Raising of capital

When a company is looking into raising capital it is faced with a lot of options such as borrowing of loans, issuing of stocks that are tradable in the floor of stocks exchange or even use of a hybrid financial assets such as convertible bonds (Alon and Gompers, 1996). The organization depending on the way it intends to use the money it will look for the appropriate means of raising that capital. At the same time the company will have to consider the costs involved in raising of that capital it should not be more than the returns to obtained from the investment (Seha, 1988). At the same time, the marketability of the asset should be considered. The company shall also consider the legalities involved with the issue of such shares.

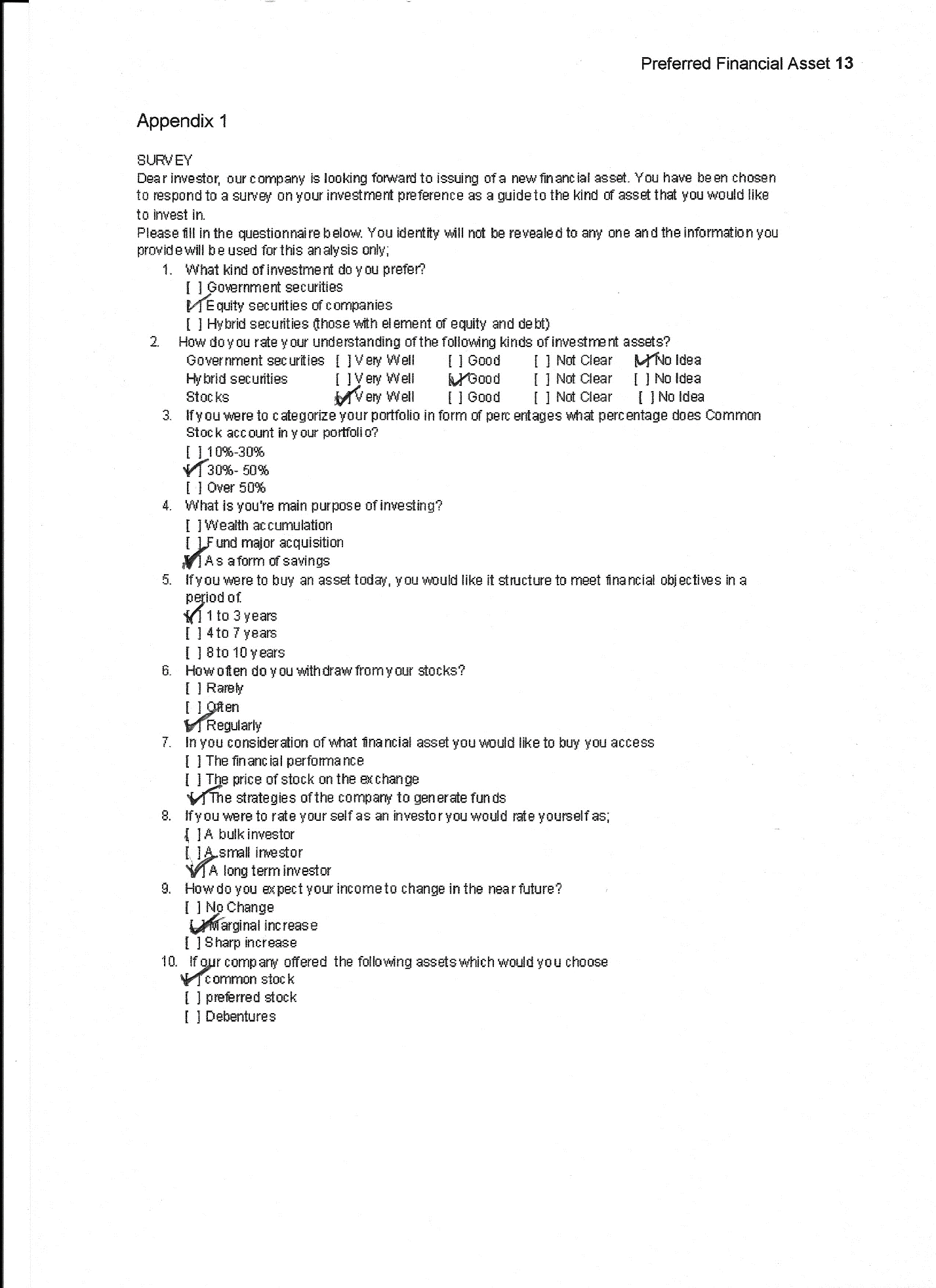

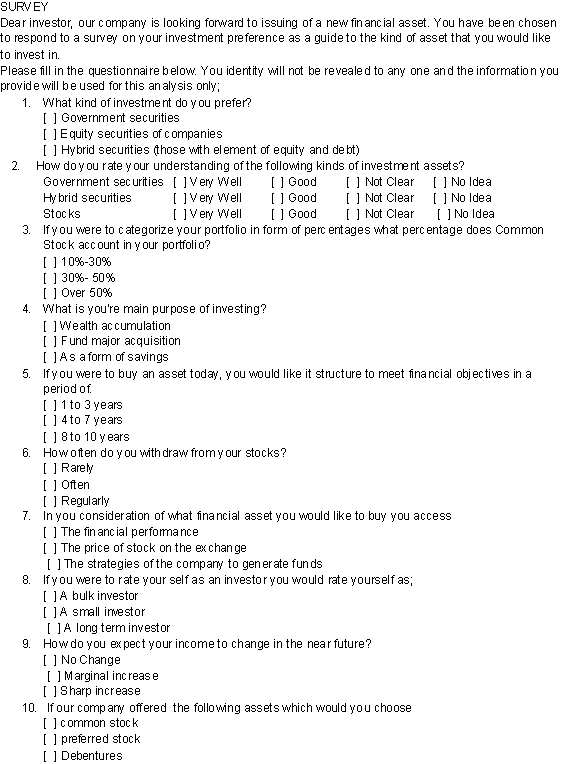

To obtain a clear picture of the investors’ perception a survey was carried out to analyze the investors’ perception of financial assets. The respondents issued with questionnaires were but only 51 of them responded. Their response was analyzed as shown in the table below where the analysis was based on a ten question questionnaire (see appendix 1).

Question Two

Survey Findings

The finding of the survey indicated that most people were aware of how the common stocks were traded as compared to other kinds of investment. The survey also indicated that people had common stock as a large share of their investment. The survey also indicated that people mainly invested in stocks as a means of saving that they would use incase their income went down or under circumstances that called for such sale. This was also reflected on the basis that people preferred assets that can be disposed in one to three years. The fear that the company did not have previous financial statements did no woe investors as they indicated that they would base their investment decisions of future strategies not necessarily previous performance of the company.

