Executive Summary

Portfolio is a collection of investments held by a person or a company. The aim of selecting a portfolio is to achieve a desirable result of return through diversified risk. It will be unwise for an individual, to invest all his money in one project or security, since unfavorable act may occur that will affect the project and drastically affect investment returns. When one invests in a portfolio, unfavorable event will affect one project and have a small impact on returns of portfolio. In selecting portfolio advisors considers the risks of all projects not for one project.

This study looks at the various principle of asset allocation imperatively applied in the task of asset allocation. Asset allocation entails making choice of the proportion of the assets which will be invested in each identified class of the assets. There is a range of classification which each given asset will fall. For instance, real estate, stocks as well as bonds fall under the large assets. Cash also falls under this category of large assets. These la5rge assets can still be subdivided further to create room for diversification of risks. This diversification is important because it allows for a much better compromise the risk of the respective portfolio and the accompanying return. Strategic asset allocation is an integral part of asset allocation and it is concerned with long-term in addition to tactical allocation. The process of tactical allocation basically entails modification of class weights of the portfolio asset class and this is typically carried out on a short term basis. The entire process of tactical allocation adds value to the return of the investment and this can finally be measured by the information ratio.

Introduction

In this report I shall discuss the portfolio return, asset allocation and variance for investment of Beatrix. Here, this is done by selecting varies securities from diverse industries like banking, energy and mining, consumer services, pharmaceutical, airline, communication, finance and government bonds (Fisher & Jordan, 2006).

According to The Skilled Investor (2005) when comprising the portfolio we should consider the effect of diversification. Diversification cushions the impact of fluctuation of a single asset on the portfolio thereby reducing the risk involved (Gapenski & Brigham E, 1994).

Risk and return are of core consideration for a well diversified portfolio. With reference to figure (1), Risk is either systematic or unsystematic.The risk which can be diversified away by increasing the number of securities is the specific risk (unsystematic risk). The risk which cannot be eliminated further is the market risk (systematic risk).The specific risk is composed of factors specific to the security. The market risk is the risk related to Market-wide factors such as interest rates, inflation, economic activity, exchange rates, and unemployment. Thereby, diversification helps bringing unsystematic risk towards zero so that the investor has to only deal with systematic risk. Thus, analyzing the investor’s portfolio we can conclude whether the investor is risk loving, neutral or risk averse (Gapenski & Brigham E, 1994).

- Portfolio Return: – By creating a well diversified portfolio, we might increase our return, but as we can see from the figure above, there is no specific relationship between return and the number of assets. Irrespective of the number of assets in the portfolio we still notice a fluctuation in the returns. In a diversified portfolio irrespective of the number of assets included, the returns do not follow normal conventions and the effect is independent of the quantity of the assets included.

- Beta: – Stocks volatility in relation to the market is measured by beta. Portfolios with high risk are characterized with high beta which tends to give higher returns. The converse for which is also true. Portfolio Beta is the sum of the individual betas; principally the market has a beta value of 1.From the graph above we derive that the portfolio beta is less than one. Bearing in mind the relation of beta to the market we can infer that the assets in the portfolio have less amount of risk involved, hence they might have lower return (Gapenski & Brigham E, 1994).

- Variance:-When an investor invests in a single asset portfolio, asset variance is important, but as we keep on adding assets and the portfolio increases, the effect of individual asset variance decreases and the effect of portfolio variance increase.

Weighted sum of the asset variances and co-variances equals the portfolio variance. Despite the fact that an asset might be very risky, having a high variance of return, the risk might be cancelled out by the covariance of the assets in the portfolio as a whole. The total risk declines when the number of securities is increases because of unsystemic risk decreases. This is because the fluctuations of the assets cancel each other out (Gapenski & Brigham E, 1994).

In a nutshell as we broaden the investment spectrum to include a diversified portfolio, we can achieve a considerable decrease in the variance with which the investor can noticeably reduce the total risk. Negative correlation between assets in the market tends to bring the variance lower and vice versa (Gapenski & Brigham E, 1994).

