gathered through interviewing some staff members from the organization, company documents and magazines, and websites. The paper suggests the best strategy for the organization and identifies the key issues that should be addressed.

Introduction

Strategic analysis is a “process of conducting a study to understand the environment under which a business operates” (Henry, 2011, p. 93). The analysis seeks to understand how the organization interacts with its environment. This understanding helps in improving organizational efficiency and effectiveness through increased capacity of the organization to deploy resources intelligently (Chapman, 2013). Organizations should be careful when interpreting results from the strategic analysis. Friend and Zehle (2010) posit that one of the important aspects of “strategic analysis is choosing the tool to use to achieve the objectives of the analysis” (p. 112). The strategic analysis offers an effective method of testing the efficiency and effectiveness of an organization’s strategies while at the same time determining whether implementing the strategy will move the business forward in its targeted strategic objectives (Henry, 2011).

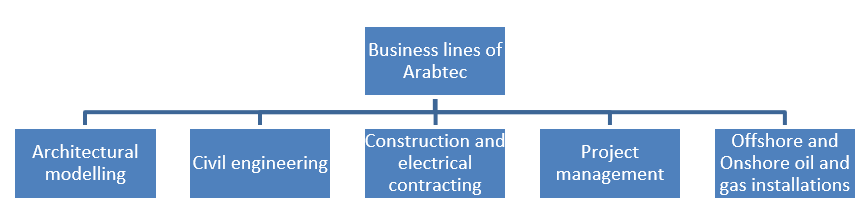

Arabtec was founded in 2004 by acquiring shares in some existing contractors in the United Arab Emirates. Therefore, it is a Public Joint Stock Limited Company (Gorgenländer, 2010). Its main objective is to offer solutions in the construction and engineering sector. Arabtec is a leading construction company known for all buildings and residential villas. Its other solutions include architectural modeling, civil works, managing projects, and electrical contracting and many others. The company has completed some large-scale projects in the construction industry for many clients, who are spread over private sector developers and public sector entities like the governments of Dubai and Abu Dhabi.

Companies in each Line

- Civil Engineering: Arabtec Precast, Australian Arabian Ready Mix Concrete Company, Arabtec engineering services LLC, Gulf Steel Industries

- Architectural and modeling: Polypod Middle East LLC

- Construction and Electrical Engineering: Emirates Falcon Electromechanical Company

- Project management: Arabtec Envirogreen Facility Management Services

- Offshore and onshore oil and gas installations: Target Engineering Construction Company

The company has its wholly-owned subsidiaries through which it executes various related services. These subsidiaries include Arabtec Construction, Arabtec Precast, Austrian Arabian Ready Mix Concrete (AAC), Arabtec Engineering Services, and Arabtec International Company (Arabtec Construction, 2015a). Its subsidiary, Arabtec Precast offers solutions in pre-cast structures and contracting while AAC manufactures and transports ready-mix concrete products. Arabtec Engineering provides services associated with infrastructural works including sewerage, stormwater drainage, and irrigation services.

Revenue Growth

The company saw a double growth in total revenues in 2008 to AED 9,721.68million from AED 4,272.85 million that it had earned in the previous year. The direct cost for the company increased substantially to AED 8,229.88 million. The net profit for 2008had increased by 79.0%, but exorbitant costs of operating and financial costs led to a decline of 9.9% in the net profit margin. These figures were reflected in the dividends where individual share earnings rose to AED 0.80 from AED 0.45in the previous year.

Strategic Directions and Goals

To counter the stiff competition and capture global opportunities, the company adopts an aggressive regional plan of expansion, which is mainly focusing on the markets in Asia and the Middle Eastern region. Arabtec is seeking to expand by engaging in partnerships with players in the local market. In Mauritius, it has partnered with AMN. The company is currently running projects in the UAE and the entire Middle East, Russia, and Pakistan. The company plans to focus on the neighboring markets, which include Abu Dhabi, Qatar, and Saudi Arabia to uphold its growth. Moreover, Arabtec is planning to retain valuable relationships with many of its customers for future opportunities.

