Introduction

Islamic banking is a model for offering financial services in addition to the conventional banking system. It entails service delivery guided by the Sharia law requirements as opposed to the usual banking system that is guided mainly by non-religious regulations. Maghfuriyah et al. (2017) state that “Islamic banking as the part of Islamic finance system is considered to be a developed segment of the global financial market with a broad perspective” (p. 1407). Islamic banking has experienced high growth and market penetration rate in the countries affiliated with the Islam religion. Nevertheless, researchers revealed that “Islamic banks have a higher liquidity risk, lower credit risk, lower insolvency risk, but encounter similar operational risk in comparison with conventional banks” (Safiullah & Shamsuddin, 2018, p. 130).

Suhartanto et al. (2018) add that “for Islamic banks, developing customer loyalty is imperative as they could favourably impact on business outcomes such as deposit amount, cost of operation and future revenues” (p. 67). The firms ensured they made viable connections and interrelationships to foster competitive advantages and benefit from the synergies’ competitive advantages. It is important for UAE to look at Islamic banking as the nation is a critical Islamic finance hub, which is substantiated by the fact that these categories of deposits and financing are equivalent of 29% of the total sector of deposit and financing as well as continuous growth of 3.6% in 2020 unlike traditional banks, indicating the resilience and underlying strength of Islamic banking as a key source financial provision for the nations of interest (“UAE Islamic banks dashboard,” 2021).

The introduction of Sharia governed financial institutions has led to massive shifts of customers from traditional banks. The increase in demand for Islamic banking services in the Middle East and North African countries has been rising for the last two decades (Mahdi & Abbes, 2018). For example, the compound annual growth rate in the Middle East and North Africa constitutes 14% and is expected to grow by more than 10% further (Mordor Intelligence, 2020, para. 2). Islamic banking attracts clients with their “ethical standards combined with the principles of profit and risk-sharing.” (Azmat et al., 2020, p. 267). Among all, “Asia and MENA region demonstrate growth in Islamic banking: Bangladesh, Indonesia, Malaysia, Iran, Egypt and Turkey” (Cham, 2018, pp. 23-24). Countries that have adopted Islamic banking include Iran, Saudi Arabia, Kuwait, UAE, Bahrain, Qatar (in the Middle East); Malaysia, Indonesia, Bangladesh, Pakistan (in the South and Southeast Asia). Next, Sudan, Egypt, Tunis, Gambia (in Africa), UK, and Turkey have also utilized Islamic banking (Cham, 2018). Therefore, the system has a global implementation in countries that share Islamic religion and traditions.

Objective

The report mission is to develop the Islamic banking cluster in the UAE in order to be number one in Islamic Banking since UAE is standing at the second ranking after Malaysia (UAE Economy, 2021). By doing this, UAE will be placed itself as Islamic Hub globally. Hence, the strategy and policies should be in place to prove the way to this to happen.

Scope

The report aims to cover the situation with Islamic banking in UAE across all Emirates. The range of operations that Islamic banking offers are unique and can only be provided here. Such transactions include Ijar or a long-term lease transaction similar to a leasing transaction, Salam, or a financial transaction that is upfront financing similar to a contracting agreement — this transaction is primarily used in the agricultural sector.

Added to this, the type of products is something to consider such as Takaful, Sukuk and Islamic funds. The suppliers of the cluster might come from national and international organizations. Islamic banking firms attempt to increase talent growth by employing high-skilled people to provide customized products and services as well as providing them with training and educational programs.

Technology is also be used in research and development, which are essential processes in product differentiation. Investment is essential indeed as it is the financial input required to process the services and products offered by the Islamic banking institutions to the customers.

Islamic Banking Cluster Definition

The Islamic banking cluster is a conglomeration of firms with similar goals of providing sharia-compliant financial services. The cluster is “an alternative to the traditional or normal banking systems” that lend money to customers to earn interest. (Suharto, 2018, p. 32). Interest rates for the common banks are determined by laws and regulations in the geographical territories in which the banks operate. However, being Sharia governed, Islamic banking does not necessitate interest as part of the business since riba is outlawed (Suharto, 2018). Islamic banking offers alternative means of enhancing businesses without outrightly charging interest on capital extended to customers (Al-Malkawi& Pillai, 2018). The management of the firms often organizes them into operational units with several players to ensure that each cluster has what it takes to do business efficiently.

Islamic banking is based on the principle of ethical competition and business conduct. The sharia law requires that the Muslim community behave and ethically relate to each other and outline ways of doing so (Ahmed et al., 2017). The prohibition of charging interest rate banks under the law is the reason why these institutions have been keen to develop Islamic banking. The organization and governance of these businesses are what sets them apart from the rest of financial institutions. Hence, Islamic Banking can be looked at using the 3 lenses mentioned in Exhibit 1.