Diversification

There are many diversification stresses that the more securities one holds in a portfolio the better. Markowitz-type diversification stresses not the number of securities but the right kinds of securities are those that exhibit less than perfect positive correlation.

An unfortunate fact is that nearly all securities are positively correlated with each other and the market. Half the variance in typical stock results from elements that affect the whole market. The upshot of this is that risk cannot be reduced to zero in portfolios of any size (Fisher & Jordan, 2006).

The one half of total risk that is not related to market forces can be reduced by proper diversification, but once unsystematic risk is reduced or eliminated we are left with systematic risk, which no one can escape. Thus beyond some finite of securities adding more is expensive in time and money spent to search them out and monitor their performance and this cost is not balanced by any benefits in the form of additional reduction of risk! Evans and Archers work suggest that unsystematic risk can be reduced by duplicating within industries). This results from simply allowing unsystematic risk on these stocks to average out to near zero. With Markowitz-type diversification, risk can technically be reduced below the systematic level if securities can be found whose rates of return have low enough correlations. Negative correlations are ideal.

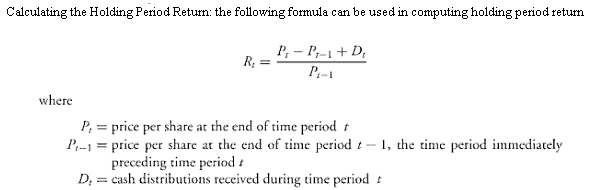

Holding Period return

This gives the capital gain or loss added to the distributions and all is divided by the price of the asset at the beginning period. The distribution for the common stocks is the dividend yielded while the distribution is the coupon payment for the bonds. The holding period return has tow significant features. The first characteristic is that there is an element of time attached to the holding period return. This means for instance that if the successive observations for price are made on quarterly basis then the rate of return would imply a quarterly figure. The second feature is the currency unit. If prices are in US dollars then both the numerator and the denominator will be in US dollars and hence the resultant figure will not be a simple ratio with no units. The resultant ratio will hold no matter what currency is denominated in the prices.

Hypothesis

Despite the fact that prior works point out that there is existence of bias in performance ratings especially when the performance are used for administrative reasons, there is no sufficient evidence to show how bias is affected by the performance ratings. In view of the fact that multiplicity in performance evaluation and subjective performance measures provide the superior discretion in performance measurement, it appears acceptable to examine if diversity and subjectivity affect performance evaluation bias (Gapenski & Brigham E, 1994).

Effects of Combining Securities

Although holding two securities is probably less risky than holding security alone it is possible t reduce the risk of portfolio by incorporating into a security whose risks is greater than that of any of the investments held initially. The portfolio average return of this portfolio can be thought of as the weighted average return of each security in the portfolio; that is (Fisher & Jordan, 2006):

Rp=∑ XiRi

where

R = expected return to portfolio

Xi = proportion of total portfolio invested in security i

Ri = expected return to security i

N= total number of securities in portfolio

The reduction of risk of a portfolio by blending into it a security whose risk is greater than that of any of the securities hold initially suggests that deducing the riskiness of a portfolio simply by knowing the riskiness of individual securities is not possible. It is vital that one know the interactive risk between securities. The risk of the portfolio is reduced by playing off one set of variations against another. Finding two securities each of which tends to perform as a whole, even if one of its components happens to be quite risky. This sort of hedging is possible whenever one can find two securities whose behaviors are inversely related. Now I need to take a closer look at the matter of how securities may be correlated in terms of rate of return. After calculating expected value then the portfolio will be subjected to the present value calculations(Gapenski & Brigham E, 1994).

Present value = Expected Value X present value factor of annuity at the rate of return for one year.

In figure below, we depict the return level R, the programming calculation indicates that point L is the least risk portfolio at that level if return. Because no portfolio points lie to the left of Li it is the most efficient portfolio at that level of return. The locus of points form A and B is the result of the tracing process. I have our efficiency locus, or so called efficient frontier. All portfolios that can be created from the available list of candidate securities are referred to as feasible portfolios. However only those portfolios that provide the highest return for a given level of risk or the lowest risk for a given level of return are referred to as efficient portfolios(Fisher & Jordan, 2006).