The vision of the company is to become the leader in providing excellent services in construction in the UAE, the Middle East, North Africa, and globally. In its mission, the company wishes to form and maintain long-term and valued relationships with its clients and partners by offering excellent solutions in the construction sector while utilizing the best available resources and modern technologies. The business objective is to offer the highest standards of quality and service in their industry for the clients to get the best satisfaction that the company can offer. The following are some of the company’s smart goals and objectives:

Corporate Responsibility

Arabtec and its subsidiaries are committed to ensuring good corporate governance. It holds that good “corporate governance increases the shareholders’ value” (Arabtec Holding, 2015, par. 8). This strong governance begins with an autonomous, absorbed, devoted, and effectual board of directors. The board institutes observe and supervise standards and policies for the business to ensure compliance with ethics and set business practices.

The company’s Corporate Social Responsibility (CSR) is “a self-regulation mechanism, which is integrated into its business model” (Arabtec Holding, 2015, par. 7). Arabtec construction accepts “full responsibility for its impacts on the environment, population, and stakeholders” (Arabtec Holding, 2015, par. 9). The company is proactive in advancing the public’s interests by advocating growth ventures and development opportunities. The company volunteers to eliminate practices that affect the environment negatively regardless of legality. Through this policy, Arabtec deliberately “includes the interest of the public in its decision-making, thus devoting to the triple bottom line of sustainability, viz. people, planet, and profit” (Arabtec Holding, 2015, par. 7).

Purpose of the Study

This study is aimed at carrying out a strategic analysis of Arabtec Holdings using various strategic analysis tools and selects the best strategy that achieves the objectives. The tools used in this study are PESTEL, SWOT, Value Chain, Porter’s Five Forces, and VRIO. The study also identifies other important issues that may affect the company such as differentiation strategies, acquisitions, and key issues in the construction industry. Moreover, it makes some recommendations on these issues. Consequently, the report is organized to address all the highlighted issues.

Organization Analysis

- External Analysis (industry/macro-environment levels)

- The PESTEL Analysis

- This section considers the factors in the macro-environment that influence the decision-making process in the Arabtec using the PESTEL analysis model.

Political Factors

Construction companies operate in highly controlled political environments that favor the interests of clients more than that of the companies. This scenario plays out because the construction industry requires a safe environment coupled with the tendency of major construction companies to practice a monopolistic behavior. These two reasons force political authorities to exert restrictions over the construction industry. Some of the specific political factors that affect Arabtec include political instability across the Middle East, which makes it difficult for businesses to operate and the influence of Abu Dhabi as a capital city.

Economic Factors

For over twenty years, the construction sector has suffered from varying economic factors. Some of the factors include fluctuations in the prices of building materials, prolonged economic recessions, fluctuating currency rates, and changes in trade agreements. These factors affect operating costs and competition from other contractors. Consequently, profitability becomes unpredictable, thus subjecting the contractors to threats of closure and bankruptcy. These hard economic factors sometimes force mergers among the construction firms to increase operating efficiencies by creating synergies (Cooper & Finkelstein, 2011). For Arabtec, other economic factors include the fast-growing city of Abu Dhabi, the strengthening of Dirham against the US dollar, and free trade agreements with Asian nations that enable the creation of mergers to these regions cheaply.

Social-Cultural Factors

One very important social factor that Arabtec should pay attention to is the emergence of ‘generation y’ in the property market. This aspect is bringing some social-cultural changes such as instant gratification and entitlement. Therefore, there is an increased number of highly demanding clients asking for better services. Construction companies are thus forced to balance their costs with the increasing demands of these new customers.

Technological Factors

Construction firms use a wide range of technologies in their operations. Many innovations have been taken by construction companies across the world to improve performance and increase customer satisfaction. Most real estate developers nowadays prefer precast technology in building residential and commercial properties. This technology involves modules generated in the factory and transported to the site for assembling. This aspect reduces costs because it requires a limited workforce, and it is quick to build. The replication of this process helps the company to gain more for less.

