Introduction

Littlewood (1997) defines taxes as the “charges levied against a citizen’s personal income or on the property or for some specific activity”. Taxes can solve many issues. Firstly, they can pay for services; hence, making life easier for future generations, either by minimizing the country’s debts owed, or by putting up national infrastructure. Secondly, they enable to transfer of wealth from generations of the future to the current one by the increasing deficit. Lastly, taxes help to minimize harmful habits like in the case of cigarette taxes. The purpose of taxation can be summarized as very straightforward and understandable, for a good performance of a state (Huxham 1940, p. 12).

Basic Tax Principles

An excellent system of taxation is necessary in order to set high standard principles for taxation. Some governments do not follow principles and therefore result in ridiculous systems of taxation where special interests and politicians look for gaining by manipulating these systems to suit their advantages (Littlewood 1989).

Tax systems differ from country to country and some work better than others. The best tax systems should be as simple as possible as it makes it harder to evade taxes and should create the best incentives for wealth creation and preservation while eliminating destructive activities that may misuse wealth and the country’s resources. They should also be fair to all citizens. This may be by levying no tax to those that do not use up resources, not taxing the poverty-stricken people unless there is no other way to fund the government. Lastly, a good taxation system should have a sustainable stream of revenue by setting up incentives that promote or hinder sustainability for the society and the system itself (Littlewood 1989).

The Hong Kong Tax System

The Hong Kong tax system is one of the most successful in the world since its structure ensures very low taxes, as well as low government spending. This allows the Hong Kong tax system to enjoy very broad public support. In order to achieve this, the system observes two things. To start with, the country focuses on relatively large incomes, and withholding methods like PAYE and GST are not used. This means that poor people are exempted from tax and ordinary people are lightly taxed. The Hong Kong tax system also shows the possibility for a developed country’s tax legislation to be simple. This is achieved by trusting the judges and avoiding complex structures which have the legislature provide for everything. The Inland Revenue Ordinance uses only general terms and leaves the work detail to the courts (Cowperthwaite 1971, p. 79).

One of the reasons why the Hong Kong tax system is one of the most successful ones in the world is the enormous reserves accumulated by the government. People seem more content with the combination of very light taxes and very low public spending (Cowperthwaite 1971, p. 79).

Reforms in the Hong Kong tax system

Up until 1940, there was no income tax in Hong Kong when the colonial government offered to establish aid in financing Britain for supporting the country during the war. The proposal required a single tax on income and would cover the worldwide incomes of all residents in the country and income derived by its residents elsewhere. The business community then objected and Sir Geoffrey Northcote had to establish a committee dominated by businessmen who had to go along with some sort of income tax. They came up with a form of tax a bit different from a normal income tax in the fact that it had three separate parts. One, property tax was charged on the rental value of the property, salaries tax was charged from employment, and profits tax from profits of businesses. After the war, British and Hong Kong governments again proposed to establish a normal income tax but the business community opposed (Littlewood 1997).

The Hong Kong Jockey Club is committed to promoting responsible gambling practices and minimizing their negative effects. The club is authorized to operate pari-mutuel and fixed-odd betting which includes horse racing, football betting, and the Mark Six lottery. This way, the government only allows social gambling to a number of outlets thereby minimizing or eliminating excessive and possible harm to the community. The club is a non-profit organization and one of the largest employers in the country (Littlewood 2005, p. 689).

Hong Kong also enabled plastic-bag tax (HK$0.5 per plastic bag) which has enhanced the public image of the country as it is perceived as an environment-friendly country and has also enabled good environmental protection business developments. According to BC Magazine, the country is comparable to a lush paradise, an idyllic landscape covered with verdant flora (Young 1967).

Hong Kong raised the cigarette tax by 50% in the 2011-2012 budget. According to Lucy Lau, (chairman of Hong Kong council on smoking and health), “the tobacco control measures provide efficient ways of encouraging people to quit smoking, and especially the younger generation” (VanderWolk 2002). This levy also brought about issues with the sellers as the profit margin remained the same while the cost was high thereby chasing away customers (Young 1976).

