Introduction

Privatisation as an economic concept became popular around the world in the 20th and early 21st centuries. A study by Nowak found that many government-owned corporations were not efficient, and as a consequence, competitive enough to be profitable (46). Because of this, they often had to rely upon government bailouts after suffering significant losses. As globalisation was taking shape in the 1970s, 1980s and 1990s, most of these companies could no longer compete with the more efficient and highly profitable multinational corporations (Rose-Ackerman et al. 54).

In Latin America, Brazil was one of the first countries to embrace the concept of privatising state-owned enterprises. The Brazilian government determined that this was the best way of ensuring that these companies could continue in operation without having to rely on taxpayer subsidies. Privatisation provided a unique development strategy for the government, leading to the creation of jobs and assuring the government of continued revenue through taxation, in addition to reducing or eliminating the need for costly government bailouts in the operation of these companies.

The Political Economy of Brazil Development and Underdevelopment

Brazil is the most populous nation in Latin America and has a rapidly developing economy. Unlike the United States and Canada, the economy of this country had long stagnated due to a number of factors, including political instability. As Le Fraga explains, the country fell under military rule after a coup d’état in 1964 and it took 21 years for the reins of the country to return to civilian rule, which finally occurred in 1985 (67). These events led to political instability and tension, which slowed economic growth as the political environment was unfavourable for the development of both local and foreign companies.

Brazil’s long period of developmental stagnation was partly caused by the economic drag of its numerous underperforming government-owned companies. The government was forced to inject large amounts of cash into these institutions just to keep them running and most of them still continued to operate at a loss (Melnik and Miryakov (49). Corruption was another constant drain on the well-being of the economy. In a display of blatant nepotism, unethical government officials would appoint their close friends and family members as a reward for their loyalty, regardless of their qualifications or professional competencies. This unscrupulous practice created a culture of mediocrity, not to mention the outright theft and wastage of public resources, leading to significant losses at these institutions.

When civilian rule was restored to the country in 1985, there was massive pressure on the new public leadership to redefine the economy. Rampant unemployment, for example, was a major problem throughout the country due to the mismanagement of public institutions across the board (Morady et al 32). It was thus necessary to find a way of making these institutions profitable once again to help bolster tax revenue for the government and generate more employment opportunities for the population at large. It was during this period that the concept of privatisation began taking shape in Latin America and around the world as it was becoming increasingly evident that the culture of theft, incompetency and wastefulness could be eliminated if these institutions were run by private citizens as opposed to the government.

In April 1990, President Fernando Collor de Mello initiated a policy known as Programa Nacional de Desestatização, a massive privatisation program meant to stimulate the country’s flagging economy (Rose-Ackerman et al. 64). The resolution targeted the transport, telecommunication, energy, sanitation and water supply sectors. It was a deliberate effort to ensure that these important industries would begin to experience rapid growth. The government sold off many government entities within these sectors to private players, which then resulted in a more conducive environment for the companies to grow in.

Theoretical Perspective

Privatisation has since remained an important and viable economic strategy that facilitates desirable growth in Latin America. In order to better understand why this has been the case, it is important to acknowledge the relationship between a policymaker’s economic paradigms and his or her developmental policies. As Nowak explains, government leaders tend to embrace certain fiscal paradigms because of their effectiveness in promoting economic development (78). Focusing more attention on the needs of the state apparatus versus caring for the needs of the people at large is one aspect of such a paradigm.

At the time that Brazil gained its independence, a prevailing economic principle in effect was the importance of helping empower its citizens by creating an environment wherein the people could achieve their career and financial dreams without undue control or restraints from the government (Aspalter 32). Developmental policies at the time emphasised the importance of providing for the socio-economic needs of the people, including proper medical care, educational opportunities, gainful employment and the like. There was a major paradigm shift, however, when the country fell under the control of the military junta. Suppression of political views, economic sabotage and close governmental surveillance became increasingly common and widespread. However, there was also a series of positive changes that came about in the country after democracy was restored. To better understand the evolution of economic thought over the past decades that eventually led to privatisation in Brazil, it will be necessary to more closely examine various theoretical concepts underpinning the country’s political/economic structure during those time periods.

Socialism

Socialism was a theory that emerged in Europe and gained popularity in Latin America soon after the period of independence. It is a socio-economic and political philosophy that emphasises the self-management of workers and the social ownership of the means of production (Rose-Ackerman et al. 90). It also emphasises the decentralisation of economic activities and control as a means of empowering the masses. It also seeks to promote a participatory process in the planning of the major socio-economic facets of a country. Instead of a few political elites making all of these decisions from the top down, socialism seeks to encourage citizens at even the lowest echelons of society to participate in the decision-making process.

