Scope of IAS 1

The International Accounting Standards Board adopted the First International Financial Reporting Standard. It summarizes the basic principles of financial reporting and establishes requirements for their content. Its scope is financial statements based on International Financial Reporting Standards, with a common purpose (IAS 1 — Presentation of Financial Statements, 2021). Moreover, it was initially issued to replace the three standards on presentation and disclosure of financial information, and it is the first comprehensive standard.

According to this standard, the statements are prepared at least once a year and must include a comparison with previous periods, preserving the sequence of these periods. Assets and liabilities cannot be offset when preparing these financial statements, and material classes are presented separately. Preparing such a report depends on the entity’s accrual basis of accounting (IAS 1 — Presentation of Financial Statements, 2021). Furthermore, the standard lists items that must be included and has requirements for information classification. For example, each liability must be categorized as either long-term or short-term and be presented separately.

Definition of Profit

If one summarizes the IAS 1 definitions of profit, it becomes clear that this concept is much broader than the strict accrual method. When evaluating the listed information through the lens of cash, it becomes apparent that the reporting system is much more structured when the timing of all liabilities is correctly considered (IAS 1 — Presentation of Financial Statements, 2021). From a cash perspective, value is typically the aggregate of the liquid assets in an organization’s account, representing the available funds. On the other hand, cash earnings usually include only checks and payments related to the sale of goods or services.

However, cash cannot be compared with the general concept of profit because it is only a part of it. Thus, in the chosen standard, profit or loss is defined as total income, including expenses, not including details of other comprehensive income, and not including items of expense and income that are not recognized in profit or loss (Gornik-Tomaszewski & Shoaf, 2020). Total comprehensive income, on the other hand, represents the increase in an organization’s equity over a specific period, resulting from its operations and other events.

Correspondingly, cash cannot be considered a profit in its entirety because its single-moment state does not account for liabilities that are still pending resolution. For instance, if there were many such liabilities without an accrual basis of accounting, the amount of cash in the account may be positive, but it is negative. That is why IAS requires the accrual basis of accounting exclusively.

Profitability alone is neither possible nor sufficient to determine an organization’s overall value, whether it is measured by profit or loss. In addition to financial gains, various factors are involved, including cultural or ethical values, loyalty, trust, and respect for customers and employees (Kujala, Lehtimäki, and Freeman, 2019). A firm that prioritizes cash as its primary goal and puts profit first is unlikely to be successful or effective.

Representing Value Through Financial Lenses

Emirates Airlines is the commercial company chosen for analysis in this work. It is a private company, and all transactions are recorded in accordance with generally accepted accounting principles and norms. Decisions regarding this company can be made based on the information in the financial statements. Analysis of these statements should facilitate a comparison of the company’s performance across different time periods (Morrell, 2021). Profitability, liquidity, operating efficiency, and solvency ratios will be used.

Profitability Ratios

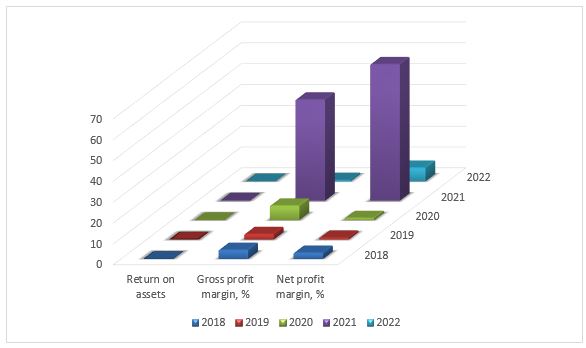

This indicator reflects a company’s ability to utilize its assets and investments to achieve its primary goal of generating a profit. Comparing these indicators in different periods or with major competitors is possible (Hughes, 2019). The company’s return on assets, gross profit margin, and net profit margin ratios will be used in this case.

Return on assets indicates the degree to which an organization’s profitability is dependent on its assets. Accordingly, the more efficiently assets are utilized, the higher this indicator is, and its level varies across different industries. Hence, it is most logical to compare with competitors in the same industry for further analysis (Morrell, 2021). The following operation calculates the ratio of net profit to total assets.

