Introduction

The International Paper (IP) is an American pulp and paper company, and it is the largest such company worldwide. The company is currently experiencing a decline in its business due to the global transition from paper products to digital media. However, IP has adapted technologically and financially to the changes, but its investors are less bullish concerning the company than its competitors.1 IP is expected to face competitive risks in the long term as there is a significant transition away from pulp and paper industry products. On the other hand, in the short to medium term, the company is positioned to continue to generate profits for shareholders.

Business Model

IP has approximately 56,000 employees, and its headquarters is located in Memphis, Tennessee. In 2015, the company generated total revenue of $22.4 billion, whereby two-thirds of the revenue was contributed to industrial packaging activities ($14.5 billion). The remaining a third of the total revenue was from consumer packaging ($2.9billion) and printing papers ($5 billion).2 The U.S. generated the most significant portion of the total revenue because its revenue was $16.6 billion, followed by Europe, the Middle East, and Africa (EMEA) region with $2.7 billion, and the last was Asia and South America, each region generating $1.5 billion from their sales.

The packaging materials segment of the company includes packaging for foods, corrugated boxes, and other retail and intermediate products. IP uses approximately 80% of its industrial packaging activities to produce packaging materials. Additionally, the company owns 18 recycling and 165 containers plants.3 Further on, IP has numerous plants distributed across the EMEA region, Asia, and South America on international platforms. The printing paper segment of IP produces papers used for printing and writing. On the other hand, the pulp segment has towels, stationery, tissues, and filtration products.

The Paper and Pulp industry is competitive, which is why IP has a research and development department that helps in the regular implementation of new technological advances. These advances ensure the company’s plants are environmentally friendly and economically efficient. Due to increase environmental regulations, investing more in research and development is crucial for IP to ensure continuous public legitimacy and economic viability.4 Additionally, IP’s balance sheet has revealed the competitive advantage that the company possesses.5 For instance, in 2015, the company’s intangible assets were $726 million when goodwill was deducted. More than two-thirds of the intangible asset was from customer relationships and lists. The remaining third was allocated to software, trademark and patents, non-complete agreements, water and land rights, and others.

The industry is experiencing broader consolidation trends, which has led to IP’s recent numerous industrial partnerships and acquisitions. Most of these partnerships and additions have been made to maximize profitable lines of business for which IP has the expertise and shed their other, less financially stimulating business activities.6 Some of the notable purchases that IP has made are Mills and other facilities acquisitions valued at $1.6 billion in 2008 and an additional buying worthy of $2 billion in 2016 to expand its business to selling sanitary products and diapers.

Horizontal Analysis

In 2015 the company’s total revenue decreased to -5.3%. A reduction in international sales mainly caused this decrease. In 2015 exports from U.S. plants were significantly low while the exports in Europe increased, but lower prices decreased the company’s revenue.7 According to IP’s 10-K, the leading cause of these effects was the negative impact of foreign exchange rates.8 In addition, the decline in revenue of IP was contributed by a relatively weak global economy that was being experienced in 2015.

From 2013 to 2014, the return on invested capital (ROIC) and operating margin of IP increased significantly. This improvement in the company’s profitability was mainly caused by low input costs such as freight, chemicals, and energy costs. In addition, IP has been complying with its business model by making strategic transitions that have led to business activities with higher profit margins.9 For instance, its partnership with Russia-based Ilim Group has helped it generate higher profit margins. Additionally, the recent diversification of its equity in the Sun Food Packaging Company stake has helped IP develop immediate earnings and boost its profit margin. Therefore, the horizontal analysis of the company points to a significant potential that it can explore in the future, as well as the impressive changes that IP has undergone recently when adapting to external changes.

