Since it was discovered in December 2019 in Wuhan, China, COVID-19 has caused massive human suffering and undermined the global economy. The lives of billions of the world’s populations have been turned upside down by the pandemic, which has significantly affected the social, environmental, health, and economic domains. By now, everybody has been hurt either directly or indirectly by the coronavirus disease. Even countries that did not go into a lockdown, like Sweden, have had their economies massively severed. This paper will provide a comprehensive analysis of the COVID-19 impacts on the economic domain as well as the vaccination programs, obstacles, recovery, and future plans.

Most governments took drastic measures to contain the disease through lockdowns, quarantine, and social distancing. However, these measures came with a serious economic downturn. They led to business closures and unemployment, which dealt consumer services a big blow. Social distancing and lockdown measures reduce the capacity of the economy to produce goods and services in many countries. COVID-19 has been responsible for millions of premature deaths across the world. It has also caused many people to stay away from work. As a result, many industries have witnessed a loss of productivity and economic stagnation.

Vaccines are the most effective approaches to fighting the pandemic besides the containment measures such as social distancing and lockdowns. Indeed, the development of effective vaccines to fight the COVID-19 pandemic was achieved with unprecedented swiftness that has never been seen before. Historically, the development of vaccines is known to take between 8 to 15 years. However, for the COVID-19 vaccine, it took scientists less than two years. However, despite the rapid development of the vaccine, a critical mass of the global population is yet to be vaccinated. This implies that it remains a huge challenge to get the pandemic under control, especially considering that more dangerous strains of the virus continue to emerge.

The slow rollout of the vaccine to different corners of the world has ensured that the negative effects of the pandemic continue to afflict. Specifically, it has disrupted the global economic supply chain across the world. China, for instance, recorded a decline in the production index by more than 54% in February 2020 from its value in January (United Nations Industrial Development Organization, 2020). COVID-19 caused many households to experience decreased income due to the loss of their economic activities. Retail sales that mainly rely on household spending suffered greatly. COVID-19 brought to the fore efficacy of the global supply chains that have been erected by many businesses over the years. The pandemic significantly affected cross-border movements of goods and people, leading to a sharp global economic contraction. This is in reaction to travel restrictions imposed by many governments.

In 2020, business travel restrictions, global supply chain concerns, lower corporate earnings, and negative business prospects resulted in a significant drop in cash flows. It gave businesses an opportunity to reassess the risks associated with their exposure to the global supply chain, which is characterized by many disruption points. It also gave governments an opportunity to assess the risks that the supply chain posed to their national supply of goods, including those considered critical for their economic growth and security. Multinational businesses that have overseas operations were the most affected by the pandemic. It emerged that shifting the locations of production and changing supplies can be an expensive undertaking for some business organizations due to additional risks introduced.

The COVID-19 pandemic led to massive unemployment across the world. Millions of U.S citizens filed for unemployment insurance, for instance, claims. Many industries shut down and let their employees go home (Haleem et al., 2020). Although the unemployment rates started reducing by the month of August, its ripple effects could be felt in various sections of the economy, including in consumer purchasing power. Businesses that depended on on-site locations, such as bars, retail, personal services, entertainment joints, and restaurants, felt the greatest pinch of the closure, which significantly contributed to unemployment.

In many jurisdictions, the COVID-19 pandemic introduced a work-from-home approach. A significant labor force was forced to work from home. The United States, Europe, and Asia suddenly became work-from-home economies. Although remote work has its challenges, like poor internet connectivity, those working from home did something to sustain the economies of their countries, albeit in small percentages. To cushion citizens from the adverse effects of coronavirus, some governments decided to lower interest rates for borrowing and reduce the requirements. The Federal Reserve in the U.S. eventually reduced interest rates to between 0% to 0.25% and removed all the requirements for loans to encourage banks to lend consumers and businesses money. As a result, the rates of bank lending dropped in the history of the U.S. For instance, the fixed rate for servicing a 30-year-old mortgage dropped to 2.71% (United Nations Industrial Development Organization, 2020). This was the lowest to have ever been witnessed in the U.S. in five decades.

The record low rates of interest led to a boom in the housing market in mid-2020. Despite the high employment rates, there was a race to acquire homes, especially more indoor spaces and bigger yards that were deemed to be more suited for home working and learning. However, there were low levels of housing inventory, perhaps this could be attributed to the lessons learned from the 2008 financial crisis that left builders trapped with unsold houses. On the other end of the carve, millions of Americans who had been rendered jobless as a result of the COVID-19 pandemic were losing their homes. Up to 20 million renters who had lost their jobs stared at losing their homes as well by the summer of 2020. Unfortunately, the eviction moratoriums mandated by the government did not cover everyone but only 30% of the renters (United Nations Industrial Development Organization, 2020). This means that many families were left to bear the brunt of harsh economic times on their own.