Investment strategy

In consideration of the state of these investors, the investment strategy adopted will be either passive or active. Active strategy involves picking up undervalued investments with the hope that the market will change in value so that you can sell them to make a profit. Passive strategy is a buy and hold approach where the investor buys the stock sand hold them for a longer period with annual returns as the benefits that the investor benefits (Sharpe, 1970). In consideration of these facts, I will advise the investor to take passive investment but the investment initially should be made on companies that have good reputation. There are many factors that make passive investment the best for this company. Passive investment does not require regular professional input in determining the earnings that will be accrued from the investment (Fisher & Jordan, 2006).

Passive management strategies provide investors with a broadly diversified way to participate in the stock and bond market. Second, investment can be done at less cost – lower brokerage and management costs – because stocks in index funds are not actively traded. Passive implies that they are virtually unmanaged their performance will mirror the moods and swings of the stock and bond market (Fisher & Jordan, 2006).

The alternatives of investment strategies and risks:-In choosing the best alternative to invest by Beatrix risk is the most important aspect to choose. In this case, passive method of management of bonds and equities has less risk as active because the strategy of buying undervalued bonds and stocks with the hope of the market catching up will be very risky especially this moment of economic crisis where everything including investments is having a downward trend. However in reducing the risk in passive investment strategy the portfolio needs to be immunized i.e. the duration of the portfolio should be made equal to investment who horizon. However the portfolio will be immunized against interest rate changes only if the yield curve is flat and any changes in the yield curve are parallel changes (Harrington, 1987). Recall that duration is a measure of price volatility for parallel shifts in the yield curve. If a change in interest rates does not correspond to this shape-preserving shift, matching the duration to the investment horizon will not ensure immunization; that is, the target yield will no longer be the minimum realized yield for the portfolio (Gapenski & Brigham, 1994).

The effectiveness of immunization strategies based on duration clearly demonstrates that immunization does not work perfectly in the real world. In the first study of immunization, Fisher and Weil found that the duration based immunization strategy would have come closer to the target yield or exceeded it more often than a strategy based on matching the maturity of the portfolio to the investment horizon even after considering transaction costs (Fisher & Jordan, 2006).

The divergence of the realized yield from the target yield is due to the assumption that the yielded curve is flat and changes only in parallel fashion. Several researchers have relaxed this assumption and developed measures of duration based on a yield curve that is not flat and does not shift in a parallel fashion (Gapenski & Brigham, 1994).

Information Ratio an adequate Performance Measure for Portfolio

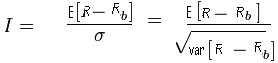

Rates of return are meted on ratio scale just like money is measured on such a scale. The active return of a given investment manager can be measured by Information Ratio. The amount of risk the investment manager takes in relation to the risk is divided by the tracking error to arrive at this ratio.

There is no major difference between information ratio and Shape ratio except information ratio is used in active investment returns and sharp index gives information related to excess returns. The ratio provides a comparison between the annualized returns of the Fund under consideration and those of the relevant benchmark index for instance ninety days Treasuries. It thus takes into consideration the annualized standard deviation of both series. Since the information ratio gives the risk-adjusted active return of the risk free Fund over the benchmark, the higher it is the better the Fund manager because it mean higher active return generated from the Fund manager considering the amount of risk involved (Gapenski & Brigham, 1994).

The various Measurement Scales

Different measurement scales are used to summarize and analyze data in relation to appreciating the work statistical tools perform in measurement of the performance of the mutual funds and other assets. A benchmark index is set and any amount of performance above or below the benchmark index is what is referred to as the active return. This implies that the active return may either be positive or negative depending on whether it is below or above the set benchmark index. The active return when divided by the tracking error drives to the information ratio. The following are scales which can be applied in measurement of various investment portfolios:

The ordinal scale is important to use for rating a bond issue in a given category. The different categories are in turn rated with respect to the probability of default. The ordinal scale is used to measure credit ratings. This ordinal scale does not necessarily have to be related with the interval scale since for instance the letter credit ratings are not meted on an interval scale (Fisher & Jordan, 2006).