Stocks

When organizations wish to raise funds for capital, some of these companies use common stock. The are basically two forms of stocks; preferred shares and ordinary or common shares. Most people prefer to invest in ordinary shares as compared to preferred shares (Seha, 1988).

Use of common stock

In our case the organization should issue common stocks. Ordinary shares refer to unit of contributions to capital. For example if the registered issue capital is $200 000, an organization may term this as one share worth $200,000 or 200 common stocks worth $100 each (Alon and Gompers, 1996). On the other hand it may issues 200,000 common stocks worth a dollar each. Taking into account the results collected from the questionnaires, it was realized that people invest in various portfolios for a vast number of reasons (Seha, 1988).

Most of the investors too, lacked specialized skills for dealing with complicated stocks and hybrid financial assets. However, common stock is one of the preferred stocks. This kind of stock allows the investor to benefit from dividends (a share of profit availed at the end of the year) and at the same time benefit from a rise in the value of stock in the floor of stock exchange. The analysis of questionnaires indicated that most of the people expected little or no increase of their income within the specified period.

At the same time, they indicated that even if it increased by a certain amount the overall effect would be zero as it would be negated by the increase in their costs. For this reason the investors will be interested is in an asset that has high returns as compared to the others and is easily convertible to cash. Common stocks are such assets that allow the investors to anticipate an increase and at the same time convert their asset to cash at whatever time they want (Alon and Gompers, 1996).

