Introduction

For the benefit of the incoming administration, I submit this report to document, analyze, and interpret the macroeconomic policy decisions I made as the chief economic policy advisor of Econland. The purpose of this document is to further our national prosperity by deepening our understanding of the relationship between macroeconomic policies and their consequences for our citizens. The report includes a thorough accounting of the major fiscal and monetary policy decisions made over each of the seven years of my term, as well as an explanation of the underlying rationales for those decisions and the resulting impacts of those policies.

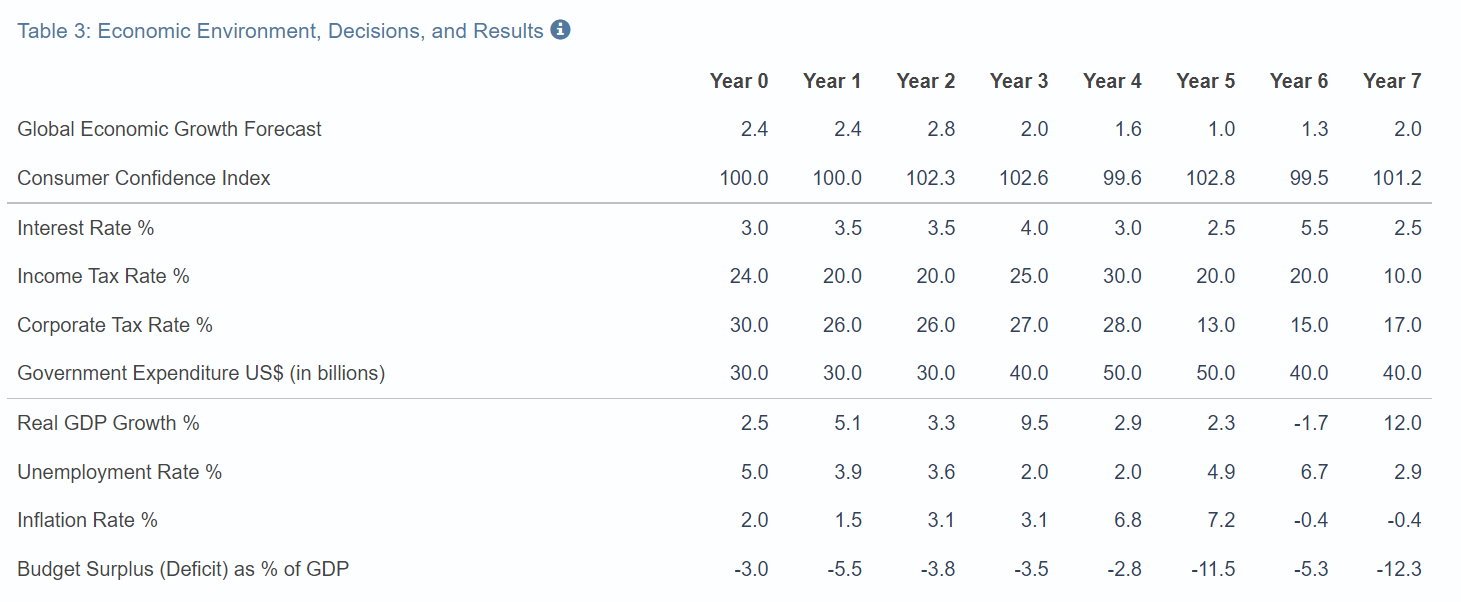

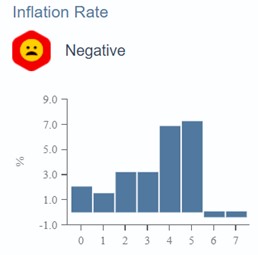

The table above summarizes the macroeconomic climate of Econland over my term. I have chosen the underlying scenario through analysis and continuous monitoring of the macroeconomic climate, identifying negative conditions and taking measures to improve them. My overall performance was good, given the growth of the consumer confidence index and government expenditure U.S. over a seven-year period. Approval ratings as the chief economic policy advisor of Econland based on my simulation results are equal to the average.

Fiscal Policy: Taxation

The intent of the taxation policy decisions I made of my seven-year is smoothing cyclical fluctuations of the economy. This policy was expressed in providing the state with financial resources by mobilizing part of the country’s created GDP to finance its expenditures. It was aimed at ensuring stable economic growth and full employment of resources to solve the problem of cyclical unemployment. It also had to create conditions for obtaining maximum profits against the background of reducing the tax burden. The macroeconomics principles and models that influenced my decision making were the IS-LM model and the classical principles of macroeconomic equilibrium (Mankiw, 2021). In combination, they made it possible to assess the potential impact of fiscal policy using government tax expenditures.