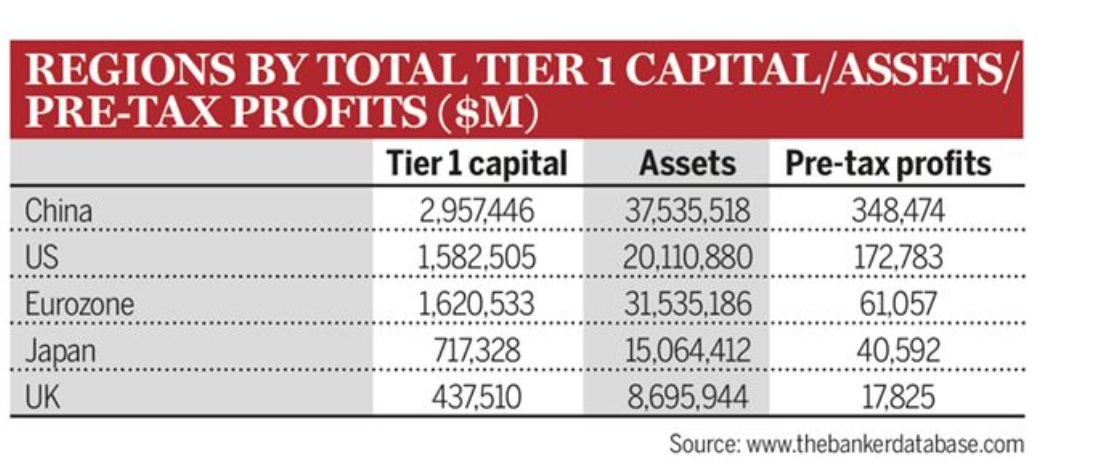

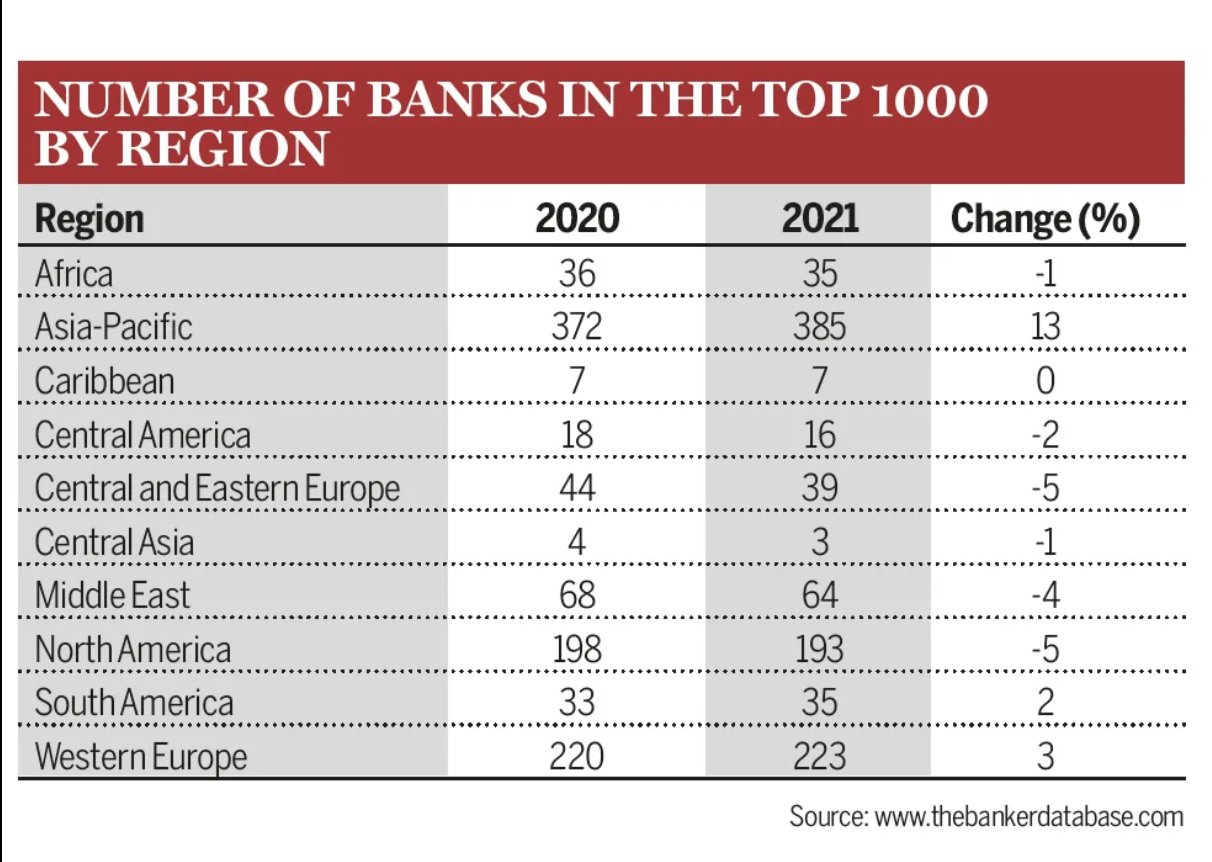

Competitive Ranking

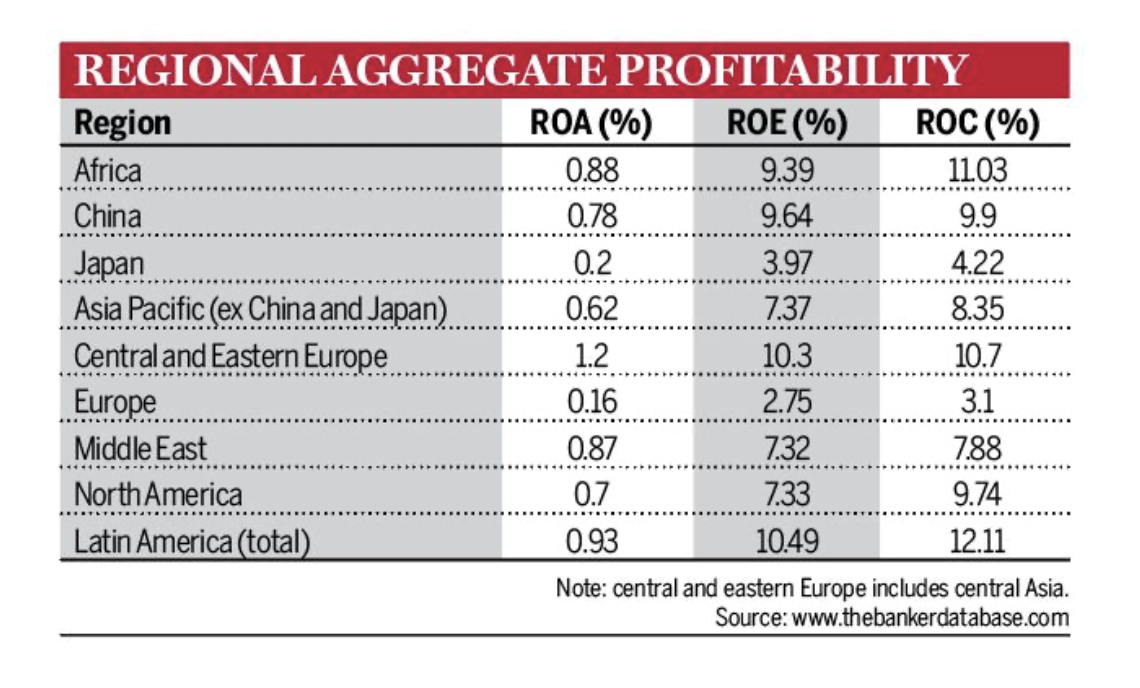

The fast growth rate experienced in adopting Islamic banking services worldwide is a sign of great potential. Currently, more than 500 Islamic banking and financial organizations with aggregate gross assets of more than $ 2 trillion have been created and operate in 105 countries of the world (Statista, 2020). The number of users of Islamic banking services in the world is estimated at 1.6 billion people (Rahmayati, 2021). The growth rate of the number of Islamic banks and the total number of users of their financial services indicates an expansion of Islamic finance in the world capital market. Muslims in the developed countries of Europe accounts for 50% of the savings of the Muslim middle class in the world (Statista, 2020). Islamic banking is developing most actively in the UK, and countries such as Great Britain, Italy, France, Luxembourg have already adopted legislation to ensure tax neutrality. The tendency for the most significant transnational and investment banks to complement traditional banking with financial products with Islamic specifics has strengthened.

The competitive ranking of the Islamic banking cluster depends on the smaller chunks of the whole system. It introduced culturally friendly services in a world mainly dominated by the Islamic religion. This process enhanced easier marketing of the products to the target customers. The adoption of Islamic banking products is also partly supported by the relevant authorities. For instance, the UAE government has observed the close relationship between Islamic banking advancement and economic growth designed policies to foster success in the industry (Gulf News, (2019). According to UAE Rankings (2021), the global innovation index for UAE is 34 as per the latest calculations, making UAE the best country in the Arab World (para. 7). Access to relevant policies and regulations adds to the competitive advantage of Islamic banks. The favorable legal framework offered by the countries in which the services dominate facilitate adequate grounds for growth.

Moreover, the innovation ranking can reflect how competitive an organization is in the market where different players struggle for the same customers. According the Global Innovation Index or GII of 2020, UAE was ranked in 34th place globally and as 1st place in the Arab region, which is a strong indicator of the innovative aspect and strategies of the Islamic banking in the country (Ismail & Bashir, 2021). Therefore, one might consider calculating the input and output efficiency ratio in accordance with the formula r=P/C, where product or P indicates the output, whereas cost or C indicates the input. The 2020’s Global Innovation Index of 34 will be utilized as the output, where the innovation input is equal to 22 and innovation output is equal to 55 (GII 2020, 2021). The efficiency ratio calculations are as follows:

55/22 x 100 = 25 – the input and output efficiency ratio for UAE for 2020. Within the context of the bank’s operations the efficiency indicates the rate of return on the bank’s inputs in relation to its outputs. The most efficient performance achievable lies at the point where the smallest amount of investment leads to the largest profit obtainable. To stay within the optimal bracket, the efficiency ratio should remain at 50% or below, which is the case for the exemplary bank, with it being at 25% in the example presented. A higher then 50% efficiency ratio would mean that the profits are decreasing when measured against investments that they require.

The use of technology has been a critical process for advancing Islamic banking services (Ali & Puah, 2017). These banks are run on innovative technological systems that make customer acquisition, service, and maintenance more efficient than the competition (Naeem, 2019). The management of the clusters acknowledges that offering quality services is one way of ensuring that the market share already won is maintained (Rahmayati, 2021). These banks can also benchmark their performance against the market average to enhance policy formulation to attain more success through technology.

Operations and Funding Sources

The main principle that governs Islamic banking is the rejection of future transactions. The concept of project investment applies to this model of carrying out activities, which is associated with the sharing of risks and equity participation (Laela et al., 2018). There are several transactions that are unique and exist only in Islamic banking. These include an operation similar to a leasing one, a financial transaction that is an advance financing similar to a contracting agreement. An agreement is also possible under which the client can purchase the equipment or structure that was previously leased. The rules and regulations that Islamic banking observes are the same for all financial institutions, regardless of a specific city or country. Islamic banks attract financial resources from individuals and institutions and channel them to commercial firms that need external financing to support their production activities. Thus, Islamic banks perform the same functions of financial intermediation as traditional banks. The main difference is how these functions are performed, that is, how they increase funds and use them.