Advantages of common stocks

This kind of investment is in a position to deliver very large gains compared to bonds, or certificates of deposit. As a result, the investors who wish to invest in safe areas and at the same time have a chance to increase their wealth will have a great preference for this kind of equity. These kind stocks also do not impose any legal commitment to the shareholder. The investors who are passive will not be required to contribute anything in operations of the business but will only inquire of dividends arising from the operations of the company. Most of the shares are known to be easily traded in Stock exchange.

The investors who would like to convert their shares to cash at any time will like this option very much. This will allow them to convert their investments at the time they required it. The maximum potential loss from stock purchased with cash is limited to the initial investment in the financial asset. This is favorable as compared to other assets where a person investment would sink including cost of total funds invested.

Stocks allow the investors to gain from capital gains such as improvement in market capitalization of the firm and at the same time gain from receiving dividends. This is an encouragement to the shareholders as they will be able to evaluate the basis they want growth the company. If they get high dividends it will compromise the value of the organization. The only disadvantage arising from common shares is the fact that the shareholder is the last to be compensated after the organization is liquidated.

Initial Public offer

However, the common stock of a company can be brought into accompany using two ways. The organization can issue of additional shares to existing shareholders through a rights issue, or it may offer an Initial Public Offer where the public is given a chance to subscribe for the shares (Dymski et al, 1993). In case the company had issued other shares, then additional shares would be provided to the existing shareholders through a rights issue where a shareholder is allowed to subscribe for shares with reference to the amount of shares he has in the company (Halloran et al, 1995). However for this case the company is evaluating the issue of a new finance asset to the public.

For this purpose then the company will have to issue shares through an initial public offer. This refer to a process where a company decides to allow the public to have a share of the company by buying shares relating to the company through an initial public offer

Advantages of initial public offers

The initial public offers will allow the company to be in a position to enjoy various advantages that include; the company will access capital for expansion immediately. It also provides a lee way where the company the company can be in apposition to expand in future. Its publicity may increase the organizations credibility with the associated stakeholders such as suppliers and creditors (Alon and Gompers, 1996).

The publicity at the time of the offer helps in highlighting the strengths of the company which attracts a lot of customers to the company as well as promote the business of the company. It is also said that going public avails the opportunity to the founders and early investors to cash their investments allowing other people to also have a share of the cake. If a company goes public it has the opportunity of providing the value which may be informs of stocks, this goes along way in assisting the company in mergers and acquisitions.

Challenges of initial public offer

However, most of the companies refrain from Initial Public Offer on the basis that it has been found to be expensive and the cost of having an Initial Public Offer cannot be justified by the revenue attained. It is assumed that the cost of staging an IPO is over fifteen percent of the amount collected; it also demands a lot commitment from the management (Halloran et al, 1995). It has also been said that inclusion of the public into the running of the company forces the management disclose some of the strategies it intend to use which the competitor may use against it (Alon and Gompers, 1996). The success of the issue is not also guaranteed as sometimes the issue may be undersubscribed or when oversubscribed the company bears the burden of refunding.

Preparing for Initial Public Offer

These negative effects however can be minimized throughout the following measures to be implemented when making preparation of the initial public offer; first, it is important to make sure that the board selected is of good appeal to the public so that it can generate confidence of the investors. The team of IPO, management should also have a balanced combination in terms of professions; lawyers, doctors, accountants, financiers and even tax advisories (Berliner and Brimson, 1999). An inclusion of public relations companies would go along way in selling the name of the company

The prospectus and the materials to be used in publicizing the company should have as much information as possible especially that which is critical to the finance status of the company. The company should also provide as much information as possible to be in a position about its financial status (Apostolou and Apostolou, 2004). Most of the investors will be provided with a lot of investment options at every particular time and it is only good if those people were provided with as much information as possible to come up with the right decisions.

The organization will be expected to prepare and provide information of two previous years and probably provide information of their respective quarterly analysis as an aid to the future analysis of the company (Berliner and Brimson, 1988). On the other hand the information ought to have been audited and the audit verdict communicated effectively among all the people involved.