Goods and Services Tax (GST) still debates a proposed value-added tax in Hong Kong. The consultation was launched in the year 2006 and brought about considerable controversy from the taxpayers to the lawmakers, journalists, and politicians. The government argued that in order to broaden the tax base and secure sustainable tax revenues, GST would have been a viable option. The tax was to be levied at a flat rate of 5% and other taxes would either be decreased or eliminated. It would include export of goods, residential property sales, GST postponement schemes, Tourist Refund Scheme, and even charities (Welsh 1997).

The government also proposed that for the first 5years, all revenues would be returned to the community either as tax relief, or other compensation measures like salaries, education, and infrastructure, but was largely condemned by major parties of the Legislative council. GST is levied at 10% on most goods and services as a value-added tax in Australia and was introduced in the year 2000 thereby replacing the previous Federal wholesale sales tax. In Canada, it was introduced in 1991 and replaced the hidden 13.5% Manufacturers sales tax. Other countries levying this tax include Singapore and New Zealand among others (Haddon-Cave 1979, p. 600).

The tourism sector in Hong Kong provides a fast-growing industry and is opening up business opportunities in other sectors including the retail trade and hospitality sectors. The outlook for Hong Kong in the year 2010 was a return to positive growth more in line with the past trend growth. Continuing the momentum in the latter part of 2009, the economy started off with strong, broad-based growth in both domestic and external sectors. With the current improving trend, the revival in the Hong Kong economy should hopefully stay on track for the rest of the year. How the situation will evolve will depend very much on the timing and tactics to be adopted by governments and central banks of the major economies (Kaldor 1955).

Tax reform schemes are necessary to enable the country to monitor and restrict the number of housing projects or investments that are coming up in the second-hand market places. This also enables them to reduce the number of people who are migrating into the country and make it possible for the Hong Kong government to be able to make profits from their own investments and reduce the amount of money that is paid in the rental of properties (Hall & Rabushka 1995).

It is very beneficial if Hong Kong became an Islamic financial hub. This is because it is advantageous in the sense that it helps to minimize risks and debt. When financial institutions do business together with the Islamic community they become partners and share in profits, risks, and losses. For Hong Kong to have good and profitable businesses, there will be a need for them to change the tax laws and stamp duties that have been put in place by the government. They may also offer tax exemptions to allow the investors to recoup their investment and also the local insurance companies to offer Islamic insurance. The government should also allow Islamic banks to open up branches in Hong Kong so as to open up more markets. This would result in cooperation with Taiwan in many areas including investment, finance, logistics, and trade, which would create large benefits for each side (Littlewood 2005, p. 689).

The opportunities would help the country to coordinate with the mainland economy and produce more internationally renowned brands, while at the same time creating business opportunities around. The opportunities would be beneficial to the country in terms of coordinating with the mainland economy and producing more internationally renowned brands, while at the same time creating business opportunities around (Miners 1991).

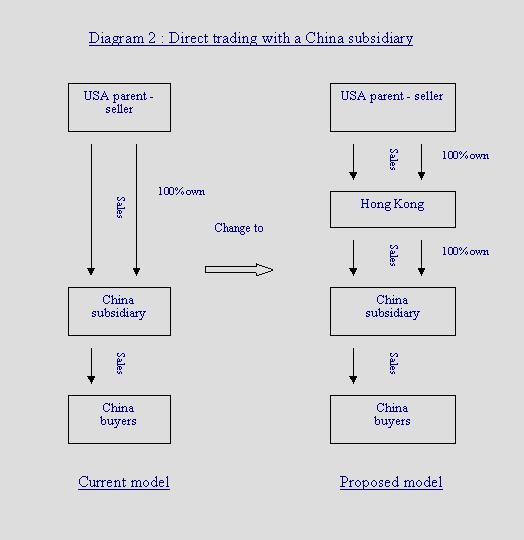

The unified tax system

Hong Kong has been able to unify trade with china and hence, be able to have opportunities to portray itself as a good holding jurisdiction for all China-related investments. Profits tax is important, especially to the international investors looking to enter these markets. The country also imposes income tax on a territorial basis. This means that the income that is taxed has to arise from Hong Kong, or else it is tax exempted. The key direct taxes in Hong Kong include Profits Tax, Salaries Tax, and Property tax. Other means of income that do not lie in any of the mentioned categories are not subjected to tax (OECD 1998).