The other scale available for measuring the portfolio assets is the nominal scale which is used in measuring the hedge fund classification schemes. Nominal scale employs the use of similar investment strategies to group the hedge funds depending on those investment strategies. On the other hand, ratio scale can be used to measure bond maturity and cash dividends per share (DeFusco et al 2007, p63-64).

To compute this value-added, Lundin (2004) employs the use of the information ratio, which is the ratio between the average recognized surplus proceeds and the volatility of those surplus returns. The main assumption is that there is normal distribution. Lundin first illustrates how to determine security selection and tactical asset allocation excess returns, weighing breakdown of portfolio returns against those of benchmark indexes. He draws out a formula that enables the contribution of an individual asset to portfolio return to be worked out, in spite of whether operational management entails tactical asset allocation or else security selection.

In order to make sure that the manager’s ability to make a tactical asset allocation is not confused with strategic allocation, contribution exclusively arising as a result of tactical asset allocation is isolated. The main assumption in this is that the asset allocation is related to portfolio selection although the investment manager has known how to make judged and tactical asset allocation decision. This skill facilitates a formula that is not dependent of the return set by the benchmark index. The formula would only be dependent on security choice of excess returns to be achieved. By making use of the formula it becomes possible to calculate the information ratio. This information ration will therefore be the measure of the value added by the manager’s tactical asset allocation.

He then demonstrates his explanation with an illustration of a portfolio comprising two asset classes. Contained in the illustration is a demonstration of how the information ratio for asset allocation is dependent only on the surplus returns and risk for every asset class, the covariance between the asset class excess returns and the asset allocation balanced yardstick weights(Fisher & Jordan, 2006).

Incentive systems are designed in such a manner that has drawn a great attention in the field of accounting research. Agency theory holds that any given costless performance measure which is informative as regards the effort of the agent should be used for incentive reasons (Holmström, 1979). Kaplan and Norton (1996), contend that there is no single performance measure that is likely to be comprehensive and thus it is only important include multiple performance measures as an informative principle of incentive contracts. Kaplan and Norton further point out that it is though there have been calls for adoption of multiple performance measures, there is inadequate empirical evidence of the manner in which these measures could be brought together in an overall appraisal and consequently tie this to compensation. A general tendency is that much emphasis is put on objective and common measures of performance more so if it is a case where the superiors have judgment of prudence in considering the different performance measures and multiple performance measures are put to use.

Analytical studies point out that incentive contracting can be perked up by integrating more varied performance measures, not withstanding the inclusion of subjective performance measures. The use of alternative means in measuring performance of investment agents can greatly improve the effort allocation of the given agent and this in turn brings improved goal congruence (Kulp et al 2001). Baker, Gibbons, and Murphy (1994) reveal that the collective use of explicit contracts and implicit contracts (objective performance measures and subjective performance measures respectively) is, in some ways, optimal. Equally, other studies indicate that by using objective or contractible information as well as non-contractible or subjective information for bonus pool arrangements brings about Pareto improvements in contrast to a setting where contractible information is the only arrangement made use of(Fisher & Jordan, 2006).

Nevertheless, apart from the fact that the improving on the number of performance measures alongside using subjective performance measures it is a good fillip for providing more efficient incentives. In addition, this kind of setup provides the principal with more prudence in performance evaluation. A good number of analytical studies make an assumption that the principal will not break a promise or renege on pledged incentive payments when employing prudence either on account of reputation concerns (Murphy et al 1994) or as a result of the principal committing to a fixed bonus pool (Baiman & Rajan, 1995). Nonetheless, individuals at higher levels of management in organizations in most cases are never the residual claimants of subordinates’ productivity and for that reason they do not have any incentives to renege but somewhat have incentives to prejudice the performance assessment (Lundin 2004).

Investigation in psychology shows that superiors squash performance evaluations and offer more relaxed performance ratings as soon as these are intended for encouragement purposes (Rajan and Baiman:1995 also Schaefer and Hayes 2000). Such kind of bias in performance evaluation is quite. This bias in performance evaluation is challenging because it turn out to be more intricate to make the precise human resource decisions, for instance promotion of employee.