Legal Factors

There have been increased the number of lawsuits filed by offended stakeholders and dissatisfied clients due to the breach of contract, environmental impacts, and safety issues. Managers in the construction firms including Arabtec should thus be aware of this increased legal awareness among project stakeholders. Besides, the construction industry regulators such as governments are also developing stricter laws to govern these companies, and thus they only authorize strategies that are fully convincing and compliant with the law.

Environmental Factors

Due to the increased social awareness of environmental pollution and safety, clients, and other project stakeholders know much about the impacts of the construction projects on their surroundings. Construction companies have to adopt environment-friendly operations or sustainable activities, which highly responds to the needs of the environment. Corporate social responsibility (CSR) initiatives are becoming considerable as activists and clients are watching the construction companies keenly.

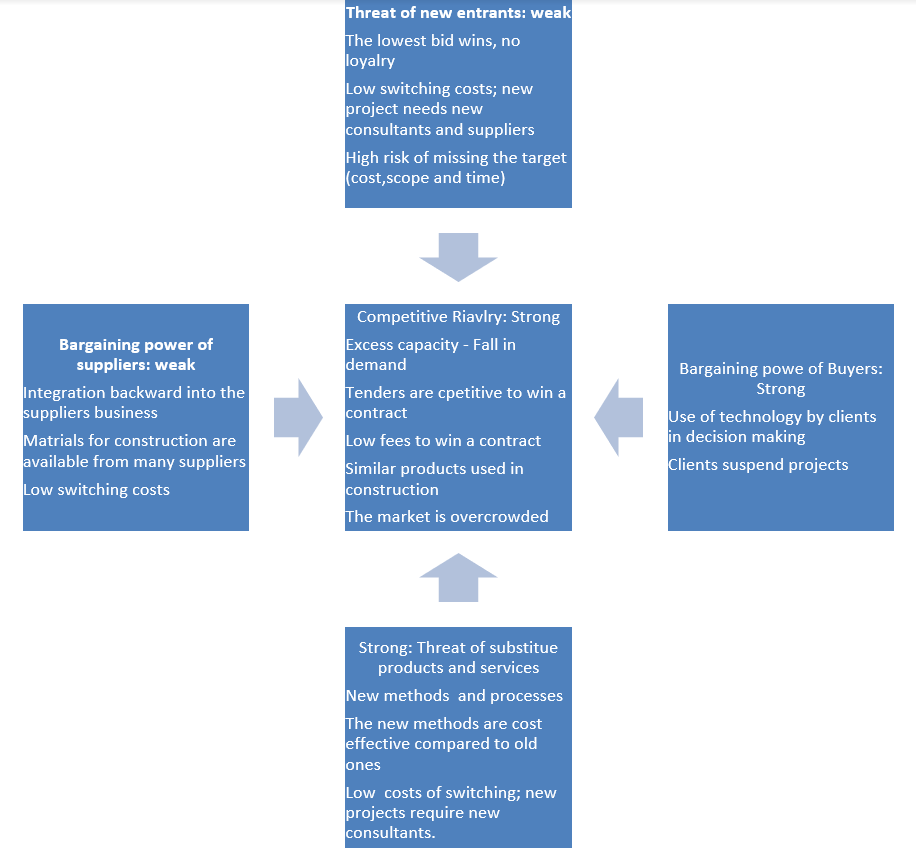

Porter’s Five Forces Analysis for Arabtec

The threat of new entrant: weak

- The switching costs are low, and thus a new project needs new consultants and suppliers

- The lowest bid wins the tenders, hence the lack of loyalty

- The risk of missing the target (cost, scope, and time) is very high

- The business requires high investment costs

- Experience curve takes a long time to gain

- It is difficult to achieve economies of scale

Bargaining power of Buyers: strong

- Clients suspend projects

- Use of technology by clients in the decision-making process

- The cost of the project is low due to crises

- The availability of many construction companies willing to handle any project

- Switching costs are low

Bargaining power of suppliers: weak

- Materials for construction are available from many suppliers

- Integrating backward into the suppliers’ business

- Low switching costs and barriers to entry

- Many construction and engineering firms and consultants have few projects

Threats of substitute products and services: Strong

- The new methods are cost-effective as opposed to the traditional ones

- New ways and processes

- Low costs of switching, whereby new projects require new consultants.

