In current economic conditions, the necessity of conscious prospective management of financial activities based on the scientific methodology of adaptation to the changing requirements of the external financial environment is actualized for enterprises. Financial planning and budgeting are the practical tools of perspective management of the enterprise’s economic activity subordinated to the realization of objectives of its general development in conditions of significant changes in macroeconomic indicators. The high dynamics related to financial activities do not allow for effective management of enterprise finances founded only on previously accumulated experience and traditional administration methods. Precisely from this, the necessity for constant development and the introduction of new strategies for economic growth arise.

As an object of research selected, the company Coty has long been operating in the market of cosmetic products. After analyzing the financial indicators and reports for the last five years, one can state that Coty follows the financial support strategy of accelerated growth. The main activity is focused on ensuring high rates of operational training and, first of all, production volumes and product sales (Svatošová, 2019). Under these conditions, the need for financial resources directed to the growth of current and non-current assets of the enterprise increases significantly.

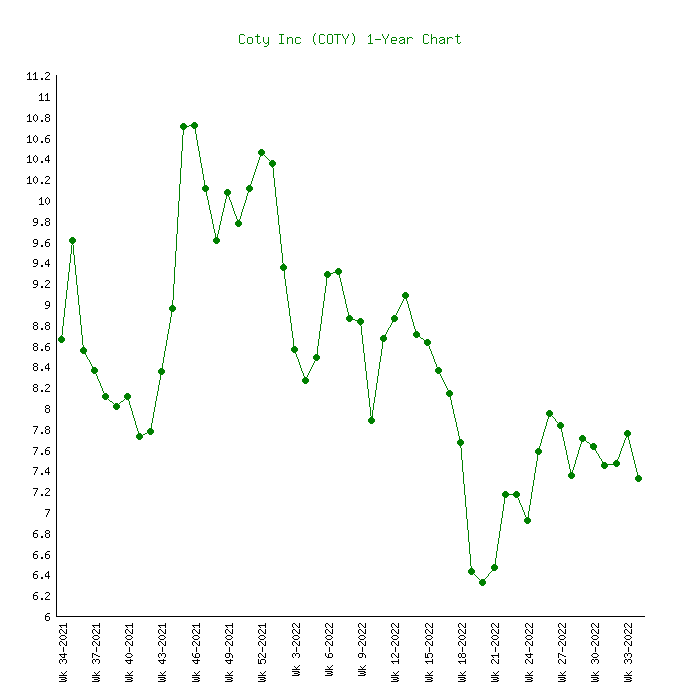

Regardless of its large-scale goals, the retailer is on the verge of bankruptcy, and the necessity to implement a cost-cutting plan is growing. The company has $124 billion in assets, $5.2 billion in long-term debt, $377 million in cash, and $257 million in lease obligations (Coty Corporation, 2021). Based on this analysis, it can be judged what financial strength characterizes this company in the forecast period. Since most of the indicators were negative, the financial condition is unstable (Chart 1). Such an economic situation may cause deterioration of the company’s solvency, and therefore the company should reduce its short-term liabilities.

Companies must have competitive advantages to survive or win in a challenging environment. Coty is in a period of deep crisis and monetary losses that can lead to bankruptcy. The primary strategic goal of the organization is to maximize profits and implement organizational and operational reorganization. Thus, the strategic plan includes reducing unit costs by increasing production volumes by March, growing earnings by 20 percent, and stabilizing the company’s financial position. For this purpose, it is necessary to realize such short-term goals:

- Hire a financial manager by November 1.

- Adjust the delivery process by November 15.

- Reduce assortment diversity, with a focus on quality, by November 22.

- Minimize costs in research and development, service, sales, advertising, and other marketing communications by December 5.

A firm’s competitive advantage is determined by how well it can communicate with suppliers and customers. By better organizing these communications, Coty can gain a competitive advantage. Regular and timely deliveries can reduce the firm’s operating costs and inventory levels. These connections occur when one activity’s method affects others’ cost or efficiency. Linkages often result in the additional cost of individual actions to each other later (Ukko et al., 2019). The firm must incur such expenses following its strategy in the name of competitive advantage. Moreover, the company produces many products while losing quality, and reducing the range of products should reduce costs and improve profits and quality.

Coty’s long-term goals for the company include the following:

- Rational business management, optimizing intra-company relationships by December 25.

- Integration of distribution networks and optimization of delivery systems by January 13.

- Creation of a branch network that, through the firm’s convenient geographic location, reduces the cost of production by taking advantage of local characteristics by March 1.

Long- and short-term goals will be measured monthly by assessing changes in financial performance and the percentage of profit increase. Moreover, the number of sales and customer satisfaction with the company’s products will be considered. It is important to note that it is necessary to reach a 20 percent increase in profit by March. At the same time, the number of deliveries should increase by at least 10 percent. The strategic plan will include several equally important and consistent stages:

- Preliminary (by November 1). The company must have a functioning payment calendar, budgets, and a plan for procuring materials and supplies. Execution of the approved data should be strictly controlled by the managers, who should present the results report by the beginning of the month.

- Comparison of the forecasted effect of cost reduction and one-time costs of changes (by November 15). The CFO will be responsible for this part of the plan, and a financial plan should be provided at the end of the phase.

- Eliminating the use of expensive raw materials and components (by January 1).

- Purchasing raw materials and supplies directly from the manufacturing plant (by January

- Reducing the number of employees, including through automation and reduction of product variety (by March 1).

The main criterion for measuring the plan is the real possibility of influencing the costs. All proposed measures are evaluated in terms of the economic effect of their implementation. Thus, the financial statements at the end of each month and the profit growth rate will be the leading measures of the effectiveness of the performance of the plan. Even though Coty is now on the verge of bankruptcy, the company has a chance to gain new competitive advantages if a new strategy is implemented.

References

Coty Corporation. (2021). Coty financial ratios for analysis 2010-2022. Web.

Svatošová, V. (2019). Proposal and simulation of dynamic financial strategy model. Future Studies Research Journal: Trends and Strategies, 11(1), 84-101. Web.

Ukko, J., Nasiri, M., Saunila, M., & Rantala, T. (2019). Sustainability strategy as a moderator in the relationship between digital business strategy and financial performance. Journal of Cleaner Production, 236, 117626. Web.