Introduction

In the context of economic development and recognition in the international arena, many states use domestic resources as key trade elements, thereby creating demand and increasing budget revenues. The oil and gas industry is promising today because, although a constant search for alternative sources of fuel is conducted, natural resources are highly valued. Accordingly, the ability to supply these products to the international market opens up broad financial prospects and opportunities for prosperity. Nevertheless, even if the stocks of liquid fuel are significant, some factors may impede the process of extraction and sale of oil and gas, despite the availability of these resources. As an example, the countries of the post-Soviet space can be used as states in which certain reasons interfere with an open trade policy. In addition to traditional problems, for instance, the features of public administration and conventions of the banking sector, the lack of foreign investments has led to a slowdown in the economic development of post-Soviet states. The increase in oil and gas prices as a favorable factor is outweighed by non-tariff barriers, and these challenges are the cause of weak economies in these countries.

Nationalization of Oil and Gas Companies

The conflict between large business and liberal reformers in the post-Soviet space has led to significant changes in the ownership system of oil and gas producing corporations. This, in turn, has led to the underdevelopment of this industry due to the lack of relevant promotion strategies. According to Okafor and Webster (2015), post-Soviet governments were not ready to use the services of foreign partners who were eager to offer convenient marketing solutions, production technologies, and other intangible resources. This desire to nationalize available resources has led to a gradual state monopolization in the industry in question and, as a result, the loss of advantageous positions in the international market. The business distrust of the authorities was expressed in the absence of useful interventions and the rejection of the property hierarchy. As a result, the economies of post-Soviet countries promoting the production and sale of oil and gas as their main resources weakened and were unable to compete with more powerful states with more liberal development models. These outcomes became the cause of the crisis that entailed the lack of investor interest in the regions of Eastern Europe and Central Asia.

Over time, the economies of individual post-Soviet countries and, in particular, Russia, have become resource-dependent. Kurronen (2015) describes this phenomenon as a situation in which the financial sector develops and receives the primary income solely from mining. Since the territory of the former USSR is very large, such valuable natural resources as oil and gas are its national treasure. Through the nationalization of this sector and the desire to capitalize on domestic products by limiting the activities of business structures and excluding the intervention of foreign partners, individual governments faced dependence on natural resources. Political instability at the end of the 20th century led to the fact that many large companies with the ownership of oil and gas were either expropriated by the governments or received the status of accountable firms with a literal lack of authority. This outcome, in turn, led to the inability of countries to adapt to the new conditions of economic development, and the course towards the extraction and sale of valuable minerals became the key. Thus, the nationalization of this sector had more negative than positive implications for the trade status of individual post-Soviet powers.

Fluctuations in Prices as a GDP Factor

For countries with resource-dependent financial systems, any drop in prices for their key products affects the economy negatively. In post-Soviet states, where foreign investments are scarce, fluctuations in the cost of oil and gas are the reasons for a slowdown in economic development. Brooks and Kurtz (2016) note that those countries that are rich in useful resources can regulate market price dynamics and control supply and demand parameters. Due to the fact that the Middle East region is the area rich in oil, foreign partnerships are signed with these states, and post-Soviet countries lose potential profit. However, in a specific context, falling oil and gas prices is convenient for citizens. This situation helps consumers lower their cost of living and save money that may be spent on more expensive purchases. According to Okafor and Webster (2015), in most cases, this implies lower transportation prices, which leads to lower costs of living and lower inflation. Any drops in oil and gas prices are a free tax cut. In theory, price reduction can lead to higher spending on other goods and services, as well as real GDP growth and cash inflows.

Nevertheless, this situation may cause deflation and lower consumer confidence, and instead of spending, they would rather choose to save. In this case, a fall in prices leads to a decrease in inflation and the likely onset of deflation, which can be extremely problematic to overcome (Brooks & Kurtz, 2016). Another disadvantage of low oil prices is that this situation can slow down investments in alternative forms of energy, for instance, electric cars. Falling oil prices may stop the reduction in car use and lead to increased traffic congestion and the negative impact of gasoline on the environment. These factors are crucial to consider when planning economic development in the context of dependence on specific resources since the likelihood of a slowdown in progress in the financial sector is real. If the economy experiences growth, the stock market is likely to show good results. Thus, rising oil prices and stock market growth are the outcomes of economic growth, and in the case of post-Soviet countries, development indicators are slow due to stagnation in their pricing policies.

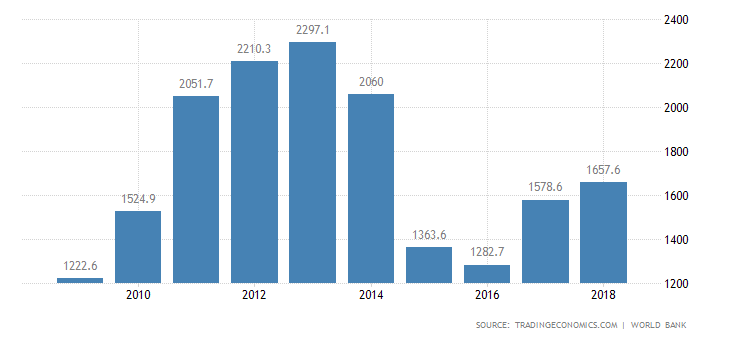

When analyzing the economy of the Russian Federation as one of the main countries of the former Soviet Union, its indicators largely depend on fluctuations in oil and gas prices. Figure 1 shows the GDP parameters over the past few years, and a decrease in the cost of natural resources in 2016 affected the success of the country’s financial sector negatively (“Russia GDP,” 2019). Despite the subsequent rise, development is slow compared to other countries that supply fuel resources to the international market.