The moratorium, nonetheless, expired on July 31, 2021, exposing many more families to evictions from their rental apartments. Although the Centers for Disease Control and Prevention tried to extend the deadline, the Supreme Court ruled it out on the grounds that it lacked the authority to do the same. This resulted in many families being evicted from their homes (McKibbin & Fernando, 2021). The experience of homelessness faced by these evicted families further complicated their chances of finding jobs. In addition, the property owners were also affected by such evictions since empty houses could not translate into money to pay mortgages. Many of them suffered bankruptcy and foreclosure and were left without their homes.

Businesses and families that were worst impacted by COVID-19 were accorded stimulus packages and financial relief. There were different approaches used to offer financial relief, including the $2 trillion aid package passed by the U.S Congress. However, as a result of this relief, the country experienced a record federal budget deficit of $3.3 trillion (United Nations Industrial Development Organization, 2020). This had ripple effects in various sectors of the U.S economy that had to be starved of funds to bridge the gaps.

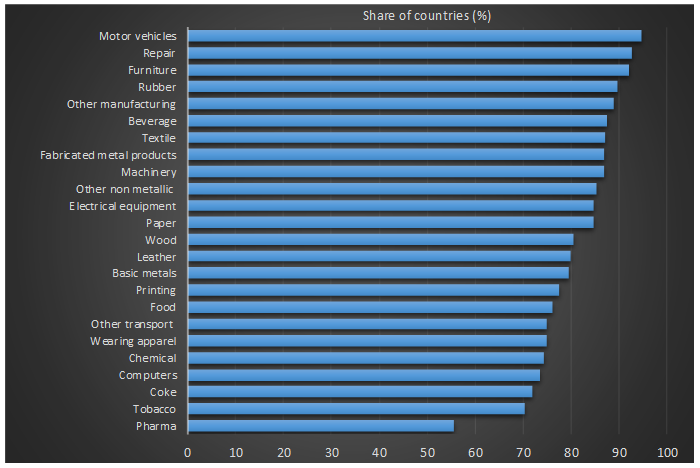

Due to the effects of the COVID-19 pandemic, some countries are now in recession. According to the International Monetary Fund (IMF), about 4.4% of the global economy was declining in 2020 (United Nations Industrial Development Organization, 2020). This was described as the worst decline since the Great Depression that took place in the 1930s. The pandemic has badly hit the manufacturing industries across many nations (Ibn-Mohammed et al., 2021). A survey conducted by the UNIDO revealed that the motor vehicle industry was the worst affected, while the pharmaceutical industry was part of the few winners from the crisis. The figure below shows the effects of the pandemic on some industries, beginning with the worst affected to the least affected in 2020.

Other than the reduction of industrial production, the pandemic also affected bilateral trades between several countries. South Africa, Mexico, Italy, India, and France suffered the highest decline in volumes of trade. Coincidentally, these are the countries that had the most stringent restriction measures against the pandemic. In January 2020, the prices of crude oil fell by about $10 per barrel (United Nations Industrial Development Organization, 2020). This is due to the reduction of oil demands as a result of travel restrictions imposed by governments across the world as well as businesses shut down.

By April the same year, oil prices had globally plummeted to $19. In the United States, it was -$40 per barrel (United Nations Industrial Development Organization, 2020). The COVID-19 pandemic also had devastating effects on global trade. According to the World Trade Organization, the volumes of global trade dropped by 5.3% in 2020. However, in the first quarter of 2021, global trade volumes in North America, Asia, and Europe rose by 20% (United Nations Industrial Development Organization, 2020). This was primarily attributed to improved performance in the growth of fiscal policy measures that these governments had introduced to support personal incomes and boost their countries’ economies.

Despite all these negative economic effects of the pandemic, it is important to note that as of now, the World Health Organization has approved more than 20 vaccines. While some countries, such as the United States, the United Kingdom, the United Arab Emirates, Singapore, and Portugal, have made significant strides in rolling up the vaccines, others still have poor records. Most developing countries and India are facing uneven rollout, a factor that has seen the pandemic spread rapidly. In Africa, only 5% of the population had been fully vaccinated by June 2021. The slow uptake of vaccines in some countries has prompted governments to come up with various measures aimed at encouraging more people to vaccinate. In Saudi Arabia and Italy for instance, both the public and private sectors employees are required to take the jab before being allowed within the precincts of their jobs.

According to the WHO, equitable access to effective and safe vaccines is one of the most critical measures of ending the COVID-19 pandemic. Towards this end, the organization has partnered with various institutions around the globe to ensure that vaccines are deployed to the underserved. Although WHO had aimed to vaccinate 10% of the global population by the end of September 2021, this target was not achieved (Covid vaccines: How fast is progress around the world? 2021). This is primarily because many poor countries rely on Covex deliveries. Cover is an alliance comprising of the WHO, the Vaccine Alliance, the Coalition for Epidemic Preparations Innovations (CEPI), and Gavi. Due to challenges in production, slow approval of regulatory processes, and global export bans, Covax has not succeeded in meeting its goal of delivering 2 billion doses. It must, however be noted if a section of the world is left without appropriate vaccination, then the vaccination efforts will remain futile. This informs the WHO’s concerted efforts to ensure that poorer countries get free vaccines in the near future.

