Introduction

The term business may have different meanings depending on how it is used, for example, if a person says that he/she is doing his/her business, they may mean that they are sorting some personal issues. Business is the “commercial activity involving the exchange of money for goods or services” (Encarta Dictionary 2007). In this case, business means exchange of goods and services while using money to make profit. There are several reasons that make people do business which include employment, to facilitate availability of the goods that are not manufactured locally, share resources from where they are abundant to places where there is scarcity and sell of what you have so that you can buy what you do not have.

International trade has impacted the world both undesirably and positively. Fernando (2011, p. 479) indicates that “nations are closely linked to one another than ever before through trade in goods and services, through the flows of capital, movement of labour and through investments in each other’s economies”. In other words, it has encouraged globalization and made the world a small village. Business has also enabled rapid development of infrastructure across countries due to the desire to attract international investors in these countries. Business is a good activity but can be bad because unscrupulous business activities crop in and hence exploitation of consumers or other businessmen/women. Some companies strive to acquire monopoly and try as much as possible to maintain the monopoly by discouraging other companies from picking up, either by use of very low and untenable prices for the new businesses.

Effects of International Business Overview

Clearly, to do business, one must make profit through various means like raising prices and interests on lending and so on as well as the major means of exchange of goods and services through money (notes and coins). Indeed money “… is an extension of the free market social order. To the extent that civil government interferes with money, it interferes with the operations of the free market order” (North 2009). Meddling with money beyond the general application of laws governing agreements has more serious consequences, all negative, than interference in any other area of the economy. In short, money is the universal medium of exchange of goods and services. This means that money is a very essential commodity. Each country makes its own currency which is referred to as money. Due to the difference in economies, valuation of each currency is based on the currency of the superpower. Basically, the United States dollar is seen as the base currency which other currencies are valued against (Microsoft Student 2007).

Each country has its own currency and the currencies have specific denominations. These denominations are a legal tender and they could be in coins or notes. All this is done to facilitate trade and other forms of exchange of goods and services. Again, each sovereign country has a central bank or rather a federal reserve that controls business activities and the flow of money in and out of the market. Currency can be classified to either domestic currency or foreign currency. Domestic currency is “Legal tender issued by the monetary authority of a country. The domestic currency is the accepted form of money in the economy, but not necessarily the exclusive currency” (InvestorWords 2012). Whereas foreign currency can be defined as “that which is not legal tender in the economy and issued by the monetary authority of another economy and not the common currency area to which the economy belongs” (Fiévet 2004, p. 2). This means that foreign currency may not be accepted readily for trade. However, in some economies where the domestic currency is so weak, the local businesses may accept foreign currency even more than the domestic currency. Because of this situation, there is a need to sell and buy currencies to facilitate trade. This is called foreign exchange. For this to take place, there must be exchange rates which include transaction costs, tax and interest rated by the service provider (Mishkin 2007, p. 43).

Global Financial Market

Therefore, countries trade in one or more commodities and services. This introduces the concept of global financial markets which can be defined as “a market in people and entities can trade financial securities, commodities, and other tradable items of value at low transaction costs and at prices that reflect supply and demand” (Byrns & Stone 1982, p. 45). Consequently, trade is carried out in securities, commodities and other fungible items. This means that there must be a supplier and the consumers. Hence, supply and demand is born. Interest rates and exchange rates are, therefore, very essential.

Flow of money is a very important item that every economy must look into so that they can assess the performance of that economy. An analysis must be done all the time. In fact, according to Walras’s Law, “the aggregated excess demand function of the real sector of the economy is identically equal to that of the monetary financial system. The two systems are, therefore, identical and it should be possible to derive the real sector from the financial sector” (Sanjeev 2012). And that is what is called fund flow analysis.