Hong Kong does not levy “payroll, turnover, sales, value-added, dividend and capital gains taxes”. However, companies carrying on business operations, professions, or trade are required to pay profits tax. Offshore profits are profits that have a foreign source and are observed to be clear of the regional taxation system of Hong Kong. In 2008, assessable profits were lowered to a rate of 16.5%, from the initial 17.5%. This resulted in Hong Kong availing specific tax incentives in various kinds of activities. China’s existing rates levied on domestic firms have been changing from 33 % and overseas invested companies 15% or 24% to a unified rate of 25% (Rabushka & Rose 2000).

The main difference between the tax system in Hong Kong and that of other countries is that other countries employ democracy, which results in continuously increasing income taxes. The future of the tax system in Hong Kong is likely to be affected by the adoption of a democratic system of government, which may, in turn, lead to increased taxes on business profits, as well as large personal incomes. The expected increase in taxes is due to some practices in the democratic governments such as taxation of all people, and reliance of the tax system on PAYE (OECD 2006).

The Hong Kong tax system amuses many people since it does not rely on heavy PAYE taxes. The heavy taxes are imposed by employers, by deducting the amount from the employees’ salaries before it reaches them. This move saves a lot of time and money for a government, which would otherwise be spent chasing defaulters and dragging them through courts. Hong Kong is able to eliminate the challenges of chasing taxpayers since it imposes light taxes that are easy to pay. This makes the system more legitimate than that for other democracies (VanderWolk 2002).

The difference in making tax payments between Hong Kong and other democracies is clear. In Hong Kong, people are aware of the amount that they pay as tax since they have to provide a cheque or hand over banknotes. People in democratic nations, on the other hand, seldom know the exact figure that is cut from their paychecks as tax. They focus only on the net figure, once all the deductions have been made. The lack of knowledge on the amount taxed makes their decisions or arguments on increasing tax rates and public spending misguided. People in democracies are more aware of the amount used in public spending than the amount they contribute a tax, and when they demand more from the government, the taxes have to increase in order to complement the public spending (Welsh 1997).

If Hong Kong was to introduce the PAYE tax system in order to exercise steep progressive income tax, it would raise concerns about the effectiveness of the low tax policy. The incorporation of PAYE would result in reduced allowances and increased tax rates especially on large incomes (Whiteman 1988).

Democracy is good; however, insisting on its implementation by provoking the masses with regressive taxes may not be a smart move. Substantially increased public spending might be a good thing, too; but, it is not advisable to whip up demand for it by means of provocatively regressive taxes (Willoughby & Halkyard 1993).

The Detailed Implementation Regulations, DIR of the new EIT law ensure that dividends are recognized as income on specific days; when the investors make resolutions to make profit distribution. This is normally done on the annual board meeting date. The Chinese authorities have taken into account the possibilities of using an application and examination formula that can assist in confirming the number of FIEs’ undistributed reserved earnings that are should be acknowledged for tax exemption. A Double Taxation Agreement involving a comprehensive income tax treaty was signed by China and Hong Kong on August 21st, 2006. “This new treaty extended the scope of the existing 1998 agreement that was later limited to business profits and income from personal services (Willoughby & Halkyard 1993).

Another industry that benefits from tax exemption relief due to the double taxation agreement is the investing companies in Hong Kong. This is due to the capital gains acquired when shared are moved from mainland companies that are mainly tax-free, provided that some criteria are met. To start with, the shares transferred should not be more than a quarter of the whole shareholding of the mainland company. Secondly, the Mainland Company assets are not comprised sorely of immovable property in the Mainland of China (Zee, Holland, & Welling 2004, p. 9).

