Introduction

Financial analysis is essential for any business, and airline companies are no exception. Evaluating their fiscal performance can be done by assessing three major categories of criteria, including financial ratios, liquidity ratios, and profitability ratios (Ellibeş & Candan, 2021). In financial ratios, such criteria as financing rate, leverage ratio, debt, and equity are analyzed. Asset, net, and gross profits are calculated to evaluate profitability rates (Ellibeş & Candan, 2021).

The airline whose financial performance will be assessed in this report is Ryanair, a designated activity company legally equivalent to a limited liability company (USSEC, 2022). It is an Irish company that provides low-cost air travel and connecting flights for its customers in all major airports of Ireland (Zuidberg, 2019). Like many businesses, it faced legal challenges with regulatory authorities during the pandemic (USSEC, 2022). Although Ryanair is an ultra-low-cost carrier, it is a successful and competitive airline with a profit margin of 17% from 2005 to 2018 (Zuidberg, 2019). Ryanair is often criticized for some of its policies; the financial analysis shows that it has relatively low debt and high profit.

Financial Analysis

The low-cost carrier (LCC) model has gained popularity worldwide, enabling airway companies to make prices more flexible for their clients. The American company Southwest Airlines first introduced the LCC model, and it was implemented in Europe by Ryanair in 1995 (Durmaz, Akan, & Bakır, 2020). Since this model became widely adopted in the market, competition rose; thus, Ryanair had to take specific measures to surpass its rivals.

For instance, one of the unique features of this airline is that it has the lowest carbon dioxide production among all European LCCs, making it the most environmentally sustainable (Ryanair, 2022). However, for a business to succeed, other factors must be considered. Indeed, a company’s profitability depends on such properties as in-cabin service, ticket booking, quality of flights, and ticket prices (Durmaz et al., 2020). All these variables contribute to the financial performance of an airline company.

Secondary Data

Ryanair Holdings offers low-cost flights across Europe and Northern Africa. The company owns 483 Boeing 737 and leases 29 Airbus A320, transporting passengers across 225 different airports in the abovementioned regions (United States Securities and Exchange Commission [USSEC], 2022). They perform approximately 3000 flights daily, allowing customers to reach different destinations faster and cheaper (USSEC, 2022).

Furthermore, the company’s operating revenues in 2022 were €4.8 billion, while in 2021, they were €1.6 billion, a threefold increase (USSEC, 2022). Ryanair’s total operating expenses in 2022 were €5.1 million, almost twice as high as the previous year (USSEC, 2022). Furthermore, the operating loss to profit ratio dropped in 2022 compared to 2021. Specifically, it was about €8.4 billion last year, while this fiscal year, it equaled €3.4 billion. Billion (USSEC, 2022). However, the expenses rose twice this week because last year, COVID-19-related restrictions did not allow people to travel freely.

Although the company’s financial performance improved at the beginning of 2022, some operational data show that sales have dropped. For example, the operating margin, which measures how much profit a business makes, was only 7% in 2022, while a year earlier, it was 51% (Hayes, 2022; USSEC, 2022). Similarly, the break-even load factor, the number of tickets that must be sold to cover operating expenses, was 108% in 2021 and only 88% at the end of March 2022 (Beers, 2022; USSEC, 2022).

However, the most recent data showed that the load factor in September of this year reached 94% (Ryanair, 2022). Since the higher numbers for this parameter indicate higher sales, the drop shows that the company could not fill all seats. This situation may be attributed to passengers’ preference to purchase flights from other providers that might have offered cheaper tickets than Ryanair. Another possible explanation for such variations in financial performance is fluctuating oil prices and changing flight demands.

Financial Analysis – Ratios and Their Interpretation

Table 1 represents Ryanair’s net cash inflow and outflow ratios. The cash flow from any company activity strongly indicates whether that operation brings profit. For example, the net cash inflow to outflow ratio from operating activities dropped by €600 million in 2022 compared to the previous year (Table 1). The ongoing pandemic, the war in Ukraine, global economic instability, and fluctuating oil prices caused such a significant decrease (Ryanair, 2022). Still, Ryanair increased its investments in 2022 by approximately €500 million (Table 1).

At the same time, the outflow-to-inflow ratio from financing activities dropped in 2022, indicating that income exceeded expenses. Moreover, the company reported a five-times drop in losses after taxation in the fiscal year of 2022 compared to 2021 (USSEC, 2022). Furthermore, Ryanair’s total revenue rose by 193% this year, which is impressive considering the current geopolitical and economic situation (USSEC, 2022). Overall, the analysis of the significant financial ratios of this airline carrier demonstrated improvement in some areas and deceleration in others.