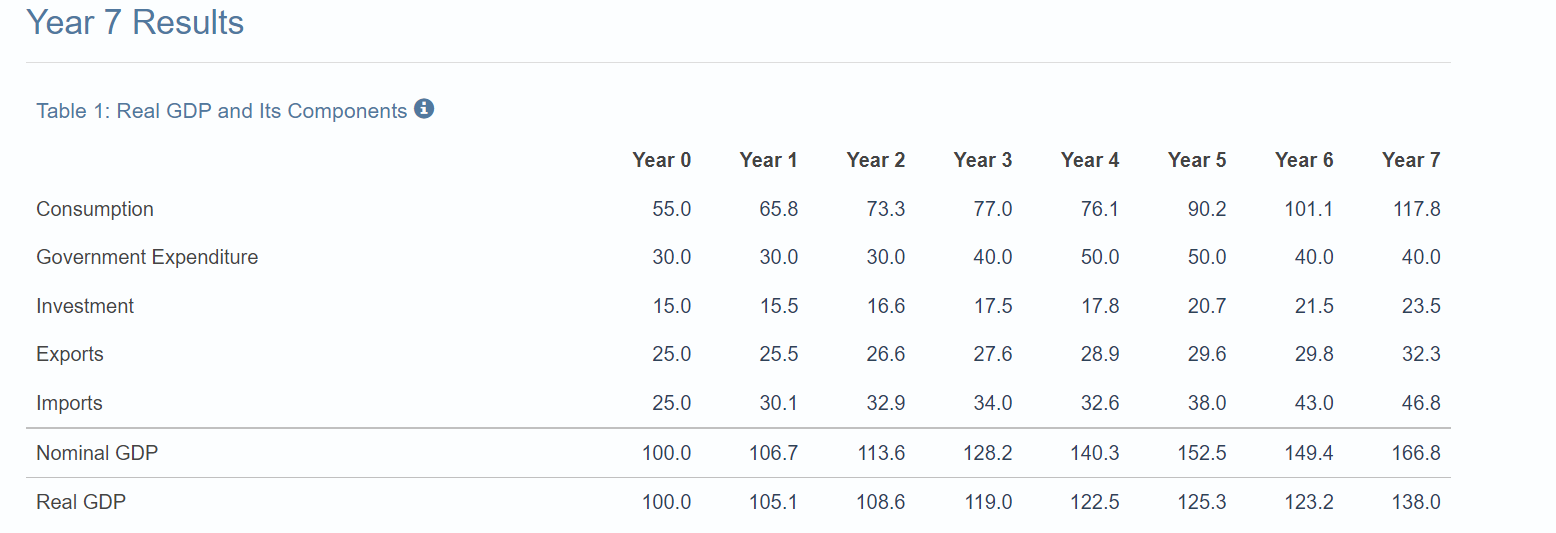

The impact of my changes to the income was positive: the summary data of planned incomes turned out to be reliable. The extension of the professional income tax has provided stable tax conditions for business development. The impact of my changes to the corporate tax rates varied depending on the year. The macroeconomic model used assumed structural maneuvering of the interest rate, which had a different effect (Mankiw, 2021). As a result of the use of tax optimization tools, the level of tax taxation showed various efficiency. Consumption was affected by my tax policy decisions: it has increased over seven years, as evidenced by the increased export and import segments. The active import of goods into the country indicates that citizens have begun to consume more. The introduction of non-linear depreciation in the framework of fiscal policy instead of investment benefits has led to an improvement (Mankiw, 2021). Accounting as expenses in determining the tax base for income tax has made the investments of enterprises in research and development extremely profitable.

The impact of my tax policy decisions is similar with those of current example in the United States. It also did not increase the list of existing taxes, focusing on improving tax administration (Board of Governors of the Federal Reserve System, 2022). However, unlike the modern policy in the United States, the quality of excise tax administration has improved. Moreover, among the differences in influence, it is possible to note the provision of stable tax conditions for economic entities. These examples demonstrate the validity of chosen macroeconomic models. They have shown their effectiveness in the context of the restructuring of tax policy. With their help, it was possible to fulfill such a basic task as creating predictable fiscal conditions.

Fiscal Policy: Government Expenditure

My decision-making regarding government expenditure was determined depending on government tasks in the current fiscal year and was carried out from different funds. The specifics of government spending in each of the seven years consisted in providing financial resources for the needs of the state sphere of activity. Over a seven-year period, it changed based on the macro economical conditions. When it deteriorated, centralized state revenues were used for the most part, while decentralized ones were used when it improved. The intent of my fiscal policy decisions in response to the given economic climate was different depending on the year. When demand fell, government spending increased, and when it increased, it decreased.

