COVID-19 is an infectious disease that was first identified in the United States in January of 2020. One of the main issues for banks is that a large number of clients, borrowers, and businesses are currently facing hardships such as job loss, slowed sales, and a decrease in profits. Due to this, these different entities are unable to maintain their current payment schedule and are seeking financial relief. Another issue these banks face is that cash, checks, and banknotes were identified to be potential carriers of the COVID-19 virus if handled by infected individuals. With the continuous increase in cases, in person transactions and physical banking have been limited. Banking institutions are now met with the challenge of ensuring banking operations remain consistent while protecting customers and staff from contamination.

With COVID-19 restrictions in place, many consumers have turned to digital banking or having to completely manage their transactions through drive-thru services. Truist Bank immediately took preventive measures such as closing or limiting services in their local branches and providing customers with payment relief options as needed. Truist Bank, being a recent merger between two different companies, Due to the severity of COVID-19, Truist Bank has had and will continue to have issues until the organization finds creative ways to identify and implement strategies that will benefit the institutions and stakeholders alike. As a newly merged institution, they have had to navigate through issues such as combining existing resources, having all parties commit to a collective mission, maintaining relationships with existing stakeholders, and finding new clientele. On top of this Truist Bank was met with the novel COVID-19 issues shortly after debuting, which means they have to navigate traditional banking operations and start adapting to new strategies amidst the crisis.

Truist Bank is an institution that was formed in December of 2019 after BB&T and SunTrust merged. The company has grown through mergers ever since 2008, when the first merge between BB&T and Southern National Bank was performed in order to withstand the pressure of the world economic crisis. Currently located in Uptown Charlotte, North Carolina, Truist is now the 6th largest bank holding company in the United States with over 275 years of experience between the two different banks combined. Between the merged organizations, Truist Financial employs over 59,000 people among over 2,100 different branches. Once fully integrated, Truist will offer online and mobile banking platforms, an extensive ATM network, and expertise for consumer, commercial, corporate, and institutional clients nationwide. With the effects of COVID-19 in place, Truist has had to hold off on all of the branch mergers so customers have not been able to see the full line of what the company has to offer them.

Truist formed with a purpose “to inspire and build better lives and communities.” They state on their website that they want to do this by empowering clients with more choice, teammates (what Truist calls their employees) with more fulfillment, and communities with more hope. Rather than having a mission statement that follows the format of the nine components, Trusit has separated theirs by what group of people they are serving. For clients, they want to “provide distinctive, secure, and successful client experiences through touch and technology.” With this statement, we see components 1 and 4 present with only mentions of customers and technology. From this, we know that their customers are their clients served at each of their branches and that through technology they hope to provide experiences which should tell us that they are technologically current. Their second mission statement has to do with their teammates and their aspiration “to create an inclusive and energizing environment that empowers teammates to learn, grow, and have meaningful careers.” Using the 9 components of a mission statement, we are able to see that the mission statement for their employees focuses on the 8th component only by explaining how they want to create an environment that employees will want to stay with and grow in the company. The last of their mission statements is the one geared towards their stakeholders and their goal to “optimize long-term value for stakeholders through safe, sound, and ethical practices.” This one we are able to see components 5 talking about their potential longevity and a very small mention of component 8 with the mention of ethical practices. However, it doesn’t seem Truist has a full mission statement to really show what their company’s mindset and goals are for the future. All of the components seem to be just about what they would like to do for a certain subset of people, not what their sole ‘why’ is of the company. Listed separately on their website, Truist mentions what their core values are:trustworthiness, caring, one team, success, happiness. Ideally, their mission statement should give a sense of purpose that shows both their why for the company and how they exude their core values on a daily basis. Something along the lines of the following would be a better mission statement for the company: “At Trust, we strive every day to inspire and build better lives and communities through financial services. We fulfill this purpose by serving with integrity and through our commitment to focus on leadership development, economic mobility, thriving communities, and educational equity for our clients, teammates, and innovative partners. Every day we are committed to providing unmatched service in all of our branches while also providing grants in support of nonprofit organizations through the Truist Foundation to grow their impact and have a chance for a better future.”