Due to increased need for use of diverse performance measures which includes the use of the subjective performance measures already mentioned, it appears reasonable to examine the effect of performance measure diversity and analyze how subjectivity affects performance evaluation bias(Fisher & Jordan, 2006).

Performance measures of portfolio:- It should be observed that prior to the development of these measures, portfolio managers performance was measured essentially by observing the rates of return they were able to earn over time. It was necessary for them to demonstrate that their rates of return equaled or exceeded the returns of an unmanaged portfolio that is either a portfolio constructed by random to choice or a portfolio that represented the returns of the market as a whole and then was held for the duration of test period. Another possible measurement of portfolio performance is to check if the manager was successful in obtaining a beta for the invested portfolio that was consistent with the objectives of the investor for his individual portfolio (Lundin, 2004). Another factor to consider in portfolio management is to evaluate the portfolios managers’ ability to completely diversify away of unsystematic risk. Because e this non market risk can be completely diversified away in a properly constructed portfolio, an efficient market will pay only for the market or systematic risk. In fact, several of the performance measurement techniques incorporate this belief (DeFusco, Dennis, Pinto, Anson , and Runkle, 2007).

Allocation of assets in the Portfolio

Considering the situation of the two investors i.e. they are at the age of retirement and they have a plan of requiring cash after 3 years and some cash after 3 years which will maintain them for many years I propose the following portfolio ;

- Investment in shares – 30% or £ 60,000

- Investment in real estate – 40% or £ 80,000

- Investment in bonds – 20% or £ 40,000

- Investment in short term liquid assets – 10% or £ 20,000

- Cash will remain the amount in the savings account currently.

I propose for the couple to have 10% cash from the current inheritance because they currently are under a salary therefore they will not need the £200,000 inheritance currently as well as the € 10,000. Therefore the only amount they will remain with in cash is the 10,000 already in the savings account the rest of the money should be invested as proposed above. The reasons behind for the above holding are that for an investor to have diversified sources of returns and to minimize risks (Abode and Bognanno, 1995).

Just as was true of investment objectives, the constraints imposed on individual investors are subject to wide variance. That is true of liquidity needs that are highly individualistic and hence, highly variable across individuals. Almost as important as risk and return in investment decision making is time horizon. This is the investment planning period for individuals (DeFusco, Dennis, Pinto, Anson and Runkle, 2007). It is highly variable from individual to individual.

In selecting a portfolio various factors were considered but the most important factor was given priority was the issue of liquidity requirement by investors. Because the investor is retiring he requires investments that will supply with constant returns and other which are long term. Investments which will supply constant incomes have been considered to be bonds especially risk free bonds of the government and they are with less risk (Harrington, 1987). However the investment in equities has high risk currently due to economic crisis and they are not good for long term investments for a retiring investor anticipating a regular inflow of cash. However the investor will put 30% of his inheritance in this category of assets because they represent a class of assets that will provide good returns (Fisher & Jordan, 2006).

The assets that will be invested some will be local other international. Since the investor is living and working in Germany and the inheritance will be from United Kingdom I will propose the investor to put some money in London stock exchange, Paris stock exchange and Germans risk free bonds. This will ensure that they have diversified sources of returns from differentiated market. However since all this countries are in the European Union it is advisable for the investor to think of putting some of his assets in America and Chinese markets. The reason why I propose china as another investment place for the current investor is a waking up giant. It is believed that with the current growth rate china is likely to be one of the largest economic powerhouses (Gapenski & Brigham, 1994).