Current ratios can be calculated using the following formula:

- The current ratio is equal to [Current assets/current liabilities] * 100%. In 2021, this ratio was equal to [€3,458.3 million/€3,526.9 million] *100% = 98%, while in 2022, it was [€5,475.1 million/€5,398.7 million] *100% = 101% (USSEC, 2022).

As can be seen from the calculations, there was a slight increase in current ratios, suggesting that Ryanair’s assets exceeded its liabilities this year. Nevertheless, since the total expenses of the company are still higher than the total revenue, the net income for 2022 is the following:

- 2022: Net income = total revenue – total expenses = €4,800.9 million – €5,140.5 million = -€339.6 million.

- 2022: Return on investment (ROI) = net income/shareholders’ equity = -€339.6 million/ €5,077.4 million = -6.7%. It appears that Ryanair will still incur some losses if ROI and net income are negative.

Table 1. Ryanair’s ratios for 2021 and 2022 (USSEC, 2022)

Critical Analysis of the Financial Situation of the Company

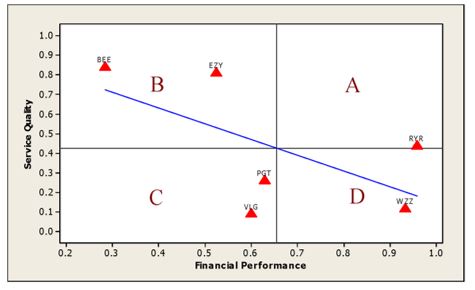

Ryanair’s recent report shows that the company performs well financially and maintains a leading position among other LCCs. For instance, an evaluation of Ryanair’s financial performance and service quality showed that its former parameter is excellent, while the latter lags behind its competitors, like Flybe and EasyJet (Figure 1). Still, Ryanair is the only LCC located in quadrant A, which means its financial performance and service quality are high (Figure 1). Notably, Wizzair, another rival firm, is almost as profitable as Ryanair but does not offer good customer service (Figure 1). Nevertheless, the company under discussion should consider improving some areas to preserve its current position and improve further.

Abbreviations:

- RYR – Ryanair,

- BEE – Flybe,

- EZY – EasyJet,

- PGT – Pegasus,

- VLG – Vueling, and

- WZZ – Wizzair.

Identification of Improvement Areas

The specific area for Ryanair to ameliorate is perfecting the quality of service. It is challenging for LCC to surpass the level of full-service carriers in terms of service because the very purpose of the low-cost flight is to limit expenses to reduce ticket prices (Durmaz et al., 2020). Still, introducing slight alterations to service may increase online ratings, primarily from consumers.

For instance, Durmaz et al. (2020) calculated the service quality part, presented in Figure 1, using the 5-scale rating from the TripAdvisor website, where customers rate various providers based on different criteria. In fact, the ratio of “very good” to “terrible” was about equal on this website, followed by “excellent,” “average,” and “poor” (Tripadvisor, 2022). Based on bad reviews, Ryanair should schedule its flights better and be more reflective of passengers’ feedback.

None of the negative reviews have changed since the company did not apologize for the unpleasant experience these passengers had. Although online customer feedback may be subjective, Ryanair should still ensure communication because other consumers use these reviews to decide which carrier to choose. The company should ensure that customers get a refund if the carrier’s actions resulted in them being taken to the wrong destination or caused other serious problems.

Budgeting Exercise for Ryanair for a Future Accounting Period

Budgeting exercise is an essential business component required to evaluate financial performance and reduce future risks and expenses. It can be performed annually to plan various events during the next fiscal year or may be done after significant failures or crises (Divvy, 2020). To be helpful for the business, the budgeting exercise should include features like strategic review, clear goals, and proposed simulations (Divvy, 2020). Furthermore, this exercise aims to review the firm’s policies and eliminate wasteful processes (Divvy, 2020). This report will assess Ryanair’s long-range and short-range budgets and justify the budgeting exercise for the next fiscal year.

Long-Range Budget and Justification of the Budgeting Exercise

The long-term budgeting exercise will be done for the next five years. It will be based on the company’s performance during the past several years; however, external political, economic, and global health issues should be considered. Since oil prices are unstable, the COVID-19 crisis is still ongoing, and the war in Ukraine is unpredictable, the predicted inflow-to-outflow from operating activities may rise by €500 million annually starting from 2023.

