Introduction

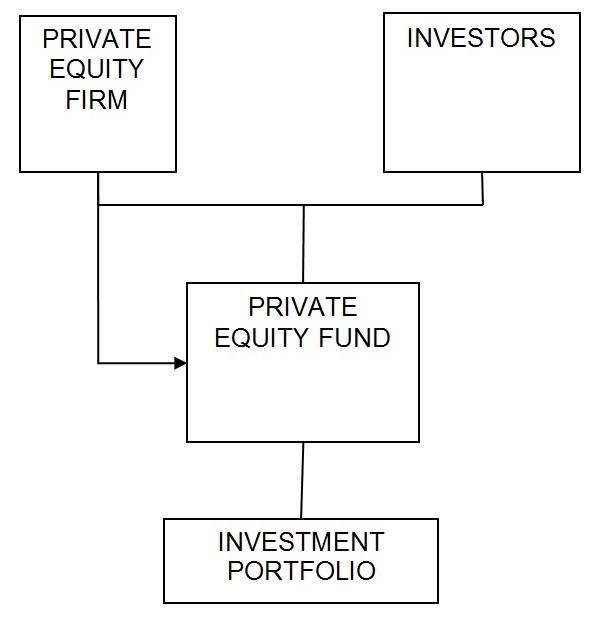

In today’s business environment, capital happens is regarded by many as one of the most important resources (Padget 2011). One way through which companies are able to finance their business ventures is through private equity (PE). According to Snider and Howards (2010), private equity is treated as capital drawn from different investors. The entrepreneurs put together their resources in a fund. The objective of this fund is usually to acquire the equity of other companies. Figure 1 illustrates how private equity works:

The fund operates under the principle of pooling resources together and investing in a lucrative business venture. In such cases, a private equity firm seeks partners to come up with an investment fund, as illustrated in figure 1 above. Guy (2011) points out that the investors who collaborate with a PE firm range from venture capitalists and angel investors to other bodies like provident funds. When they come together, the firms are able to raise capital that is sufficient for the acquisition of equities of other companies, developing their investment portfolios in the process.

The current paper seeks to develop an understanding of PE by illustrating an example of the same in the business world. To this end, TPG is cited as a private equity firm for the purposes of this study. The author of this paper scrutinizes the operations of this company in a bid to justify the need for continued use of PE.

TPG: A Private Equity Firm

Overview

Information obtained from the company’s website indicates that approximately $55 billion of its capital is kept in investments (TPG 2013). The company was formed in 1992 with the objective of acquiring equity from other entities. After this acquisition, TPG recapitalizes the investment in the stock market. To date, the company has created a number of investment portfolios in different parts of the world. Today, TPG is regarded as a leader in terms of private equity management. The same is in line with its operating principles.

Investment Strategy and Philosophies

In the opinion of Finkel and Greising (2009), the idea behind private equity is to come up with a fund in order to invest in the equities market. Consequently, any firm keen on venturing into this business must align its objectives with the provisions of this principle. The same explains why TPG has its strategic plan modeled in the same direction. The understanding put forward by Finkel and Greising (2009) is that companies whose equity is acquired by a PE firm are usually not listed in a securities exchange market. In the event that such entities have a presence in the stock market, they are de-listed before the parties strike the deal. Typically, a private equity firm seeks companies whose stock is on the downfall or has feeble financial positions.

From the backdrop of the workings of a private equity firm, TPG has developed a philosophy of being a ‘problem solver’ (TPG 2013). The contrarian philosophy of this organization dictates its investment strategy, where resources are used to create investments in situations that are quite challenging. The company has developed several investment portfolios by blending time, capital, and expertise (TPG 2013).

Notably, the organization has a substantial investment package. For instance, there is the Continental Airlines deal, which was the company’s flagship project in 1993 (TPG 2013). The entity has also invested in Oxford Health Plans Inc., Korea First Bank, and MI Energy. The investment strategy adopted by the company does not restrict it to a particular industry. The same explains why it is a leader in this field.

The Continental Airline Deal

As aforementioned, private equity firms are known to channel their investments into the equity of another company. According to Padget (2011), poor stock performance and a general decline in business are some of the reasons why companies are ‘acquired’ by PE firms. Such acquisitions are informed by an analysis of the performance of the company in relation to the expected situation once the deal is complete. The bottom line is that private equity investments are only made if they stand to profit the PE firm and its partners.