Prior to the merger with SunTrust, BB&T had their own strategy to help the company grow: mergers and acquisitions. In April of 2016 they bought National Penn Bancshares Inc and have now merged with SunTrust to form Truist. While these mergers have helped show an increase in size and revenue, Truist needs to show new strategies in how they are going to last and be one of the leading companies in the banking industry. When it comes to strategies, Truist should pursue a differentiation strategy to show why they are the financial company to go with for a client’s banking needs – showing greater service improvement and flexibility as well as being the most convenient and compatible for any potential needs. While unlike normal differentiation strategies, Truist would not need to worry about offering services at a higher cost than other banking firms, they would need to focus on how to make their services more tailored to the clients they are trying to serve. With the rampant spread of COVID-19 around the nation, causing many Americans to lose jobs and see financial hardships, Truist would need to focus on how they can help their customers in their times of need.

Trusit Financial is part of the modern banking industry, which has seen many ups and downs over the years. The principle services for this industry tend to include storing, transferring, extending credit against, and managing the risks associated with client’s wealth. Many companies put their emphasis on either personal or commercial banking to help reach a wider client base for the area they’re located in. With so much money to manage, organizations within the industry differ their services based on their key demographics and industry regulations to help differentiate and give themselves what they would all consider the competitive edge on the other industry firms. The industry itself is in a much better position since the 2008 recession but due to the recent COVID-19 pandemic, it seems to be taking on those same hardships.

The state of the domestic environment for Truist Financial can be analyzed using the PESTEL tool, which allows for accounting for political, economic, social, technological, legal, and environmental factors. The primary political factors include lobbying, trade wars and tariff regulations, as well as macropolitical events such as Brexit (Marketline, 2020). Lobbying for the company’s interests becomes increasingly difficult due to the polarization of the political parties one against another, meaning that Truist would have to support a bipartisan coalition rather than side with a single party, in order to achieve the required motions. Trade wars and tariff regulations play a largely negative role in Truist dynamic, due to being outside of the bank’s control. Trump administration is currently engaged in a trade war with China and threatens to sanction any company that works with the Russians to complete the Nord Stream 2 project, some of which are Truist’s clients (Marketline, 2020). Finally, the effects of Brexit have significantly lowered the importance of Britain for the company due to its loss of connections with the European banking system, making it less viable.

In terms of domestic economic factors, the primary two that affect Truist Financial is the crisis facilitated by COVID-19, followed by the planned replacement of LIBOR (London Interbank Offered Rate) with SOFR (Secure Overnight Financing Rate) in 2021-2022 (Marketline, 2020). The former’s effects are obvious – companies and banks are losing money, bail out on credit, and withdraw deposits, which hurts Truist. In addition, the company suffered losses from stock market drops associated with the disease. As for LIBOR, it managed to discredit itself as a system due to being prone to financial manipulation, as many companies propped up returns and hid weaknesses. Its replacement with SOFR, which is based on real transactions, should make the process secure and less open to interpretation. For Truist, this would mean that, while the bank’s transactions are going to be safer, the potential revenue might decrease. In addition, it would take time for the bank to transition from one model to another.

Social factors largely include the quick and progressively massive switch to online banking as a result of a proactive response to COVID-19 threat (Marketline, 2020). This presents both a threat and an opportunity for Truist on a domestic level, as the speed at which it enables most (if not all) operations typically available in offices, on an online platform, would ensure its growth or diminishment in popularity. This might be followed by the closure of unnecessary or redundant offices, especially in larger cities, in order to save costs and respond to the decreasing number of physical customers at the bank.

Technological factors are directly connected with the switch to digital – the bank would need to feature larger servers, better online security, and ways to handle additional transactions over the Internet, at a larger volume than ever before (Marketline, 2020). Truist would have to invest in technologies of inscription, personal identification, and security to withstand against hacking attempts, in order to ensure the security of transactions. Procedures that would allow individuals and businesses to obtain digital signatures would have to be streamlined and made accessible in a short period of time. Finally, the installation of self-service machines and ATMs would need to be facilitated, to make up for office closures.