Specific securities to be invested: – The securities selected in this portfolio are in New York stock exchange, Paris stock exchange, Saudi Arabia stock exchange and London stock exchange. The main reason for purchasing stock and bonds traded in various markets is because of diversification of risks both systematic and unsystematic risks. In London stock exchange, the investor will purchase stocks of Barclays PLC stock, Vodafone PLC and bonds of Smithkline Beecham. In Paris stock exchange, shell stocks shall be purchased as well as Orange telecommunications stocks. In New-York stock exchange, I will advise the investor to purchase diamond-rock Hospitality Company shares Ryan air holding stocks, bonds of Coca Cola Company and Microsoft. In Saudi Arabia the investor should invest in Saudi International Petrochemical Company. I will advise the investor also to take a four year government bonds of the government of England, government of London, government of France and the government of United States of America. The main reasons for selecting this type of securities for investment is because of differentiation and diversification of the risk both foreign exchange and the risk within the country (Fisher & Jordan, 2006).

Analysis of the securities invested: – The securities selected for investment will be analyzed based on various issues such as price earning ratio, interest yield, and systematic risk for holding some of the securities. In selecting this stocks price earning ratio has been considered as the basis for selecting the stocks in various aspects. I have considered the current actual price earning ratio with the market ratios. I have analyzed the past performance of this company in terms of price earning ratio with a point that am satisfied that the stocks taken from a specific industry have in the past been performing well and they represent the best investment as per the needs of the customer. In a normal circumstance the principle determinant of a good price earning ratio for a stock is considered using the following variables (Fisher & Jordan, 2006).

- Sales stability of a company

- institutional ownership of the company

- the volume of the stocks traded in the market

- expected 5 year growth of earnings

- the amount of debt financing and

- The dividend payout ratio taken by the company.

Another factor that I considered in selecting the stocks that have been considered in this case is the present value of dividends and capital gains. This forms the basis for selecting a stock for my current investors because they expect growth for their investment and a constant inflow of cash since they have only 3 years to retire. However if they were having many years to retire I would have selected different stocks (DeFusco, Dennis, Pinto, Anson, and Runkle, 2007).

In selecting the bonds that I have though they are good for these investors I have considered the interest yield and the performance in the market. The corporate bonds I have selected have high yielding history therefore they are good for investment. The performance of interest rates for the government bonds in the countries selected are considered to be more stable although not high earning therefore they can make a good investment (Harrington, 1987).

Out of these, treasury bonds, treasury certificates and stocks are marketable and negotiable, while treasury bonds, ways and means advances are not marketable, but held solely by investors. Development stocks are traded in the capital market, but since1987, the federal government has not issued any new development stock.

The risk of the securities to be invested: – The invested securities pose various risks these risks include foreign exchange risks, market systematic risks and unsystematic risk (Lundin, 2004). Since the investor is currently living in Germany and wishes to settle in France, for some time the flow of income, will have to face foreign exchange risks for stocks from London, USA and Paris. However some of the countries in question share the same currency therefore there will be no problem of foreign currency exchange except the market risk. However stocks from NY and Saudi Arabia will face foreign exchange risk (Sharpe, 1970).

In order for the investor to receive his money in Germany without many problems he should operate an online bank account because most banks are offering online services which ensure he receives money instantly (Levy and Post, 2005).

Assumptions of the case study

One major assumption of this study is that the two investors have identical behavior. This assumption is more helpful because it is quite difficult to measure the behavior of individual superiors. Though measurement of behavior is a limitation of such an empirical study, studies in psychology point out that superiors have a common inclination to bias the performance ratings, it may be that superior-specific attributes influence bias. Second, since the data are cross-sectional data of a particular year, it is not easy to evaluate the extent of persistence of performance evaluation bias. It is also not easy to examine whether the firm essentially incurs the supposed indirect costs of bias (Fisher & Jordan, 2006).

In this portfolio we have assumed that the investor has invested in various proportions of various assets which might not be the case practically, depending on the preference and tendency of the investor his proportion in the assets may significantly. The investor may prefer to invest in either more risky assets or less risky assets depending on the nature of the investor. The returns of the portfolio, to some extent depend on the choice and preference of risk of the investor as higher risk prone assets yield more returns and vice versa.

Limitations

This narrows the selection criterion of the assets for the portfolio, thus the choice is restricted if the investor prefers a well diversified portfolio. When one buys an asset the inherent risk is also bought. The asset is purchased with some intrinsic risk in itself. The portfolio is subjected to domestic market and therefore domestic risk only; Investing globally helps reducing systematic and unsystematic risk significantly thereby helping to reduce the portfolio variance considerably. On the other hand this also exposes the portfolio to global risks like political risk and exchange rate risk.