- March 31, 2022: 3.917/149.984 = 0.026

- March 31, 2021: 20.279/151.777 = 0.133

- March 31, 2020: 1,056/172,062 = 0.006

- March 31, 2019: 0.871/127.398 = 0.007

- March 31, 2018: 2.796/127.587 = 0.021

The profitability ratios indicate the company’s poor stewardship of its assets from 2018 to 2020, followed by an improvement in the 2020-2021 reporting period, which was then reversed. Considering the company’s close connection with the tourism sector, hotel business, and air travel, the reason for this could be attributed to the COVID-19 pandemic.

The gross profit margin demonstrates a company’s ability to control its production costs and, simultaneously, set the correct prices for its services. It is necessary to apply the formula to calculate the coefficient: (gross profit/sales) × 100%.

- March 31, 2022: (438/59,180) × 100% = 0.7%

- March 31, 2021: (15,021/30,927) × 100% = 48.6%

- March 31, 2020: (6,408/91,972) × 100% = 7.0%

- March 31, 2019: (2,647/97,907) × 100% = 2.7%

- March 31, 2018: (4,086/92,322) × 100% = 4.4%

The overall upward trend was broken by a substantial decrease in the indicator in the last reporting period.

The net profit ratio reflects the organization’s ability to generate net profit. It is calculated accordingly to the gross profit margin, but it considers the net profit: (net profit after taxes/sales) × 100%.

- March 31, 2022: (3,917/59,180) × 100% = 6.6%

- March 31, 2021: (20,279/30,927) × 100% = 65.6%

- March 31, 2020: (1,056/91,972) × 100% = 1.1%

- March 31, 2019: (871/97.907) × 100% = 0.9%

- March 31, 2018: (2,796/92,322) × 100% = 3.0%.

Liquidity Ratios

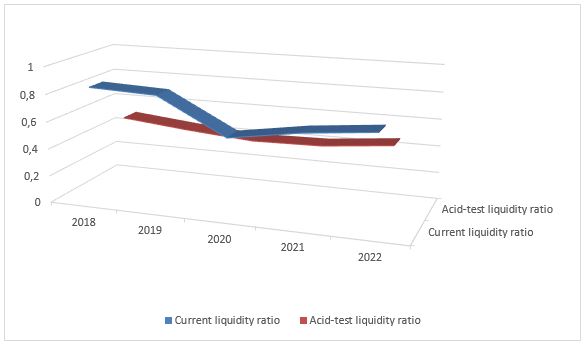

These essential ratios confirm the company’s ability to earn the funds needed to pay its financial obligations on time. The organization and its creditors use these ratios to focus on the company’s ability to pay its obligations. The current ratio is calculated by dividing current assets by current liabilities. The current ratio for the financial period ending:

- March 31, 2022: 30,420/44,148 = 0.69

- March 31, 2021: 22,891/35,705 = 0.64

- March 31, 2020: 27.705/48.892 = 0.56

- March 31, 2019: 30,915/37,465 = 0.82

- March 31, 2018: 34,170/40,566 = 0.84

The acid-test ratio measures a company’s ability to meet short-term obligations with its most liquid assets. It is calculated by subtracting inventory assets from current assets (Morrell, 2021). The current acid test ratio for the fiscal period ending:

- March 31, 2022: 20,880/44,148 = 0.47

- March 31, 2021: 15,108/35,705 = 0.42

- March 31, 2020: 20,249/48,892 = 0.41

- March 31, 2019: 17,037/37,465 = 0.45

- March 31, 2018: 20,420/40,566 = 0.50.

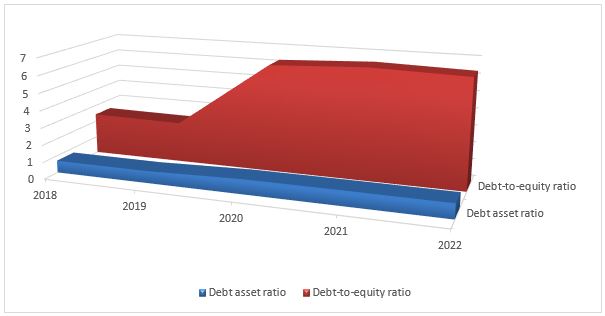

Solvency Ratios

These ratios demonstrate a company’s efficiency in paying its long-term obligations and reflect its ability to function over the long term. These ratios are essential to the airline, as all creditors and other stakeholders are interested in the organization’s successful functioning. The higher these ratios are, the better the chances of all parties obtaining investments and loans on more favorable terms.

