Introduction

Monopolistic power is a profit earner for many companies. Monopolism still prevails despite the presence of government regulations against the formation of monopolistic power in the market, which brings deformities into the competitive scenarios. One of the vivid examples of the monopolistic dominance is Microsoft (Burrows, 2009). The article “Microsoft’s Aggressive New Pricing Strategy” demonstrates how a monopolist can charge whatever price it deems to, but it is not in their power to set the quantity of the product demanded. Therefore, a monopolist must increase prices to gain market share. Further, a monopolist sets different prices in different places. This price discrimination depends on the demand of the product among various subgroups of the target customers.

This essay is a review of the article “Microsoft’s Aggressive New Pricing Strategy”, which was published on July 16, 2009 in BusinessWeek regarding the new strategy that Microsoft has adopted to reduce the prices of its products. Microsoft has a history of gaining the monopolistic power and bringing in deformities into the market. However, with the economic recession there has been a decline in demand for the products of Microsoft, so it took a strategic decision to reduce the prices of its chief revenue earners, such as the Office software and Windows operating system (OS). The article “Microsoft’s Aggressive New Pricing Strategy” relates the strategies taken by Microsoft to regain its competitive power and combat the global financial recession. The paper will analyze the events mentioned in the article in terms of microeconomic theories.

The review of the article “Microsoft’s Aggressive New Pricing Strategy” in terms of microeconomic theory

Microsoft as a monopolist in software industry

The article “Microsoft’s Aggressive New Pricing Strategy” written by Peter Burrows (2009) first refers to Microsoft’s pricing strategy as a monopolist. It states that Microsoft had “enjoyed Olympian profit margins, using its monopoly power to maintain prices on its software” (Burrows, 2009). The company used its power as a monopoly to price its products high and gained market share through other measures. A monopoly is a market condition wherein there is only one seller.

Microsoft has long been accused to be a monopolist due to its dominating share of the software market, in particular with its Windows OS and Office software. Microsoft gained a lot of power as a monopolist and enjoyed pricing its products in order to gain maximum profit. Thus, as a monopolist, Microsoft was in a position to influence the price of the products and the buyers had no power against the price set by the company.

The article informs that Microsoft enjoyed monopoly power throughout its history. However, with the advent of financial recession in the global economy, there has been pressure on the company to meet its revenue targets. The article states that Microsoft used its “monopoly power” to keep high prices for its software even during “tough times” (Burrows, 2009). However, the company has been facing competition from other software giants like Google, and with the economic downturn found itself in a position wherein it could not use its monopoly power to sustain high prices for its products.

Therefore, the company was forced to decrease the prices of its products, from high-end OS Windows and Office products to even the newly launched internet products. The primary objective of the company was to reduce prices and increase sales volume, which would rejuvenate their low-profit margins. The CEO of Microsoft, Steve Ballmer, intended to get into the growth opportunities such as entering very lucrative and quickly emerging markets in Europe and Asia (Burrows, 2009). Microsoft has concentrated more on gaining corporate buyers for its software and reducing prices for individual customers. The primary intent of the price reduction was to increase sales of original software, mainly to those who would use the pirated software otherwise.

Apart from reducing the prices of the products, it has also altered its revenue model. As in the case of newly showcased Office 2010, Microsoft has two versions – one is supposed to be bought, and the other is a less powerful free online version which is supported by advertisements (Burrows, 2009). The company has also shifted its sale more through online transactions, which effectively reduced its price and increased profit by almost three times. The article then provides information on how Microsoft has launched its new OS, Windows 7, and informs that the price of this product is almost $40 less than the price of the earlier OS, Windows Vista (Burrows, 2009). This is the first time when Microsoft has charged a lower price on its product than the price of its earlier counterpart.

Google as the main company’s competitor in the software market

Microsoft enjoyed monopoly power with its OS and Office software. However, with the increasing pressure from competitors like Google, Microsoft is facing the market which has become oligopolistic (rather duopolistic) in nature. This has brought in the competition for Microsoft. Thus, the increased competition has forced Microsoft to aim at the market, which it had so far neglected and had continued to charge high prices for its products. However, with the advent of competition, Microsoft is forced to look forward to markets, which are emerging and have not been penetrated into. That is the reason for the company’s promotional pricing in countries like China and India.

The present software market is oligopolistic in nature where there are two major players in the Office software industry – Google and Microsoft. Google follows a different business model. It does not charge any price for the software but allows consumers to use their products and earns revenue through advertisements, while Microsoft believes in “traditional” pricing of the products. This creates more demand for Google’s word processor and spreadsheet software as they are free, especially in a market where price elasticity is relatively high. A company in an oligopolistic market establishes a so-called “Nash equilibrium”. Nash equilibrium is a concept that states that a firm will attain equilibrium when it adopts the best possible alternative given the competitor’s actions (Pindyck & Rubinfeld, 2009).