Relationship between Islamic Banking and STI

Islamic banking cluster offers its services in the chosen markets in a way that can attract more customers. The process has all aspects of ordinary business management except that the institutions are governed by Sharia law. As represented in the Exhibit 2, there is a variety of federal laws, as well, that regulate the banking sector in the UAE. Suffice to say that UAE, indeed, have a proven and stable banking system, both for Islamic and international sectors. The Central Bank of UAE – the main banking regulative organization – maintains its duty of the organization of effective functioning, provision of support and supervision over the activities of the country’s banking system. In this regard, the UAE Central Bank issues various directives, policies, guidelines and recommendations, both general and individual.

UAE Vision 2030 is centered around the infrastructure, market demand, talent, funding, and legislative structure (TDRA, 2021). In the case of the Federal Law no. 4 on combating commercial fraud, it primarily contributes to the latter part of the vision since it is important for the nation to have strong judicial system of justice, which only allows fair practices and harnesses non-tolerance for fraudulent activities. In regards to the Federal Law no. 20 on the mortgage of movable property to secure debt, the regulatory point is related to the infrastructure and legislative structure objectives of the vision 2030. Standard Employment Contracts Equal Remuneration Convention as well as Rules and Conditions for the Termination of Employment Relations contributes to talent and market demand aspects of the vision.

For example, in order to obtain a license, the UAE Central Bank puts forward stringent requirements for commercial banks. However, the majority of the banks successfully operate in the country according to the Islamic banking system. Moreover, the policies also regulate the sector of investment banks as a separate type of banking. The Central Bank’s legislations are easily accessible for anyone in the sector, and support the general strategic vision of the country by working closely with other branches of UAE’s economy.

Strategy, technology, and investment policies (STI) are ways available to the management teams of Islamic banking institutions to foster healthy competition. If well used as management tools, they can enhance the clusters’ competitive advantage, placing these institutions in better positions.

Strategy refers to a plan through which an organization aims to achieve its objectives. Strategies can be formulated from different aspects of business, such as referring to the strengths, weaknesses, risks, or opportunities available in the current period or future (Laela et al., 2018). Strategies revolving around strengths target making the clusters stronger than the competitors. The plans revolving around the weaknesses entail finding alternative ways to sail through the challenges without adversely affecting customers or the business. Strategic planning based on risks looks at the future by observing trends and positioning the cluster in safer places on the market in all aspects.

Technology is closely connected to Islamic banking because it is a tool through which the SWOT analysis can be actualized. Through technology, innovation can also be achieved, and it can be geared towards improving the quality of services (Al-Malkawi & Pillai, 2018). Technological advancements are, therefore, the link between the human aspect in management and the unseen information that can be manipulated to benefit the cluster.

Investment is the financial input required to process the services and products offered by the Islamic banking institutions to the customers. Each investment represents the actualization of a strategic plan, having considered alternative ways to improve the cluster (Kalim & Arshed, 2018). The alternative investment options available are scrutinized with technological inputs, and finally, one among the competing opportunities is settled on. That becomes the institutions’ strategy over a certain period until there is a need for a change.

Identify Stakeholders

Islamic banking cluster is composed of many stakeholders, and each has a value to add to the supply chain process. The government lays down the legal and regulatory framework upon which the institutions operate. It is, therefore, an integral part of the composition of the cluster. The individual firms forming the cluster must be aware of the local and international laws in the banking business. The clusters also require funding from other organizations, which form an essential part of the supply chain. Funding sources can be shareholders who raise capital to start Islamic banking services, but they do not manage the daily affairs of the institutions (Smaoui et al., 2020). They offer the funding needed to cover some of the risks, such as liquidity risks.

Stakeholders can also be classified in terms of their being publicly or privately owned or affiliated. Mainly, Islamic banking works with private institutions, forming the cluster and creating the base for strong customer service. Other stakeholders associated with Islamic banking are the research and development institutions (Janahi & Al Mubarak, 2017). These associates research on behalf of the financial institutions to unravel new investment trends and other relevant trends. They project futuristic overviews of markets to enable the product development teams in the Islamic banking sector to device viable products for each market. Proper market research is significant for the success of Islamic banking products because it helps identify new opportunities (Al-Malkawi, & Pillai, 2018). Moreover, market research can outline risks associated with specific markets and provide relevant information for the management to make appropriate decisions.

Stakeholder analysis

The stakeholders have direct or indirect interrelationships, and these affiliations are important for the functioning of the clusters. For instance, some of the firms in the cluster have better knowledge about research and development than the rest. Other firms have specializations in product marketing, and all these are synergies required to keep the cluster strong. The government sets the regulations for fair trade and, in turn, benefits from the growth of the country’s economy when the Islamic banking firms thrive in the business. For example, Federal Law No. 14 passed in 2018 in UAE establishes authority over Islamic banking for regulation purposes (Warsame & Ireri, 2018). The ripple effect is a mutual benefit to both the firms and the government. The shareholders in the firms provide the capital needed for strategic positioning and, in turn, expect the management of the institutions to facilitate an ethical trade for the benefit of all.

- H: High.

- M: Medium.

- L: Low.

Based on analysis and coding of stakeholder, there is a lack of policy to regulate the process and how the knowledge can be used or developed in the most beneficial way. That is why there is a good number of R&D institutions, but the knowledge is not produced at the expected level. Another motivate to have a policy or strategy in place is that mostly all stakeholders have high interest in Islamic banking. The government can contribute to local and international alliances, which will benefit the Islamic Banking Cluster and may result in moving UAE to be in the first ranking instead of Malaysia.

