Introduction

Commercial aviation, which is a component of civil aviation, is the business of operating aircraft to transport people and goods on hire. The airliners used in the transportation of passengers and cargo range from single-engine freight planes to the Boeing 747. Commercial aircraft were accepted after the Second World War. Since then, it has been experiencing steady growth. For instance, in the 1950s, most European countries started manufacturing new aircraft such as The Beech and Cessna.

The Cessna was the most used aircraft since it had a greater production volume and could earn revenue of between $10,000 -$ 30,000 annually. In the 1960s, commercial airliners adopted planes that had turbo-powered engines, jet engines, and pressurized cockpits and cabin. As the paper reveals, although such developments have been in use up to date, the ever-changing technology and customer demands or preferences leave commercial aviation with no choice other than incorporating changes in the industry to remain relevant in the current business world. Hence, commercial aviation is expected to change significantly in the next 5 years.

Analysis of Forecasts in Commercial Aviation

With the expected change in commercial aviation, the financial analysis forecasting tools that will contribute to analyzing the industry can be classified into four classes. According to Hansen (2003), the market share financial analysis is a top-down tool where activity at an airport is regarded as being directly proportional to growth in the combined external measure. Hence, to produce correct predictions, it is vital for the airport activity and the larger aggregate link ratio to remain constant over a specified duration.

Most airport economic forecasts use econometrics, which relies on explanatory variables that discuss the impacts of the demand and supply of commercial aviation activities. These variables are categorized into macroeconomic and demographic elements, aviation market forces, innovation and production costs, and technology. Other variables include legal factors, capital investment constraints or upgrades, and substitutes for air travel. The third financial tool is the Time Series analysis that involves extrapolating the current data or graph into the future.

This financial analysis tool considers the values of the factors that need to be forecasted. It aims to predict future profit or outcomes based on existing or past trends. This financial analysis tool is a low-cost approach to forecasting compared to the econometric tool. Even though the method is easy to use and understand, individual statistical theories that are adopted to enhance the accuracy level can be quite complex.

This financial analyzing approach is necessary when unusual forces hinder the stability of the relationship between local activity and other external variables. The simulation method is another technique of analysis that captures high-fidelity pictures of traffic flows in a channel or at an airport. Such a technique imposes strict regulations that dictate how people, cargo, and aircraft are routed. It then calculates the results in a manner that the management can analyze the establishment requirements of the system or airport with the view of establishing mechanisms to sustain the estimated traffic flow.

Despite the drastic decline in activities throughout the last decade, the use of financial analysis tools to forecast commercial aviation has maintained a positive outcome. The challenges of forecasting the aviation industry activities led to the need for an advanced understanding of the components that have an impact on this business.

The Expected Changes

In the next five years, commercial aviation is bound to change significantly. The first expected change will revolve around its customer relationship strategies. The rising competition in the airline industry, which is expected to be at peak in the half-a-decade period, brings with it the need for new strategies that commercial aviation should adopt to retain its clientele or attract new ones from its competitors. To implement its Customer Relationship Management (CRM) framework, commercial aviation will need to take into account the elements that characterize successful CRM as shown in Figure 1.

In other businesses, customer knowledge, tastes, and preferences, and other consumer-related activities are important to offer personalized products and services. Therefore, airlines must change or improve on their reliance on the current loyalty models, which can enhance critical customer data that includes increased spending activities through branded credit cards. It may reveal the real situation about the travel patterns and preferences of customers.

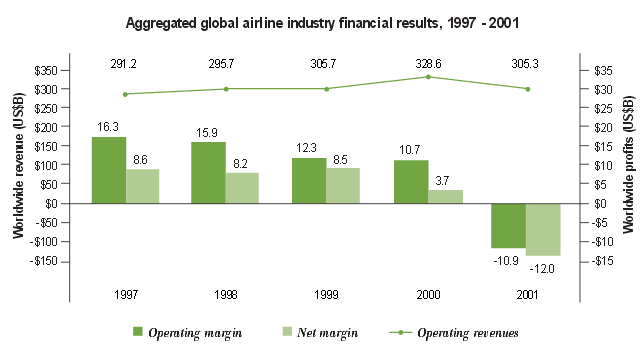

In the 1997-2001 period, commercial aviation recorded significant losses because of the then financial crisis that discouraged many clients from using airlines. Economic meltdown and fuel costs are the primary factors that are currently hindering the growth of the aviation industry. According to Boland, Morrison, and O’Neill (2002, p. 2), ‘On a global basis, airlines saw a US$12 billion operating loss in 2001 before taking into account various government bail-outs’. Graph 1 below shows the financial performance during this period.