The article reports that in China, the company has sold its Office at $29 with other versions like Word, Excel, and others free to counter competition from Google (Burrows, 2009). Further, with loads of promotional offers available, the effective price of Office in countries like Brazil and India decreases from $150 to $100. Using price reduction as a tool, the company has reported increasing its sales figure by 4155 in the second half of 2008 (Burrows, 2009). In the countries where the use of pirated software is especially common, like China – where it is was reported to be 95% – Microsoft introduced a price reduction. That move has effectively increased sales of Office in China by 800%. This has heavily crippled the pirated software industry in China as the trial version cost only $29 (Burrows, 2009). Office was so successful that Microsoft has decided to keep the prices at this level permanently.

Strategies taken by Microsoft to regain the competitive power

In a more innovative marketing strategy, Microsoft has made a decision to have the CDs for Windows 7 loaded with different versions. People who buy the cheapest version will just have to upgrade to the premium versions by paying an extra surcharge. However, Microsoft is still facing competition from companies like Google who are willing to provide similar features at a cheaper rate.

It is clear from this article that Microsoft faces a downward-sloping demand curve for its products. As there is an increase in price, the quantity demanded declines and vice versa, provided ceteris paribus assumption holds true (Pindyck & Rubinfeld, 2009). Now, as there is a change in the external environment of the market, the demand curve shifts. Due to an economic downturn, cash crunch was created in economies, reducing the income of people. This shifted the demand curve to the left.

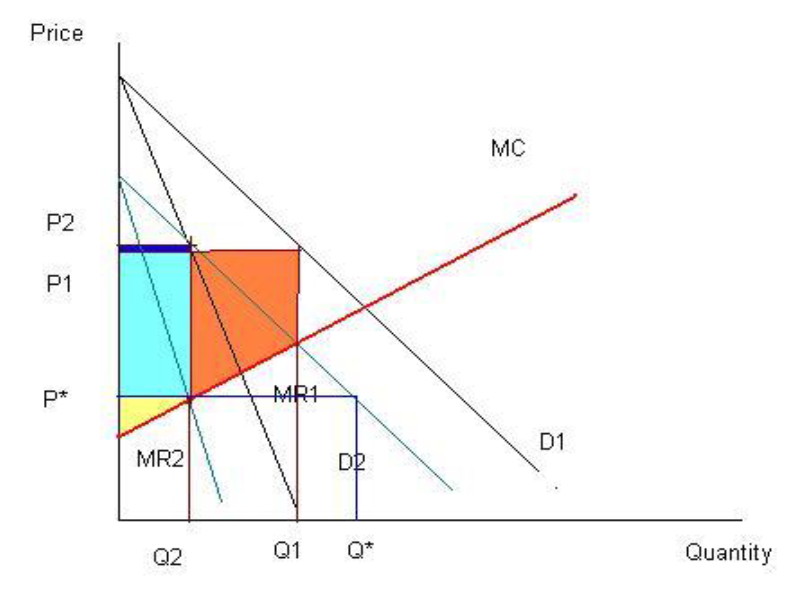

Figure 1 shows that initially, the demand curve faced by Microsoft was D1 which now moves leftward due to changes in economic condition to D2. Initially, when Microsoft faced the demand curve D1, its marginal revenue curve was MR1. Given marginal cost MC, the profit maximizing price and quantity were P1 and Q1. Assuming that Microsoft used to price its products at a profit maximizing price, the company earns a producer’s surplus equal to the region colored in orange, light blue, and yellow. With a shift in the demand curve to D2, the marginal revenue curve becomes MR2 too. The profit-maximizing price increases from P1 to P2 and quantity demanded reduces by Q1 to Q2. However, due to excess competition from the industry, Microsoft decides to price its products at a lower rate (P). At this price, the quantity demanded increases from Q2 to Q. The producer’s surplus reduces drastically to only the yellow region. However, it sells more products. Thus, Microsoft foregoes to its surplus in order to gain market share and increase sales.

From Figure 1, it is seen that at price P, the company still enjoys producer surplus, even though it is less than the profit-maximizing case. Further, due to the downward sloping demand curve of Microsoft products, the price reduction is accompanied by an increase in sales of the products, which is the same as the one experienced by Microsoft in the cases of China, India, and Brazil.

