Abstract

For European nations’ economies to expand consistently and steadily, access to energy resources is essential. Power consumption is continuously increasing; hence a long-term strategy for unified European policy is required. However, European countries now rely significantly on imported natural gas and oil while gradually converting to renewable energy sources. The findings show that a high reliance on oil and natural gas imports causes inflation to rise, which weakens the economy. As a result, authorities must quicken their efforts to control gas use, get ready to transfer resources around the Eurozone in times of need, and secure supply from alternative suppliers and global LNG markets. In subsequent years, it would be vital to transition from natural resources, such as oil and gas, to renewable energy in order to mitigate geopolitical risks and maintain economic growth.

Introduction

Presently, the European Union nations’ top issues are energy independence and environmental sustainability. The accessibility of energy resources is crucial for European countries’ sustained and steady growth and economic growth. The continual rise in power consumption necessitates a long-term strategy for shared European policy. As of now, European nations are heavily dependent on importing natural gas and oil while slowly shifting toward renewable energy approaches. However, as will be shown further, dependence on these energy resources leads to less flexibility due to geopolitical and economic risks.

In this sense, there is a necessity for research on the oil and natural gas industry, its predominance in the European economy, and its effects, which helps gain insight into the scope of the issue for further problem-solving. The research questions are as follows: To what extent does European production depend on energy sources, and what are the risks of oil and natural gas imports? Therefore, the objective of the research is to see the dependence on economic resources of European countries and the extent to which the European economy can be paralyzed in case of energy shocks. The findings indicate that heavy reliance on oil and natural gas imports leads to increased inflation, which damages the economy.

Literature Review

An integrative notion, the issue of energy stability brings together the energy, economic, and environmental aspects. Since energy imports and exports might have a significant influence on the equilibrium of payments, the stability of energy production is intimately tied to micro- and macroeconomic dynamics (Degiannakis et al., 2018). The government budget may be significantly impacted by subsidies, taxes, and the expenses or earnings of state-owned businesses (Bluszcz, 2017). Energy prices also have a significant role in the rate of inflation and the economic competitiveness of a nation on the global stage.

Following petroleum-based goods, natural gas ranks as one of the most significant fuel sources in the Eurozone. In the industrial sector, it serves as the most potent source of energy, and almost 90% of the gas used in the eurozone countries is imported from other countries (Bluszcz, 2017). the part gas plays in the industrial process. Natural gas is a crucial production source for some industries, such as industrial chemicals and glass manufacturers (Di Bella et al., 2022). Yet, it is less so for other industries or is only used indirectly, like when it is used to generate electricity.

However, while having such a role in the Eurozone, natural gas and oil-based products are significantly reliant on imports in the European Union. Only renewable and nuclear energy is locally produced. Petroleum-based power is the most widely used in the economy, primarily due to its usage in the transportation industry (Gunnella et al., 2022). Contrarily, gas is the primary energy source that is used the most in industry, as well as by non-transportation businesses and residences (Gunnella et al., 2022). Given the adaptability of gas-run power stations and the total gas infrastructural facilities in adjusting to volatility in electricity consumption, gas further serves as the primary marginal fuel source in the production of electricity (Gunnella et al., 2022). This dependence has grown as countries move toward renewable energy sources, whose supply is based on erratic weather systems.

The fundamental reason why the European Union’s energy production system varies from that of the rest of the world is that far less coal and oil are used to generate power there. Currently, the Eurozone uses just 45.8% of them, or 41% less than the world’s other nations. Presently, the Union uses 12.5% nuclear energy, 20% hydroelectric power, and up to 21.7% of sources of renewable energy (Bluszcz, 2017). According to the European Union 2030 program, there will be a decrease in the proportion of gas and oil used to produce electricity to a standard of 39% (Bluszcz, 2017). There will additionally be an increase in the proportion of nuclear energy to a standard of 22%, a rise in the balance of renewable fuels to a standard of 26%, and a decrease in the proportion of hydro-energy to a level of 13% (Bluszcz, 2017).

In this sense, such heavy reliance on the oil and natural gas sectors affects the European economy. Due to imports, the Eurozone economy is heavily susceptible to geopolitical risks. For decades, Russia has been a major supplier of gas and oil to Europe. Two-fifths of the energy utilized by Europeans in 2021 comes from Russia (World Economic Forum, 2022). More than a quarter of the oil products that the EU imports originate from Russia. The EU purchased gas from Russia for $108 billion (€99 billion) in 2021, the world’s largest amount (World Economic Forum, 2022). Still, during the previous ten years, the EU’s imports have decreased dramatically in volume. The Eurozone purchased energy from Russia in 2012 for a total of $173 billion (€157 billion) (World Economic Forum, 2022). As a result, Eurozone’s economy will be affected by shocks in supply and demand.

