The Market

The Australian biscuit market is facing rapid growth due to the changes in preference for snacks. Relevant sources have projected the consumer market of the Australian biscuits to rise to an average of $4 billion by the year 2025. The market recorded a 2.2% growth rate from 2010 to 2014, with a sales volume of $865.9 in 2014 (Hooper, 2018). The consumption rate at the time increased to attain 911 kilograms of biscuit consumed. The increase in sales is attributed to an increased preference for light snacks on daily businesses or traveling.

Also, a significant number of people have become mindful of the contents they consume in a snack. Australian biscuits are healthy snacks as the manufacturers carefully measure the number of ingredients they use. While biscuits are primarily consumed in urban areas, the Australian urban population increases the Australian biscuit market share. The largest market for biscuit products in Australia is the youth, whose population is constantly rising (Hooper, 2018). In addition, there is a rise in disposable income in Australia; thus, people can afford the snack at regular intervals. There is an increasing product variant in the Australian biscuit market. For instance, the sweet biscuit industry or cookies can be classified into assorted cookies, wafer cookies, cream-filled, chocolate, American cookies, egg-based, artisanal, plain, and in-store or bakery cookies others.

The market size of the Australian biscuit market is measured by the revenue generated. For instance, in 2021, the Australian biscuit market is at $1.1 dollars (O’Brien et al., 2020). The analysis of the Australian biscuit market is represented in Figure 1 below. According to the diagram, the market has measured a 3.1% growth rate over the last five years. However, the greatest threat in the market is high competition as numerous investors identify the opportunity for growth of the market.

Market Segmentation

Australian biscuit market consumers prefer different products based on a variety of factors. The market is mainly segmented by the type of product, the manufacturing company, the channel used to distribute the biscuits, and the consumers’ or manufacturers’ region. In addition, the different segments are further subdivided into sub-segments (Pasqualone et al., 2020). For instance, segmentation by type is segmented into plain biscuits, chocolate biscuits, egg-based, and sweet biscuits (cookies). Biscuit consumers have specific preferences l

The biscuit product type refers to the ingredients used by the manufacturer in the production process. The consumers of the product are keen on the different components and tastes of a biscuit. The different types of biscuit products include; sweet biscuits, American biscuits, plain biscuits, and in-store biscuits (Pasqualone et al., 2020). Other consumers prefer a different amount of sugar in their products. Also, additional flavors are added, such as chocolate, vanilla, strawberry, and banana, among others that make up different product types. In addition, the level of crunchiness of the biscuit is a factor that divides the Australian biscuit market; for instance, there are crackers, crisps biscuits, and sandwiched biscuits. The plain and cookies biscuits segments account for the largest consumers and are expected to dominate the market even in the future.

Due to different marketing activities or brand competitions, consumers may be influenced to buy a biscuit from a specific company. For instance, a marketing message may influence a customer to form a particular perspective of the product, which affects a customer to buy. Additionally, some customers prefer a product from a specific brand or company. The Australian most famous biscuit companies are Arnott’s Biscuit Holdings Pty Limited, with over 125 biscuit products. Other brands include Mondelez, Unibic, Mondelez, Bryon Bay Cookie Company, and Waterthins, among others.

The Australian biscuit company is also segmented along the channels of distribution. This could be because different shoppers prefer different places for making their purchases. For instance, some may find it convenient to visit a supermarket to buy a biscuit packet of their choice, while others prefer to buy a biscuit packet in small grocery shops. Diverse shoppers know where to find their selected product. Some of the commonly used distribution channels include small grocery stores, malls, supermarkets and hypermarkets, online stores, and convenience stores.

Segmentation along different regions depends on the manufacturer’s or the consumer’s region. Some areas, especially in urban settings, have a higher biscuit consumer market than others. Some of the most common areas with the highest biscuit consumption include Australia’s capital territory and New South Wales, the Northern Territory and Southern Australia, Western territory, and Victoria and Tasmania, among others. The most significant target market is the Northern Territory and Southern Australia, followed by the Victoria and Tasmania regions.

Market Targeting

The Australian biscuit consumer market is characterized by numerous competition from various brands. For this reason, one has to identify themselves with a particular segment when launching a new product. The differentiated lines of the Australian biscuit industry do not substitute each other; instead, they are complementary. In other words, the Australian biscuit market is segmented along with product type, the channel of distribution, regions, and industry or brand. For instance, if one chooses to produce plain biscuits, they must select the distribution channel, the area, and the brand.

