The site at west London has been a point of controversy in regards to the cost charged to airlines that use the facility (Sky News par. 1). While the price cap instituted to the Heathrow airport operator may be justified in several ways, it is pertinent to mention that price control can harm the economic performance of individual firms.

The west London site is used by several international airlines on a daily basis. The price cap is probably meant to safeguard international airlines from being exploited by a single service provider. This type of protectionist policy is indeed welcomed since monopolies often take advantage of imperfect or absence of competition to exploit consumers.

It is the duty of the Civil Aviation Authority to oversee the smooth operation of airline activities.

The price cap imposed by the authority must have been reached after considering several pertinent factors. However, it is surprising that the price ceiling has gone beyond the originally suggested rate. Perhaps, the aviation authority should have consulted the operator before executing the changes.

As it stands now, a grueling tussle between the Heathrow Airport operator and the Civil Aviation Authority may begin. As much as the authority has express powers to put in place new legal provisions and frameworks in the operation of airport facilities, it does not have the mandate to disrupt the activities of individual firms.

According to the statement released by the Civil Aviation Authority, the move was meant to cut down levies charged from passengers and also improve service provision to the airport users. The company that runs the airport is still emphatic that maintenance costs are high and therefore, there is need to seek alternative sources of revenue within the airport facilities.

The officials argue that the commercial revenue targets have been surpassed by the growing expenditure of the running the west London site facility. These are apparently valid arguments that the Civil Aviation Authority should consider before implementing a significant price cap deal.

The larger Heathrow airport serves thousands of users on a daily basis. In order to improve the provision of high-quality services, the investor at the site should obviously charge higher rates for the services offered. However, the charges should be commensurate with the nature of services provided at the airport facility. Both parties are excellently arguing their cases, and as a result, it may be difficult to establish the truth of the matter.

The most crucial step that the aviation authority should take is to appraise the average costs of various services offered at the west London site and the nature of services offered by the investor. Such an evaluation will give a clearer picture of whether customers are really receiving value for their monies.

The west London investor should, however, not bear the feeling of being the only target of the Civil Aviation Authority because the regulator has also pointed its finger to both the Stansted and Gatwick airports. These are key airports that are equally supposed to adhere to the minimum guidelines that will be stipulated in the new legislation.

As a matter of fact, airports that handle services which are not prioritized often risk the life of passengers. It will be a timely move by the aviation authority to streamline the operations of such airports. Operators at major international airports should only be allowed to handle services that they can effectively deliver to both travelers and other customers who frequent their facilities (Taudes and Rudloff 33).

In the case of an airport like Stansted, the Civil Aviation Authority should give it adequate time to recover from the negative growth of the aviation industry. Economic regulation should be preferred to major players in the industry because they are highly likely to flout most of the safety and ethical provisions stipulated by the regulator.

While price control is a major protection policy that governments across the globe have used to curtail exploitation of consumers, regulatory bodies should tread cautiously before implementing certain controls (Atkin 103). For example, we should understand that global trade has been significantly liberalized especially since the advent of globalization.

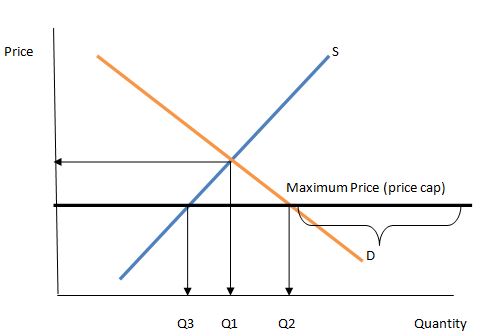

Price controls hardly work in most circumstances due to the concept of “willing buyer, willing seller.” If a buyer is willing and able to pay for a product at a given market price, then there should be no cause of alarm at all (Kenyon 93). The demand and supply curves below illustrate how market forces dictate the maximum price.

The liberalized markets mostly rely on the power of various marketing forces such as demand and supply as well as price elasticity. When such factors are combined in a perfect market environment, price control becomes a bother, especially to investors who have set certain fiscal targets to attain.

In retrospect, it is pertinent to underscore the fact that both the west London operator and the aviation authority should renegotiate the new terms, so that service provision at Heathrow airport is not interrupted. Exchanging conversations through the media will not resolve the current impasse. It will only exacerbate the working relationship between the investor and the government regulator.

Works Cited

Atkin, Jason. “Hybrid Metaheuristics to Aid Runway Scheduling at London Heathrow Airport.” Transportation Science 41.1 (2007): 90-106. Print.

Kenyon, Peter. “Price Control, Investment and Resource Allocation.” History of Economics Review.57 (2013): 88-95. Print.

Sky News (2014). Heathrow Slams Price Cap Put On Airline Fees. Web.

Taudes, Alfred and Christian Rudloff. “Integrating Inventory Control and a Price Change in the Presence of Reference Price Effects: A Two-Period Model.” Mathematical Methods of Operations Research 75.1 (2012): 29-65. Print.