Added to this, Islamic banking cluster is composed of many stakeholders, and each has a value to add to the supply chain process. The government lays down the legal and regulatory framework upon which the institutions operate. It is, therefore, an integral part of the composition of the cluster. Hence, Central Bank is considered to be an anchor institute. The individual firms forming the cluster must be aware of the local and international laws in the banking business. The clusters also require funding from other organizations, which form an essential part of the supply chain. Funding sources can be shareholders or investors who raise capital to start Islamic banking services, but they do not manage the daily affairs of the institutions (Smaoui et al., 2020). They offer the funding needed to cover some of the risks, such as liquidity risks.

Stakeholders can also be classified in terms of their being publicly or privately owned or affiliated. Mainly, Islamic banking works with private institutions, forming the cluster and creating the base for strong customer service. Other stakeholders associated with Islamic banking are the research and development institutions (Janahi & Al Mubarak, 2017). These associates research on behalf of the financial institutions to unravel new investment trends and other relevant trends. They project futuristic overviews of markets to enable the product development teams in the Islamic banking sector to device viable products for each market. Proper market research is significant for the success of Islamic banking products because it helps identify new opportunities (Al-Malkawi, & Pillai, 2018). Moreover, market research can outline risks associated with specific markets and provide relevant information for the management to make appropriate decisions.

The government sets the regulations for fair trade and, in turn, benefits from the growth of the country’s economy when the Islamic banking firms thrive in the business. For example, Federal Law No. 14 passed in 2018 in UAE establishes authority over Islamic banking for regulation purposes (Warsame & Ireri, 2018). Some stakeholders of Islamic banking come from semi-governmental or private organizations. For example, Kuwait Finance House is a semi-governmental institution in Kuwait that adheres to the Shari’a law in its financial operations (Kuwait Finance House, n.d.). Moreover, Al Rayan Bank is situated in Great Britain and presents an eligible organization that follows Islamic banking principles outside the usual Islamic counties limits (Al Rayan Bank, n.d.). The other example of the stakeholders of Islamic banking is HSBC Amanah which successfully offers services to the Islamic population (HSBC Amanah, n.d.). The ripple effect is a mutual benefit to both the firms and the government. As an example, two international banks in the UK can be cited, HSBC and other private banks, which offer their clients Islamic banking products for mortgage lending.

Since there are various governmental regulations in countries that are not directly related to the Islamic world and few startups in the sphere, a specific strategy should be defined. Namely, the main stakeholders of Islamic banking seem to be governments of Islamic counties and customers of these organizations. Then, Islamic banking should attempt to receive governmental support and funds. Moreover, the service should be client-centered to bring more customer loyalty and popularity among the Islamic people.