I will choose to manufacture Oatmeal biscuit for the population based in urban areas for my new product development. Oatmeal biscuits are family biscuits that all ages can enjoy as a regular snack (Soldatova et al., 2019). The product type is classified under a healthy biscuit due to its rich nutrition value. The biscuit is prepared using an oat-meal dough and raisins. Also, it can be designed using nuts, toppings, fruits, or chocolate chippings. Also, the snack can be consumed regularly for breakfast, brunch, or just a random on-the-go snack.

I choose to specialize in this product market due to the health benefits associated with the product. Due to the increased health campaigns by nutritionists and other healthcare professionals, people have become keen on what they consume. Owing to this fact, the production of a health-based biscuit would result in ease of market penetration. In 2018, the healthy biscuit market was valued at $2.2billion and was forecasted to expand at a 5% growth rate by 2025. The most significant consumers of the biscuit are the millennials and the working professionals.

The healthy benefits of the oatmeal biscuits will be the competitive advantage of my new product. Unlike other biscuits or cookies, the oatmeal biscuit provides a small number of proteins absent in other products (Soldatova et al., 2019). In addition, oatmeal cookies contain a higher amount of fiber than further cookies. Fiber is an essential nutrient in a meal as it helps in the digestion process. Other minerals in the cookies include potasium, iron, magnesium, and calcium needed in the body for overall physical health (Grasso and Asioli, 2020). The biscuit has fewer sugars than other types of biscuits, thus fewer calories. This characteristic makes it most beneficial to people who are trying to lose or maintain their weight. Oatmeal biscuits help in building muscles, hence has a lot of benefits to children.

Consequently, I plan on segmenting my product in convenience stores and online stores. Online shopping has tremendously increased due to the emergence and prevalence of technology. Most of the shoppers who use online stores are the younger generation, the highest biscuits consumers. Using online stores to sell my product can also help me connect to new markets. Also, I will choose to place my creations in convenience stores because shoppers in the market look for specialized and quality goods (Hooper, 2018). When visiting a convenience store, shoppers aim at getting a particular product making it easier for my product to be identified.

Market Positioning Map

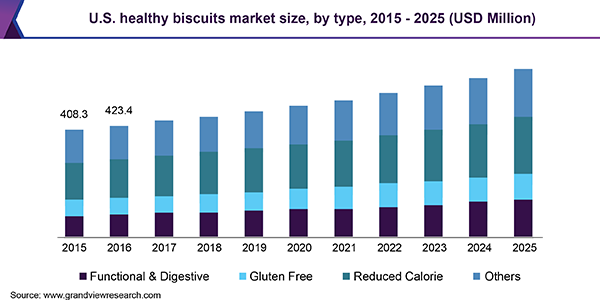

The healthy biscuit industry is divided into other products such as functional and digestive biscuits, gluten-free biscuits, calorie free biscuits, and oatmeal biscuits (Soldatova et al., 2019). The market share of these products is shown in Figure 3 below. All these products are differentiated in terms of the health benefits provided. The market share of the health biscuits is expected to increase by a 5% growth rate by 2025. The increase will be due to creased health benefits awareness among consumers, high availability, reduced prices of the products, improved taste, and increased marketing activities of the product.

I will expect my product will take a 10% market share of the existing healthy biscuit market. In addition, I forecast the effect to have sales of $100 million by the end of the first year in business. In three years, I indicate a 10% growth rate to a $120million sales volume. Besides the biscuit having reduced sugars, it also has additional health benefits while compared to other healthy biscuits.

Positioning Statement

Without a doubt, biscuits have grown to become one of the most loved snacks across the Australian market. Even though it receives constant competition from other snacks such as cakes, crisps, and juices, biscuits have remained a continuous attraction to consumers in Australia (Pasqualone et al., 2020). Additionally, biscuits are snacks that customers can enjoy and consume across all weather. Their weather-friendly nature provides a complimentary snack for consumers since they can use them across all seasons. This has resulted in a significant rise in competition in the biscuit business market in the country. Consequently, I have to develop effective strategies to ensure that I attract a large consumer base for my product, providing a competitive advantage over my direct competition.