- Many firms are willing to carry out projects with similar or lower prices and better quality performance

Internal Analysis

Resources and Competencies

Arabtec has the following resources and competencies:

Physical facilities

The Company has a strong base of physical plants and equipment that are ultra-modern, thus enabling it to handle complex projects.

Intangible assets

The Company has strong brand names with a good reputation and IT infrastructure, which enable it to keep in touch with its clients and suppliers.

Human resource

The Company has strong leadership followed by a qualified and motivated workforce. The workforce is selected with an emphasis on the qualities rather than formal qualifications.

Financial position

The Company has a strong financial position, and thus it is in a position to meet all its capital expenditure.

Marketing and CSR

On top of building iconic structures, which market the company, it uses conventional channels of marketing to increase brand awareness. The company uses social media to get updates from its clients. Additionally, it has a corporate social responsibility policy committed to ensuring increased stakeholder value.

Culture

The Company has a strong culture that entails the involvement of employees by encouraging them to take initiatives. This move helps the company to get the best out of its employees.

Replication

The Company collaborates with other companies in its areas of interest to execute projects. This way, the company replicates its home expertise in new regions.

Design

The use of partnership enables the company to beat geographical challenges in new regions and deliver projects within time and costs.

Stores/Warehousing

The Company has partnered with suppliers who deliver materials on project sites in time. This aspect saves the company related warehousing costs.

Table: resources and competencies

Arabtec’s market position is backed by its strong financial position and strong plant and equipment base and qualified labor. Therefore, the company is highly ranked in the UAE, and it is an emerging global player in the construction industry. These outstanding resources have seen the company rise to recognition as one of the top entities in the industry.

The company has a reputable record of building the most iconic building projects across the Gulf region. The iconic projects executed have positioned the company as a leader in the building and construction industry. Therefore, the company has expertise in a wide range of projects such as

- Hotels such as the Palace Hotel in the Emirates

- Tall buildings like Burj Khalifa, which is the tallest tower in the world

- Interior design projects such as the Burj Al Arab Hotel

- Commercial property projects such as the Maritime City in Dubai and the DIFC Gate Village (Ramos, 2010).

- Petroleum industry (Oil and Gas installations)such as the Mubarraz Island Gas processing plant

- Sporting stadiums like the Ghantoot Grand Stadium and the Sports City stadium in Dubai

- Residential complexes and villas such as the Emirates Hills, Arabian Ranches, and Jumeira Beach Residence

- Mixed developments such as Al Waal City

- Marine and industrial projects such as the Abu Dhabi facility for shipbuilding

On the human resource base, the company has been increasing its workforce, with emphasis on retaining the best talent. The company has over forty thousand employees providing a broad range of skills. The company assigns a dedicated, focused, and the best expertise to each project. Arabtec has modern equipment and plant that enable it to handle diverse projects, by combining the latest technology and professional expertise.

VRIO Analysis

Arabtec gains much of its continuous competitive advantage from its organizational culture. It can replicate that aspect across the regions of operation. The elements constitute rare capabilities, which are difficult to imitate. The company’s record of accomplishment also attests to the view that the unique culture, leadership, and human resource practices are valuable strategic capabilities, which give the company a sustainable strategic edge. In purchasing, the company has a temporary competitive advantage because it receives the same benefits as other buyers (McGrath, 2013).

Value Chain Analysis

For over three decades since its launch, Arabtec has undergone remarkable growth, which has placed it as one of the leading contractors in the UAE and across the globe. This success has seen it being listed in the financial market. Arabtec remains the first and the only construction company to be listed in the country.

The company’s illustrious knowledge is being used in the construction of key projects being undertaken in the region. These achievements are due to the company’s reputation to deliver results within the stipulated timelines and the set budget. The company has been in a position to achieve this goal due to its exceptional technical competency. The company has maintained the best practices in the construction sector and an uncompromised approach to issues on environmental and safety standards. All these aspects are attributable to the company’s endeavor to satisfy its customers and create wealth for the stakeholders. Consequently, “the company’s turnover has seen a five-fold increase within five years” (Arabtec Construction, 2015b, par. 3).

