In managerial processes, capital budgeting has been observed to be an important managerial tool requirement (Steve & Burton 165).

It is a procedure used by financial managers to compare, evaluate as well as select particular projects to be able to determine whether an investment is worth risking (Steve & Burton 168).

It has often been understood that capital is a limited resource as far as retained earnings, notes payable or equity is a concern. Therefore, company management ought to make careful decisions as to whether a particular project is perceived to be economically acceptable (Steve & Burton 170).

In general, capital budgeting is concerned with justifying the capital expenditure.

On the other hand, the Internal Rate of Return, also known as IRR can be defined as the flipside of Net Present Value, or NPV (Steve & Burton 171).

IRR is also based on similar principles and math. While NPV portrays the value of a stream of future cash flow discounted back to the present using percentage representing a minimum desired rate of return, IRR computes a break-even rate of return (). The minimum desired rate of return shown by the NPV constitutes a company’s cost of capital. IRR is normally used as a hurdle rate or some form of go/no-go investment threshold (Steve & Burton 182).

As far as capital budgeting decisions are concerned, there have been queries as to which method, which is between IRR and NPV, is the better one. Considering several studies carried out, it has been revealed that the IRR method, in practice, is more preferable as compared to the NPV approach (Steve & Burton 186). This has been attributed to the fact that it is not only straightforward but also uses cash flows, recognizing the time value of money (Steve & Burton 188). It is considered understandable and easy to apply. Despite these few advantages, it is not the best of options. In other words, NPV is the better one to use over IRR.

IRR has been said to give unrealistic rates of return upon computing. For this reason, it is advisable for companies not to use the method unless the calculated IRR is considered a reasonable rate of re-investment of future cash flows (Steve & Burton 194).

It should not be used to determine rejection or acceptance of a project. In addition, studies have shown that IRR may give different rates of return. Using the IRR method always results in the selection of similar projects whereas using the NPV method is determined by the type of discount rate chosen for the project (Steve & Burton 197).

A number of reasons have been brought forward as being causes of conflict between NPV and IRR methods of computing rate of return. The most common ones have been the project life and size (Steve & Burton 200). In comparing large, long-term projects with smaller one that are perceived to be short-term while using both IRR and NPV methods, one is expected to obtain different selection results. In addition, two projects of the same length may possess distinct patterns of cash flow for instance in cases where the cash flow of one project consistently increases over time while the other one increases, decreases and stops (Steve & Burton 207).

Considering the aforementioned points, it is wise to conclude that NPV method is better than IRR method as far as making capital budgeting decisions is concerned.

Discount rate = 0%

PVIF = 1%

Therefore NPV = PV of cash flows (In) – Po

= (100,000 x 1) + (10,000 x 1) + (550,000 X 1) – 500,000

= $260,000

IRR

CFo + CF1/(1+r)1+ CF2/(1+r)2+ CF3/(1+r)3+ CFn/(1+r)n=0

= -165,000+ 141,000/(1+r)1+ 300,000/(1+r)2 + 300,000/(1+r)3 = 0

=-165,000+ 141,000/(1+0.04)1+ 300,000/(1+0.08)2 + 300,000/(1+0.12)3 = 0

= -165,000+ 141,000/(1.04)1+ 300,000/(1.08)2 + 300,000/(1.12)3 = 0

=-165,000+ 141,000/1.04+ 300,000/1.1664 + 300,000/1.4049 = 0

=-615000+135577+257202+213588=0

= $-8683.1

Discount rate = 0%

PVIF = 1%

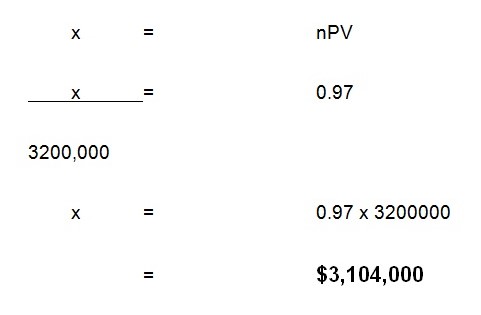

Therefore NPV = PV of cash flows (In) – Po

= (141,000 x 1) + (300,000 x 1) + (300,000 X 1) – 65,000

= $ 126,000

Works Cited

Steven, Bragg and Burton, James. Accounting and finance for your small business John Wiley and Sons, Washington, 2006 pp 164 – 208