The portfolio is limited by securities listed on various stock exchanges bearing in mind that the portfolio does include indirect property investments, bonds, and the likes that would have further diversified with improved effect on the portfolio regarding risk and return.

Recommendations

After analyzing our data we can recommend the following:

- First Beatrix should essentially opt for a diversified portfolio on a domestic or a global scenario. This takes care of both systematic and un-systematic risk as discussed earlier.

- Secondly depending upon the propensity of the investor a balance of risk and risk free assets should be sought with a view to optimize the returns of the portfolio.

- It is important to study the company before investing in it. The historic background, the financial performances’ of past years, their recent developments on and off the balance sheet, all contribute towards the company’s success or failures

Conclusion

Based on the findings of the portfolio returns, beta and variance we can conclude that our portfolio can be considered to have low risk. The beta of the portfolio is less than one that further supports our assumptions. However the findings do not reach a concrete conclusion because of the limitations mentioned above, the impingement of factors like the number of assets, limitations of choice in assets and such other issues affect the results there by taking into considerations these ideal circumstances and bearing in mind our assumptions are true the portfolio in the above circumstances has given us the derived effect (Fisher & Jordan, 2006).

References

DeFusco, R.A., Dennis W. M., Pinto J. E., Anson J. P., and Runkle, D. E. (2007). “Quantitative Investment Analysis” J. Wiley and Sons

DeFusco, R.A., Dennis W. M., Pinto J. E., Anson J. P., and Runkle, D. E. (2007). “Quantitative Investment Analysis” J. Wiley and Sons

Fisher D E. & Jordan R J (2006) Security analysis and portfolio management, prentice hall of India private limited

Gapenski l & Brigham E; (1994); Financial Management: Theory and Practice; Dryden Press. Hall, 7 th Enhanced Media Edition,

Harrington R. (1987); Modern portfolio theory 2nd ed. Englewood cliffs, N J: Prentice Hall, 1987

Holmström, B. (1982). “Moral hazard and observability” International Bell Journal of Economics 12, 74–91.

Kaplan, S. R., and Norton, D.P. (1996). “The balanced scorecard: translating strategy into action” Boston, MA: Harvard Business School Press.

Kaplan, S. R., and Norton, D.P. (2001). “Transforming the balanced scorecard from performance measurement to strategic management” Accounting Horizons 15, 147–160.

Kulp, C., S., Datar, S., and Lambert, R.A. (2001). “Balancing performance measures” Accounting Research: Journal of 39, 74–93.

Larcker F. D., and Ittner, D. C., (1998). “Innovations in performance measurement: trends and research implications” International Journal of Management Accounting Research 18, 205–238.

Larcker, F. D., and Ittner, D. C., (1997). “The choice of performance measures in annual bonus contacts” The Accounting Review 73, 231–255.

Larcker, F. D., and Ittner, D. C., (1999). “The effects of performance measure diversity on incentive plan outcomes” Working Paper: University of Pennsylvania.

Larcker, F. D., and Ittner, D. C., (2003). “The evidence from a balanced scorecard of Subjectivity and the weighting of performance measures” The Accounting Review 79, 725–758.

Levy H and Post T (2005); investments published, Prentice hall

Lundin, M. (2004): “Tactical Asset Allocation and the information ratio” Journal of Asset Management 4, (5)

Murphy, J. K., Baker, G. and Gibbons, R., (1994). “Subjective performance measures in optimal incentive contracts.” Journal of Economics 105, 1133–1156.

Salterio, E., and G. Lipe (2000). “The balanced scorecard: judgmental effects of common and unique performance measures” The Accounting Review 75, 284–298.

Schaefer, J. S. and Hayes, R.M., (2000). “Implicit contracts and the instructive power of top management compensation for future performance” Rand Journal of Economics 32, 272–293.

Sharpe, W.F (1970). Portfolio theory and capital markets. New York: McGraw-hill