Interest Rates and Its Effects on Cash Flow

Interest rate is the rate at which someone pays interest on money borrowed from the some source. The rate is determined mainly by the expenses incurred in processing and servicing the loan, the competition by lenders and the regulations set by the central reserve bank (central bank). For instance, in given economies, increasing the central reserve lending rates means the commercial banks, lending rates must go up. This is usually a measure used to reduce inflation or curb inflation. Generally, lending rates affect the circulation of money in any economy which in turn leads to corresponding effects in the economy (InvestorWords 2012, p. 31).

Effects of Exchange Rate and Interest Rate on Each other

The following are the effects of increasing or reducing lending rates in any economy:

- Increases borrowing costs, therefore, reducing the amount of money borrowed and saving is also distracted because people have to service their loans, hence, save less.

- Deposits increase because the interest rates rise on money deposited.

- Investors are more likely to save in British banks because the increases of interest rates raise the value of the UK £.

- In terms of business consumer confidence, the confidence is reduced due to the high cost of doing business.

- It leads to an anticipated higher tax because the government is also a borrower, and being a borrower means to spend more on repaying the loans it has and this is passed to the citizens in form of taxes.

- Home loans or mortgages servicing is adversely affected because of the increase in interest rates; mortgages become more expensive which adversely affects disposable incomes.

- There might be falls in consumption and investment due to the increased interest rates.

In general, higher interest rates affect consumption and investments greatly.

Concept of Demand and Supply

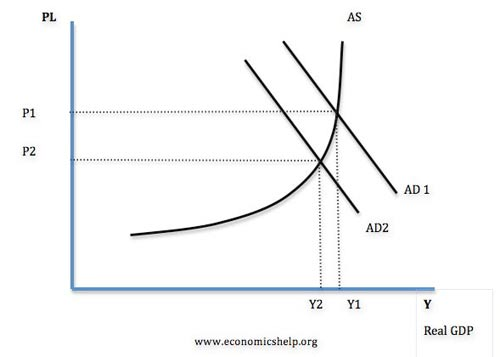

The following graph illustrates the effect of increasing of interest rates on demand and supply.

From the graph, a number of observations may be recorded as observable or expected. One means that the effect of increase in interest rate affects people in different ways. For instance, those who have borrowed will get higher interest rates than they have had before the increase, hence, a negative effect. However, those who have deposited their money as savings will have higher rewards because of the increased interest rates gained from the deposits. Again, those with half completed projects will have to hurry to finish their projects, yet, they will be unwilling to start new projects. On the other hand, interest rates may have little effect on the economy because the ‘panic’ that may be created by the increase may make people think that there is a good thing coming up, hence, they will rush to buy more. Finally, real interest rate increase may be smaller because of the effect of the increase in inflation rate which may balance out the increase in interest rates (Investopedia 2012, p. 7).

Exchange Rates and its Effects on Cash Flow

On the other hand, reducing interest rates also has a number of effects on the economy. However, the most outstanding is an increase in borrowing and investment. It is clear that people will have the power to buy, thus, demand of commodities will increase. Consequently, the prices may rise. These effects may be experienced as inflation if they are in large scale. In fact, Gwartney et al (2008, p. 309) indicate that “the shift in monetary policy is transmitted through interest rates, exchange rates, and asset prices”. Tanzi (1986 p. 17) emphasizes that “as additional money is injected to the economy, individuals may excess liquidity for a time experience, particularly if the increase in the money supply is not fully anticipated”. Hence, before prices and inflationary expectations fully adjust upwards, the impact of excess money leads to a lowering of the rate of interest.

Exchange rate is also an important factor that influences monetary policies and economics in general. Exchange rate is the rate at which one currency can be converted to another for instance, US $1 is equivalent to UK £1.75. If currencies have the same value, they exchange at a rate of one to one, however, due to the service charge, the rate may be slightly different. Exchange rate affects the flow of funds, demand and supply in the global financial markets in different ways. Taking the United States as an example, (Scribd 2012) explains that “If the dollar weakens against all currencies, the U.S. balance of trade deficit will likely be smaller. Some U.S. importers would have more seriously considered purchasing their goods in the U.S. if majority of currencies simultaneously strengthened against the dollar”. Conversely, it is observable that if some currencies weaken against the dollar, the U.S. importers may have simply shifted their importing from one foreign country to another.