To begin with, the diverse nature of these biscuits will enhance the creation of high market demand. For instance, biscuits can be utilized as a means to improve the health of consumers through using a wide range of healthy ingredients during their production. The ideology of using healthy and nutritious ingredients during bakery processes in biscuit production provides healthy snacking options to consumers (O’Brien et al., 2020)s. The Australian market is driven by increased demand for convenient snacking options that are incorporated with healthy ingredients. With a significant rise of diseases and health complications in Australia, the production of oat-based and nut-based biscuits, among other nutritious biscuit products, would be received by high demand from consumers (Grasso and Asioli, 2020). Notably, healthy biscuits would help patients address health challenges such as weight loss, reduction in blood sugar levels, and reduced risks of heart complications.

Additionally, these biscuits will be easily accessible, affordable, and possess high quality for consumers across Australia. For instance, these products will be available for consumers across the grassroots levels to ensure their availability at local markets. Also, the biscuits will be available at lower prices to attract all consumers in the country. Fixing higher prices for biscuits would discourage consumers from purchasing this product; hence lower prices would attract a large consumer base (Soldatova et al., 2019). In this scenario, this product will be produced by utilizing readily available raw materials, which will reduce the production cost. Resultantly, my new product will be cheaper than the majority of the direct competitors hence providing a competitive advantage for this product. Producing quality products is critical in fostering the success of this product. As such, this product will observe all the health and safety guidelines necessary in ensuring the generation of a quality product. In addition, quality for these products will be guaranteed through the practical purchase of quality raw materials while highly trained experts will perform all processes.

Conversely, these products will attract consumers across all age groups in the Australian market. This is because all products will be channeled towards satisfying a particular need for all consumers. For example, children are known for their love of sweet snacks. Children’s products will be integrated with chocolate, milk, and sugar will attract them to these products. On the other hand, teenagers enjoy a wide range of snacks; hence these new products will be guided by social trends and various blends (O’Brien et al., 2020). Orange, lemon, and passion products are among the essential flavors incorporated in these products due to their love for parties, picnics, and other social functions. Conversely, adults will be broadly represented in the development of these products. This product will be driven towards providing better nutrition for adults; hence the new products will utilize high nutritional products such as honey and oatmeal in their production.

Moreover, these products will utilize unique features that will increase consumer demands. For instance, these products will be packed in environmentally-friendly packages to emphasize the importance of environmental protection. Containers used to wrap these products will are easily decomposable hence reducing the environmental pollution. This will play a significant role in attracting a large consumer base, including environmentalists. Furthermore, these packages will be hygienic and easy to carry to make it easy for consumers to enjoy their snacks while engaging in other activities such as walking. Providing food-on-the-go snacks for consumers will offer a competitive advantage for my new product in the Australian market. Hygienic packaging will help improve the health of all citizens across Australia since it will reduce the spread of all viruses and diseases.

Finally, the multipurpose nature of this new product will provide stiff competition to direct competitors of this new product. The provision of various flavors and blends for this product will make it a preferable snack for parties served with drinks such as juices and wines. Also, these biscuits can be taken as meals at hotels, events, and homes (Grasso and Asioli, 2020). In this case, the new products can be served as breakfast and tea while they can also be consumed as dessert after meals. Consumers will be provided with an opportunity to pre-order these products for events and home consumption, whereby they will have a chance of requesting new flavors and blends.

References

Grasso, S., & Asioli, D. (2020). Consumer preferences for upcycled ingredients: A case study with biscuits. Food Quality and Preference, 84, 103951.

Hooper, N. (2018). Directors’ counsel: Bob Baxt-a retrospective. COMPANY DIRECTOR, 34(4), 36-37.

O’Brien, L., Jacobs, B. J., Dunckel, S. M., & Panozzo, J. F. (2020). A century of improvement in the quality of Australian wheat. Agricultural Science, 31(2), 82.

Pasqualone, A., Laddomada, B., Boukid, F., Angelis, D. D., & Summo, C. (2020). Use of Almond Skins to Improve Nutritional and Functional Properties of Biscuits: An Example of Upcycling. Foods, 9(11), 1705.

Soldatova, E. A., Misteneva, S. Y., & Savenkova, T. V. (2019). Methods of optimizing technologies and recipe of oatmeal cookies. Web.