What is a HELOC

Home Equity Line of Credit is a type of credit that is secured by a home and one is able to use it for anything. The way HELOC work is similar to the way the credit card is being used, it allows one to continually to get into the line of credit, use even up to the credit limit within the draw period (Farrell, 2020). Since allows one to have the access to the credit line, it therefore guarantees spending as much or as little one wishes but interest is paid on the amount used.

Advantages of HELOC

HELOC have a comparatively lower interest rate compared to the credits and personal loan. Though the rate of credit is dependent on the credit score, HELOC typically tends to have a lower rate the other forms of credits. They have a variable rate of products, this will mean that over time, the rate will change, but even when the rates will rise those for HELOC will still be lower compared to other credits and personal loans (Farrell, 2020). It gives one an option of locking the rates. This allows one to fix the interest rate on the outstanding balances and prevented from being affected by the rising rates. Lastly, one is only required to pay what is spent. This kind of flexibility will make HELOC to be the option for project that one cannot determine full cost at the start.

Didisadvantages of HELOC

HELOC offers a minimum withdrawal requirement that borrowers must follow. Unlike credit cards and personal loans, which allows one to withdraw any amount of money. HELOC has some rules with commits one to maintain the line of credit open for a given amount (Kim, 2020). Correspondingly, HELOC have a variable interest rate, unless one chooses a rate-lock option that is given by some lenders. This the means that rate will depend on the prime rate and is subjected to change due to fluctuation of prime rates.

Lender/Bank Offering the Best HELOC Program

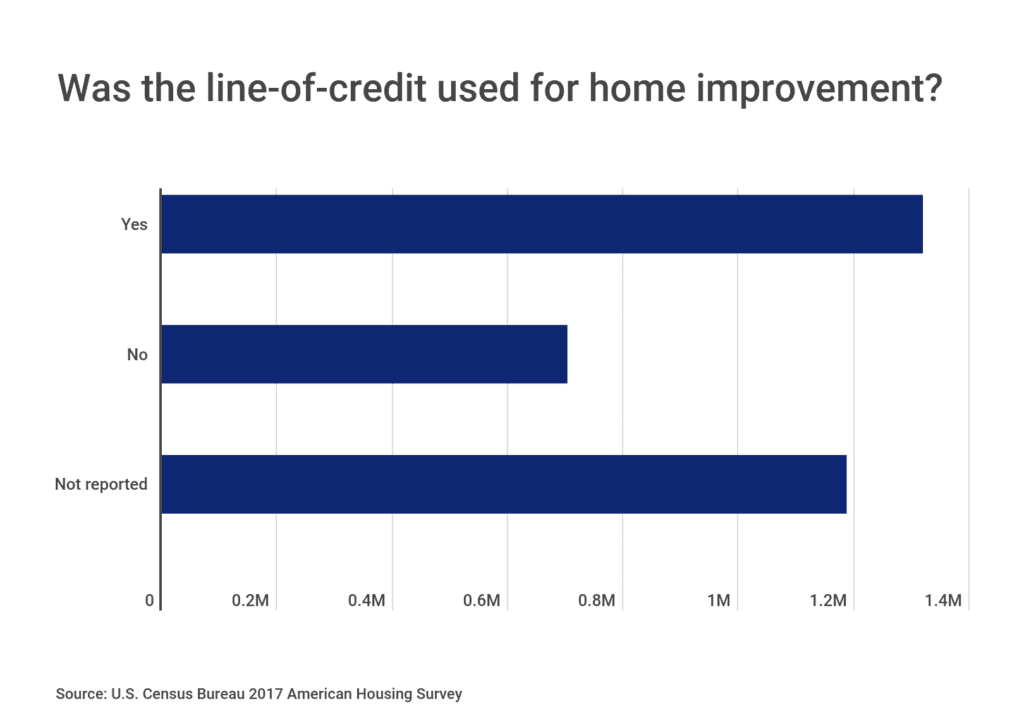

Flagstar Bank in the best lender in 2022, its minimum credit score is 620 and their minimum down payment 3%. The bank excelled in offering low fees, affordable loans, convenience and flexibility. This is according to the interest rates that reflect as the annual percentage rates (Medina, 2022). In addition, lender’s combined loan to value ratio requirement which was added by totaling all loan property to its current value. The graph below shows how most borrowers have kept their funds from the credit line to do home improvements, such as additions and renovations.

Does HELOC Increase Your Mortgage Payment

HELOC does not increase or affect the existing mortgage, as the cash-out refinancing. Therefore, if anyone who has low rates on the existing loan and not ready to refinance, one can keep the low rate in intact and only service the higher rate on what is borrowed from equity (Kim, 2020). A home equity loan is like a mortgage, this mean debt that is kept for the property, added to the mortgage used to build it. One can tap the equity as needed and payment can be done on that which was borrowed. They can finance projects using HELOC this will increase the mortgage payment.

How is HELOC Paid Back?

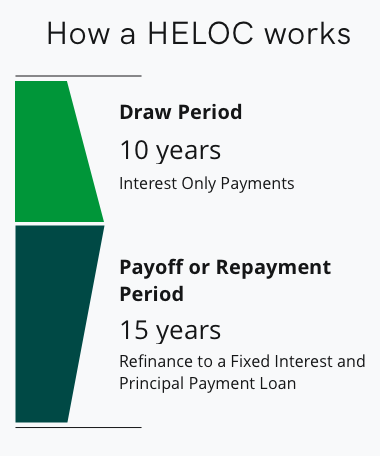

Over a period of time HELOC have been working within a 30-year model. This where it allows one 10 years to draw money, then it gives 20 years of paying off whatever was spent; however, other draw and payment period exist. If one has an interest-only HELOC, the required is that the payment should be made to cater for interest not the principal in the draw period (Farrell, 2020). The full principal and interest payment is done during the payment period. However, it is advisable that if one is to make payment towards draw period to do, this will enable one to avoid larger monthly payment.

References

Canner, G. B., Fergus, J. T., & Luckett, C. A. (2019). Home equity lines of credit. Federal Reserve Bulletin, 74(7), 361. Web.

Farrell, D., Greig, F. and Zhao, C. (2020) “Tapping home equity: Income and spending trends around cash-out refinances and helocs,” SSRN Electronic Journal. Web.

Kim, J. (2020) “Macroeconomic effects of the mortgage refinance and the Home Equity Lines of Credit,” Journal of Economic Dynamics and Control, 121, p. 104021. Web.

Medina, B. (2022) The 4 best HELOC lenders & home equity line of credit rates, Construction Coverage. Web.