Socialism gained popularity in 21st century Brazil as the best way of fighting a whole host of societal ills including the exploitation of workers, poverty, hunger, racism, sexism, economic oppression and the destruction of natural resources (Melnik and Miryakov 48). Brazil’s civilian government realised the importance of empowering its citizens by giving them a voice in the formulation of new policies. One of the most important concepts promoted in Brazil at that time was the creation of free markets. The government realised that it had to promote an environment in which private sector businesses could thrive and this led to the privatisation of companies that had previously belonged to the government.

Neoliberalism

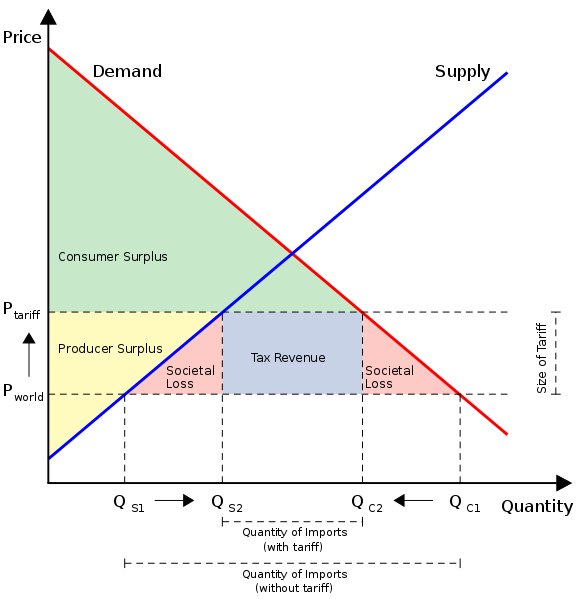

The concept of neoliberalism emerged in the 20th century as a resurgence of 19th century liberal economic theory and eventually gained widespread acceptance. As pointed out by Ndimande and Lubienski, neoliberalism promotes free market capitalism and economic liberation (63). The theory emphasises the significance of deregulation, privatisation, free trade, austerity, globalisation and reduced government expenditure as a way of promoting the private sector. As Nowak observes, proponents of neoliberalism believe that the primary role of the government is to create an enabling environment for private sector entities to flourish without the state bureaucracy itself getting unnecessarily involved (86). Neoliberals would stress that such a strategy could potentially reduce social loss, provide more revenue to the government through taxation and stabilise the markets as shown in Figure 1 below.

Neoliberalism as a socio-political and economic paradigm has been one of the forces that led to privatisation in Latin America. In Brazil, the government was keen on finding an effective way of ensuring that large companies not only remained operational to protect jobs, but become more profitable as well. Most of them were inefficient and a burden to tax payers, however. Privatisation was viewed as the best way of eliminating this burden, ensuring employment security and creating revenue for the government through taxation (Jacobs and Laybourn-Langton 116). The government created an environment that not only attracted local investors, but foreign ones as well, especially from Europe and North America.

The Benefits of Selling Off National Assets

The sale of national assets to private enterprise became a popular practice in Brazil in the early 1990s as the government focused more attention on promoting economic growth and development (Aspalter 78). The government realised that the best way of creating employment, eliminating public waste and promoting overall economic growth was to better empower the private sector. The following are some benefits that the strategy of privatisation has bestowed upon this country.

Elimination of Economic Burden

The Brazilian government was spending too much of its resources on running these institutions before privatisation emerged as a major trend. It was very costly to run the companies because they were inefficiently managed and consequently not profitable. As Aspalter observes, the main motivation that managers had for overseeing these institutions was to protect their own financial well-being and to reward political cronies and family members (55).

When the government made the decision to sell off many of these companies, especially the least profitable ones, it was a huge economic relief for tax payers. Money that had once been used to fund the companies’ operations could now be directed toward other economic projects. The government no longer had to bear the financial loss brought about by inefficiency, waste and outright graft (Sandberg and Rocha 67). Executives of a for-profit company are forced to look to the well-being of the company itself rather than their own personal interests.

