Introduction

The US economy is affected by bonds that determine the market’s liquidity aspects, hence determining the standards of living through consumerism metrics. Due to investment perspectives, bonds are useful in capital preservation, which can predict returns for a given enterprise. In the New York Times, Neil Irwin has articulated the bond market in exemplary prose by comparing various aspects of the economy, such as inflation and capital flows that will affect the US nationals in the market places. In his article titled “The bond market is telling us to worry about growth, not inflation,” Irwin (2021) navigates various concepts that show a surging economy characterized by shortages, distribution networks, and high prices all affect the Americans. The author is hinting at the right moves for prices and interests since interest charges, prices of stock and equity estimates reflect the current and future financial position, which foresees a loss of money worth.

Bond Market and Economic Growth

The article is relevant due to the slowing indicators that predict economic recess in the US if the bond market is not effectively checked. Assuming the yields on long-term bonds are increasing faster than the short-term ones, perhaps Irwin could have seen a growth in the future. However, when the curve steepens, the bond market is experiencing a dragging factor that slows economic growth. The moment economists start observing the discrepancy in bond yields, it indicates that a crisis is coming, and there must be a solution before matters get to adverse levels. Citing to Irwin (2021), ‘The yield on 10-year Treasury bonds fell to 1.29 percent…from a recent high of 1.75 percent…’ (Irwin, 2021, par. 4). In this case, uncertainty brings panic due to the expected rise of inflation that can be forecasted from the current trends.

The fall of long-term interest rates means the bond prices will rise. For instance, under the impact of interest rates in the market, new bonds that depict low yields will be more likely to be released, which means stockholders will be unwilling to obtain the new issues (Wells & Ballentine, 2022). Therefore, the author’s argument that the economy needs a varying degree of growth and low inflation is true since that will bring the reality of the future with definite growth. Therefore, the bond market is an accurate forecasting tool for economic circumstances.

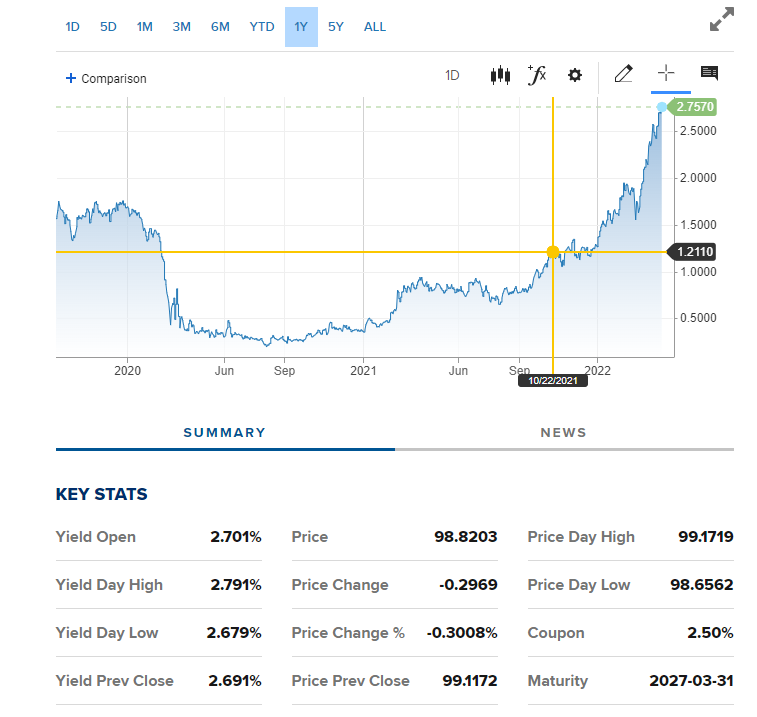

The reason why the economy remains hot at the moment, as per the author, is due to the management of affairs at state and federal levels of government in the US. Historically, the performance of bonds has been a measure of how the economy is doing (Wells & Ballentine, 2022). In this case, investors usually put their money in various segmented markets hoping to generate high returns on investment. If the stockholders are not willing to risk anymore, the operations for areas such as banking will witness a predicted rise in interest rate. As seen in Figure 1 below, the yield curve shows varying amounts of yield that investors will be able to get after a given time. The curve has not shown steady slopes upward, which means the insight into economic matters requires a notably risky investor who puts their money on a non-promising economic signal (Irwin, 2021). Due to the price challenges, markets turn to be explosive, which paves the way for inflation to develop more hence, making the economy appear less buoyant.