Industry Analysis and Assessment of Risk

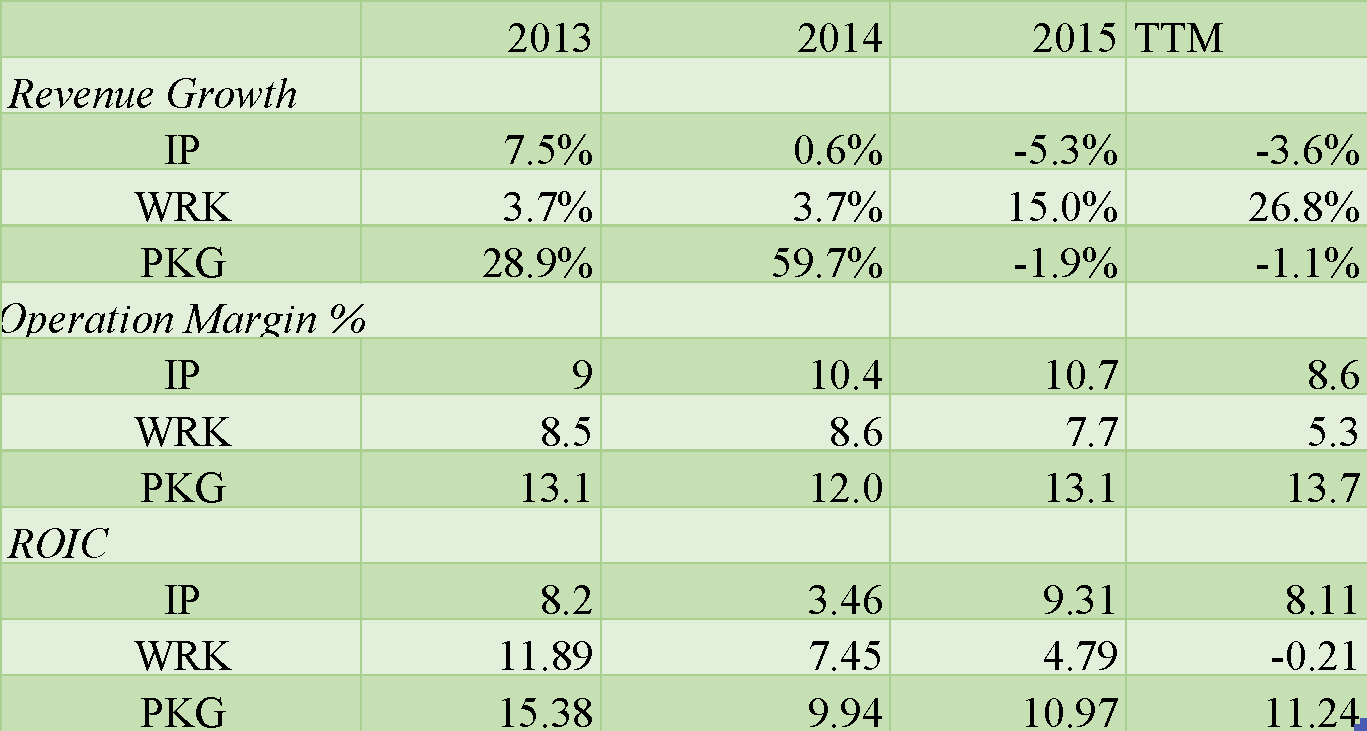

The WestRock Company (WRK) and Packaging Corporation of America (PKG) are the closest competitors of IP. Both competitors have been facing similar industry challenges with IP. The pulp and paper industry challenges are increasing competition and decreasing demand.10 For instance, Exhibit 1 shows that IP and PKG have experienced declining revenue growth. On the other hand, WRK’s growth revenue has increased to 26.8%. However, WRK’s growth was not organic because it resulted from a merger between MeadWesrvaco Corporation and RockTenn Company. The merger between the two companies was a strategic move to resolve the firms’ competitive issues. Combining the resources to form a large entity will be a better effort to compete with PKG and IP.

The operating margin and ROIC of IP, PKG, and WRK are within the average industry profitability measure. For instance, the ROIC of IP is 8.11% which is less than PKG’s 11.24% but higher than WRK’s -0.2. The ROIC shows that WRK is dealing with a significant industrial challenge because it has a negative ROIC, significantly lower than the pre-merger ROIC of 11.9% in 2013.11 Additionally, the operating margin of IP in 2015 was 8.6% which is less than PKG’s operating margin of 13.7% but more than 5.3% of WRK.

Recently PKG has been experiencing a slighter decrease in revenue growth compared as well as higher profit margins. Due to this, IP investors should be worried because PKG has the potential to take its market share.12 However, this competitive risk is less significant than the more extensive industry risk that IP is supposed to handle. Other significant risks that IP has discussed in its 10-K report are quite few. These include (1) underperforming on strategic acquisitions, and joint ventures; (2) variable costs of inputs; (3) compliance costs due to progressively stringent environmental regulations.13 Also, (4) financial solvency and the corresponding likelihood of a ratings downgrade that is capable of increasing IP’s rate of borrowing; and (5) decrease in market demand for paper-based products should be listed.