The development and distribution of effective and safe vaccines against COVID-19 have drawn immense global interest. The WHO and the CDC have since authorized multiple vaccines, which many countries have effectively rolled out. The development, manufacture, and delivery of vaccines in one year have been an exceptional scientific breakthrough that has never been seen before. Nonetheless, there are multiple policy challenges that laden the development, authorization, production, administration, distribution, and monitoring usage of vaccines.

The efficacy of the COVID-19 vaccine rollout revolves around its development, dissemination, and deployment. However, there are multiple challenges that often stall the success of these processes. It has proven to be a challenge to maintain sensible and strong research and development initiatives for COVID-19 vaccines. In addition, since many countries are not involved in the production of vaccines, it has not been easy to run clinical trials in coordinated formats. There are also some fears that the authorization of vaccines as safe and effective was seen in some quarters as lacking transparency. Some vaccines were swiftly endorsed, while others were rejected even before trials.

The WHO and other global health organizations have not clearly explained how they will monitor the effectiveness of the vaccines during or after their deployment. However, the most domineering challenge is the failure to ensure that the vaccines are accessed equally by all. As of now, while some countries are giving their citizens their fifth jabs, others are yet to even get their first doses. There are glaring inequalities in the vaccine rollout and uptake across the world. There is also the challenge of manufacturing enough quantities of vaccines as well as maintaining the supply chain capacity. Some vaccines require astronomical temperatures to be stored, creating more challenges when it comes to safe and secure transportation and delivery. The WHO is also grappling with the issue of determining which countries need to be allocated free vaccines amidst the high number of deserving cases.

The uptake of vaccines has also been a big challenge that many governments have been forced to confront. At the start, several myths were advanced to discourage people from taking the japs. Some claimed that it interferes with fertility, while others argued that it causes impotence in men. Although governments put up concerted efforts to debunk these myths, they created apathy among citizens, which slowed down the process. Unfortunately, other parts of the world still hold discouraging beliefs about the vaccine’s uptake up to date. As the virus continues to mutate, more variants continue to emerge.

Manufacturing vaccines that can keep up with the different versions of the virus is not only proving to be a big challenge but also seen as riddled by global politics of discrimination. For instance, after South Africa rejected the Pitzer vaccines, a new variant emerged in the country. This was swiftly followed by banning flights from South Africa and its neighbors from entering Europe. Interestingly, flights from other European countries whose citizens have recorded a greater number of cases have not been banned from flying to other countries. This unfair and unequal treatment of nations will continue to be a big obstacle to the success of the COVID-19 vaccines. It negatively affects the economies of these countries since airlines provide jobs to millions of people. Unless all these challenges are addressed amicably, the rollout of the COVID-19 vaccines will continue to be laden with opaqueness and mistrust. The net effect of all these is the continued stagnation of the economies of the affected countries.

The COVID-19 pandemic has impacted many sectors of the global economy. Every corner of the world has been affected by the pandemic. The measures that were imposed by various governments, such as social distancing, lockdowns, and working from home, have led to massive job losses. As a result, many families have been thrown out of their houses due to their inability to pay their rent. Consumer spending has also declined drastically as a result of income losses. The austerity measures brought by governments to cushion their citizens against the impacts of the pandemic have instead destroyed the global economy further. However, over the past year, efforts have been put in place to roll out vaccination programs across all corners of the world. While many developed worlds are recording improved vaccinations, the developing world is still lagging behind due to various challenges. The WHO and other bodies are in talks that are aimed at scaling up vaccine uptake among the vulnerable and most deserving populations.

References

Covid vaccines: How fast is progress around the world? (2021). BBC News.

Haleem, A., Javaid, M., & Vaishya, R. (2020). Effects of COVID-19 pandemic in daily life. Current Medical Research Practice, 10(2), 78–79. doi: 10.1016/j.cmrp.2020.03.011.

Ibn-Mohammed, T., Mustapha, K. B., Godsell, J., & Adamu, Z. (2021). A critical analysis of the impacts of COVID-19 on the global economy and ecosystems and opportunities for circular economy strategies. Resources, Conservation and Recycling, 164.

McKibbin, W., & Fernando, R. (2021). The Global macroeconomic impacts of COVID-19: Seven scenarios. Asian Economic Papers, 20(2), 1-30.

United Nations Industrial Development Organization. (2020). Coronavirus: the economic impact. United Nations Industrial Development Organization.