The main domestic legal issues remained largely the same – Truist has to respond to the changing laws and regulations in the banking industry, confirm to the standards of intellectual property and data protection, adhere to rigid consumer protection laws, and follow anti-racism and anti-discrimination protocols in the workplace (Marketline, 2020). To these challenges are added the legal conundrums of mass bankruptcies of businesses credited by Truist. With how many individuals and enterprises were affected, the company may need to consider updating its Force Majeure clauses and develop a standing strategy on what to do in situations like these.

Finally, the domestic crisis has to bring changes about Truist’s relationship with the environment. The financial group has been notorious for its environmental contributions, as it planted over 1,000 acres of trees, helps save over 800,000 kilowatt-hours every year, and has a digital environmental sponsorship platform named LightStream (Marketline, 2020). However, with expected losses mounting by the end of 2020, it is likely the company will reproliferate its environmental stance from actively funding efforts to reducing their own electrical, environmental, and carbon footprints, which will help save money while preserving the environment.

Using the Porter Five Forces Model, we are able to explore profitable opportunities for Truist Financial while also taking a look at ways to develop a strategic position in the banking industry. The five forces that Truist will need to focus on are threats of new entrants, bargaining power of suppliers, bargaining power of buyers, threats of substitute products or services, and rivalry among the existing competitors. New entrants in the banking industry are unlikely due to the high requirements for financial resources as well as mounting legal regulations. Although Truist itself is a new merger, between SunTrust and BB&T, the two companies have been around long enough to see new entrants in the industry come in and prove new value propositions to customers. Nevertheless, such new entrees are few and far between. In order for Truist to tackle Threats of New Entrants, they will need to innovate a new product or service that will help bring in new customers but also give current clients a reason to stay with them for the long haul. The current level of threat for this factor is low. The bargaining power of customers is considered moderate to high, as the banking sector has numerous offers that duplicate one another, meaning that customers can choose between them. The power of suppliers also fluctuates between medium to high, due to the fact that customers are also the suppliers of banks through deposits. At this time, it is critical for banks to maintain customer deposits, thus increasing supplier power. Truist can overcome these by building strong and lasting relationships with all of their constituents – clients, employees, stakeholders, and other organizations Truist works with on a frequent basis. Probably the most important aspect is looking at the implications of rivalry among the existing competitors for Truist Financial. While customers are going to have to adjust to the change in their banking experience as Truist converts all of their branches in the upcoming year, they will also have to continuously look at their competitors to ensure they are staying on top. In order to do so, Truist will need to build a sustainable differentiation between them and every other banking firm to show they can compete better and increase their market size. By focusing on their mission of creating lasting relationships with corporate partnerships as well as customers, Truist will be able to keep an edge over their competitors.