Benchmarking

SWOT Analysis

Strengths

- The company has a strong financial position, and thus it can finance its capital expenditures

- It has a strong human capital and business culture, which cannot be imitated.

- It has a strong base of physical facilities, and thus it can handle complex projects

- The company has high levels of cash generation, and thus it meets its capital operations as well as debts.

- The company has a precast concrete plant hence matching the current market need

Weaknesses

- The company is associated with large-scale projects from large commercial developers, which may scare away potential clients from the middle-class developers

- Due to its large-scale operations, its services may be perceived as expensive.

Opportunities

- Huge investments in the real estate sector of the UAE due to the increasing oil prices. These investments offer great opportunities for the company.

- The UAE has a highly fragmented construction market.

- A growing need for precast housing technology

- Having long-term associations with the leading property developers is likely to help in managing receivables efficiently.

Threats

- The fortunes of the company are affected by the slowdown in the real estate activity, which is caused by the anticipated correction in the Dubai real estate market. This aspect may force the company not to launch some of the proposed projects in the future (Vogt, 2011).

- Political instability in the Gulf region is negatively affecting the infrastructure industry

- An increasing number of court cases in the construction industry places a higher probability that the company is likely to find itself in a court case.

- Strong bargaining power of buyers means that clients are highly evaluating contractor’s prices and will select the best available rate.

- There is a strong threat from substitute products. Many contractors can offer alternative services.

TOWS Matrix

Stakeholder Analysis

Board of Directors

The aspect of interest and power amongst the board of directors is extremely high. The CEO and board of directors are involved in the strategic planning and the decision-making process of Arabtec. In turn, they are entitled to bonuses and other benefits.

Employees

The power of employees is limited in the running of the company because they follow their manager’s directives. However, they are highly concerned about their job security, promotion prospects, and equitable pay. Therefore, employees can be involved in the organization’s activities like training opportunities and other fringe benefits.

Customers

The Arabtec’s customers enjoy medium power because their power in deciding the future of the company is limited. The customers also have a medium interest because they expect good services, low prices, correct information, and quality (Kimmich, 2012). Loyalty programs, frequent flyers preferring Arabtec to its competitors, and personal recognition can motivate the customers.

Chief Executive Officer

The CEO’s level of interest and power in the organization is the highest. He decides the strategy with the support of the board of directors.

Investors and Banks

The interest and power of investors in the day-to-day activities of the company are very important. They look for capital gains and the long-term growth of the company. Therefore, Arabtec can involve investors in the performance and accountability of its financial activities.

Community

The community has low- medium power. This section of stakeholders has a noteworthy influence on the decision-making of the organization. The community has many interests because it is looking for ethical behavior, social responsibility, environmental protection, and employment prospects in the organization.

Suppliers

Suppliers have low-moderate power because they are interested in looking for long-term contracts with a frequent and regular supply of orders.

Government

The government expects the company to adhere to the regulations of the construction industry. It also expects it to comply with tax remittance and labor laws. The company expects the government to provide a politically stable environment for carrying out businesses.

Stakeholder Mapping

Building Blocks of Competitive Advantage

Efficiency

The company offers quality construction services and delivers projects on time and within budget. Besides, the company has a strong base of state-of-the-art construction equipment and plants. All these aspects coupled with a qualified labor force ensure the efficiency of operations.

Customer Responsiveness

Arabtec has evolved with the changing client needs. The company is flexible in its services to the varying needs of customers in the construction industry. Therefore, it offers varying designs and gives a wide range of building materials. It maintains good relationships with its clients for future opportunities.

Innovation

Arabtec is rated as one of the UAE’s most innovative companies in the construction industry. It has taken many innovative steps to get better performance and increase satisfaction to its customers. The company has modern equipment and plants that enable it to handle diverse projects by combining the latest technology and professional expertise.

