Segmentation Analysis

The main issue identified for Softron Tax is low awareness and the need to establish a strong customer base in Ottawa; the issue is directly associated with segmentation. Segmentation is the primary strategic process that a business needs to conduct to ensure proper operation and development. The process is essentially about identifying customer groups that a business needs to reach with its products and services, and the identification is to be based on particular characteristics and combinations of characteristics, such as customers’ backgrounds, demographic information, income, and so on. Therefore, the first step in successful segmentation is defining dimensions of segmenting the market.

Softron Tax provides services to several customer groups with different needs, and segmentation should be based exactly on the considerations of different groups’ needs. First of all, a major part of services provided by the company consists in personal tax preparations services (“Softron has the services you need,” 2015). These services are demanded by individuals, and especially those who are expected to face additional complications with their taxes, e.g. new immigrants, residents of the United States, self-employed persons, and persons who have debts and credits. Based on these criteria, the first identified segment of the market to be targeted consists of individuals who are either entrepreneurs or self-employed (as opposed to hired workers).

Another large group of services is corporate tax preparation, and these services are aimed at corporate bodies, which qualifies for business-to-business services and implies different segmentation. Also, the company offers tax preparation for death taxes and taxes on sale of property (“Softron has the services you need,” 2015).

Therefore, the dimensions for segmentation for personal tax preparation services should include income (people with higher incomes are expected to be more in need of tax preparation services), occupation (targeting self-employed and entrepreneurs), and age (senior people are more likely be interested in will preparation). These multiple variables may overlap, i.e. senior citizens who have their own business that gives them high income will be particularly targeted due to the presence of all three markers of targeted segments.

Segments should be properly assessed to establish whether segmentation is reasonable, i.e. whether or not described segmentation is a good foundation for further targeting and positioning. First of all, the segments are sizable. For example, according to Statistics Canada, almost 2.8 million people in Canada reported being self-employed in 2016 (“Self-employment,” 2017). Most of these people live in urban areas, which is why the segment is particularly relevant for Softron Tax’s initiative to promote their new locations in Ottawa. Such basic criteria as age and income are not expected either to segment the market into too narrow parts, i.e. identified segments are sufficiently large.

Also, it is important that the needs within the segments are homogeneous (e.g. self-employments taxes for all self-employed individuals), while the needs among the segments are heterogeneous (e.g. will preparation among seniors and tax audit for the high-income group). Also, the segments are identifiable and accessible because the dimensions used for segmentation are basic. Based on the description of segmentation above, a segmentation grid was created. In the grid, offered services are matched with identified segments.

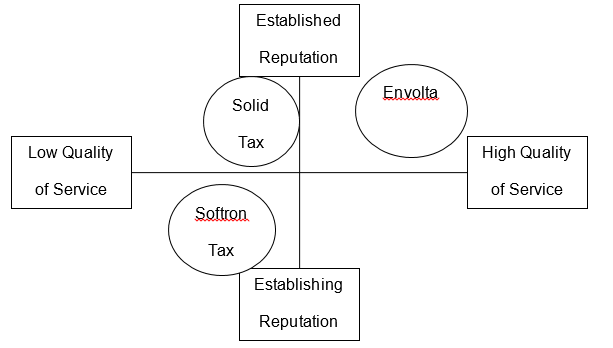

Further, a perceptual map was created to place Softron Tax on two axes: perceived quality of service and established versus establishing reputation. The company receives high ratings (“Best tax services in Ottawa,” 2017), but it should not be neglected that, as it was previously established, the company is still struggling for raising awareness and building reputation, which is why it is placed lower than its competitors on the reputation axis, and the company receives complaints about inconsistency of its services from customers, which is why its position on the quality axis is worse than the positions of its closest competitors.

The perceptual map shows that the company should work toward increasing awareness and customer satisfaction to earn competitive advantages.

Implementation

In implementing strategic recommendations and alternatives, it is useful to consult marketing theories. One of possible approaches in this regard is turning to P’s of marketing; for instance, Mudie and Pirrie (2012) propose seven P’s of marketing for services: product, price, promotion, place, people, physical evidence, and process. An additional component can be recognized as an eighth P: productivity and quality. This classical understanding suggests that all aspects of providing services to customers should be considered in strategic decision-making.

First of all, in terms of product, Softron Tax should ensure that the services it provides meet identified needs of customers, and the way they meet those needs is clearly communicated to existing and potential customer groups. This part of implementation will require efforts from two areas: marketing research and communications. Employees responsible for exploring the market should report their progress and identified needs to those who design new services and oversee the provision of current ones. Employees responsible for communications and public relations should ensure that the information on offered services reaches potential and existing customers and addresses their needs properly.

Second, the price of services should be competitive, which is why marketing research should encompass pricing, too, and a certain pricing strategy should be proposed. Third, promotion is the responsibility of communication and public relations practitioners, too. They should implement actions expected to reach more people. Fourth, the place component of the mix suggests that potential customers targeted within the framework of promotion can be accessed in proper places, i.e. in places where high-income people, senior citizens, and self-employed individuals or entrepreneurs (the three targeted segments) are expected to spend time. Fifth, people should be trained to provide better customer-oriented services. For this, the company can either establish its own training programs and facilities or outsource the training.

Sixth, for physical evidence, the company’s communications and public relations specialists should collect feedback from existing customers and provide it to potential customers. Also, this component of the mix refers to customers’ experiences of dealing with the company, i.e. the locations should be designed to provide comfort and positive impression. This is close to the seventh component: process, which refers to the procedures of providing services.

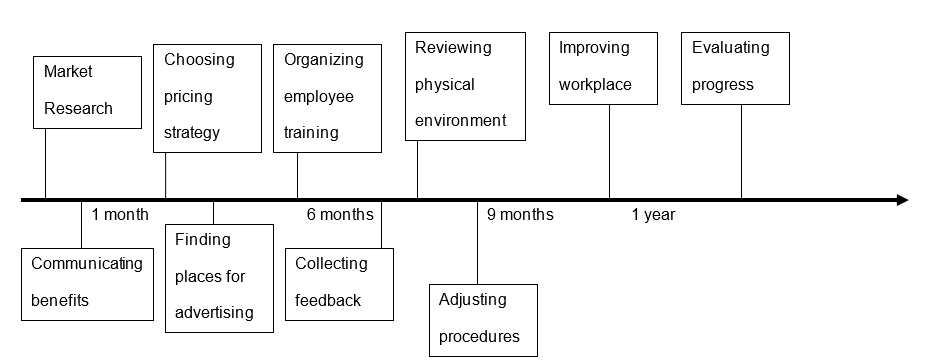

They should be fast, efficient, and simple for the optimal customer satisfaction. Customers demand tax preparation services exactly because they find the taxation system too complicated and taxpaying too time-consuming or confusing, which is why the process of providing services should be made as simple and enjoyable as possible. Finally, the productivity and quality of services component refers both to internal operation (organization of work in the optimal way) and external operation (raising perceived quality of services). The timeline for the proposed implementation is described in the figure below.

References

Best tax services in Ottawa, ON. (2017). Web.

Mudie, P., & Pirrie, A. (2012). Services marketing management (3rd ed.). Burlington, MA: Elsevier.

Self-employment, historical summary. (2017). Web.

Softron has the services you need. (2015). Web.