Exchange rate is rather unique than interest rates or even prices of assets in affecting the flow of funds. The following factors make it that unique:

- Its huge trading volume, leading to high liquidity;

- Its geographical dispersion;

- Its continuous operation, 24 hours a day except weekends;

- The variety of factors that affect exchange rates;

- The low margins of relative profit compared with other markets of fixed income;

- The use of leverage to enhance profit margins with respect to account size” (FX-Trader 2012).

That puts the effect of the exchange rate in a nutshell, that is if a country’s currency weakens, it will encourage exports because of the power of the other currencies which have against the local currency. Thus, more money will be injected to that economy. However, the country may suffer when importing commodities that it may not be having. This kind of situation puts the players of the global financial market in competition. This competition may lead to lower prices, thereby, lowering the cost of living (FRBSF, 2012). On the other hand, prices may come down but quality may be compromised as well.

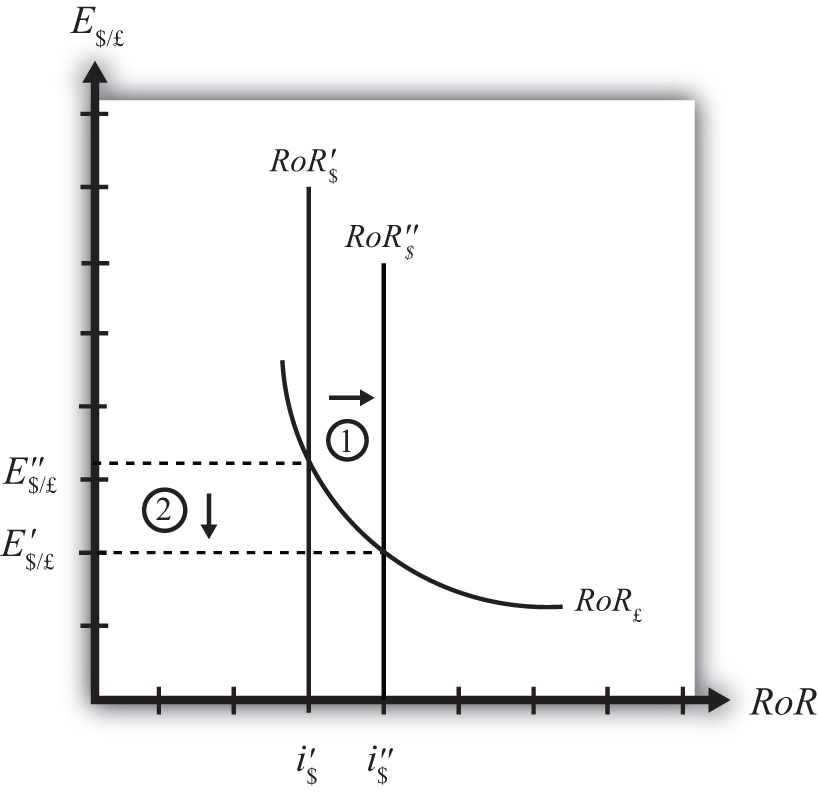

Exchange rates and interest rates have effects on each other directly. The following graph indicates the effect:

Explanation: “higher U.S. interest rates will make the U.S. dollar investments more attractive to investors, leading to an increase in demand for dollars on the ‘Forex’ resulting in an appreciation of the dollar, a depreciation of the pound, and a decrease in E$/£. The exchange rate will fall to the new equilibrium rate E″$/£ as indicated by the step 2 in the figure” (Suranovic 2010, p. 352).