Improved Efficiency of the Corporations

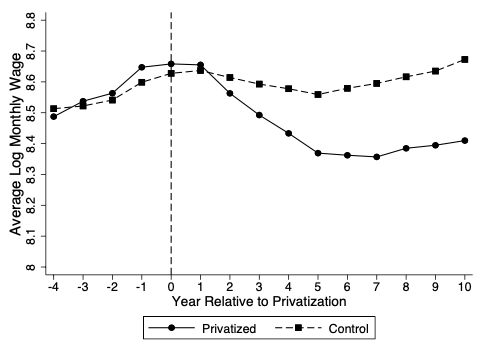

The large government-owned corporations of Brazil were so inefficient in their operations that it became virtually impossible for them to turn profits. This was partly because many of them were managed by individuals who lacked academic qualifications or the experience needed for their success (Morady et al. 58). When their operations were handed over to private investors, one of the first changes made was in the area of leadership. The new, more highly qualified and experienced managers redefined operations at their respective firms. They identified sources of waste and introduced new policies and operational procedures that were based on the industry’s best practices for the time. The performance of these companies subsequently improved at a time when competition was only getting stiffer due to globalisation. Figure 2 below shows that companies that were privatized performed better than those that remained under the control of the government.

Protection of Employment

One of the main reasons cited by the Brazilian government for the continued operation of these companies at a loss was to address the problem of unemployment in the country. Governmental leaders ostensibly felt that by maintaining the status quo, they would be able to protect the existing employees’ jobs (Rose-Ackerman et al. 59). Regardless of how altruistic these intentions may or may not have been, privatisation was able to solve the problem of unemployment in a more effective manner.

At the time that privatisation was coming of age, competition from multinational corporations was becoming increasingly stiff (Ndimande and Lubienski 78). It was no longer viable for the government to continue running these companies because of the massive financial losses they were experiencing. This meant that the government would have eventually been forced to close the companies altogether at some point, leading to the catastrophic loss of employment they were trying to prevent in the first place. However, privatisation caused these firms to be much more efficient and made them more competitive than ever. They could now compete with their larger multinational counterparts, which in turn led to the greater protection of jobs for Brazilians.

Revenues through the Sale and Taxation

The Brazilian government was forfeiting much of its revenue through the financial underwriting of failing companies. Most of the cost to do so came from Brazil’s repressive taxation regime and constant borrowing from the international community (Melnik and Miryakov 44). Privatisation led to massive revenue streams being generated through the sale of government-owned companies and the subsequent taxation of the newly privatised enterprises. This income was then able to be directed towards various developmental projects or the paying down of debt. For example, the sale of Petrobras’ gas pipeline subsidiary known as TAG earned the government $8.7 billion (Aspalter 34). The revenue has been used in various developmental projects.

Empowering the Private Sector

The policy of selling off national assets to individual and corporate investors was seen as a strategic move that empowered the private sector. According to Nowak, private companies often feel intimidated to compete against government-owned firms (93). Through privatisation, the Brazilian government was passing a message on to the private sector that it now wished to create an environment for their businesses to flourish without the fear of interference or competition from the government. The private sector enjoyed government support not only by purchasing these assets in the first place, but also by enjoying a business environment that was now supportive of private enterprise despite continuing competition from foreign firms. Companhia Siderúrgica Nacional is an example of a flourishing company after privatization. In 2018, the company’s revenue was US$ 6.0 billion, which was a major growth compared with that of the previous years (Berti 56). Embratel and Telebras some of the privatized companies that has continued to register growth over the recent past.

Costs of Selling off National Assets

Although the privatisation of government companies created numerous benefits, it is important to appreciate the fact that there were also some costs that the government incurred in doing so. In this case, the focus was to assess the opportunity cost of the government selling its assets to private investors after holding on to these companies for several decades. The following points represent the downsides of the strategy.

Reduced Capacity for the Government to Control the Sector

When the government sold off its publicly held businesses, it lost its capacity to direct their business operations in the manner it had done previously. The government’s role was now restricted to that of a regulator that simply defined the overall policies that the players in each respective industry had to observe. A further downside of this was that these private companies were now at liberty to hire foreign executives and managers instead of Brazilian citizens to lead their companies. Before the sales, however, the government was keen on ensuring that these firms were headed by Brazilians only (Chong and Lopez-de-Silanes 41). The power to make such decisions had now been forfeited. As long as these now privately held companies were operating within the law, the government’s involvement in their operations had been highly constrained if not outright eliminated.

Fear of Job Losses as Firms Downsize

It is a self-evident fact that privately-owned companies need to remain profitable in order to be sustainable. Le Fraga explains that the need to turn a profit forces such companies to maximise efficiency and to maintain a lean workforce capable of delivering the expected outcomes at the minimal amount of expenditure (56). Downsizing is a common practice that companies use to eliminate waste and improve profitability. They will then regularly evaluate their workforces to assess the productivity of their employees. When redundancy and inefficiency is detected, management may choose to reduce the overall number of workers. They may also choose to replace Brazilian employees with foreign nationals whom they feel have better skills and credentials to improve the overall performance of the company. Hiring foreigners of course, however, tends to reduce employment opportunities for the citizens of the country in question.