One such example, as previously mentioned, is the deal entered between TPG and Continental Airlines during the former’s formative years in the industry. The airline was grappling with financial issues to the point of filing for bankruptcy. With a decline in stock value and a dip in its revenues, Continental Airlines was not looking good financially. As a result, in 1993, TPG came along and acquired a substantial stake in the airline company. According to Shasha (2009), TPG invested a total of $66 million into the new firm.

At the time, experts expected the airline industry to grow in the future (Shasha 2009). However, due to certain inefficiencies, Continental Airlines was not performing as expected in the market. In the deal, TPG acquired a controlling stake in the firm, but it was not involved in the day-to-day affairs of the company. The company offered what would be seen as ‘behind-the-scenes’ investment advice. It benefited from the revenues generated by the new entity. When the time came to exit, TPG sold its shares at a total of $780 million. At the end of the deal, the PE firm ended up making $714 as profits from this venture.

The motivation behind the use of Private Equity

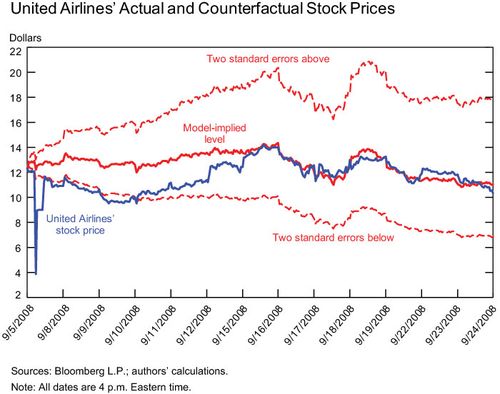

From the discourse above, it becomes apparent that private equity is indeed a requisite tool for investment. Lerner, Hardymon, and Leamon (2012) argue that the benefits of this mode of investment are essential to the growth of the stock market. Such an argument is true, considering the re-entry of Continental Airlines into the stock market (see figure 2). There are other benefits of private equity, which are discussed in this section. It is important, however, to reiterate the notion that private equity and, by extension, private equity investments are usually capital-intensive business ventures. Lerner et al. (2012) posit that investments of such magnitudes usually have a high return. The same is evident in the TPG – Continental Airline deal discussed in the previous section.

Lerner et al. (2012) point out the vastness of the equity market and argue how it remains untapped. The understanding here is that depending on the stage at which a company is at, there are no restrictions in investment. Guy (2011) is of the opinion that there are many companies that have not yet been listed in the stock markets. Most of such companies are start-ups or small and mid-sized enterprises. The same offer somewhat unlimited potential for PE firms like TPG to invest in. Consider the growing airline industry and the rise of technology-based firms. Depending on solid analysis, such companies have a potential for growth. The same as illustrated in the Continental Airlines deal at a time when the private equity industry was just nascent.

Another advantage of private equity is the element of incentives when the investors acquire a stake in the company. Lerner et al. (2012) suggest that PE firms and managers of a company develop strong accountability measures and a mutual need for the realization of targets. The said realization acts as an incentive to both parties since it necessitates growth which translates into profits. Thus, both parties stand to benefit. In fact, the high standards of accountability cultivated in this business practice help to assure investors of the safety in their investments.

Other than the investors who stand to benefit, private equity is also beneficial to companies that face bankruptcy. Sasha (2009) has shown how Continental Airlines was on the verge of collapse. However, the investment by TPG helped to bring to life the dying airline carrier (see figure 2):

From figure 2, it is apparent that the stock price of Continental Airlines is fairing pretty well. For a company that was about to file for bankruptcy, such robust performance in the market is quite impressive. The same can be credited to the PE investment undertaken by TPG, as previously discussed. Lerner et al. (2012) argue that private equity is an opportune business venture. Thus, companies with high capital capacities should consider venturing into private equity.

Disadvantages of Private Equity

Private equity is a relatively untouched avenue of business. Stowell (2012) mentions that there are certain restrictions to entities that can carry out the business. One such restriction is the issue of limited partnerships. From figure 1, it was illustrated that a PE firm forms a partnership with investors. The partnership is limited and thus locks out other investors. The same acts as a disadvantage because there might be other investors who would increase expertise in the PE investment. However, the regulation for limited partnerships only locks them out.