The pricing strategy that has been applied by Microsoft also provides monopolistic power to the company. The company charges different prices in different geographic locations. For instance, Office in India costs $100 while in China, it costs $29. There is a $71 difference in the prices of Office in those countries (Burrows, 2009).

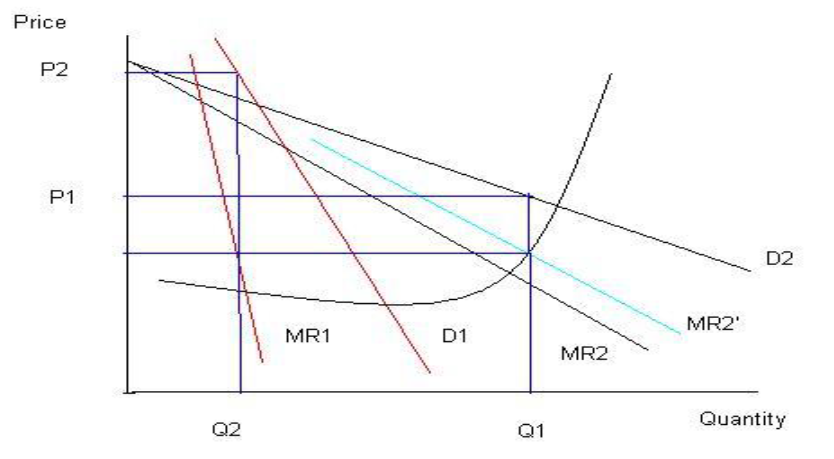

This is a third-degree price discrimination practiced by the company. Here, Microsoft has divided the consumers of China and India depending on the demand curves and price elasticity of the consumer demands.

As Chinese consumers have many alternatives in terms of cheap pirate versions of the software, a switch from the pirated version to the original one cannot be induced without reducing the prices to almost the same level as the pirated versions of the software. In China, the demand for Office is highly price elastic as there are pirated versions of the software that are sold at a very low price. Thus, pricing has to be kept low in the country to gain higher sales volume. In India, the price elasticity of demand for the software is less elastic than that of Chinese consumers. Therefore, prices can be kept higher than in China. Further, in China Microsoft Office faces the competition from pirated versions of the software, whereas in India, this competition is comparatively lower.

Figure 2 shows the third-degree discrimination followed by Microsoft. Here D1 is the market of India with the less elastic demand curve, and D2 is the highly elastic demand curve of China. As a necessary condition for profit maximization in the case of third-degree discrimination, the marginal revenue earned from both markets must be equal to the marginal cost. It can be deduced that the altered MR curve is MR2’. The price at which the product is offered in China is much lower (P1) than that offered in India (P2). However, in one market, the company earns a supernormal profit and in the other, it does not, but the company maximizes the profit earned in both markets.

In the case of its new OS launch, Microsoft has decided to price it lower than the initial launch price of Windows Vista (Pindyck & Rubinfeld, 2009). There were two main reasons for that: (1) decreased demand for the product due to an economic recession, and (2) advent of competitors and increasing competition pressure. In Chinese market, Microsoft competes with pirated versions, which are sold at a cheaper rate. The demand for the products depends on the price they set and on the price set by the competitors. In the case of Microsoft, it chooses $29 for the Chinese market, assuming a price that will be set for the pirated versions (Burrows, 2009). In this case, the product sold is the same product as both Microsoft and black market companies sell Office. The Bertrand model of oligopolies in the case of homogeneous products can be considered. The companies assume they will treat the price of their competitor as fixed and they simultaneously decide what price they should charge for the product. Usually, in such a situation Nash equilibrium is reached when both firms set the price equal to marginal cost (Pindyck & Rubinfeld, 2009). Thus, in order to bring the market into equilibrium, Microsoft has tried to price its product closer to marginal cost. In the given circumstances, profit tends towards zero.

Conclusion

The article demonstrates two conditions wherein the Microsoft acts both as a monopolist and as a company in oligopolistic market facing competition. Initially, being a monopolist, Microsoft priced its products high. However, with the increased competition and the need to keep their overall profit intact, the company reduced its price drastically. The article describes this aspect of the company’s pricing strategy. In the oligopolistic market, Microsoft has to reduce the price in order to face a competitor with the very low prices. Consequently, the company has decided to follow the revenue generation model of the pirating companies and to price its products low.

References

Burrows, P. (2009). Microsoft’s aggressive new pricing strategy. BusinessWeek, 4140, 51.

Pindyck, R. S., & Rubinfeld, D. (2009). Microeconomics (7th ed.). New York, NY: Prentice Hall.