In the next five years and based on the above results, airliners will need to invest in more sophisticated customer analytics. Advanced technology alone will not solve this issue. Eriksson and Steenhuis (2015) assert that commercial aviation must reorganize its structure and procedures to suit its customer service into its organizational mission and vision. Commercial airlines will need to reframe every point of contact between the client and the airline personnel, especially in the areas of booking up flights, check-in, and in-flight experiences.

These points will assist the airline management not only to collect vital data about customers’ tastes and choices but also to adopt ways to meet and surpass their expectations. More customer knowledge and affection aim to realize better customer service experience and good revenues (Boland, Morrison, & O’Neill 2002). Hence, commercial aviation will need to examine its clients’ demands and worth addressing or serve them efficiently.

The improved customers experience such as the recommended flights to customers’ destinations of choice will present the airliner with a bigger chance to generate the targeted revenue while attracting loyal customers. The strategy will result in a higher percentage of sales through direct channels. These changes will also allow full-service carriers to maintain existing services and/or charge fees for specific flight features that include fast-tracking security measures or pre-boarding.

The next five years will be marked by the adoption of digitization in commercial aviation to minimize operating costs. Aircraft manufacturing companies must make use of the latest technology and innovation to improve internal systems and/or reduce costs.

An airline system that can allow regular resource distribution and allocation enables its greater utilization. Digital engines can send alerts to the maintenance and operations desks if mechanical problems arise while an aircraft is on a flight. It can also request assistance when it lands. This change will not only minimize the downtime but also enhance performance in a huge way. Besides reducing operational costs, it will increase customer satisfaction through frequent on-time arrivals and departures. According to Linden (2002), the majority of these costs shot up in the 1980s because of increased itinerant operations.

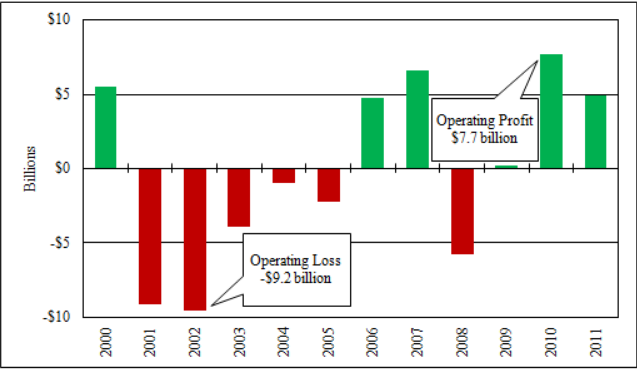

Consequently, both local and itinerant service costs went up following the same upward trends. After the recent innovation, improvements, and the digitization of aircraft, the aviation operations expenses and the operation cost dropped dramatically during the 2006-2011 period. The drop led to the profits that were recorded in the same period as shown in Graph 2 below (The US Department of Transportation 2012).

Irrespective of the challenges that are expected to come with increased fuel expenses and reduced customer requirements, the next five years call for key airlines to cooperatively move from a sequence of yearly working losses, as it was witnessed between 2002 and 2006, to breaking even in 2016 and more importantly recording operating profitability that surpasses the 2010-2011 returns. Commercial aviation will need to cut costs to enhance operational efficiency.

The current business world is characterized by a growing need for airlines to make large innovations to function more efficiently. The most profitable airlines have the strictest cost regulations. The biggest lever to minimize costs lies in fuel consumption. For instance, in most airliners’ budget, jet fuel amounts to between 40 to 50 percent of the operational cost. Airliners with surplus funds are now digitizing their fleet to make space for the more fuel-efficient fleet.

As Dixon (2006) asserts, the rapid rise in jet fuel prices has significantly changed the matrix of airline business plans, which have resulted in an unprecedented urge for fuel-efficient aircraft. Hence, a decrease in fuel prices will most likely alter the carriers’ business plans. Since the short-term financial goals for many airlines are achieved, the new change may result in a mixed expectation for airliners and fleet manufacturers over the years.

Experts believe that the aviation industry will expend roughly $70 billion less on jet energy in 2016 compared to 2015, which is a 33% decrease (Flottau et al. 2015). Even though these planes are expensive to manufacture or buy, this change has a real value, especially if the idea is formulated in line with commercial aviation business’ long-term investment plans of configuring its system. The change will have an impact on the programmatic diversification of particular routes over time. Cost-cutting changes will also be attained through improvements in management structures, operating methods, and job practices.