The most conspicuous element of private equity is the large capital required (Finkel & Greising, 2009). Stowell (2012) points out that in certain markets like Europe, the requirement for investment in private equity starts from a value like £10 million. Such high capital requirements lockout other small and medium-sized investors. Such regulations also act as a barrier to a PE firm’s entry into a market. For instance, a company where the investors committed minimal amounts that is an equivalent of £ 7 million might find it hard to enter a market that is strictly set at £ 10 million.

The equities market, as aforementioned, is vast. Thus, carrying out due diligence on a company and forecasting growth is an expensive affair. According to Stowell (2012), such issues force a company to incur an extra expense apart from the actual ‘buy-out’ price. Consequently, it can be argued that private equity is extremely costly. The extra costs come in when one factors in the resources required for due diligence and forecasting. Thus, for a PE company that does not have a significantly large investment fund, they risk facing losses from the initial high cost.

Conclusion on Private Equity

Private equity is indeed a lucrative business venture. The example of the continental deal and TPG illustrates the potential for a huge return on investments. Pignataro (2013) insists that private equity remains significantly untapped. The same explains some of the restrictions on high capital requirements, perhaps to cushion investors from losing their money. The same also acts as an avenue of preventing unscrupulous businessmen from taking advantage of investors. Notwithstanding the high risk involved in the process, PE has a high-profit margin considering the profits made by TPG in the continental airline deal. Moving forward, it would be prudent for a review of the regulations of private equity. The same can go a long way in bailing out companies that would have otherwise gone under. In a way, private equity benefits both the investors and the company being acquired.

Section 2: Mergers and Acquisitions

In the business world, there comes a time when two companies are brought together by prevailing circumstances. Mergers and acquisitions are some of the circumstances that bring companies together. However, it is important to mention that although there is the convergence of companies, mergers and acquisitions have select instances of divergence. According to Padget (2011), a merger is regarded as a process where two companies come together, consolidating their assets by mutual consent. During mergers, companies undergo a legal process in which the details of the incorporation are discussed. Such issues as the percentage shareholding take the bulk of the negotiations. On the other hand and acquisition is viewed as a process where a company takes control of another company, as evidenced by the term ‘acquire.’The company that is acquired does continue to exist as a legal entity. However, its ownership shifts to the new company that acquired it.

Advani (2011) points out that mergers and acquisitions should be treated as separate entities. The discussions in this section of the paper will illustrate the thin line that separates the two. An illustration of the same will surround the discussions of a particular merger that occurred between an American-based securities exchange and one based in Europe. Full details of the merger are disclosed, with the benefits further illustrated. Also, the discussions will illustrate the barriers to mergers using the said example. Towards the end, details of the financing are elaborated in a bid to illustrate the difference between mergers and acquisitions. The example cited is of particular importance owing to the size of the transaction and the respective issues at stake. Both companies are leaders in their own regions.

Intercontinental Exchange takeover of New York Securities Exchange Euronext

Overview

On November 13th, 2013, IntercontinentalExchange Inc. (ICE.N) completed its takeover of NYSE Euronext (NYX.N). In an article published on Reuters, McCrank (2013) indicates that the deal gives ICE substantive control of the derivatives market. In what appears to be a merger, the process which started way back in 2000 ICE is poised to take control of the latter in terms of shareholding. McCrank (2013) points out that the deal was estimated to cost a whopping $10.9 billion. The said investment is expected to pay off with ICE positioning itself for entry into the other European markets like Paris and Lisbon (McCrank 2013). As part of the regulations of such business deals, each of the company’s shares was suspended from sale a day prior to the actual merger (or, in this case, acquisition).

Whenever a merger is in the offing, both parties normally raise certain pertinent issues. The most fundamental is what each stands to benefit from the deal (Stowell, 2012). According to McCrank (2013), ICE.N is making an offer on NYX.N with the intention of reaping the benefits of the boom in the energy sector. The same is explained by its strategy to acquire several franchises in Europe. The global market for derivative products is on the rise, and the merger will enable ICE.N to create some sort of monopoly. On the other hand, NYX.N also stands to benefit from the merger by tapping into the derivatives which are already established in London by ICE.N. A merger of an American giant and European leader coupled with a strong hold in the London market offers NYX.N a chance to benefit from the lucrative boom in the derivatives market.

