Introduction

The government undertakes the implementation of various public policies most of which are aimed at protecting its citizens. Taxation is one of these public policy measures that are used by the government to control harmful behaviors of individual or organizational consumption. About controlling individual consumption of substances that can be of harmful effect to their health such as cigarettes, governments of most countries have imposed taxation on these substances. This paper seeks to determine the effectiveness of the taxation system in controlling these consumption behaviors through an economic analysis.

Main body

Consumption tax refers to the tax that is levied on individual commodities where tax is included in the retail price of the commodity (Campbell, 2004). The consideration of introducing the tax policy is based on the assumption that the tax is a ‘user’s fee’. Regarding taxation on a cigarette, it is assumed that higher taxes lead to individuals quitting the habit, preventing relapse into the behavior while restricting others from endorsing the habit. It is also assumed that raising the tax on cigarettes is not solely aimed at increasing government revenue but is a measure towards reducing smoking (Frank, 1998).

About the tools of economic analysis, the demand curve for most products is downward sloping showing the relationship between the price and demand. While considering tobacco, its demand curve is exceptional. Despite this, the demand for tobacco and other related products responds to price changes (Frank, 1998).

Various governments use various tobacco tax systems to control the demand for tobacco. The specific tax is added directly to the price of cigarettes. Other taxes are ad valorem such as the sales and the value-added tax which are added on top of the excise tax. The effect of the tax is an increase in the ultimate price of cigarettes.

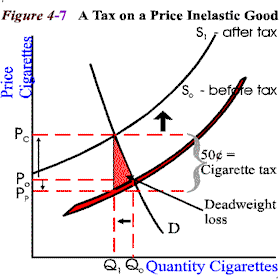

Due to the addictive nature of tobacco, any increase in the price of cigarettes as a result of tax will not lead to a decline in the quantity the individual consumes. This is because the smoker is ready to pay any amount for the cigarette to satisfy his demand; this is shown in figure 1. In this graph, the demand for cigarettes changes with a small margin despite the rise in price as a result of taxation. The demand falls slightly from Q0 to Q1. Considering a tax rate of 0.5 of a dollar imposed on a cigarette, the demand curve is steep due to the inelasticity of the cigarette. The effect of the tax is to shift the supply curve of the cigarette outwards as shown by figure 1 with the magnitude of the amount of tax imposed. From the figure, it is evident that the decline in the amount of cigarette demand as a result of tax is low due to its relative inelastic nature (Jay, 2002).

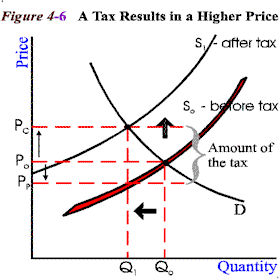

Despite this argument, recent research in Canada shows that price affects the demand for tobacco. Between 1982 and 1992, there was a steep decline in tobacco consumption due to an increase in the real price of the consumption (Economics of Tobacco Control n.d). This shows that tax policy can be an effective measure of reducing cigarette consumption. This concept is illustrated in the graph in figure 2 where the quantity demanded significantly declines from Q0 to Q1.

This shows that the elasticity of consumption of cigarettes is changing to depict elastic characteristics. For instance, in the US studies have shown that an increase in the price of cigarettes by 10% due to taxation results in a 4% decline in the demand for a cigarette (Economics of Tobacco Control n.d).

In Ukraine, the elasticity of demand considering the tax rate was established to be at -0.06 in 2004 in the short run while in the long run it is forecasted to be at 0.09%. This means that with an increase of 10% in the price due to tax, the consumption of cigarettes drops by 0.6% in the short run. This is a significant reduction in the demand for a cigarette because substitutes for cigarettes are scarce if there is any (Maksym, 2004).

Also in Ukraine, taxation is used to control the consumption of tobacco. Based on research conducted between 1997 and 2003, the results show that there is a strong relationship between the excise tax and the price of cigarettes. If the tax rate rises by 0.1 UAH, the price of one packet of cigarettes rises by 0.14 UAH (Maksym, 2004).

Inelasticity refers to a less than a unit response in the price which means that if price changes by 1% there will be less than 1% which makes the demand curve to be relatively steep as illustrated by the graph in figure 1 (Jay, 2002).

Conclusion

In conclusion, researchers have concluded that taxation as a policy measure has over the years led to a reduction in cigarette consumption. This is due to the inflating effect of taxation on the price of the commodities. There is also a significant change in the price of elasticity of tobacco as a result of taxation. Through the taxation policy smokers are encouraged to stop while preventing others from starting to smoke and ex-smokers from resuming the habit.

P0 – original price

P1-new price after an imposition of tax

Q 0 -original demand

Q1– new demand after taxation

S0 -is the original supply curve

S1 -new supply curve

Note that the demand curve is steep and it declines with a small magnitude from Q0 to Q1 while price increases from Po to Pc. The deadweight loss depicts the revenue that is lost by both the government and the consumers as a result of tax. The supply curve shifts inwards by the amount of tax imposed on the cigarettes.

Q0 -the original quantity of cigarette demanded

Q1 -the new demand after taxation

P0– original price

P1- Price after imposing tax

Note that the demand curve is not steep showing the relative elasticity of demand. The demand declines by a larger quantity while price also rises by a larger magnitude.

References

- Alfred M.1924.Elasticity and it uses. Cambridge University: London.

- Incorporation: Houghton.

- Economics of tobacco: Measures to reduce the demand of tobacco. The World Bank Group.

- Frank J.C1998.How effective is taxation in reducing tobacco consumption. South Morgan Publishers: Chicago.

- Jay K 2002.Elasticity. Prentice-Hall: Sydney.

- Michael G, Jody L, Sindelar J, & Richard 1993.A Policy watch. Alcohol and Cigarette taxes. Journal of economic perspective.Vol.7, issue 4.pp 211- 222

- Maksym M.2004.Achieving Tobacco Control Policy Goals through Economic Tools. OSI: Budapest. Web.