Fiscal austerity relates to public revenues and this is mostly (revenues) from taxation. It is mostly concerned with fiscal prudence. Therefore, fiscal austerity is a wide topic with various effects and impacts on the economy (Economist 2010, p. 26). These impacts can therefore be manifested in various ways. There has been an argument that fiscal austerity can possibly result in the shrinking of the economy. This is mostly in the short run.

Whenever countries have budget deficits, they can not avoid fiscal austerity because this is a reality that they are supposed to face. In this case, they will be forced to tighten their belts to aid the economic growth rate in the short run. It should be known that fiscal austerity can also have various short-term benefits. For instance, a good austerity package can increase optimism in the economy. In the process, consumers will spend freely at least in the short run without any problem (Agrawal 2010, p. 28).

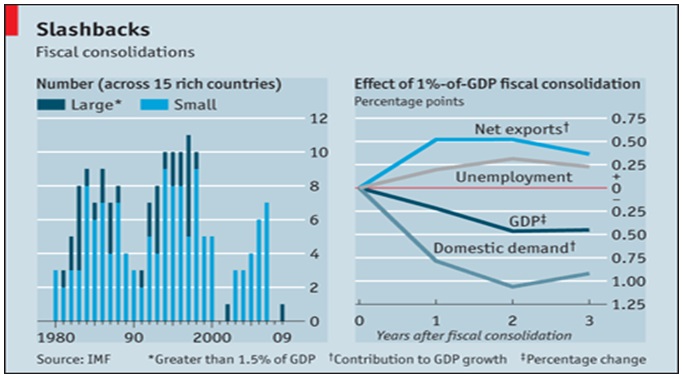

This diagram tries to explain various aspects of fiscal austerity in relation to fiscal consolidation and GDP. For instance, a decline in interest rates can explain why GDP rates did not drop as expected (Agrawal 2010, p. 13). In this case, any rise in exports cushions various blows that can be witnessed in the economy. Through fiscal austerity, appropriate spending levels can be set as time goes by. This can mostly be set with planned tax increases for sustainability.

In the short run, most fiscal austerity programs have an impact on a country’s future GDP- debt ratio. If such programs are not well implemented, they can reduce growth and employment because of various shocks that will come with such adjustments (Economist 2010, p. 18). Inflation can also follow fiscal austerity programs if it is not effectively evaluated.

Fiscal contractions

Fiscal contractions can mostly be seen in economies that are facing a massive unemployment problem. In this case, they have to engage in stimulus expenditure to stimulate economic growth rates (Sheffrin 2003, p. 18). As a matter of fact, any contrarian budget approach will have various impacts and effects on the economy. It should be known that as far as fiscal contractions are concerned, there are various factors that will be important in determining the size and duration of movements on output.

Such factors will always vary depending on the prevailing economic circumstances at a given period of time. The size and distribution of any gains from trade is a very important factor that will determine movements in output (Larch & Nogueira 2009, p.17). This is because trade can be able to maximize any pay-off that the economy will be having. Inelasticity of demand and supply is another factor that is supposed to be looked at.

Inelasticity of demand and supply keeps on changing and it will always have an impact on the movement of output. This is far as any fiscal contraction that the economy will settle on is concerned. The budgetary size of any fiscal stimulus program can also have an impact on the size and duration of the movement of output. In this case, there are supposed to be good spill-overs that will be witnessed in the economy.

The business cycle is another important factor that needs to be evaluated. This is because business cycles have an impact on spending and this can be evaluated from different perspectives. As a matter of fact, any fiscal contraction must look at the business cycle for sustainability. In this case, an economy’s output is highly dependent on the prevailing business cycle (Sheffrin 2003, p. 25). Variations in investment spending have various impacts on an economy’s general output.

Reference list

Agrawal, A., 2010. Fresh research and debate on fiscal austerity. Web.

Economist., 2010. Does fiscal austerity boost short-term growth? A new IMF paper thinks not. Web.

Larch, M. & Nogueira, J, M., 2009. Fiscal Policy Making in the European Union – An Assessment of Current Practice and Challenges. Ney York: Routledge.

Sheffrin, M, S., 2003. Economics: Principles in action. New Jersey: Prentice Hall.