Moreover, the degree to which shortages materialize and gas exchanges collapse will likely determine how a gas crisis affects GDP. The effect on GDP is determined by comparing the yield reduction over a period of 12 months to a benchmark scenario where the overall supply of gas in the Eurozone would be at average rates (Di Bella et al., 2022). In the event of a complete shutdown, there would probably be severe scarcity in some of the Central and Eastern European nations, and their GDPs would be negatively impacted by up to 6% (Di Bella et al., 2022). Therefore, in the face of unbalanced supply and demand, the Eurozone economy might experience inflation and decreased GDP.

Method

The method that was chosen for this research is secondary data analysis. The secondary data included statistics provided by European authorities on official website platforms. The method was preferred in order to see the correlation between oil and gas consumption and the economic state of Eurozone representatives. With an emphasis on the official data retrieved from government data, it is possible to provide recommendations and see the effects on the economy.

Results and Discussion

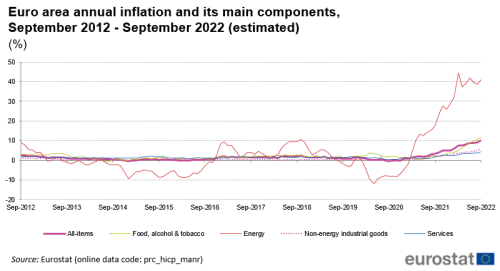

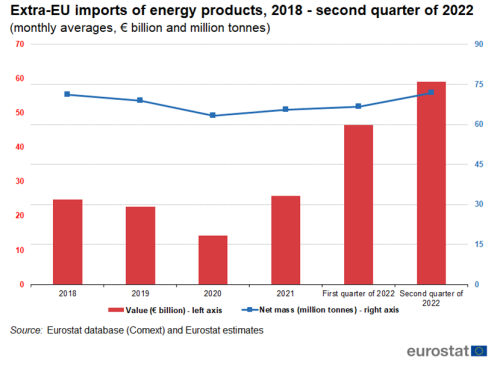

As has been mentioned, Europe relies heavily on natural gas and oil imports due to the unavailability of one’s own sufficient storage of energy sources. However, as can be seen from the statistics provided by the Directorate-General of the European Commission, oil and natural gas imports damage the economy. In this sense, the prices of oil and natural gas play a significant role in influencing inflation, as can be seen from the correlation between Figure 1 and Figure 2. Rising inflation results from massive increases in oil and gas costs.

As a result, while the literature review mentioned that the economy of Europe requires a significant amount of energy resources to maintain its infrastructure, it does not mention the correlation between inflation and imports of energy products. The higher inflation started along with higher imports in 2021, spurred by the coronavirus virus. However, the situation has been exacerbated due to the Ukrainian conflict in 2022, which led to more considerable imports and greater inflation that resulted from the accumulation of other factors, such as supply and demand distortion and consumer confidence. Therefore, the economy of the Eurozone is affected by reliance on gas and oil imports, their prices, and the geopolitical risks that come with such dependence.

Conclusion and Policy Recommendations

Hence, the oil and natural gas sectors play an integral part in the growth of Eurozone infrastructure and yet destabilize its economy with geopolitical risks. However, the financial consequences of being heavily reliant on natural gas and oil may be significantly reduced. Efforts should concentrate on crisis readiness and risk management. Authorities must accelerate their measures to regulate gas consumption, prepare to distribute resources in crises throughout the Eurozone, and secure supplies from other suppliers and international LNG marketplaces. As the geopolitical and overall economic situations stabilize, there is a need for authorities to concentrate on the promotion of alternative sources of energy and provide incentives, implementing taxation incentives to reduce reliance on gas and oil.

References

Bluszcz, A. (2017). European economies in terms of energy dependence. Quality & Quantity, 51(4), 1531-1548. Web.

Degiannakis, S., Filis, G., & Arora, V. (2018). Oil prices and stock markets: a review of the theory and empirical evidence. The Energy Journal, 39(5), 85-130. Web.

Di Bella, G., Flanagan, M. J., Foda, K., Maslova, S., Pienkowski, A., Stuermer, M., & Toscani, F. G. (2022). Natural gas in Europe: The potential impact of disruptions to supply. IMF Working Papers, 2022(145), 1-48.

Eurostat. (2022-a). EU imports of energy products. Web.

Eurostat. (2022-b). Inflation in the Euro area. Web.

Gunnella, V., Jarvis, V., Morris r., & and Tóth, M. (2022). Natural gas dependence and risks to euro area activity. European Central Bank. Web.

World Economic Forum. (2022). How much energy does the EU import from Russia? Web.