Valuation and Future Outlook

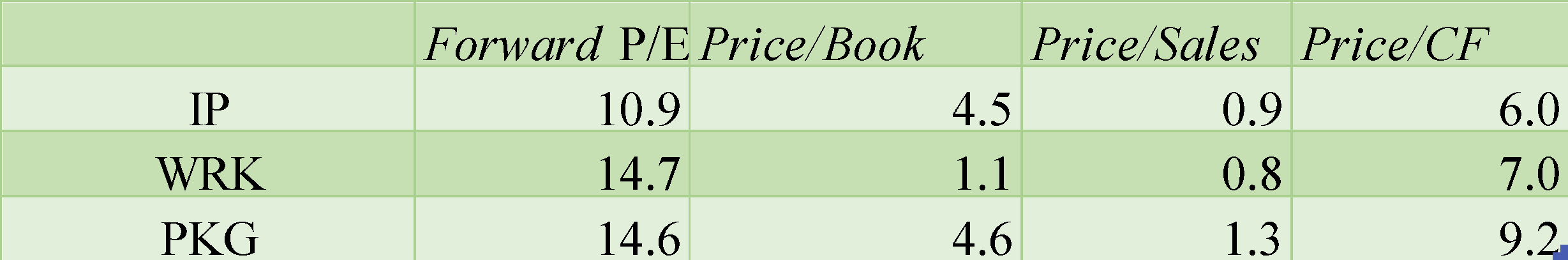

Exhibit 2 shows that IP’s price-to-earnings (P/E) ratio is 10.9, the lowest of its competitors, PKG at 14.6 and WRK at 14.7. A similar pattern is reflected in price-to-cash-flow and price-to-sales measures. Since PKG is relatively strong, this is the main reason it has the highest P/E ratio of its competitors. Given WRK’s recent low profitability indicators, it’s odd, at least on the surface, that it has a higher P/E ratio than IP. However, a closer examination of WRK’s annual report elucidates the problem.14 According to WRK’s CEO, synergies from the company’s recent merger have already reached $165 million for the year, and these synergies will reach $1 billion annually by the end of 2018. If this synergy estimate is correct, WRK’s shareholders will benefit significantly, then the fact that WRK’s P/E ratio is more significant than IP’s becomes less unexpected. Furthermore, if these synergy values are realized, WRK’s success may come at the expense of IP. The 6-month stock price history of these three corporations, as shown in Exhibit 3, conveys a similar story. IP’s stock has only risen 5% in the last six months, but PKG and WRK have seen 21% and 15% stock price rises, respectively.

Conclusion

In conclusion, IP seems like a strong company because its strategic actions enable it to remain profitable in a struggling industry. However, its competitors will be more favorable to the investors due to their higher profit margins. Additionally, IP can potentially lose its market share if the expectations of WRK and PKG become true. From another perspective, IP has moderate concerns on debt and pension, but this has not significantly affected the profitability ratios. In addition, IP acquisitions are the main reason it tries to overcome competitive and industrial risks. Although IP’s competitors seem to be better, it is coping will the industry, and it has a high chance of surviving in the long term.

Bibliography

Coopers, L. L. P. “Global Forest, Paper & Packaging Industry Survey. 2015 edition survey of 2014 results.” PWC. Web.

“Currency Fluctuations: How They Affect the Economy”. Investopedia.

Hunt, Vivian, Dennis Layton, and Sara Prince. “Why Diversity Matters”. Mckinsey & Company.

“International Paper Financial Ratios for Analysis 2009-2022 | IP”. Macrotrends.

“International Paper Agrees to Purchase Weyerhaeuser’s Packaging Business”. Investor International Paper. Web.

“Kimberly-Clark Corporation”. Kimberly-Clark.

“Morningstar | Empowering Investor Success”. Morningstar.

“SEC Filings”. Internationalpaper.com.

Stynes, Mike. “Int’l Paper’s Latest Deal Reflects Demand for Diapers, Feminine Products”. WSJ.

U.S. Securities and Exchange Commission. “Commission File No. 1-3157 INTERNATIONAL PAPER COMPANY.” Sec.gov.

“Yahoo Is Part Of The Yahoo Family Of Brands”. Finance.Yahoo.com.

Exhibit 1

Exhibit 2

Exhibit 3

Footnotes

- “International Paper Agrees to Purchase Weyerhaeuser’s Packaging Business,” Investor International Paper. Web.

- U.S. Securities and Exchange Commission, “Commission File No. 1-3157 INTERNATIONAL PAPER COMPANY,” Sec.gov. Web.

- Coopers, L. L. P, “Global Forest, Paper & Packaging Industry Survey. 2015 edition survey of 2014 results,” PWC. Web.

- Ibid.

- Mike Stynes, “Int’l Paper’s Latest Deal Reflects Demand for Diapers, Feminine Products,” WSJ. Web.

- Vivian, Hunt, Dennis Layton, and Sara Prince, “Why Diversity Matters,” Mckinsey & Company. Web.

- “International Paper Agrees to Purchase Weyerhaeuser’s Packaging Business,” Investor International Paper. Web.

- “International Paper Financial Ratios for Analysis 2009-2022 | IP,” Macrotrends. Web.

- Ibid.

- “Kimberly-Clark Corporation,” Kimberly-Clark. Web.

- “SEC Filings,” Internationalpaper.com. Web.

- “Morningstar | Empowering Investor Success,” Morningstar. Web.

- “Currency Fluctuations: How They Affect the Economy,” Investopedia. Web.

- “Yahoo Is Part of the Yahoo Family of Brands,” Finance.Yahoo.com. Web.