The debt asset ratio compares debt to assets and is calculated using the formula: total liabilities/total assets. The current debt asset ratio for the fiscal period ending:

- March 31, 2022: (85,523+44,148)/149,984 = 0.86

- March 31, 2021: (95.925+35.705)/151.777 = 0.87

- March 31, 2020: (99.583+48.892)/172.062 = 0.86

- March 31, 2019: (52,190+37,465)/127,398 = 0.70

- March 31, 2018: (49,975+40,566)/127,587 = 0.71

The debt-to-equity ratio shows the share of debt or equity in acquired assets and indicates the degree of financial leverage of the organization. This ratio is calculated as total liabilities/equity. Current ratio:

- March 31, 2022: (85,523+44,148)/20,313 = 6.38

- March 31, 2021: (95,925+35,705)/20,147 = 6.53

- March 31, 2020: (99,583+48,892)/23,587 = 6.29

- March 31, 2019: (52,190+37,465)/37,743 = 2.37

- March 31, 2018: (49,975+40,566)/37,046 = 2.44.

Seeking Answers to Organizational Issues

Organizational issues that a company’s board may have based on the financial analysis will be based on the three main factors most important to the airline. These factors include the liquidity ratio, the debt-to-capitalization ratio, and the return on assets. At the same time, according to the financial analysis results, these indicators show negative growth, and undoubtedly, all the stakeholders in the company are interested in their increase.

Judging by the calculations, acid test ratios and current liquidity ratios significantly declined in 2021-2022. This may demonstrate the company’s inability to repay its short-term liabilities with short-term assets. Moreover, it may negatively affect the opinion of potential investors. The debt-to-capitalization ratio is excessively high, most likely caused by the company’s financial problems.

There are likewise significant problems in the fuel market, which, combined with the pandemic’s effects, negatively affect the organization’s overall return on assets. From Morrell’s perspective (2021, p. 62), liquidity should not be less than one in a normal situation. In the case of Emirates Airlines, the upward trend in liquidity is present, but it is still not high enough. Hughes (2019, p. 63) describes a so-called “liquidity management” that some airlines use, which may help. This method involves shifting liquidity to destinations with a risk of late payment to creditors. Naturally, such processes must occur within the organization’s risk tolerance boundaries.

However, when making decisions based on the analysis of the data provided, it is worth refraining from radical changes or risky decisions. When conducting such an insufficiently dynamic analysis, the information will be untimely even if the company is fully confident in the data quality. A great deal of time has already passed since the reports used for the analysis were generated, and more active monitoring of the company’s current affairs is necessary to determine the dynamics (Lemus-Aguilar et al., 2019). Possible expansion of the staff of analysts and financiers will be able to solve this problem, and further options for organizational changes may be provided to direct the vector to remedy the situation.

