Executive Summary

Many companies around the globe are faced with several issues, which range from bookkeeping, financial management, auditing, and tax compliance. Failure to effectively manage these concerns is associated with setbacks, such as bankruptcy. In this report, the author focused on how the company to be established will help small and medium-sized businesses tackle these issues.

To provide the services as required and gain a strong market position, the managers of the new entity will assess such facets as key driving forces, location, opportunities, and success factors. Accofirm’s identified success factors include hiring professional employees, using up-to-date software, offering high-quality services, and charging affordable fees.

Business Idea

The business idea presented in this feasibility report entails starting an accounting firm. The company will offer bookkeeping, tax compliance, auditing, and financial management services. The primary reason for selecting the product line is the fact that only a few firms provide these services. The name selected for the business is Accofirm. The target market is small and medium-sized organizations.

Business and Industry Description

Current and Future Trends

Accofirm Accounting will provide bookkeeping and tax compliance services to SMEs within the locality. Current trends reveal that the bookkeeping and tax compliance sub-sector is growing at a high rate. Companies are realizing the importance of effective bookkeeping and tax management. Longenecker (2010) notes that bookkeeping is used to document the transactions carried out by various firms. Financial transactions recorded include sales, payments, and purchases by both individuals and corporations. Tax compliance is the degree to which companies conform to tax rules. Tax management is a big challenge for both small and medium-sized companies (Scarborough, 2014). As a result, corporations are seeking expert services to help them manage tax compliance issues.

The future of the business is bright. The sector is expected to experience more growth and development. The reason is that more organizations continue to seek accounting services to complement traditional forms of operations. Also, technological innovations are expected to influence business growth (Longenecker, 2010).

Key Driving Forces

There are various key driving forces behind Accofirm. They include trust, business diversification, high standards and practices, an increase in the number of small and medium businesses, and technology. Business diversification brings about change in organizational operations (Hodgetts & Kuratko, 2008). As companies focus on growth and efficiency, they adopt new work approaches. The measures help them to stay ahead in the business and on the path to success. The desire to change traditional modes of operations will prompt companies to seek accounting services.

Technological advancements have led to the development of different software used for bookkeeping and monitoring tax issues. To ensure a fast and accurate recording of transactions, firms need to use new technologies and services provided by accounting firms (Weirich, Pearson & Churyk, 2010).

The increase in the number of small and medium companies is a key driving force for Accofirm. The competitive nature of the corporate world has led to the establishment of new corporations to offer different products (Weirich et al., 2010). A rise in the number of these businesses means that accounting firms will be in high demand.

Key Success Factors

The key success factors for Accofirm include affordability, use of advanced software, professional employees, and location. Highly trained employees provide excellent and high standard services to clients (Longenecker, 2010). Besides, they are more productive and focused on their work. By employing qualified experts, Accofirm will be able to provide satisfactory bookkeeping and tax compliance services.

The use of up-to-date software will help the firm to offer its services fast and accurately. Due to the numerous technological advancements, companies strive to use the latest technology to serve their clients (English & Moate, 2010). If Accofirm uses obsolete software, clients may be forced to seek the services of other firms.

Charging affordable prices and providing high-quality services will attract more clients (Williams, 2012). The firm will use this approach to create its customer base. The proposed location of the business is also expected to be a success factor.

Opportunities

The opportunities available for Accofirm include specialization and flexibility in the provision of services. The primary services to be offered are bookkeeping and tax compliance. The reason for offering these services is that only a few corporations offer them within the area. The firm will also evaluate other primary services not provided and add them to its portfolio (Williams, 2012).

The second opportunity is the target market. Most accounting firms in Canberra focus on big and well-established companies. Accofirm will target small and medium-sized corporations within the area and beyond. Also, the company will offer services at charges affordable to small organizations (Williams, 2012).

Target Market

The Profile of Target Market and Segments

There are several well-established accounting companies in Canberra. Consequently, Accofirm will need to differentiate itself from the rest. The new company will target small and medium businesses within the city and its suburbs. It will offer essential services that are not provided by competitors. However, as the business grows, Accofirm will expand to attract clients from all over Australia.

Small businesses in Australia, according to the Fair Work Act of 2009, are entities with less than fifty employees (Williams, 2012). Despite the companies having few employees, they face several challenges related to accounting (English & Moate, 2010). Some of the common problems associated with their size include bankruptcy and tax compliance. Bankruptcy arises due to poor planning and management of funds. Accofirm will help small businesses by providing such services as financial planning and auditing. The services will be used to solve the major concerns affecting the establishments.

In Australia, medium-sized businesses refer to companies with not more than 200 employees. Organizations face numerous accounting challenges. If the concerns are not well managed, they may lead to the collapse of the firms. Scarborough (2010) observes that the major problems affecting medium-sized companies are related to bookkeeping and analysis of financial reports.

Due to financial constraints, small and medium-sized companies cannot afford the services of well-established accounting organizations (Williams, 2012). Accofirm aims to provide its services at reduced and affordable costs.