Furthermore, Ryanair should try to maintain the loading factor in the range of 100-110% because lower numbers may lead to bankruptcy in the long term. The airline’s total operating revenue is expected to reach the pre-pandemic levels of €7.5 billion in the next five years. Still, to maintain a high loading factor and income, improving the service quality is essential to attract more customers. Thus, the annual budget must be expanded by approximately €1–1.5 billion. Although Ryanair is an LCC and is not expected to have the same features as full-service airlines, addressing the issues of refund, timing, and the correctness of destination will increase its ratings.

Short-Range Budget and Justification of the Budgeting Exercise

The short-term budgeting exercise will be performed only for one year. Since the pandemic-related restrictions are unlikely to be entirely removed in 2023, Ryanair’s total revenue and expenses are expected to remain approximately the same as in 2022. Still, the inflow-to-outflow ratio from operating activities may rise slightly by €2–2.5 billion next year. Furthermore, this firm seems to increase its investments steadily; hence, the outflow-to-inflow ratio from investing activity will increase to €1.9 billion. Moreover, the annual budget may be expanded to €500 million in 2023, but higher numbers are unlikely since Ryanair is still required to cover major operational expenses.

Financial Analysis for the Budgeting Exercise – Ratios and Their Interpretation

The ratios in the budgeting exercises were predicted based on Ryanair’s financial performance in 2022. Table 2 represents the approximate ratios for the following year. The net cash outflow-to-inflow is not expected to change substantially in 2023 since the basic operating expenses remain the same. The prediction of a decrease/increase in cash equivalents was made based on comparing the change between 2021 and 2022.

Table 2. Predicted financial ratios for Ryanair in 2023 (based on the 2022 data from USSEC (2022))

Ratios to Be Monitored When Budgets Are Implemented

When budgets are implemented, it is critical to monitor some financial ratios. The change in cash equivalents and cash flow from investing and operating activities should be controlled. The company may consider diminishing its investments if a significant decline is observed in the income. Conversely, if payment is higher than predicted, Ryanair may increase operating expenses to improve service quality. Overall, the following ratios should be monitored by the company:

- ROI.

- Cash flow.

Critical Analysis of the Budgeting Exercise

The predicted numbers in the budgeting exercise reflect the approximate financial picture within the next year and five years. Additional factors such as the restrictions related to the pandemic, unstable global economy, fluctuating oil prices, and the Russian-Ukrainian conflict had to be considered when estimating these ratios. Ryanair must consider the negative and positive reviews its passengers leave on various online platforms because they are essential for LCC’s growth and development. Indeed, if the airline wants to increase its total revenue in the future, it should improve the quality of service; otherwise, this company is in danger of being surpassed by its competitors.

Conclusions

In summary, Ryanair is a financially successful low-cost carrier based in Ireland that offers flights across Europe and North Africa. Being an LCC allows this company to maintain a relatively high load factor annually. At the same time, the need to keep ticket prices low makes Ryanair limit its services, resulting in complaints from passengers. Although some of these negative reviews cannot be applied to LCC, the airline should still resolve severe issues to prevent damage to the company’s reputation. Overall, Ryanair’s revenue is expected to increase in the subsequent years; however, the airline may need to adjust its services.

References

Beers, B. (2022). How does load factor impact airline profitability? Investopedia. Web.

Divvy. (2020). What are corporate budgeting exercises? Web.

Durmaz, E., Akan, Ş., & Bakır, M. (2020). Service quality and financial performance analysis in low-cost airlines: An integrated multi-criteria quadrant application. International Journal of Economics and Business Research, 20(2), 168–191. Web.

Ellibeş, E., & Candan, G. (2021). Financial performance evaluation of airline companies with Fuzzy AHP and Grey Relational Analysis methods. Ekoist: Journal of Econometrics and Statistics, (34), 37–56. Web.

Hayes, A. (2022). Operating margin: What it is and the formula for calculating it, with examples. Investopedia. Web.

Ryanair. (2022). Annual report 2022. Web.

Tripadvisor. (2022). Ryanair. Web.

United States Securities and Exchange Commission. (2022). Ryanair holdings plc. Web.

Zuidberg, J. (2019). Network geographies and financial performances in low-cost carrier versus network carrier competition: The case of Norwegian versus SAS. Journal of Transport Geography, 79, 168–191. Web.