Uncertainties in the Bond Market

The context of the article insinuates that the expected growth has been approached, but the gains from the fiscal policy are fading by the day. What the author discussed is evident a year later, whereby the real yield is negative, and the federal government has contributed to inflation by protecting demand for items in the market. Many Americans will agree that the prices of basic commodities do not have a fixed cost-friendly price. Rather the pricing of goods and services is tentative due to the economic observations. When the author says that “Economy will be better over the medium-term if it experiences medium growth and low inflation…’ (Irwin, 2021, par. 8). To complement that statement, the truth is that the federal government has been on the front line in a move to throttle high inflation. As seen in Figure 2 below, the US five-year treasury has increased by 0.065, which affected the market by price and yield changes that can help predict an economic surge (Reinicke, 2022). As a result, the Treasury yields have increased in 2022 since the levels of government are fighting to end inflation that stagnates economic growth.

The interest rates are the key elements that determine bond yields. Through the two, business conditions rebound, and that is why the service sector has been expanding rapidly in some months and less rapidly in others. It has come to be an order of the day in terms of delayed shipments and inflexible lead times responsible for reducing cost increases in business transactions (McQuarrie, 2018). Despite the US having grown its economy for many years, the same might slam into a wall. The reason is that there are pandemic issues, a decline in assistance from fiscal policies, and monetary values that are essential in checking progress. As of 2022, there is negligible economic growth due to omicron, which has contributed to the falling gross domestic product (Kenny, 2021). The same idea is seen in the article whereby the author suggests lowering long-term rates to make borrowing easy through legislative actions. There is a need for planning that is directed towards affordable measures of living the Americans.

The American citizens have felt the impact of slow growth in the economy so far. The Federal Reserve has raised interest rates to curl the inflation rate. Considering how consumers have been affected by high prices, it feels notably disturbing to continue straining taxpayers when it comes to borrowing. The consumer price index rose to 7.9% in February 2022, which became the highest level in 40 years (Flanagan et al., 2018, p.4). Due to all these factors, the US nationals are feeling the pinch when paying for food and fuel, eroding society’s economic structure. Fed’s mandate includes promoting maximum employment, stabilizing prices, and embracing neutral long-term interest rates. The Fed uses interest rates to conceal or slow the economic challenges that nay proves a person to seek clarification.

Inflation, Prices, and Interest Rates

Irwin’s prediction about the rise of inflation in the US is logical according to the measures that can be witnessed in the US economy today. The current inflation tells the public that the volatility of food and fuel will run higher than now due to the pandemic-related factors. The increase in vaccination and reduction of health risks must balance the way the country spends so that a decrease in demand for goods will not be subject to increased demand for services (Anari & Kolari, 2017). For example, when there are high medical demands, the country is having an issue. Inflation may rise due to the lagging of increased service demand due to the high supply of services.

Although there are plenty of reasons that make one believe price increase will fade with time, the existing demand decrease in some commodities produced with high cost may deteriorate the matter. Income inequality adds to the blocks that constitute the weakening of the economy through variation in price indexes and interest rates (Flanagan et al., 2018). Theoretically, the stock must offer hedges against inflation. The reason is that a company’s profitability levels must match an inflated economy after the adjustment period. When inflation has varying degrees in price and value of money, stocks increase the volatility of equitable market share, hence risking premium.

Conclusion

The US economy is surging to a notable extent nowadays. With the rate of inflation being significantly high in 40 years, prices and interest rates have been phenomenal. Irwin’s article offers comprehensive data that can be useful when determining a course of action when it comes to reviving the weak economic force. Stock market changes have a direct impact on price and interest rates. The yield curve is useful to predict the future of a given firm by noting the alterations that stock takes in the graphical presentation. For the US economy to stabilize, there needs to be the moderation of pandemic issues, especially on medical grounds. The Federal government should not overlook the side of economic projection that is evident after implementing policies to combat inflation.

Reference List

Anari, A. and Kolari, J. (2017) ‘Impacts of monetary policy rates on interest and inflation rates’, SSRN Electronic Journal, 3(8), pp.22-28.

Flanagan, T., Kedia, S. and Zhou, X. (2018) ‘Secondary market liquidity and primary market allocations in corporate bonds’, SSRN Electronic Journal, 3(8), pp.2-7.

Irwin, N., 2021. The bond market is telling us to worry about growth, not inflation. (online) Nytimes.com. Web.

Kenny, T. (2021) Can bonds predict the direction of the economy? (online) The Balance. Web.

McQuarrie, E. (2018) ‘The first eighty years of the us bond market: investor total return from 1793, combining federal, municipal, and corporate bonds’, SSRN Electronic Journal, 2(3), pp.58-64.

Reinicke, C. (2022) Why the Federal Reserve raises interest rates to combat inflation? (online) CNBC. Web.

Wells, C. and Ballentine, C. (2022) Bloomberg – Are you a robot? (online) Bloomberg.com. Web.