Owing to the treaty, china contributes passive income, including “dividends, interest, royalties and capital gains received by Hong Kong investing companies”. This would be considered as preferential treatment due to the minimal withholding tax rates. It could also be viewed as a tax exemption due to specific conditions. Taxpayers are supposed to regulate their “cross-border business transactions and tax affairs in a consistent manner”. This is because they are allowed to exchange information and maintain proper, efficient record-keeping systems that aid in the support of commercial objectives underlying the business transactions. The significance of this is well seen in the case of companies in Hong Kong that assert offshore income. The significance of running suboptimal profit allocation strategies is seen when a company grows to be international (Zee, Holland, & Welling 2004, p. 9).

Conclusion

The taxation system in Hong Kong informs us about the requirements for any democracy to exercise low tax rates successfully. These are the concentration of the tax burden on relatively large incomes, exemption of poor people from taxes, imposing light taxes on ordinary people, and transparency of the tax system. The taxation system in Hong Kong has been in practice for over seventy years, with just a few policies and heavy reliance on a good and unbiased judicial system. The government sees the system as inadequate since it is difficult to implement progressive taxes on consumption taxes as opposed to income tax. The population, on the other hand, is quite satisfied with the low taxes. Though the system is effective, ad has minimal problems, it is observed to be grossly inadequate when compared to other systems in place around the world. Hong Kong has impressive fiscal policies, which have been attributed to the extremely light taxation. According to Littlewoods (2010), “Hong Kong’s real achievement is not merely that the burden of taxation is very light, but that the system is so structured as apparently to enjoy a strangely high level of popular support” (Littlewood 2010).

References

Cowperthwaite, J., 1971, Hong Kong Hansard, Budget Speech, pp. 79.

Haddon-Cave, P., 1979, Hong Kong Hansard, Budget Speech, Annex 15, pp. 600.

Hall, R. E. & Rabushka, A., 1995, The Flat Tax, Stanford: Hoover Institution Press.

Huxham, H. J., 1940, Report of the War Revenue Committee, 12.

Kaldor, N., 1955, An Expenditure Tax, London: Allen & Unwin.

Littlewood, M., 1989, Consultative Paper: Sales Tax, Hong Kong, Hong Kong Government Secretaria.

Littlewood, M., 1997, HKLJ, The Taxation of Manufacturing Profits: A Re-interpretation.

Littlewood, M., 2005, How Simple Can Tax Law be? The Instructive Case of Hong Kong, Tax Notes International, pp. 689.

Littlewood, M., 2010, The History of Hong Kong’s Troublingly Successful Tax System, Taxation Without Representation.

Miners, N., 1991, The Government and Politics of Hong Kon, Hong Kong: Oxford University Press.

OECD., 1998, An Emerging Global Issue, Harmful Tax Competition.

OECD, 2006, Towards a Level Playing Field: 2006 Assessment by the Global Forum on Taxation, Tax Cooperation.

Rabushka, A., & Rose, M., 2000, The Flat Tax: American and European Perspectives, Massachusetts: American Institute for Economic Research.

VanderWolk, J., 2002, The Source of Income: Tax Law and Practice in Hong Kong, Hong Kong: Sweet & Maxwell.

Welsh, F., 1997, A History of Hong Kong, London: Harper Collins.

Whiteman, P. G., 1988, Whiteman on Income Tax, London: Sweet and Maxwell.

Willoughby, P. & Halkyard, A., 1993, Encyclopaedia of Hong Kong Taxation, Hong Kong: Butterworths.

Young, S., 1967, Report of the Inland Revenue Ordinance Review Committee Part I. Hong Kong: Government Printer.

Young, S., 1976, Report of the Third Inland Revenue Ordinance Review Committee, Hong Kong: Government Printer.

Zee, H. H., Holland, G. & Welling, M., 2004, Policy and Administrative Issues in Introducing a Goods and Services Tax: Further Considerations, Hong Kong SAR , pp. 9.