The Needs, Motives, and Purchase Decision Factors of the Target Market

Medium and small-sized companies have different needs and motives for seeking services (Weirich et al., 2010). Besides, their acquisition decisions are influenced by varying factors. Some of the aspects that influence buying include quality and price.

The table below shows the needs and buying motives for these market segments:

Table 1. Needs and motives of SMEs in Canberra.

Purchasers

The purchasers of Accofirm services (the SMEs) are also consumers.

Size and Share

The Australian accounting industry comprises firms offering different services. Weirich et al. (2010) observe that the market was shaped by the global financial crisis. The crisis forced many companies to seek the help of accountants. Between 2011 and 2012, the market size grew by 5.6%. By 2017, the industry’s revenue is expected to reach A$20.7 billion (English & Moate, 2010, p. 34). The increased earning and size of the market is influenced by a rise in the number of small and large companies.

The big accounting firms account for 30% of the market share (English & Moate, 2010, p. 33). However, such companies may not pose a threat to Accofirm and other SMEs. The reason is that each has a specific target market.

The sale potential for Accofirm is expected to be positive. However, the sales may not be very high during the first months. The reason is that the firm will be trying to create a strong customer base (Williams, 2012).

Factors Affecting Sales

The operations of accounting firms are affected by various elements. The factors include government policies, global economic trends, and competition. Some of these aspects will have a positive impact on sales. However, others may lead to a decline in sales volumes (Williams, 2012).

Factors expected to positively impact on Accofirm’s sales include government policies on tax and competition. Implementation of tax laws requires companies to review and comply with the new reforms (Williams, 2012). As such, the SMEs will require the services of accounting firms to calculate tax liabilities and keep records of all transactions showing compliance.

The competition will impact positively on sales if Accofirm differentiates itself and develops measures to maintain a competitive advantage. Failure to keep up with the competition may result in low sales volumes and losses (Williams, 2012).

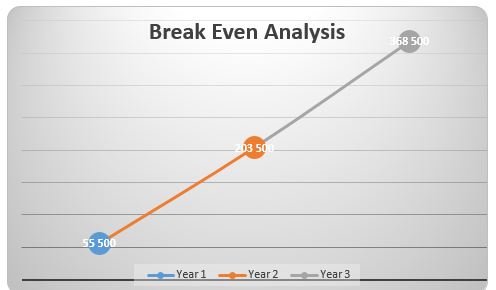

The expected annual growth in market share for the first three years will be calculated using the formula below:

×100

×100Since Accofirm is a new company, the growth rate calculation formula will only be applicable for the first financial year (Scarborough, 2014). However, the management is optimistic that sales during the first quarter will be high enough to have a positive impact on the firm’s growth during the following three years.

An assumption can be made to the effect that the company will generate $100,000 during the first financial year and 110,000 in the following year. The application of the projected growth rate formula using the annual revenues indicates that Accofirm’s growth rate over one year will be 10%. Within three years, the company’s average growth is expected to be at least 30%.

Competition

Competitors

Potential competitors for Accofirm are entities offering similar services within a 45km radius. There are four companies offering bookkeeping and tax compliance services within the locality. The firms include:

- Axiom Services

- Dellavedova & Associates

- Nexia Australia, and

- Cosgrave Soutter

Competitor Ratings on KSFs

The Australian accounting industry has over 10000 companies (English & Moate, 2010, p.23). However, their services vary in terms of price, quality, and expertise.

The strategic map below shows Accofirm’s main competitors:

Accofirm’s closest competitors account control around 30% of the bookkeeping, audit, and tax compliance market in the region. Also, they meet three out of the four key success factors identified.

The table below shows a comparative rating of Accofirm’s primary competitors:

Table 2. Comparative rating for competitors.

Business Position and Product Lines

Accofirm’s business position within the region is strong. The reason is that it is offering services that are not provided by most competitors. The primary tool used to evaluate Accofirm’s position is the SWOT analysis (refer to appendix 1).

Accofirm has four different service lines. They include bookkeeping, tax compliance, auditing, and business valuation. These services aim to meet the needs of the clients.

Operations Plan

Proposed Location

Accofirm plans to find a suitable location within Canberra’s suburbs. The location has some advantages. They include easy accessibility, safety, serenity, and convenience. It is a 15-minutes drive from the CBD (Williams, 2012). Also, the majority of the target customers are located within the area. The main disadvantage of the location is high leasing fees for business premises.

Acquisition of Premises

The premises will be acquired through a leasehold arrangement. However, there will be an option to purchase the building later. The estimated cost of leasing is $35,000 per year. The decision to lease was made because it is cheaper than purchasing the premises (Scarborough, 2014). Since the company is just beginning, most of its financial resources will be directed towards the current business operations. Besides, leasing has tax advantages that help to save more funds.