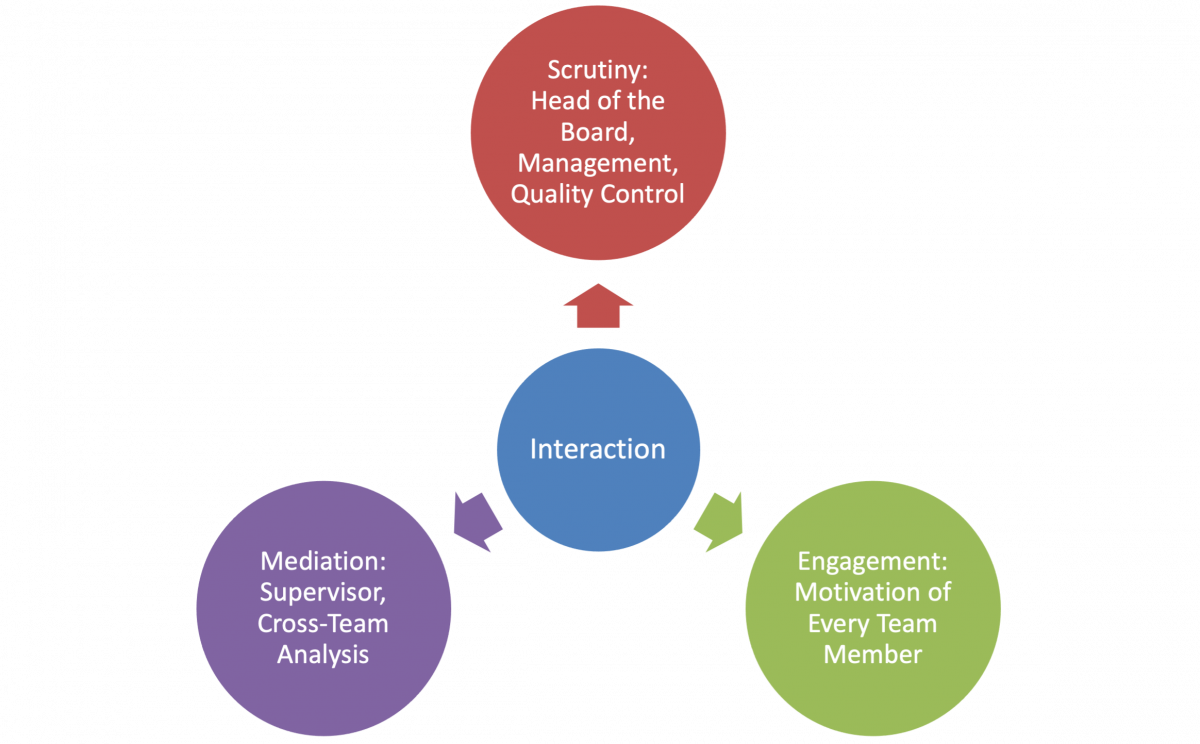

Governance Framework Design

A management framework has been designed to optimize organizational change processes. It is built on four rhetorical principles, each intended to contribute to solving the problem of ambiguity and uncertainty (Quattrone, 2015). Fig. 4 shows the basic diagram of the framework. It represents these principles, which are adapted to the company’s specifics and interconnected with each framework part.

The scrutiny principle is, in a way, the foundation of this framework because it relates to management, whose primary goal is to correct the airline’s financial situation. At this stage, the primary goals and implementation methods are defined to streamline the ambiguity (Dealing with the unknown). Moreover, this principle sets the stage for discussion and debate among management and employees.

The interaction principle is the unifying principle of the other principles. It helps to visualize and summarize the individual understanding of the issue by each employee involved in the solution process. In the case of Emirates Airlines, a full-fledged visualization of the interaction between employees is mandatory – it is easier and faster to understand each other. For example, statistical information about the number of tickets purchased, presented in the form of diagrams, is perceived quickly and almost equally by the entire team.

The mediation principle denotes brokering, mandatory in a hierarchical company like Emirates Airlines. The leading owner has no opportunity for personal communication with each employee. After the task is set, it is communicated to all the relevant departments through the mediation of senior managers and software platforms (Dealing with the unknown). In the same format, the transfer of information in the opposite direction works, helping to remove the problem of complexity and ambiguity.

The fourth principle, related to engagement, is necessary for successful employee interaction and effective organizational performance. Emirates Airlines embraces an atmosphere of patriotism and dedication to the business and the company, and this motivational point must necessarily remain in the framework. Employee engagement directly depends on their motivation, and there is always the possibility of materially influencing this motivation in case of necessity.

Reference List

Dealing with the unknown (no date). Web.

Gornik-Tomaszewski, S. and Shoaf, V. (2020) ‘Continued impact of International Financial Reporting Standards on U.S. generally accepted accounting principles,’ The Journal of Global Awareness, 11(1), pp. 1–12. Web.

Hughes, V. (2019) Airline management finance: The essentials. 1st ed. London, England: Routledge.

IAS 1 — presentation of financial statements (2021). Web.

Kujala, J., Lehtimäki, H., and Freeman, E. R. (2019) ‘A stakeholder approach to value creation and leadership,’ in Leading Change In a Complex World: Transdisciplinary Perspectives, pp. 123-144. Web.

Lemus-Aguilar et al. (2019) ‘Sustainable business models through the lens of organizational design: A systematic literature review,‘ Sustainability, 11(19), p. 5379. Web.

Morrell, P. S. (2021) Airline finance. 5th ed. New York, NY: Routledge.

Quattrone, P. (2015) ‘Governing social orders, unfolding rationality, and Jesuit accounting practices: A procedural approach to institutional logics,’ Administrative Science Quarterly, 60(3), pp. 411–445. Web.