Synergies and Expected Gains

Whenever two companies agree to become a single but legal trading entity, the same is understood to be a merger (DePamphilis 2013). In such cases, the parties are usually involved in negotiations to determine the shareholding and other management partners. The underlying principle behind mergers is that they are important in enhancing growth when companies combine resources and expertise. However, it is important to mention that mergers tend to differ from acquisitions. In the latter case, there is a case of an unwilling party. DePamphilis (2013) points out that an acquisition is characterized by a larger company forcefully buying out the shares of a smaller company. In the case of a merger, there are long-term benefits for both parties. The merger between ICE.N and NYX.N best illustrates the advantages of the said process.

DePamphilis (2013) points out that a merger is a good avenue through which companies can reduce their costs. The same happens when the larger company in the merger is allowed to exercise a large purchase power. Evidently, ICE.N is the larger company in the merger. Consequently, NYX.N will experience a reduction in cost in such areas as marketing. The need to reduce cost can be extended to areas like human resources where redundant or duplicating roles are replaced. Another benefit of the merger will be evident in market penetration. According to McCrank (2013), NYX.N was a significant player in Europe’s security exchange market. Thus following the merger, the company hopes to penetrate more markets. The same has been outlined by McCrank, who points out the proposed entry into Lisbon’s and Paris’ security exchanges.

When two companies merge, they tend to incorporate their respective portfolios. DePamphilis (2013) points out that such kind of incorporation helps companies diversify. Thus, the merger between the two companies has the potential of creating a wide array of products in response to the market’s demands. The same can be realized by having NYX.N offer some services which were not previously offered by ICE.N. In the days to come, the diverse services will act in favor of both companies since their intention to penetrate even deeper into the European market will require the expertise of the NYX.N staff. The merger will see the American services incorporated into the European services and the process transmitted to large parts of Europe owing to the proposed control of different franchises.

Skills and knowledge are also important aspects of mergers. As illustrated by McCrank (2013, para. 3), both companies were market leaders prior to the merge. The implication is that each company would boast of highly skilled workforces. Consequently, a merger would result in an even more skilled workforce due to the combined knowledge brought by the respective staff. DePamphilis (2013) points out that with increased skills and knowledge, a company is able to increase its shareholder value. In their merger, ICE.N brings American business expertise while NYX.N brings European expertise. Going by the size of the market, the two sides stand to benefit from the knowledge pool.

Barriers

According to Pearl and Rosenbaum (2013), mergers, like any other business activity, suffer certain challenges that constitute barriers to their realization. The deal by ICE:N and NYX:N is heralded as a potential game-changer in the securities exchange market in Europe. However, it is important to mention that prior to the merger, there were a number of hurdles that both companies were expected to overcome if at all the deal was to be a success. The two main barriers to the problem emerged from the European regulators and the element of market entry. Interestingly, McCrank (2013) points out that competition is a common barrier. The same was responsible for inhibiting an earlier deal with a certain company. However, by virtue of being a giant in the securities market, ICE.N is able to overcome this barrier.

From the discussion made thus far, it becomes apparent that ICE.N is an American company seeking to join the European securities market. Courtesy of the said merger, ICE.N has the intention of expanding its control into the European market (McCrank 2013). However, when a company attempts to join a new market, it faces entry-related barriers. Pearl and Rosenbaum (2013) advise that in such cases, companies should carry out an analysis of the potential barriers. When such analyses are carried out, it is important to factor in the economies of scale, product differentiation, and absolute cost advantages. Thus, upon thorough analysis, the element of economies of scale was found to pose a barrier to entry into the European market. The same is true since ICE.N does not come in from a perspective of cost disadvantage.

In terms of product differentiation, ICE.N happens to be coming from a market where the market prices are higher than those in Europe. Consequently, they will be forced to charge lower prices for stock once they enter the European market. This barrier is overcome because regulators require that incumbents in a market should charge higher prices in comparison to new entrants. In this case, the incumbents were not in a position to charge higher prices, thereby resolving this barrier. Pearl and Rosenbaum (2013) argue that most regulators are shunning this requirement owing to the recent economic downturn in Europe.