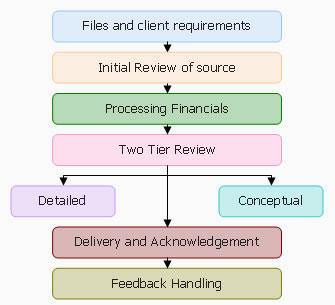

Service Process

The service process will entail establishing contact with the clients and filing their requirements for future reviews. The issues presented by the customers will be assessed using a two-tier review process. The procedure entails a detailed and conceptual evaluation. The final phase of the service process is the delivery and handling of feedback. The figure below shows Accofirm’s service process:

Client’s File Management System

The systems and software to be used by Accofirm to effectively manage client’s documents include Cabinet Safe Cloud, CCH Axcess, and ProSystem fx Document, and ConArc iChannel. Other applications to be used are Doc. It Suite and eFile Cabinet (Longenecker, 2010). Cabinet Safe Cloud is used to store documents in a hierarchy. It uses tabs, cabinets, repositories, and cabinets (Weirich et al., 2010). On their parts, CCH Axcess Document and ProSystem fx Document are used to organize files by practice area or department.

Layout

The proposed layout for Accofirm’s offices is shown in appendix 2. The workstations are designed to increase efficiency and enhance safety. The stations are spacious. They have a maximum of six employees and a minimum of four. At the entrance, there is a reception area with two receptionists. Another special feature is a meeting room with a capacity of ten persons.

Acquisition of Facilities

The items needed to start operations include computers, office chairs, desks, file cabinets, and communications equipment. The table below shows the estimated costs for each item:

Table 3. The estimated cost of items.

The method of acquisition for all items is a direct purchase.

Maintenance of Facilities

All employees will be required to familiarise themselves with the devices to be used. As such, they will be able to detect any problems with the functioning of the equipment (Williams, 2012). Comprehensive preventive maintenance will be conducted regularly. Also, a log-book will be created to record instances of maintenance and warranties for all purchased and repaired equipment.

Selection of Subcontractors

Subcontractors to be used by Accofirm include part-time employees to be hired during peak seasons and other accounting firms that offer similar services. The criteria for selecting subcontractors include service cost or charges, experience, specialty, and current business relationship (English & Moate, 2010). The duties, terms and conditions, and period for offering services will be stipulated in contracts.

Materials, Supplies, and Inventory

Materials and supplies

The supplies needed by Accofirm include reference materials, economy tax return design report covers, and business postcards. Other products are tax covers, metal tab pockets, working papers, and client subfolders (Scarborough, 2014). The suppliers for the materials needed by the company include Notemaker and Office Choice Australia.

Inventory management system

Inventory management is a challenging task for many companies. The reason is that it may be difficult to predict demand. Williams (2012) observes that the process entails monitoring non-capitalized assets, stock items, and work-in-progress needs. To manage inventory, Accofirm will make use of computer-based systems and quality accounting software. The tools will be utilized to generate reports on past and current sales, deliveries, and orders. The information will help the management understand the market and identify services that are in high demand.

Managing Seasonal Variations

Seasonal variations in sales and cash flow may have adverse effects on a business (Longenecker, 2010). At Accofirm, the variations will be managed through forecasting, saving finances when cash flow is good, and hiring a flexible workforce. Other measures include offering promotional discounts during off-peaks, diversification of services, and development of a strong network with local businesses and groups.

Regulations and Legal issues

The accounting sector in Australia is regulated by somebodies. The entities include the Australian Securities and Investment Commission (ASIC), the Tax Practitioners Board, and the Australian Prudential Regulation Authority [APRA] (Williams, 2012). Other bodies are Insolvency Trustee Service Australia (ITSA) and Australian Accounting Standards Board (AASB).

The agencies require all accounting firms to have operating licenses, permits, and Tax File and Australian Business Numbers (English & Moate, 2010). Before Accofirm starts operations, the relevant permits and licenses will be acquired.

Conclusion: Feasibility Assessment

A feasibility study is vital to the success of new ventures (Scarborough, 2014). It is used to determine the viability of the proposed business. The accounting industry is expected to experience extensive growth. The development will be influenced by an increase in the number of companies. As such, accounting firms will be in high demand. Accofirm aims to differentiate itself from other organizations by offering several services, such as bookkeeping and tax compliance, using a smart and flexible approach. The mode of operation will put the company in a good position upon entry into the market. Research on services provided by other firms reveals that most competitors ignore the needs of SMEs. As a result, Accofirm will have an added advantage because it will specialize in the provision of such services.

References

English, J., & Moate, B. (2010). Managing a small business in Australia: The complete handbook. Crows Nest, N.S.W.: Allen & Unwin.

Hodgetts, R., & Kuratko, D. (2008). Small business management. Hoboken, NJ: Wiley.

Longenecker, J. (2010). Small business management: Launching & growing entrepreneurial ventures. Sydney: South-Western Cengage Learning.

Scarborough, N. (2014). Entrepreneurship and effective small business management (11th ed.). New York: Pearson Education.

Weirich, T., Pearson, T., & Churyk, N. (2010). Accounting & auditing research: Tools & strategies. Hoboken, NJ: Wiley.

Williams, J. (2012). Financial accounting. New York: McGraw-Hill/Irwin.

Appendices

Appendix 1: A SWOT analysis for Accofirm

Appendix 2: A layout of Accofirm’s offices