Foreign Investments as a Crucial Factor

In order for the countries of the post-Soviet space to profit from oil and gas production, they need to ensure the stable export of these resources and find as many partners as possible. According to Okafor and Webster (2015), in some states, in particular, Belarus, Lithuania, Latvia, and some other countries, the practice of tax exemption is maintained, which influences the economy positively and expands trade opportunities. However, due to the recent fall in oil and gas prices in Russia, exports from this country have declined, and it may take more than one year to get out of the crisis. Thus, in order to raise their financial status, post-Soviet countries need to involve foreign investments as a background for establishing trade contacts and supplying valuable natural resources. Otherwise, the slow growth of the economy may stop, which is unacceptable in conditions of resource-dependence.

The unwillingness of foreign partners to interact with the countries of the former Soviet Union is explained by the aforementioned reasons for the nationalization of the oil and gas industry and government monopolization. Okafor and Webster (2015) note that the low activity of potential investors is due to the fears of the lack of freedom to trade and, consequently, low profits. Business privatization is ineffective due to increased control by the government, although theoretically, in case of establishing numerous partnership agreements, these countries could make a significant profit. It is beneficial for the authorities to restrain the development of this industry in order to control the distribution of finances and impose tax obligations to supplement the budget. However, from the perspective of economic growth, this policy has some negative aspects, for instance, the depreciation of post-Soviet oil and gas in the international market and, consequently, the lack of sales markets. Such an outcome is fraught with the loss of trade authority and the reluctance of investors to participate in the formation of demand. Therefore, engaging foreign partners is an important aspect of economic growth and promotion in the international arena.

Possible Ways of Accelerating Economic Growth

One of the key factors that could stimulate the growth of the economies of the post-Soviet countries is engaging more foreign investors by minimizing government intervention. As Kurronen (2015) argues, increasing the level of financial intermediation may help build potential partners’ confidence in trading opportunities with the states of the former Soviet Union. For these purposes, the author recommends revising bank lending strategies and providing corporations with more possibilities for asset and resource management (Kurronen, 2015). These measures will create a favorable competitive environment and become an incentive for many companies to invest in local production due to confidence in the freedom of decisions and flexibility of foreign trade policies. Government monopolization should be weakened so that business firms could have greater freedom in choosing marketing strategies. This decision will make it possible to exclude intermediation that impedes the growth of the economy and hinders the establishment of productive contacts.

The relationship between falling oil and gas prices and economic downturns is a good reason for post-Soviet governments to create conditions that could mitigate the effects of such a crisis. In this regard, Brooks and Kurtz (2016) offer to rely not only on large volumes of production but also on strengthening the technological potential. The development of highly efficient oil and gas extraction complexes can expand the capabilities of mining companies and, thereby, attract the interest of potential partners in the local market. International trade is an incentive explaining the need to invest in this sector in order to create favorable conditions for sales and a stable technological base. As a result, as Brooks and Kurtz (2016) argue, the benefits will be tangible not only for foreign trade policies but also for domestic markets due to the involvement of interested parties and, consequently, the provision of enhanced business opportunities. Therefore, investing in technological development in the oil and gas industry is an important aspect of recognizing the economic development of the post-Soviet countries and their credibility in the market.

Based on the aforementioned factors promoting the economies of post-Soviet countries, lowering taxes on oil and gas trade may be another valuable initiative. According to Okafor and Webster (2015), for more successful interaction with foreign investors, benefits can be provided to domestic companies for importing the necessary equipment, expedited customs procedures, and other incentives simplifying trading procedures. These steps will allow local corporations to act more freely and quickly, which, in turn, will guarantee a stable inflow of foreign investment into budgets. In addition, potential partners will have confidence in the sustainability of local markets and will not opt for other regions. Therefore, for the states of the former Soviet Union, easing tax policy is an effective mechanism for strengthening domestic economies.

Conclusion

The slow development of the economies of the post-Soviet countries is caused not only by fluctuations in oil and gas prices but also by non-tariff challenges that create obstacles to free trade. The government monopolization of this sector is one of the main reasons complicating the development of open business, and resource-dependence as an economic aspect of the region does not contribute to overcoming the crisis. As potentially effective measures, such steps may be implemented as engaging international investors, strengthening technological potential, as well as providing a freer tax system. Expanding opportunities for business corporations can create healthy competition in the industry and establish productive partnerships, which, in turn, will be an incentive for economic growth.

References

Brooks, S. M., & Kurtz, M. J. (2016). Oil and democracy: Endogenous natural resources and the political “resource curse.” International Organization, 70(2), 279-311. Web.

Kurronen, S. (2015). Financial sector in resource-dependent economies. Emerging Markets Review, 23, 208-229. Web.

Okafor, G., & Webster, A. (2015). Foreign direct investment in transition economies of Europe and the former Soviet Union. In J. Hölscher & H. Tomann (Eds.), Palgrave dictionary of emerging markets and transition economics (pp. 413-434). London, UK: Palgrave Macmillan.

Russia GDP [Image]. (2019). Web.