Suranovic 2010 fig 16.2 Exchange rates, asset prices and interest rates are closely tied to international trade or the global flow of finance. All the concepts revolve around investments, imports and exports. Once the value of one currency is stronger, it tends to attract foreign investors leading to an increased demand for the currency and consequently it strengthens further and weakens the other country’s currency. This means that money will flow towards the stronger economy (Economics Help, 2012).

About Surplus and Deficit units

There are other factors that influence the exchange rates other than interest rates, namely:

- Political stability and economic performance. A more politically stable and economically performing countries attract investors which means that they draw money from other economies, hence, making the local currency more valuable;

- Local trade regulations. Countries that provide good investment policies attract investors or improve investor confidence, therefore, the local currency may become more valuable because it draws funds from other economies;

- Large public debt. Countries with large public debts discourage investors because they risk inflation and servicing the debts in case of inflation may worsen the situation further;

- Current account deficits which obviously indicate that a country is borrowing more than it is lending or is buying more than it is selling. This is a poor indicator in the sense that the demand for foreign currency is higher which makes the local currency less valuable;

- Inflation. If a country’s inflation rate is low, it follows that the currency is stronger while a higher inflation rate indicates that the local currency is not doing well in the foreign exchange market.

The terms surplus units and deficit units usually used in the global financial markets simply means that an economic unit that has more income than the expenditures (savers) and units that spend more than they earn (borrowers) respectively (Das 2004, p. 23).

Conclusion

In conclusion, interest rates once increased, generally reduce the circulation of currency which may lead to strengthening of the local currency. Once the local currency is strengthened, it attracts investors which results in strengthening the value. However, with increase in investments, the central bank may want to improve the infrastructure. Since improvement of infrastructure may purely depend on imports and the government may find itself in a situation where it spends more than it makes. And, if that is the case, then the currency may deepen in value due to the savers and borrowing imbalance. Therefore, economies must plan carefully and look into the current and future benefits of spending in any project. The services of strategic leadership may be required. Lowering the interest rates will increase the circulation of money, increased borrowing and investment on assets. This may lead to inflation in a way. Exchange rate, as argued above, is influenced by the interest rates. However, if a currency becomes stronger, it attracts investors increasing its demand and consequently becoming better in value. The two affect each other directly. Other issues that must be put into consideration when assessing the factors that affect exchange rates, interest rates and flow of funds in the financial markets are political stability of the economy in question, trade laws and regulations enacted, the forces of demand and supply, inflation, government debts and incomes in general.

Reference List

Byrns, R., & Stone, G., 1982. Microeconomics. Pennsylvania State University: Scott, Foresman.

Das, D., 2004. Financial Globalization and the Emerging Market Economies. New York, NY: Routledge.

Economics Help., 2012. “Effects of Rising Interest Rates in UK: Why do interest rates have a big impact on the UK economy? Web.

Fernando, A., 2011. Business Environment. New Delhi: Dorling Kindersley Ltd.

FRBSF, 2012. “ Federal Reserve Bank of San Francisco: How does monetary policy affect the U S economy?” Web.

FX-Trader, 2012. “What is Forex?” Web.

Gwartney, J. et al, 2008. Economics: Private and Public Choice. Mason, OH: Cengage Learning Inc.

Investopedia, 2012. “6 Factors That Influence Exchange Rates” Web.

InvestorWords, 2012. “What is domestic currency?” Web.

Microsoft Student, (2007) [DVD]. Redmond, WA: Microsoft Corporation.

Mishkin, F., 2007. The economics of money, banking, and financial markets. California: Pearson/Addison Wesley.

North, G., 2009. “What is Money?” Web.

Scribd, 2012. “International flow of funds” Web.

Suranovic, S., 2010. International Economics. Washington, DC: McMillian Publishers.

Tanzi, V., 1986. Taxation, inflation, and interest rates. Washington, DC: International Monetary Fund.