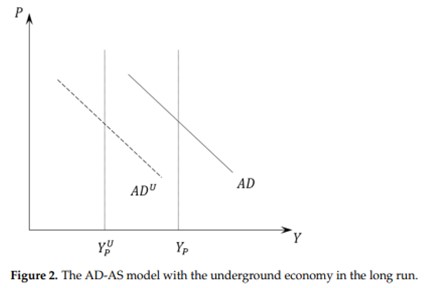

The fiscal policy decision I adopted was one of the important components of the country’s GDP. An increase or decrease in government spending increased the demand for goods and services in the economy over a certain period, positively affecting GDP. The expenses included the costs of unemployment benefits. As a result, the number of unemployed citizens has increased, as it has become profitable to work informally and receive benefits. Government spending has increased unemployment and reduced employment. My policies yielded both to positive and negative outcomes. The positive results were significant GDP growth rates, while the negative ones were the artificial growth of the unemployed. The set of measures taken to increase GDP also led to an increase in the unemployment rate. The AD/AS model shown in the graph shows the impact on the equilibrium output volume as well as autonomous consumption and investment (Lisi, 2021, p. 4). As can be seen from the graph, the fiscal policy decisions are not autonomous, since their value directly depends on the amount of national income (Lisi, 2021).

Monetary Policies

The real interest rate has been changed taking into account current or forecast inflation, depending on the purpose of the calculation. It was not nominal, as inflation was taken into account. These changes have affected inflation, as there is an inverse correlation between interest rates and inflation. Consequently, the rate of increase in the overall level of prices for goods and services has decreased over a seven-year period of time. The changed level of interest rates also affected the attractiveness of loans and deposits for bank customers. Accordingly, it influenced the choice in favor of current rather than future consumption, which is the last stage of the percentage channel of the transmission mechanism. The impact on investment was due to the fact that with lower rates, it became easier to finance current expenses with borrowed funds and less attractive to save. On the contrary, with the increase in rates, the attractiveness of deposits has increased and the attractiveness of lending has decreased. The sum of the cost of total goods and services also has an inverse correlation with the interest rate, so it fell when the changes occurred. The interest rate level is the main lever of influence on foreign trade. As can be seen from the graph, it was in the year when the interest rate reached 7 that the highest percentage of foreign trade was, which indicates a direct interdependence of indicators (Congressional Budget Office: Budget and Economic Data, 2022).

The similarity between the existing monetary policy and mine lies in the primary goals and their impact. These are a success in maintaining price stability in the food and foreign exchange market and increasing production volumes and, consequently, economic growth in the country (The White House, 2022). However, the modern monetary policies of the United States allowed us to achieve a high level of employment, whereas the model I chose did not. These examples demonstrate the validity of macro economical models and the importance of choosing the right monetary policy. Various aspects of public and state life of different scales depend on the choice of instruments for regulating these economic processes.

Global Context

The impacts of openness to trade in general is rather significant. Such an economic system has practically no obstacles to market activity. The ratio of the indices of economic openness and involvement in international trade are proportional. This is due to the fact that foreign direct investments received from economic operations account for a large share of finances aimed at the development of the state. The openness of countries to foreign markets also serves as an important factor in the formation of competition in domestic markets. Due to imports, international competition directly affects domestic markets, weakening the monopoly power of domestic producers. However, the impact of monetary and fiscal policy in a closed economy will have a less positive effect due to the lack of foreign funds in the share of the financial sector (Mankiw, 2021). Most of the funds in an open economy allow the market to be regulated with the help of duties, whereas in a closed economy any monetary and fiscal policy adopted will be softened as a result of the presence of the shadow economy.

Conclusions

Macroeconomics, as a part of economics, is very important to study. There are several reasons for this: it can be used to establish links between phenomena in the economic life of the country. It also shows how the existing situation can be changed for the better. Knowledge of the laws of macroeconomics makes it possible to assume the development of all economic processes in the future. The effectiveness of my economic decisions varied in different years. In general, it did not exceed the average performance indicators and was not critically low. My economic policy decisions almost produced the anticipated results. There were slight deviations from the expected result, but for the most part the forecast coincided with the effect described in the textbooks from the use of models. The chosen macroeconomics principles and models almost behaved in ways that I expected. For example, the application of the AD/AS model really led to government expenditure in the volume in which it was awaited (Lisi, 2021).

Consumer confidence might have impacted the outcomes of my policy decisions for the economy of England as the basis for key moments of fiscal policy decision-making. Consumer confidence is a relevant factor for making informed macro economical decisions because it is sales operations and customer activity that are the engine of all economic processes.

References

Board of Governors of the Federal Reserve System. (2022). Monetary policy report.

Congressional Budget Office: Budget and Economic Data. (2022). Long-term budget projections.

Lisi, G. (2021). Can the AD-AS model explain the presence and persistence of the underground economy? Evidence from Italy. economies, 9(17), 1-11.

Mankiw, N. G. (2021). Principles of economics (9th ed.). Boston, MA: Cengage Learning.

The White House. (2022). Economy & jobs.