In consideration of an entry barrier, firms are required to make considerations touching on the amounts required for production. DePamphilis (2013) suggests that the understanding, her, is that a company seeking to enter a particular market is expected to bear all the production costs of the company it intends to be merging with Although this stands to benefit the lesser partner in the merge (the incumbent) the same inhibits potential partners to a merger. Fortunately, in the merger between ICE.N and NYX.N, there was a common view that there was much to gain regardless of this production cost. Hence, there were able to overcome the said barrier.

Financing

The merger of two business enterprises is a process that requires significant amounts of resources. According to Melicher and Norton (2011), the point of departure between mergers and acquisitions is determined by financing. To that effect, there are multiple avenues through which such deals are financed. It is important to understand that much of the resources are consumed during the preliminary process. The same includes carrying out analyses making payments to the regulators and the companies proposed for a merger. In the occasions where the merger is cross-border, the cost is usually higher. The merger between ICE.N and NYX.N is cross-border. Given the former being in America, while NYX.N is in Europe, the $10 billion deal is evidently a high capital venture. The same calls for informed financing. The most common modes of financing include stock and cash amounts.

Advani (2011, p. 104) points out that companies engaged in a merger end up using cash as payment when the intention is to acquire another company. In such cases, the larger company forcefully makes a bid on the shares of a smaller company being acquired. Thiessen (2013) points out that under the deal, the shareholders from both sides would either trade their positions for a cash amount. The shareholders from NYX.N would receive a lump sum of $33.12 per share. The other option on the table was that for every ten shares owned by the company, eight would go to ICE.N while the remaining two remain with NYX.N. However, the companies agreed to blend both options (Thiessen 2013).

According to McCrank (2013), the deals required that ICE.N make the payment using 75% stock and 25% cash. With regards to its future, the merged company has its sights on other markets in Europe. As already mentioned, the same would be made possible by means of an initial public offer (IPO). It is important to mention that IPOs are a safe way of financing since there is shared risk in the investments. Unfortunately, the deal between these two companies was not financed, courtesy of an IPO. ICE.N was in a position to raise the amounts required for the merger without the need for an IPO.

Conclusion on the ICE.N – NYX.N Merger

Mergers are important in enabling a company to push forward its growth agenda (Advani 2011). The merger by the two companies brings to light the increasing demand for companies to make forays into the international market in a bid to enhance trade. The example set by these two companies helps to demonstrate the importance of partnerships in business with the intention of maximizing the prevalent demands in the market. The motivating factor in the merger was the potential to tap into the boom in the energy markets. Since ICE.N has the resources, it required NYX.N to facilitate easy entry into the market. However, mergers should be carefully through, especially when it comes to barriers and the financing required. Thiessen (2013) posits that the benefits of the deal are realized by the performance of the company’s share exchange. Thus, going by NYX.N’s performance to date, the merger was a success.

References

Advani, R 2011, The Wallstreet MBA, McGraw-Hill, New York.

Carvalho, C, Klagge, N & Moench, E 2011, How well do financial markets separate news from noise? Evidence from an internet blooper, Web.

DePamphilis, D 2013, Mergers and acquisitions basics: negotiations and deal restructuring, Academic Press, London.

Finkel, R & Greising, D 2009, The masters of private equity and venture capital, McGraw Hill, New York.

Guy, F 2011, Private equity as an asset class, Wiley, London.

Lerner, J, Hardymon, F & Leamon, A 2012, Venture capital and private equity: a casebook, Wiley, London.

McCrank, J 2013, ICE’s takeover of NYSE to close on November 13, Web.

Melicher, W & Norton, E 2011, Introduction to finance: markets, investments and financial management, Wiley, London.

Padget, C 2011, Corporate governance: theory and practice, Palgrave, Basingstoke.

Pearl, J & Rosenbaum, J 2013, Investment banking, leveraged buyouts and mergers and acquisitions, Wiley, London.

Pignataro, P 2013, Financial modeling and valuation: a practical guide to investment banking and private equity, Wiley Finance, London.

Shasha, D 2009, TPG and the airlines: tales of bad meals and a fax gone astray, Web.

Snider, D & Howards, C 2010, Money makers: inside the new world of finance and business, Palgrave Macmillan, Basingstoke.

Stowell, D 2012, Investment banks, hedge funds and private equity, Academic Press, London.

Thiessen, M 2013, The merging of exchange power houses, Web.

TPG 2013, Philosophy, Web.