The company should provide a lot of information on how the company current status and the future expectations paying attention to the kind financial environment that will available at that time. This information will include information on what those predictions are made (Halloran et al, 1995). The information they provide during promotions and meetings with the potential investors should be construed from the financial statements and a lot of efforts should be made to avoid provision of misleading information (Apostolou and Apostolou, 2004).

This is because if the issuer provides in accurate information and the company does not realize the benefits stated, then the company will be under pressure to act accordingly especially if it attracts a lot of investors (Berliner and Brimson, 1988). On the other hand the company will have an obligation to include all the requirements needed for the publicly listed companies these include issues such as company’s social responsibility and their relationship with the investors in the business (Trevis et al, 2002).

The organization has obligation to provide information to the people at hand but on the same note the information should not expose the strategies of the company explicitly as the competitors may take advantage of it (Lehmann, 2007). There are some adjustments that ought to be made in the corporate governance to be in a position to benefit from the initial public offers. In America for example there are some expectations that will be expected to be adhered to (Trevis et al, 2002).

The governance of the company will have to be adjusted in to reflect the structure of the governance of a publicly listed company. For example the board will have to include some fair-minded governors, members from other industries and establish a compensation committee. The company should indicate the rights of the shareholders explicitly within all its work. At the same time the shareholders will expect some flexibility in the manner that the asset is dealt with.

Adjustment required in corporate culture

The shareholders of companies will evaluate investment on both long term and short term issues of the organization. One of the bases of analysis will include how the company is doing currently and what it expects to do in future. For that purpose the management will have to encourage its workers to display an attitude that is seen to portray a good return in future (Lehmann, 2007). This will involve changing or enrichment of their culture among other things that promote the well being of the culture of the company.

Employee benefits

The investor is also keen on how the future or performance on how the employees perceive their job. The company will under the responsibility to adopt employees’ policies that allows it to be seen as encouraging to the society (Apostolou and Apostolou, 2004). The introduction of pension plans as well as plans of mortgage allows people to see the commitment of the management to the future of the company. Allowing of the employees to buy share could be seen as a strategy that would encourage the employees to be committed to the way the organization operates (Apostolou and Apostolou, 2004). The company could consider employee share conversion schemes which would eventually give the employees a share of the company. Such schemes allow the investors to perceive commitment of employees to financial success.

Conclusion

The analysis indicated has shown both benefits and challenges that arise as a result of issue of common. The evaluation also looks into ways of how to improve efficiency of initial public offers as an amicable solution of dealing with the chances of failure. The study looks at other important factors that will also promote the chances of growth when those shares are initially transferred to public and employee ownership. The most important factor is to consider that issue of common shares allows the organization to have immediate access to funds and at the same time provide way for easy increase of such fund (Travis et al, 2002). The liability is also limited and the market exploitation will be maximized as it will attract a large pool of investors.

References

Alon B and Gompers P (1996). Myth or Reality? Long-Run Underperformance of Initial Public Offerings; Evidence from Venture Capital and Non-venture Capital-backed IPOs. Journal of Finance, 52, 4.

Apostolou B and Apostolou N (2004). Keys to Investing in Common Stocks 4th Edition. New York: Barron’s Educational Series.

Berliner C and Brimson J eds (1988). Cost Management for Today’s Advanced Manufacturing: The CAM-I Conceptual Design. Boston: Harvard Business School Press.

Dymski G, Epstein G and Pollin R eds (1993) Transforming the U.S. financial system equity and efficiency for the 21st Century. Economic Policy Institute Series. Armonk: M.E. Sharp.

Halloran M, et al. (1995). Venture Capital and Public Offering Negotiation, Englewood Cliffs, NJ. Aspen Law and Business, 1.

Lehmann R (2007) Income Investing Today: Safety & High Income through Diversification. New Jersey: John Wiley & Sons, Inc.

Seha M. 1988. Anatomy of Initial Public Offerings of Common Stock. Journal of Finance 43:4.

Trevis C, Jeffrey C, Daily C and Dalton D (2002). Wealth and the Effects of Founder Management among IPO-Stage New Ventures. Strategic Management Journal, 22.

Appendix 1

Appendix 2 Survey Samples