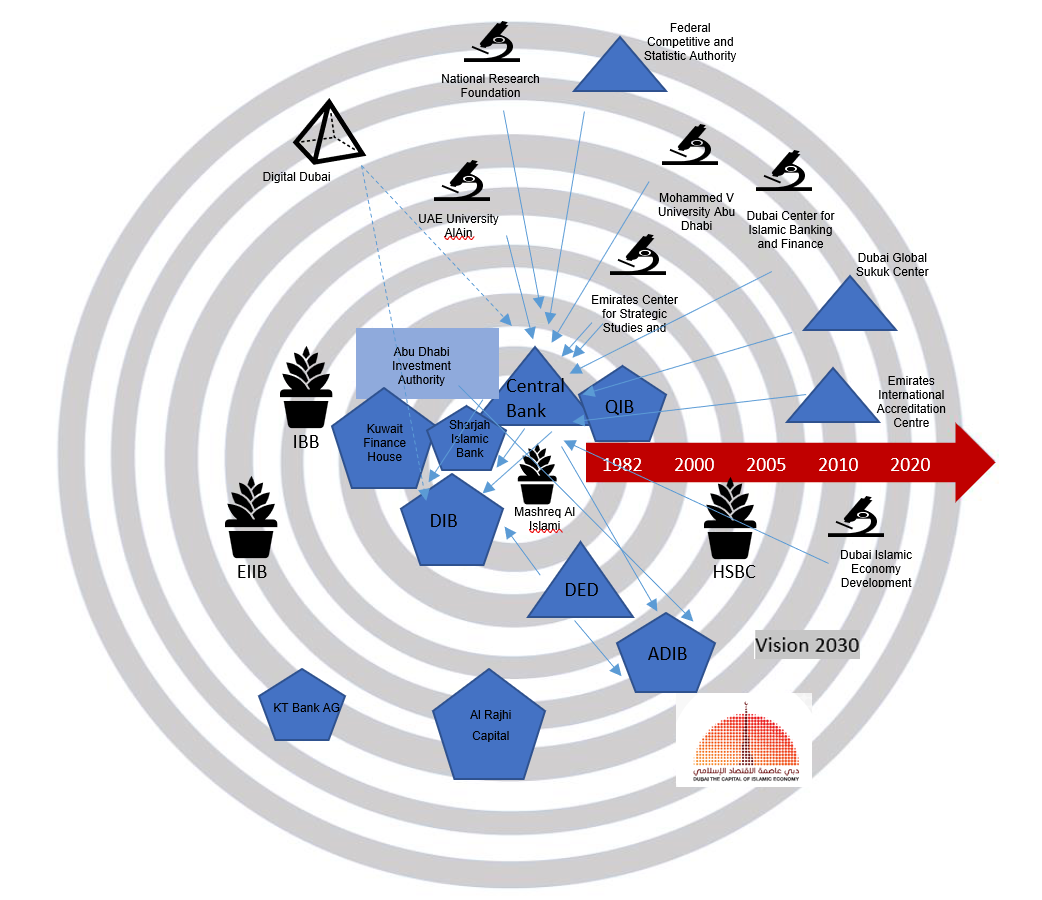

Historical Development of the Cluster

Islamic banking development took place in different timelines across varying geographical locations in the world. The idea behind globally acceptable Islamic banking is believed to have made early advancements in early 1963 in Egypt. In 1970, there was a boom in the oil industry, and it imparted a positive change in Islamic banking by boosting the financial institutions (Shahar et al., 2017). During this time, stakeholders held a convention aimed at bringing together a concept that would later be advanced into effective financial service. In the early 1920s, the service had grown to a point where there was the first bank with a majority of Muslim shareholders in Pakistan. By 1982, the Islamic financial services had spread to other countries such as Bahrain, Malaysia, Sudan, Jeddah, and Dubai.

Two decades later, the services would spread into the Middle East and North Africa regions. The rate of acceptance and adoption of Islamic banking services was heightened by the perception that the process aided in the economic growth of the relevant countries (Shahar et al., 2017). The services have since been improved to the current date status marked by reputable services. In the countries of Islamic concentration, the services rapidly because of their affiliation to the Islam religion. This development has led to a great contribution to the countries’ economic growth. For example, In UAE, the average contribution by Islamic banking towards GDP was estimated at 8.5% in 2019 (Gulf News, (2019). Another reason for the great success of Islamic banking in the MENA countries is the investment in technology with the view to continue offering globally competitive services. Below is the arrangement of Anchor firms along the Historical Timeline to show the relationship between them.

Based on the above figure, kindly find the gaps below.

- Unfortunately, a small number of startups is funded which slows down the growth of the industry due to hard entry to the cluster since Central bank is anchor firm and regulate the cluster.

- Unfortunately, seems no synergy between R&D and universities, where a policy is needed to regulate this.

- Alliances also are missing which can create a real synergy between competitors and more healthy relations where is free move of talent, funds and resources between them.

- Lack of programs and initiatives in order to have more successful cluster through robust ecosystem. This can be done through universities.

Cluster Life Cycle Stage

Islamic banking has been existed for a long time and has grown through research and experiments. Currently, the global standing of the Islamic banking cluster is at the maturing stage (Nurdin & Yusuf, 2020). Through the early inception stages, there were many entrants into this market. They formed alliances, grew together in clusters, and later graduated from emerging to developing stage in the life cycle. The emerging stage can be viewed as the period when Islamic banking was just starting. The formations were strategically made to raise capital, beat the competition, and stabilize the business. At this stage, activities within the cluster do not have strong ties; the cluster is unrecognizable, and there is a high demand for R&D that may require funding.

The maturing stage can be categorized as the period spanning from the last two decades. In this stage, the level of competition is relatively higher than at the two preceding stages. Due to the stiff competition, the number of firms willing and able to enter the market is low. At this level, the existing firms tend to do a lot of niche marketing than undifferentiated marketing. A significant level of investment goes into product research and design to offer to the market customized products. Through this strategy, the firms together have an increased chance of survival from the tough competition. The most effective stage is maturation; the economy of the agglomeration creates new opportunities that must be used, using resources and the most effective strategies. After maturity, clusters at this stage of development are close to the collapse of the cluster. This is since the competent cluster did not attempt to seize the opportunity for development and transformation.

Factors for Transformation

Unfortunately, in each stage of the industry’s lifecycle, it lacked a competitive advantage to be distinctive from its rivals. The competition in the industry is relatively high, which is the reason why the companies in the sphere should choose the strategy of customized services. These services should be of high quality, so research and development of such services are required. Thus, it is essential to create a highly distinctive industry for Islamic banking to prosper. All of this will be based on strong R&D and activate the role of the research centers and academic institutions around the UAE.

The alternative to Islamic banking is the conventional banking system based on interest charges (Azmat et al., 2020). These banks charge interest for loans extended to customers but are rarely concerned with using the capital borrowed. On the other side, Islamic banking offers a different value proposition matrix, including sharing of profits or losses as one of the several models in place. The conventional banking system still has gaps left, which Islamic banking has been keen on targeting. For instance, in UAE, Islamic banking is estimated to have an annual growth rate of 11% compared to the 6% growth of unconventional banking (Gulf News, 2019). The unsatisfied market gap is an opportunity for Islamic banking to capture and do a business out of it. Thus, it can be concluded that the main global competition cluster to the Islamic banking system is represented by the Western banking cluster, that uses the traditional approach. The national competition is underrepresented, however, as the Islamic banking is majorly used in Muslim-populated countries, and the Sharia-based banking system is highly preferable to them.

Therefore, the international cluster is the Islamic Bank of Britain, and its strength is its size and market resilience due to strong asset acquisitions, which are capable of enduring the global crisis events. In the national arena, the cluster is comprised on traditional banks, where the strengths are manifested in the fact that these institutions are not constrained with Islamic regulations as Islamic banks are making them more opportunistic and hence, have more potential for short term profit increases. The traditional banking systems mainly provide competition to Islamic banking.