Quality

Arabtec believes that quality must involve all employees in the entire organization. The company seeks to become the best organization driven by customers. To keep pace with the fast growth as well as offer reliable processes in all the divisions of the project, the company has come up with reference manuals for its employees. It has also acquired ISO certifications. Arabtec strongly believes that this goal is only achievable through the commitment of its human resource base.

The company approaches its projects with a tailor-made quality control plan. This plan includes items such as artistry, filing of documents, storage of materials, submittals, as-built designs, and outstanding work. The plan further details procedures for testing and quality assurance for each project.

Strategic Choices and Evaluation

The strategic choice follows the strategic analysis. It involves developing strategic options like growth, diversification, acquisition, or concentration. It evaluates the available options to assess their relative merits and feasibility. At this stage, the strategy is selected (Murray-Webster & Williams, 2010). The selection of the strategy is likely to be influenced by the interests of managers and other parties who have interests in the organization. The following sections describe this process for Arabtec.

Differentiation Strategy

Besides being the first to be listed in the Dubai’s financial market, the company has invested heavily in modern equipment and plants that enable it to handle diverse projects by combining the latest technology and professional expertise. It is also known for retaining good relationships with its clients for future opportunities.

Strategic Alliances

The company is adopting a very aggressive regional plan of expansion, which is mainly focusing on the markets in Asia and the Middle Eastern region. Arabtec is seeking to expand by engaging in partnerships with players in the local market. For instance, in Qatar, it has collaborated with Bin Khaled Group, which is among the largest business conglomerates in the country. This partnership has led to the creation of Arabtec Qatar and the establishment of a ready-mix concrete plant. In Mauritius, the company has a partnership with AMN.

Alternative Strategies

Go Global

The company should go global to achieve the following

- Duplicate its business success in new markets – To achieve this goal, the company must give priorities to new markets depending on the number of customers and variables in the market.

- Achieve a competitive advantage by identifying great opportunities in a wide geographic area.

- Increased business volumes by securing businesses in the new markets increase revenues

- Wide business experience – Global markets give a wide exposure, and thus the project teams will gain multinational experiences

Evaluation

Suitability

Suitability is concerned with the general principles surrounding a given strategy. Suitability is assessed using SWOT, PESTEL, Porter’s Five Forces, or value chain analyses. A suitable strategy is the one that fits within the organization’s mission, reflects the capabilities of the organization, and at the same time captures the opportunities within the external environment. A suitable strategy avoids threats and drives competitive advantage. Suitable strategies for Arabtec are highlighted below

The best strategic options are described below

Acceptability of the Strategy

Acceptability is concerned with what stakeholders like customers and employees expect together with the expected outcomes both financial and non-financial. Stakeholders accept or reject the strategy according to the risk (possibility of consequences), and the expected returns (benefits expected by stakeholders). Employees as stakeholders are in most cases likely to be concerned with non-monetary issues like work environment or outsourcing because they fear to lose their jobs. Customers could have concerns against mergers due to quality and support issues (Sherman, 2011). Acceptability of a strategy is measured using the “what-if analysis” or stakeholder mapping (Macey et. al., 2011).

Feasibility of Strategy

Feasibility is “concerned with the availability of resources that are required to implement the identified strategy” (Macey et. al., 2011, p. 92). These resources include finances, human resources, time, and information. Feasibility is evaluated using tools like “cash flow analysis and projection, resource deployment analysis, or break-even analysis” (Macey et. al., 2011, p. 92).

Questionnaire Analysis

An open questionnaire was used in this study where the respondents were supposed to respond by mentioning their answers. The interviewer then related the respondents’ answers to what was expected in the questionnaire. The study also involved perusing some of the company documents, magazines, and websites to gather relevant information. This report has been compiled using the information that was gathered from those sources. Therefore, it is limited to the case of Arabtec and its subsidiaries. The following are the questions that were asked”

- Is your business affected in any way by any economic factor?

- How is your business affected by the current systems of the government?

- What are some of the social issues that your business encounters?

- How is your business affected by technology?

- What are some of the environmental issues that affect your business

- How does your business interact with legal institutions?

