Introduction

Strategic financial management involves making complex decisions by the high management to bring success to an organization. Financial management interacts with strategic management and comes up with financial criteria that the management uses to make decisions affecting the finances in an organization. Organizations with competitive advantage over others that offer similar commodities acquire more revenue than the competitors. So as to remain competitive, the management evaluates expansion opportunities, sets up rewards systems for employees, mergers and acquisitions, manages risks, makes decisions for complex opportunities, and many others (Allen, 1988, p.35). For manufacturing organizations, decisions about production structure and how attractive markets are very important.

Diageo plc is an organization that deals with the manufacture of beer, wine, and spirits (Annual Report, 2008, para.1). It is the largest multinational organization in the manufacture of these premium drinks. Although, the organization has a wide range of products, the most popular among these include Captain Morgan, Smirnoff, and Baileys. With operations in over 200 nations, Diageo plc boasts of over twenty-five thousand employees and earns revenue of about thirteen million U.S. dollars. It has its head office in Westminster in London. The company’s shares are offered in the New York Stock Exchange and in the London stock exchange. The company has undergone many developments since then especially the movement from manufacturing foods and drinks to the manufacture of premium drinks.

SAB Miller plc is a company that deals with brewing beer. The company also deals with bottling of other company’s products especially Coca-Cola. It distributes its products on six different continents. The company started in South Africa in 1895 and has since then expanded to the six continents. On its part, SAB Miller has acquisitions such as Miller Brewing Company, Altria Group, and many others. These acquisitions are located in areas such as Asia, Europe, and the United States. Some of the most renowned brands of SAB Miller plc include Bavaria, Pilsner Urquell and Grolsch. Shares belonging to the company are sold in the London Stock Exchange and Johannesburg Stock Exchange. In the year that ended in March 2009, the company reported revenue of about three thousand, four hundred and five million U.S. dollars adjusted pretax revenue and group revenue of about twenty-five thousand, three hundred and two million U.S. dollars (RNS, 2009, para.1). Both Diageo plc and SAB Miller plc have strategic financial management that helps in making the complex decisions that increase their competitive advantages and eventually increase revenue. This paper will seek to compare and contrast the strategic financial management of the companies.

Factors that have Affected Current Development and Financial Position of Diageo plc

Diageo plc has recently developed to cover many parts of the world and has enjoyed huge profits as a result of several factors. The company supplies and produces ingredients in different parts of the world. The production of brands in different parts of the world helps the company to perform the production in places that are near the raw materials and markets for the products. This reduces distribution costs increasing its revenue. The management in the company has been involved in the evaluation of expansion opportunities in different parts of the world. As a result, major investments are located in the most effective markets. Some of the brands by Diageo plc are associated with specific countries. These are countries where the demands for the products are the highest and bring a return on investment within a short period of time. For example, Johnnie Walker Whisky is associated with Scotland while Guinness is associated with Ireland. Identification of targets for certain brands has helped the company increase sales and in turn revenue. The production of brands in the target markets ensures a consistent supply which creates customer loyalty.

Since its formation, the management in the company has been involved in making decisions that open opportunities for its expansion in other parts (Corporate Watch, 2005, para.12). Marketing research is done so that the target markets are identified. Selection of the target market then takes place where the company concentrates on the economies that have the capacity to buy its products. The marketing mix is used to define the product, promotion, price, and others. Concentrating on the marketing mix ensures that the product satisfies the customers. The product eventually attains great sales in the selected markets and helps the company attain high revenue.

The company and its brands have earned respect and trust from its customers. It considers these as key factors in delivering its business. One way that it uses to win respect and trust from the customers is ensuring that members of the company act with great integrity in all their operations (CBI, 2005, para.4). To protect its reputation, the employees in the company act with integrity. In its corporate social responsibilities, the company addresses issues touching on drinking and driving, underage drinking and alcohol abuse. As much as it would wish to increase sales, the company recognizes that these issues are harmful and unethical. The approach that the company gives to these issues includes a responsible marketing of its products to encourage sensible drinking. There is also a code of ethics that members of the top management together with other staff are supposed to sign. This ensures that they act with integrity in all their activities. The company promotes social, economic, and environmental development. The corporate social responsibility approach given by the company ensures that it improves the well-being of individuals in the society. The well-being of the society on the other hand helps in the welfare of the company.

