Price elasticity of demand is a measure of the changes in a product’s consumption with regard to alterations in its price. It determines the responsiveness of the demanded quality or goods supplied to a change in its price (Mankiw, 2018). Price elasticity of demand is calculated by dividing the percentage change in the quantity demanded over the percentage alteration in price.

Income elasticity of demand can be defined as an economic measure of a good service’s demand quantity’s responsiveness to income changes. It is calculated as the percentage change in the demanded quantity divided by the percentage alteration in income (Mankiw, 2018). The tool allows microeconomists to determine if a good or service is a necessity or luxury item based on whether it is larger than or lower than 1.

Cross-price elasticity of demand can be deemed an economic notion that assesses the demand quantity’s responsiveness of a good when the price for another is altered. It is also referred to as cross elasticity of demand and is calculated by considering the percentage chance in demanded quantity of a good and dividing it by the percent alteration in another good’s price (Mankiw, 2018). The value is always positive when substitute goods are involved while complementary goods posit negative values.

Total revenue is defined as the collective amount of total goods and services sales. The value is calculated by multiplying the total goods and services amount sold in an entity by the price of the goods and services (Mankiw, 2018). It is an important concept for business as they seek higher profits. To this end, they maximize the variance between total revenues and costs, boosting production and sales revenues and minimizing costs associated with boosting production.

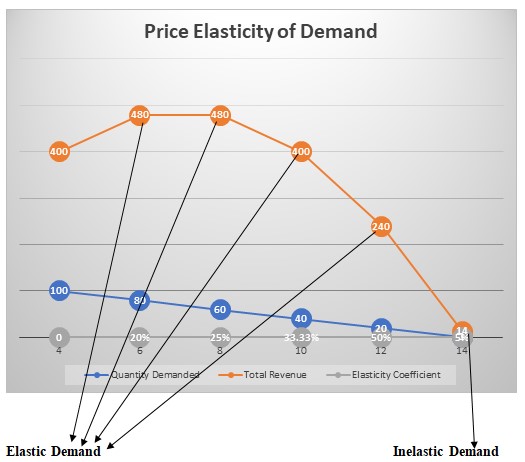

The first four instances have a high elasticity coefficient indicating significant demand changes due to large changes in quantity demanded. The final revenue shows there is inelastic demand because of a low change in the quantity demanded,

An elastic demand involves a system where changes in quantity demanded because of a price change is significantly large. In contrast, an inelastic demand is one where alterations in the quantity demanded because of a price change is limited and small. Some instances result in an equal variation between these measures, where quantity changes at a similar rate with the price (Mankiw, 2018). These values are related to total revenues because they deal with the elasticity of demand. Elastic, inelastic, and unitary demand result in higher or lower production based on individuals’ demand for products based on price changes.

Question 9

Current quantity demanded for Good A is 100 units. 8% increase would result in (0.08*100) = 8 additional units, bringing the total to 108 units demanded. Price increases by 10%, (0.1*4), resulting in a $4.4 value Income elasticity of demanded is calculated as follows:

Where:

- D1=108

- D0=100

- I0=4.4

- I2=4

=0.0385/0.0476

=0.81

=81% elasticity coefficient

The organization has an elastic product due to significant changes in quantity demanded and price alterations.

Question 10

Good A and Good B are complementary luxury goods. Decrease in quantity demanded of good A would result in a (0.08*100) reduction in demand amounting to 100-8=92 units demanded. Good B price decrease amounts to (0.05*6)=6-0.3. the new price is $5.7.

Therefore, the cross-price elasticity of demand is calculated as changes in quantity demanded for Good A *changes in price of Good B. (8/0.3)*(5.7/92).

=26.67*0.062

=1.6535

Reference

Mankiw, N. G. (2018). Principles of microeconomics (8th ed.). Cengage Learning.