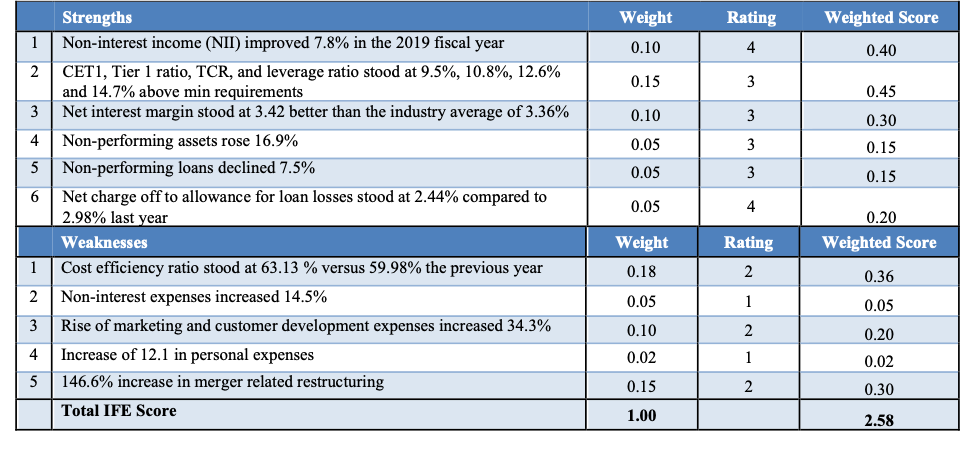

In the Internal Factor Evaluation Matrix seen below, key internal factors are evaluated to identify major strengths and weaknesses for Truist Financial. Non-interest income improved 7.8% in the 2019 Fiscal year. (MarketLine, 2020) This increase represents a major strength for the company as it represents a key source of revenue in the banking industry. Another major strength for the company is the decrease in net charge-off which represents the debt owed to Truist that they will unlikely recover, impacting their overall revenue. The IFE shows some minor strengths such as the increase in adequate capital. Common equity ratio, tier 1 ratio, total capital ratio, and leverage all which stood at 9.5%, 10.8%, 12.6% and 14.7%.(MarketLine, 2020) Net interest margin stood at 3.42% which was better than the industry average which currently sits at 3.36%. Two other minor strengths include non-performing assets and non performing loans, a rise and decline in these ratios respectively, prove how healthy Truist is when it comes to issuing loans and ensuring interest income from them. Major weaknesses have also been identified in the IFE matrix below. Pictured, we see that non-interest expenses have increased 12.1%. (MarketLine, 2020) increase has been impacted negatively by the recent merger between SunTrust and BB&T. Other minor weaknesses include marketing and customer development expenses, an increase in cost efficiency ratios, and an increase in merger restructuring.

Despite being a newly merged company, Truist holds many strengths such as; non-interest income (NII), adequate capital, net interest margin, and asset quality (MarketLine, 2020). In the last 3 years, the non-interest income has enhanced revenue by 7.8%. NII includes deposit and transaction fees, insufficient fund fees, monthly account charges, annual fees, and dormant fees. The merger between SunTrust Inc and BB&T Corp has also supported the 58.4% revenue increase from investments and 11.9% from insurance income. In 2019, Truist had high adequate capital ratios that were above the industry average. This means that the company has a healthy capital base which facilitates growth in their secured and unsecured lending. Another important strength is the net interest margin (NIM). The NIM is the amount of money earned in interest on loans versus the amount it’s paying in interest on deposits. Their ratio of 3.42% was better than the industry average of 3.36% and proves that the company is profitable and growing. Asset quality has been proven to be another strength that allows Truist to have competitive advantage over their competition. High quality assets make certain that there will be interest income from current loans and leases.

Despite being a newly merged company, Truist holds many strengths such as; non-interest income (NII), adequate capital, net interest margin, and asset quality (MarketLine, 2020). In the last 3 years, the non-interest income has enhanced revenue by 7.8%. NII includes deposit and transaction fees, insufficient fund fees, monthly account charges, annual fees, and dormant fees. The merger between SunTrust Inc and BB&T Corp has also supported the 58.4% revenue increase from investments and 11.9% from insurance income. In 2019, Truist had high adequate capital ratios that were above the industry average. This means that the company has a healthy capital base which facilitates growth in their secured and unsecured lending. Another important strength is the net interest margin (NIM). The NIM is the amount of money earned in interest on loans versus the amount it’s paying in interest on deposits. Their ratio of 3.42% was better than the industry average of 3.36% and proves that the company is profitable and growing. Asset quality has been proven to be another strength that allows Truist to have competitive advantage over their competition. High quality assets make certain that there will be interest income from current loans and leases.In the 2019 fiscal year, Truist’s cost efficiency ratio rose from 59.98% to a higher ratio of 63.13%. This negatively affects the profitability of the company as the average ratio in the banking industry is 56.63%. Merger related restructuring and a rise in marketing and customer development expenses have been identified as the reasons why cost efficiency has become one of Truist Financial’s biggest weaknesses.

Fortunately for Truist, many opportunities exist that will be in favor of the company through the COVID-19 pandemic. As a newly merged company, Truist has the opportunity to enhance its financial position in the banking industry. Geographically, the merger has expanded business to Southeast and Mid-Atlantic states, increasing the number of households the organization can reach. Another opportunity that can provide new growth opportunities for the bank is the addition and expansion of mobile payments, e-commerce, and contactless terminals. This has grown the market for debit cards, credit cards, and charge cards. The company has also seen corporate tax cuts to be one of the most important and influential opportunities in the banking industry since signed into law in 2017. These tax cuts for large corporations have increased borrowing by businesses which in turn increases banks profit margins. The 2017 bill has also presented other opportunities for Truist such as repatriation of overseas cash. With this, companies can bring in their overseas profits and not be subject to U.S. taxes a second time. These policies have been put into place to ignite investment banking, increase dividends, and share buybacks that will improve equity markets.