The company has defined the systems that will be used in recruiting and rewarding employees. Its system of recruiting employees ensures that quality employees are recruited. The company’s human resource department ensures a thorough recruitment. This enables it to acquire quality employees who help in production of products that meet the requirements of the customers. Employees who are absorbed in the organization receive detailed training and orientation so that they are capable of carrying out all the operations required. In addition, the recruitment is fair and transparent. Employees who greatly contribute to the revenue of the company are rewarded so as to encourage them to continue working hard and challenge other employees. When a high position emerges in the company, one of the employees who have been very productive and disciplined in the company is promoted instead of hiring an individual from outside. This motivates other employees towards working harder so that they can also receive promotions.

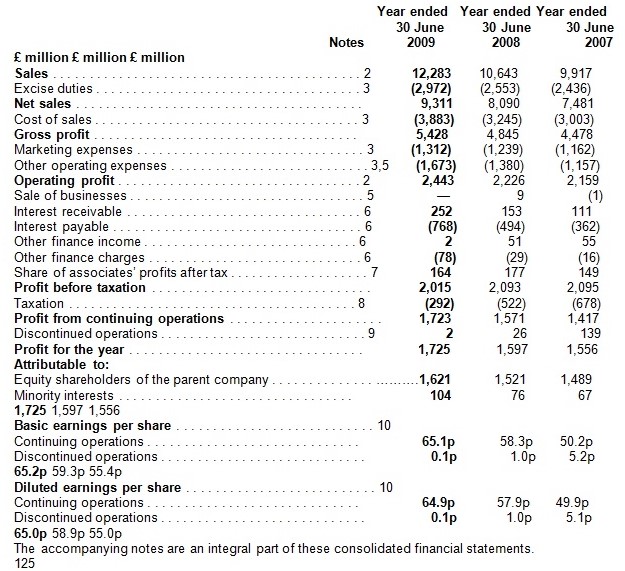

Diageo plc: Consolidated Income Statement

Factors that have Affected Current Development and Financial Position of SAB Miller plc

As stated before, SAB Miller started in South African but has since then expanded to different parts of the world. The company has performed several acquisitions that have helped it reduce competition. The acquisition tendency led to its spread in Asia, Europe and the United States. For example, the company got into London Stock Exchange so as to raise capital for acquisitions (SAB Miller, 2010, para.9). As a result, the original company bought the Miller Brewing Company and adopted the name SAB Miller. Contrary to Diageo, SAB Miller has its operations in both developed markets and emerging economies.

The company is committed to ensuring that it is responsible for all its operations. The management in the company believes that behaving responsibly has a positive effect on profitability and economic growth. Acting responsibly helps the company to secure economic growth for the local communities and the company itself. The company grows raw materials for production of its products in the communities. Members of the communities are employed in the farms where they earn a living. Brewing beer in the communities also gives members of the community an opportunity to work in them. Performing production in the communities ensures that the products are readily available. SAB Miller plc is involved in other activities that benefit the communities where it carries out its operations. It has been involved in the HIV campaign, education and training, local sourcing, and many others (SAB Miller, 2010, para.11). This helps increase their reputation in the communities and win customers’ loyalty.

The spread of the company to many parts of the world has been facilitated by several factors. The shareholders in the company enjoy a return on their investment. This attracts more other investors into investing with SAB Miller plc. The revenue that the company earns is used to invest in emerging economies. Investments in places such as China and India have been facilitated by the profits that the company earns (Company Snapshot, 2009, para.7). This has led the development of the company to operations in many parts of the world. Acquisitions have been a key aspect in the growth of the company in many parts of the world.