- Kindly share with us some of the strengths, weaknesses, opportunities, and threats your business has

- How would you say your business is affected by the following:

- Bargaining power of suppliers

- The threat of new entrants

- Bargaining power of buyers

- What are some of the internal capabilities of your business?

- Who are the key stakeholders in your business?

Key Strategic Issues

The following are potential problems that the organization should address.

Increasing prices of construction materials

Currently, prices of construction materials are going up, which is attributed to global inflation and the increasing cost of energy. Consequently, construction projects are becoming expensive. The company needs to look at these issues because it can be a burden to the clients or reduce the profit margin.

Environment

The construction industry has not been quick to respond to environmental issues. However, there is an increasing concern and hence regulation towards the reduction of wastes and carbon emissions. These regulations are forcing companies to improve their operations while also, many clients are demanding responsible design approaches. Environmental responsibility is relevant to all companies regardless of their sizes and areas of operation.

It is important to consider the environment because environmentally sensitive companies are financially viable. Other benefits of environmental responsibility include Reputation, risk management, Access to capital, improved financial performance and employee satisfaction.

Recommendations

From the analysis above, the key strategic issues have been identified as increasing prices of construction materials and many court cases in the construction industry. It is recommended as follows:

- Due to the increasing regulations forcing companies to improve their operations in planning, construction, warehousing, and operation management, the company should strengthen these aspects to ensure full compliance with statutory requirements. The resulting benefits would be improved reputation and minimum risk in operation

- The company should properly manage its logistical operations so that the costs of operation are minimized. This move would protect it from responding to the escalating costs of materials by increasing the prices of services. Therefore, its services will remain competitive.

Conclusion

Strategic analysis entails research to understand the environment of operations for an organization. Through strategic evaluation, an organization can identify the necessary corrective actions and the best time to apply them to bring back the performance in line with business objectives. The tools used in strategic analysis include the PESTEL analysis, which analyzes the business environment and the SWOT to analyze the strengths, weaknesses, opportunities, and threats of an organization, and the Porter’s Five Force analysis, which analyzes the market entry forces. The internal analysis tackles the capabilities of the organization and value chain analysis explores the process through which the company adds values to its services. A key skill in the strategic analysis is choosing which tool to use to achieve the objectives of the analysis. The strategy adopted by an organization should be suitable, acceptable, and feasible. The best strategy suits the organization’s mission reflects its capabilities, and at the same time capture the opportunities within the external environment.

References

AECOM: Middle East Handbook –Property and construction handbook. (2014). Web.

Arabtec Construction: Associated Companies. (2015). Web.

Arabtec Construction: Value in the Market. (2015). Web.

Arabtec Holding: Corporate Governance. (2015). Web.

Chapman, R. (2013). Simple tools and techniques for enterprise risk management. Hoboken, NJ: Wiley.

Cooper, L., & Finkelstein, S. (2011). Advances in mergers and acquisitions. Bingley, UK: Emerald.

Friend, G., & Zehle, S. (2010). Guide to business planning. London, UK: Profile Books.

Gorgenländer, V. (2010). A strategic analysis of the construction industry in the United Arab Emirates: Opportunities and threats in the construction business. Hamburg, Germany: Verlang.

Henry, A. (2011). Understanding strategic management. Oxford, UK: Oxford University Press.

Kimmich, C. (2012). Methods for stakeholder analysis. Bremen, Germany: Europaeischer.

McGrath, R. (2013). The end of competitive advantage: How to keep your strategy moving as fast as your business. Boston, MA: Harvard Business Review Press.

Macey, H., Schneider, B., Barbera, M., & Young, S. (2011). Employee Engagement: Tools for Analysis, Practice, and Competitive Advantage. Hoboken, NJ: John Wiley & Sons.

Murray-Webster, R., & Williams, G. (2010). Management of risk: Guidance for practitioners. Norwich, UK: The Stationery Office.

Ramos, J. (2010). Dubai amplified: The engineering of a port geography. Farnham, UK: Ashgate.

Sherman, J. (2011). Mergers & acquisitions from A to Z. New York, NY: American Management Association.

Vogt, J. (2011). Value creation within the construction industry: A study of strategic takeovers. New York, NY: Peter Lang.