Effect of the high demand for corn on its substitute soybeans and effect of the high demand for corn on soybeans farm

An increase in the quantity demanded of corn oil will reduce demand for its substitute corn oil. Farmers will consider supplying more of the highly demanded corn oil and in this context substitute soybeans for corn. High demand is usually associated with rising revenue thus farmers will supply more as revenue increases at a higher pace. Price elasticity of demand refers to changes in the quantity demanded following the changes in the price of the same product which in this context is the change in the price of corn (Opocher, 2009). If the substitutes of a good are close and many, then the price elasticity of demand will be strong.

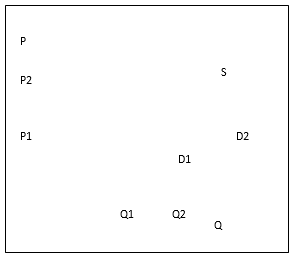

The following graph will enhance the understanding of the price elasticity of corn. As the price of corn increases from P1 to P2, more of the commodity will be supplied into the market along the same supply curve.

Effect of the high demand for corn on its price

As the quantity demanded of corn oil increases, the price will also increase in the short-run period. However, this observation will change in the long run as consumers shy away from high prices by adjusting their habits.

Influence of price elasticity of demand for corn oil on quantity demanded and the total revenue

The changes in quantity demanded of corn due to changes in its price shows its price elasticity of demand. If the price elasticity of demand is strong, i.e. E > 1, a change in the price will have a subsequent effect on the quantity demanded of corn. A theoretical perspective reveals that less revenue is derived from commodities with a high price elasticity of demand (Opocher, 2009). With high prices, less will be demanded leading to a loss in revenue. The time factor also determines the price elasticity of demand. In the long-run period, E> 1 as the consumers alter their habits.

Reference

Opocher, A., & Steedman, I. (2009): “Input Price-Input Quantity Relations and the Numeraire”, Cambridge Journal of Economics, 33(5), 937-948.