Islamic banking’s market potential is vast, as indicated by trends in prior years. With at least 55% of the UAE population being subscribers to at least one of the Islamic banking products, the demand has been high (Osmanovica & Stojanovic, 2020). The trajectory is upwards, indicating that the sector still has an unmet demand to satisfy (Al-Malkawi & Pillai, 2018). Meeting this demand calls for a well-designed marketing mix and strategies to ensure that all customers are served. Strategy mapping should be done conscious of the fact that the traditional banks are also formulating ways of increasing their market share. Islamic banking should not follow traditional marketing of its products; instead, niche marketing should be employed to make the best out of the process. Islamic banking is in a critical stage in the cluster life cycle. To continue thriving, all risks should be well analyzed for proper decision-making to ensure the maintenance of its competitive advantage.

Policy Intervention

The future of Islamic banking is pegged on the continued efficiency in service delivery and the appropriate advancement into new markets. This process requires strategic planning and positioning through investing in modern trade tools and technology (Al-Malkawi & Pillai, 2018). The strategy that can be exploited to ensure success in the future assumes an integrated approach, which is the basis of the Competitive Cluster Strategy. The clusters should invest strategically in research and development. It may take more than just put in the financing. Effective research and development of products might entail incorporating some of the most effective R&D firms in the cluster to manage the process costs. The firms become part of the clusters instead of hiring them as standalone service providers. In exchange, the research firms will do their best to offer quality information, trend projection, and data to help the managers understand the market dynamics.

Talent hunting and acquisition is the second strategy the clusters can employ to keep up with new market skill requirements. The clusters should strive to acquire, train and mentor their staff to global standards to ensure quality services to customers (Al-Malkawi & Pillai, 2018). Research and development would lead to customized products and services but getting these services to be adopted in the market require skills such as selling. The clusters, therefore, should have a plan in place for effective talent growth and empowerment. The best human resource strategies should ensure that employees are highly motivated and ready to deal with each day’s challenge. This process would foster market share growth in the target markets and make the clusters financially stronger than the competition.

In some markets, the Islamic banking services would require a lot of customization for their adoption. Currently, these services are concentrated in the Middle East and North African regions. Advancing in new territories would mean competing against the traditional banking setups (Ali & Puah, 2017). In the new regions, the latter is more stabilized in terms of market share and customer appreciation. Changing this fact might not just be pegged on the efficiency of services. It would also depend on how the clusters can work closely with other business networks in those regions. This would translate to the need to collaborate more with other organizations.

The idea of continuous improvement of services through investment in technologies is also another strategy through which the clusters would grow. Technological innovations would not only add to the competitive advantage, but they would also strategically position these clusters for better customer service (Al-Malkawi & Pillai, 2018). Technology would also enhance research and development to ensure that the capital from clusters is optimally invested for best returns and advantage for all stakeholders.

The Cluster Model

Based on Exhibit 6, Arrangement of Anchor firms along the Historical Timeline, it is evident that the cluster is centered on Central Bank which is a government entity. The latter is surrounded by Islamic banks as well as R&D institutions and other government entities.

Benefits from Lessons Learned from Islamic Banking

Islamic banking services in the UAE can be attributed to technological growth, government support, innovation, and unmatched customer service. Together with the strong cluster foundation, each of these aspects makes the prosperity of the service more viable in the future. Although Islamic banking might not completely replace the conventional banking system, a market gap needs to be bridged. The existence of this unsatisfied demand has been proven by the speed of adoption of Islamic banking services. Going to the future, the government in UAE should work closely with the central bank to ensure that the country has a business-friendly environment.

Overall, clusters should address specific banking policies to externalize their vision and reach the objectives while constantly comparing the reality and the desired future outcomes. In addition, it is vital for clusters to ensure their competitiveness among other international cluster in the same field. Therefore, the State Centered Model would be appropriate for the cluster because it is centered in government. Everything mentioned relates to all clusters’ lifecycle stages, including emerging, developing, maturing, and after-maturity.

It is obvious that the current trends in the development of Islamic banks will continue, as oil exporting countries continue to receive significant revenues, the financial markets of Islamic states continue to develop, and Western companies compete to attract foreign investors. However, the lack of hedging instruments, is not resolved, will continue to lead to the concentration of risks in Islamic financial institutions. Consequently, the unregulated development of Islamic financial institutions within the framework of the traditional financial system is fraught with an increase in its financial instability. Apparently, almost any Islamic financial instrument has a traditional analog in competing international cluster, the implementation of which is simpler and related to lower transaction costs. In such a situation, a serious question arises about the advisability of the emergence of Islamic financial institutions in traditional financial systems. Thus, if the Islamic banking system will continue to conquer the world, there is an acute need to review and restructure some of the policies and tools used within it.

The gap between vision and objectives as well as policies can be categorized as narrow, which is indicative of the fact that there is a strong degree of adherence to the pre-established strategies for development, innovation, and growth despite the potential barriers, such as competition and inherent regulatory restrictions. In the case of the gap between reality and where one wants to be, for the current assessment, it is safe to state that this gap is also relatively small since all efforts are in tune with the predetermined goals. For the competitiveness analysis, the first stage is emerging stage, which indicates a rather narrow gap between the cluster of interest and other intentional cluster due to the business environment promoting equivalent elements.

For the developing stage, the cluster of interest and other intentional cluster gap is more visible due to activities being more noticeable and visible, which subsequently makes the gap more prominent. For the maturing stage, the gap between the cluster of interest and other intentional cluster is the highest due to a significant degree of divergence of the paths of development and innovation since the underlying strategies accumulate a substantial amount of differential steps and objectives. For post-maturity cluster, the transformational changes in the cluster of interest and other intentional cluster narrows the widened gap due to the equivalency of innovativeness and business environment since at this stage, the enterprises are no longer directly impacted by the anchors, but rather operate and develop more independently.