Several threats exist that impact the performance and strategic management of the company. These threats include online identity theft and hacking, prolonged low-interest rate environment, and the COVID-19 pandemic. According to MarketLine, Truist’s IT business operations suffer from various security threats, making services such as phone transactions, card payments, and online banking prone to attacks. A significant threat to consider is a prolonged low-interest rate environment whose impact could increase the chances of a flattened yield curve. Changes like these affect insurers and pension funds negatively, which would then lead to larger banks taking risk in other countries. Currently, COVID-19 has brought devastating effects on global economies. Banks are expected to be more resilient compared to the 2008 financial crisis but Truist continues to monitor the development of the pandemic. In March of 2020, the Federal Reserve decided to lower interest rates from a 0% to 0.25%. (Federal Reserve issues FOMC statement, 2020) Due to the uncertainty, Truist is expected to restructure their loan terms which will affect borrowers and future earnings.

Alternative strategies to those proposed in the paper already could be generated with the use of SWOT analysis, which is good at highlighting strengths, weaknesses, opportunities, and threats to Truist Financial Group, and provide a basis for a holistic strategy. Strengths of Truist include the presence of a vast network of branches throughout the US, a strong and diverse brand portfolio, the combined resources of two equally powerful banks (SunTrust and BB&T), reasonably high levels of customer satisfaction in comparison to other banks, such as CHASE, and starting from a position of financial strength (Marketlin, 2020). The bank’s weaknesses include poor choice of brand name, and limited global presence. Threats to Truist’s continued development largely revolve around the domestic region, the recession as a result of COVID-19, and the inability to decrease costs without significantly altering the system. Opportunities, on the other hand, include leveraging the strengths of both entities in order to increase online presence, and proceeding with digital innovation (Marketlin, 2020).

Based on these findings, the alternative strategies include large-scale cost-saving methods and continuous digitalization of services. The company should expect an inevitable dip in customer revenue and flow, and should consolidate its assets first. As it stands, the company fields over 58,000 employees in over 3,000 branches (Misback 1). With some of these branches being currently useless, and likely having diminished returns once the crisis passes, it would be prudent to close some of them in order to optimize the rest.

Second recommendation for Truist Financial is to expand its online services. Before the crisis, the company pursued such a policy by allowing individuals to use mobile banking services to make transfers, deposits, and so forth, but the majority of crediting and loan operations for individuals and small businesses had to be done in the office (Acharya and Steffen e32165). Allowing the full range of banking services from the safety and comfort of one’s home would ensure the value and accessibility of Truist to customers even during the COVID-19 epidemic. Finally, the company must review its crediting policy in order to ensure maximum return on loans and reduce the number of defaults on money given to customers (Acharya and Steffen e32165).

Works Cited

“About Truist: Truist Bank.” Truist, 2020, Web.

Acharya, Viral V., and Sascha Steffen. “The Risk of Being A Fallen Angel and The Corporate Dash for Cash in The Midst Of COVID.” CEPR COVID Economics 10, 2020, e32165.

Davis, Paul. “Truist Rising: With Megamerger Done, Pressure on to Deliver.” American Banker, American Banker, 2019, Web.

“MarketLine Company Profile: Truist Financial Corp.” Truist Financial Corp. MarketLine Company Profile, 2020, pp. 1–30. Web.

Meola, Andrew. “The Digital Trends Disrupting the Banking Industry in 2020.” Business Insider, Business Insider, 2019, Web.

Misback, Ann E. “BB&T Corporation.” Federal Reserve Bulletin, vol. 106, no. 2, 2020, pp. 1-20.

Srinivas, Val, et al. “2020 Banking and Capital Markets Outlook.” Deloitte Insights, 2020, Web.

“USF NetID Single-SignOn | University of South Florida.” Webauth.Usf.Edu, Web.