Fuel-efficient planes are more profitable compared to the ordinary. Hence, in the coming five years, most banks will be willing to finance the buying or manufacture of these modern planes at low-interest rates. According to Bubb (2012), a reduction in fuel prices will be a huge exception, which will increase the carriers’ fortunes while disrupting the current market dynamics in the short run. The situation will lead to a significant shift in the cost gap between European, U.S. airlines, and Gulf carriers. For instance, the Fly Emirates, which is completely unhedged, will be among the largest carriers to witness the immediate advantages.

Overall Outlook of Commercial aviation after the Changes

As commercial aviation ushers in a new era of profit-making planes, it is relying on the manufacturers’ modification of improved performance, fuel-efficient engines, and better maintenance techniques, for instance, longer intervals between checks ups. New planes such as the Boeing 737 have advanced computer-based health monitoring systems as one of the crucial maintenance techniques and cost-cutting features. Most of the new planes are glossy.

They come with an intrinsic safe and secure network file server that undertakes many self-diagnostics functions. Such systems reduce operational costs. Regarding customers and airport security, airplane checkpoints are currently sorting passengers and grouping them through digital screening technology. Risk assessment of travelers is crucial progress towards arresting terrorists and anyone who possesses a security threat.

According to Chow (2005), this change will lead to positive customer response since much time will be saved in the checkpoint areas. The new modernized inspection will work in a manner whereby passengers’ walk to the checkpoint will be directed to various lanes, depending on the data collected from their passports or travel tickets. At the lane, a biometric check such as an iris scan will be used to search passenger identity. After the biometric test, the next security check will be the advanced x-ray scanners and chemical sniffers that will clear passengers before they proceed. This innovation will guarantee convenience to customers since they will not be required to remove shoes, clothing, gadgets, or any liquids they carry.

It will also eliminate physical contact when searching. Such changes will improve service delivery and security in most airports. As a result, the commercial aviation industry is expected to increase tremendously in air traffic in the coming years. Also, the increased emissions of greenhouse gas, thanks to the full electrification of commercial planes, will lead to ensuring that the aircraft becomes environmentally friendly through its zero or no CO2 emission plan.

Due to the increased usage, parts of the plane can malfunction at any time. However, the new Airbus design has made innovations and improvements in terms of reliability and operational efficiency. Hence, in the next five years, manufacturing companies will start producing engines with better terms of inspection intervals. Besides being built with lighter materials, the engines will be much more fuel-efficient and less noisy.

Conclusion

The paper has discussed in detail the status of commercial aviation as an important aspect of the national airspace and airport system. Even though the industry faces operational expenses, commercial aviation is an important part of the community as a whole, including other stakeholders. These stakeholders include pilots, plane manufacturers, and a reliable workforce. These stakeholder groups are among the factors that drive commercial aviation activity.

They help to forecast its future. Based on the findings of the paper, it is indeed clear that commercial aviation will change significantly in the next five years. The paper has discussed how financial tools can be used in forecasting commercial aviation activities whose primary aim is to obtain the future perspective of the industry as a whole. The paper has also discussed the previous levels in the aviation industry operations concerning trends and historical events, which brought to light what drives this huge industry. As seen in the paper, fuel costs and operational expenses will have a significant impact on the activity levels of the industry.

Even though the airline industry struggles with revenue margins, the current growth rate in most markets in conjunction with advancing innovation and customer preferences present the industry with a real opportunity. Hence, it is likely to advance in the next half a decade.

References

Boland, D, Morrison, D & O’Neill, S 2002, The future of CRM in the airline industry: A new paradigm for customer management, IBM Corporation, Somers, NY.

Bubb, D 2012, Landing in Las Vegas: Commercial Aviation and the making of a Tourist City, University of Nevada Press, Reno.

Chow, J 2005, Protecting Commercial Aviation against the Shoulder-fired Missile Threat, Rand Corp, Santa Monica, CA.

Dixon, M 2006, The Maintenance Costs of Aging Aircraft: Insights from Commercial Aviation, RAND, Santa Monica, LA.

Eriksson, S & Steenhuis, H 2015, The Global Commercial Aviation Industry, Routledge, London.

Flottau, J, Broderick, S, Unnikrishnan, M & Schofield, A 2015, Drop In Oil Prices Means An Airline Profitability Boost Now. Web.

Hansen, O 2003, Commercial Aviation, Crabtree, New York, NY.

Linden, R 2002, Airlines and Airmail: The Post Office and the Birth of the Commercial Aviation Industry, University Press of Kentucky, Lexington, KY.

The US Department of Transportation 2012, Aviation Industry Performance-A Review of the Aviation Industry, 2008-2011. Web.