SBA Miller’s strategic approach to growth has been very helpful in its development. The desire to create a balanced spread all over the world has seen the company open operations in the six different continents. In addition to the balanced spread, the company has also been interested in creating an attractive spread in all parts of the world. Numerous research has helped the company come up with products that meet the needs of the customers in different markets. The products not only meet the demands but also go for affordable prices. It has different products that meet the needs of the customers in different markets. Marketing for its products has always been given a priority in the company. It has a marketing department that performs research so as to determine target markets and select those markets that have the capacity to give a return on investment. Marketing mix has helped them determine the best products for each market, the prices, and the targeted people. This has in turn helped increase the performance of the company in local operations.

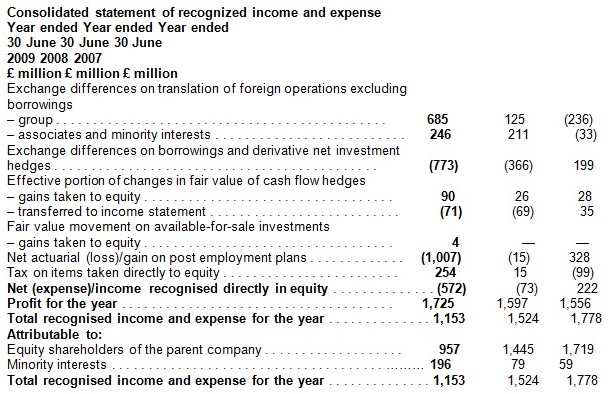

Financial Statements for SABMiller plc

Diageo plc Future Potential for Growth and Change

The current growth that Diageo plc has experienced is as a result of acquisitions and mergers. The act of involving large markets especially in developed economies has helped it retain selling its products at high prices (CBI, 2005, para.7). The future potential for growth of the company is not very well defined. The company has been experiencing controversies that could negatively affect its future. For example, the company decided to change the contents of the Cardhu brand without informing the customers. The company decided to change the brand and retain the name and the shape of the bottle. This was due to the fact that the company could not manage to meet the demand in the Spanish market. The company could have left the market because the brand was very successful here. This greatly affects the loyalty of the customers to the company and its products and in turn reduces the competitive advantage of the company. One brand could increase the doubt of the customers to affect all the products. Since there are many competitors in the premium drinks industry, the company may lose many of its customers to the competitors. This took place in 2002 but the company decided to shift the brand back to being a single malt. However, the shift is still seen as disloyalty to customers.

The plan to close its bottling plant and blending in Kilmarnock has not been taken positively by members of the community, the press, and the politicians (Packaging-Gateway, 2009, para.6). The move has received numerous criticisms due to the effects it will have on the communities. Many individuals working with the company are likely to lose their jobs. The company has been recently involved in sacking employees extensively in past recent years. The company has been generating much profit in the U.K. unfortunately, it has been reported that it has restructured itself so that it could evade paying taxes. This is seen as an unethical issue and the company could lose its market in one of the places it receives huge revenue.

Since 2006, the company’s profit has been increasing frequently. The changes that took place in 2009 and are likely to affect the profitability of the company in the future. The sale of some businesses is likely to affect the investment intensity. These investments if well managed could have brought more profits. The quality of products is high but the market share of the company is not very big because it offers its products in specific markets.

SAB Miller plc Future Potential for Growth and Change

The success experienced by SAB Miller is basically a result of joint ventures with other companies. The operations of the company in different levels of market have helped increase sales and eventually revenue (Korhonen, 2001, p.424). Its plans to venture into emerging economies have helped increase profits. The company has future potential for growth and change. Joint venture with Deloitte and SAP has helped the company achieve many goals. The management in the company has been able to make complex decisions that have helped it spread and attract many customers. The food and beverage packaged solution offered by Deloitte and SAP has helped the company increase its speed of operations. This has played a major role in the growth of the company in many parts. The joint venture has also allowed the company to reduce risks. The decisions that the management has been making help reduce risks in the company.