The management in the Islamic banking clusters should take into account the importance of strategy formulation. They should also consider talent acquisition, maintenance, and development as critical aspects in the cluster development agenda. Some of the quick wins associated with Islamic banking include the ease of adoption, the potential to grow, and the ability to boost the economy of the UAE. With appropriate plans in place, UAE can continue growing from 55% coverage to deeper Islamic banking services’ acceptance (Al-Malkawi & Pillai, 2018). With the appropriate investments geared towards developing the product, Islamic banking can be more useful in UAE. This experience is the story of creating and running a business effectively.

References

Ahmed, I., Akhtar, M., Ahmed, I., & Aziz, S. (2017). Practices of Islamic banking in the light of Islamic ethics: A critical review. International Journal of Economics, Management, and Accounting, 25(3), 465-490. Web.

Al Rayan Bank. (n.d.). Personal homepage. Web.

Ali, M., & Puah, C. H. (2017). Acceptance of Islamic banking as innovation: A case of Pakistan. Humanomics. Web.

Al-Malkawi, H. A. N., & Pillai, R. (2018). Analyzing financial performance by integrating conventional governance mechanisms into the GCC Islamic banking framework. Managerial Finance. Web.

Azmat, S., Azad, A. S., Bhatti, M. I., & Ghaffar, H. (2020). Islamic banking, costly religiosity, and competition. Journal of Financial Research, 43(2), 263-303. Web.

Cham, T. (2018). Determinants of Islamic banking growth: An empirical analysis. International Journal of Islamic and Middle Eastern Finance and Management, 11(1), 18–39. Web.

Gulf News. (2019). Demand for Islamic banking to drive profitability in UAE. Web.

HSBC Amanah. (n.d.). HSBC Amanah – credit cards, deposits, personal financing. Web.

Ismail, E., & Bashir, H. (2021). UAE ranks first in Arab region, 34th globally in Global Innovation Index 2020. Emirates News Agency. Web.

Jan A, Mata MN, Albinsson PA, Martins JM, Hassan RB, Mata PN. Alignment of Islamic Banking Sustainability Indicators with Sustainable Development Goals: Policy Recommendations for Addressing the COVID-19 Pandemic. Sustainability. 2021; 13(5):2607. Web.

Janahi, M. A., & Al Mubarak, M. M. S. (2017). The impact of customer service quality on customer satisfaction in Islamic banking. Journal of Islamic Marketing. Web.

Kalim, R., & Arshed, N. (2018). What determines the social efficiency of Islamic banking investment portfolio? Journal of Islamic Business and Management, 8(2). Web.

Kuwait Finance House. (n.d.). Understanding Islamic banking. Web.

Laela, S. F., Rossieta, H., Wijanto, S. H., & Ismal, R. (2018). Management accounting-strategy coalignment in Islamic banking. International Journal of Islamic and Middle Eastern Finance and Management. Web.

Mahdi, I. B. S., & Abbes, M. B. (2018). Relationship between capital, risk, and liquidity: A comparative study between Islamic and conventional banks in MENA region. Research in International Business and Finance, 45, 588-596. Web.

Mordor Intelligence. (2020). Global Islamic finance market. Web.

Naeem, M. (2019). Understanding the role of social networking platforms in addressing the challenges of Islamic banks. Journal of Management Development. Web.

Nurdin, N., & Yusuf, K. (2020). Knowledge management lifecycle in Islamic bank: The case of Syariah banks in Indonesia. International Journal of Knowledge Management Studies, 11(1), 59-80. Web.

Osmanovica, N., Kb, P., & Stojanovic, I. (2020). Impacts of Islamic Banking System on Economic Growth of UAE. Journal of Talent Development and Excellence, 12(3s), 1555-1566.

Rahmayati, R. (2021). Competition srategy in the Islamic banking industry: An empirical review. International Journal of Business, Economics, and Social Development, 2(2), 65-71. Web.

Safiullah, M., & Shamsuddin, A. (2018). Risk in Islamic banking and corporate governance. Pacific-Basin Finance Journal, 47, 129–149. Web.

Shahar, W., Shahar, W. S. S., Puad, N. M., Rafdi, N. J., Sanusi, S. W. S. A., & Hassin, W. S. W. (2017). The historical development of Islamic banking. In 4th International Conference on Management and Muamalah. Putrajaya: ICoMM. Web.

Smaoui, H., Mimouni, K., Miniaoui, H., & Temimi, A. (2020). Funding liquidity risk and banks’ risk-taking: Evidence from Islamic and conventional banks. Pacific-Basin Finance Journal, 64, 101436. Web.

Statista. (2020). Distribution of global Islamic banking assets 2019, by country. Web.

Suharto, U. (2018). Riba and interest in Islamic finance: Semantic and terminological issue. International Journal of Islamic and Middle Eastern Finance and Management, 11(1), 131-138. Web.

TDRA. (2021). Islamic economy – The Official Portal of the UAE Government. Telecommunications and Digital Government Regulatory Authority. Web.

UAE Islamic banks dashboard: 2020 results. (2021). Web.

UAE Rankings. (2021). Federal Competitiveness and Statistics Centre. Web.

GII 2020. (2021). United Arab Emirates. Web.

Warsame, M.H., & Ireri, E.M. (2018). Moderation effect on Islamic banking preferences in UAE. International Journal of Bank Marketing, 36(1), 41-67. Web.