Lost Profits for the Government

A final downside of the privatisation movement in Latin America, especially in Brazil, involves the potential loss of revenue to the government when a government-owned business is sold, but was already performing very well. Although most of Brazil’s government-owned companies were poorly run, some were still in fact earning profit for the government (Aspalter 39). In the energy sector, for example, the government had been enjoying meaningful profit from a number of its companies.

When these firms were sold off to private investors, the profit that the government had been earning was subsequently lost. From then on, the government’s only revenue stream was from taxes charged on the gross profits that these firms made; the companies’ lucrative profit thus benefitted only the new private owners and/or shareholders. Despite the government having to bear the brunt of these costs, however, further analysis revealed that the selling of public assets overall was still a sound socio-economic and political move (Sandberg and Rocha 92). The net result of the strategy was positive in the end as it resolved a number of fiscal challenges that the government had been facing prior to privatisation. Most of these companies are now able to compete favourably against many of the top brands in the market, leading to an increased level of overall prosperity for the people of Brazil.

Conclusion

Privatisation has become one of the most successful strategies for strengthening the economy and political landscape of Latin America. Brazil, in particular, has embraced this strategy as a means of strengthening its previously faltering economy. When the military handed the reins of the country back to its civilian leadership base, some of the more pressing issues that had to be addressed included a growing public wage bill, rampant unemployment and underperforming government corporations. Government leaders eventually determined that by dealing with the poorly run governmental companies, they were also addressing the problem of excessive governmental expenditures and weak employment.

It was clear that governmentally owned companies in Brazil were facing stiff competition from their more efficiently run multinational counterparts in North America, Europe and parts of Asia. The privatisation process offered a solution for improving the performance of these companies, making them efficient enough to compete. The government also needed to implement an import substitution policy and privatisation provided the best platform to achieve that goal.

Unlike before when they were governmentally run and operating at a loss, the privatisation strategy forced these companies to eliminate waste and ensure profitability. One thing they did to accomplish this goal was to redefine their policies and focus on improving the performance of individual employees. The outcome was impressive as they were able to achieve industry best practices. Although there were some costs associated with this strategy as discussed above, privatisation has helped in strengthening the economy of Brazil in an assortment of ways.

Works Cited

Arnold. David. “How privatisation impacts workers: Evidence from Brazil.” Vox EU, 2019, pp. 1-2.

Aspalter, Christian. The Routledge International Handbook to Welfare State Systems. Taylor & Francis, 2017.

Berti, Suman. The Human Right to Water in Latin America: Challenges to Implementation and Contribution to the Concept. Brill, 2018.

Chong, Alberto, and Florencio Lopez-de-Silanes. “Privatization in Latin America: What Does the Evidence Say?” Economía, vol. 4, no. 2, 2004, pp. 37-111.

Jacobs, Michael, and Laurie Laybourn-Langton. “Paradigm Shifts in Economic Theory and Policy.” Intereconomics: Review of European Economic Policy, vol. 53, no. 3, pp. 113-118.

Le Fraga, Victoria, “The Impacts of Pension Privatization in Latin American: A Cross-Country Comparison of Pension Reforms and the Introduction of Individual Accounts. An analysis Modeled After the Six Guiding Core Principles of Social Security.” (2017). Senior Projects, vol. 34, no. 1, 2017, pp. 8-112.

Melnik Denis, and Mikhail Miryakov. “Privatization of Pension System in Chile and Formation of New Pension Orthodoxy.” Voprosy Ekonomiki, vol. 9, no. 1, 2019, pp. 40-54.

Morady, Farhang, et al., editors, Development & Growth: Economic Impacts of Globalization. IJOPEC Publication, 2016.

Ndimande, Bekisizwe, and Christopher Lubienski. “Privatization and the Education of Marginalized Children: Policies, Impacts and Global Lessons.” Taylor & Francis, 2017.

Nowak, Manfred. Human Rights or Global Capitalism: The Limits of Privatization. University of Pennsylvania Press, 2017.

Rose-Ackerman, Susan, et al., editors. Comparative Administrative Law. Edward Elgar Publishing Limited, 2017.

Sandberg, Claudia, and Carolina Rocha, editors. Contemporary Latin American Cinema: Resisting Neoliberalism? Palgrave Macmillan, 2018.