The activities that take place in the company ensure that the company’s future is secure. The management in the company has several programs aimed at ensuring the enhancement of the business (Kaplan & Norton, 2005, p.122). Different processes are integrated to ensure that there is a return on investment in every market that is ventured. Procurement programs help leverage scale in the different continents where the company has operations. The marketing department is run by experts who devise marketing strategies that promote its products. Brand portfolios are evaluated frequently. This ensures that current and future growth opportunities are utilized. The culture in the company allows development on part of the employees. Promotions and motivation of employees encourage responsibility. So as to meet the demands of customers in different communities, the company organizes outsourcing of raw materials whose supply may be low in a given place. As a result, the quality of the brands is always standard and as per the preferences of the customers.

Diageo plc versus SAB Miller plc

Both Diageo plc and SAB Miller plc have made profits in the past. Diageo has been quite consistent in increasing its revenue. SAB Miller plc on the other hand has been making high profits but the trend has not been consistent (Reuters, 2009, para.1). The operations that have been taking place in SAB Miller plc are likely to increase the revenue and success. Contrary, the recent plans by Diageo may affect its operations negatively. In terms of market share, SAB Miller plc has a larger share of the market due to its widespread operations. Its investment intensity is also higher than that of Diageo plc. Target markets seem more attractive to SAB Miller than they are to Diageo plc. As a result, SAB Miller plc is likely to be more successful than Diageo.

Conclusion

A strategic financial management is very important for the success of an organization. For an organization to be profitable, the management must make some complex decisions related to the market where it operates. The quality of the products offered and the market share of an organization increase its profitability. Other factors that affect the profitability of an organization are the attractiveness of the served market and the production structure that it uses. Diageo plc is a manufacturing company dealing with the manufacture of premium drinks. It is the largest organization dealing with the manufacture of these drinks. SAB Miller plc on the other hand deals with brewing and bottling of other companies’ products. Each company has some factors that have facilitated the current development and economic status. For Diageo plc, it specializes in specific drinks meant for specific markets. All the operations that take place are directed towards meeting the needs of the individuals in these markets. SAN Miller plc on the other hand deals with many products that are sold on six different continents. The company does all that it can to remain loyal to customers by always providing products that meet their needs. The future potential for Diageo plc is not as promising as the future potential for SAB Miller plc. In addition, SAB Miller plc is likely to be more successful than Diageo.

Reference

Allen, D. (1988). Strategic Financial Management: Managing for Long-term Financial Success. New York: Financial times Business Information.

Annual Report, (2008). Diageo. Web.

CBI (2005). Diageo plc: Corporate Social responsibility. Web.

Company Snapshot, (2009). One Of the World’s Largest Brewers, SAB Miller Plc Has Brewing Interests and Distribution Agreements across Six Continents. Web.

Corporate Watch, (2005). Diageo, The Major UK Drinks Multinational Which Owns Gleneagles, Has Much To Gain Not Only From Hosting The G8 Event Itself But Also From The Policies Being Discussed At The Summit. Web.

Kaplan, R. S. & Norton, D. P. (2005) Using the Balanced Scorecard as a Strategic Management System. Harvard Business Review.

Korhonen, A. (2001) Strategic Financial Management in a Multinational Financial Management in a Multinational Financial Conglomerate: A Multiple Goal Stochastic Programming Approach. European Journal of Operational research. (128)1. pp: 418-434.

Packaging-Gateway, (2009). Diageo Bottling Plant Refurbishment, Leven, Fife, Scotland, United Kingdom. Web.

Reuters, (2009). Income Statements: SAB Miller plc. Web.

RNS, (2009). SAB Miller plc: Annual Financial report. Web.

SAB Miller, (2010). SAB Miller plc Annual report 2009. Web.