Introduction

Crude Oil or petroleum, as we all know is the world’s most robustly dealt commodity. In her book Oil: The Economics of Fuel, Joann Jovinelly emphasizes the importance of this source for the whole world and the USA in particular (2007). It is extracted from the earth through oil wells. Richard John Eden examines the ways of oil production and extraction in more detail (1981). The use of crude oil dates back to the 6th Century B.C., when Kir II, the Shah of Achaemenid (present Iran), used it as a fire weapon to invade enemy positions.

But the first oil extraction, as recorded in history, was in the year 347 A.D. in China. The human race has come a long way since then. Consequent to the advent of new technologies, the extraction of crude oil has been modernized and various by-products have been discovered. James H. Gary examines the physical and chemical properties of petroleum and mentions that to know them is of high importance for dealing with this sphere of oil production (2001).

The invaluable attribute of crude oil is evident from the fact that not even a single drop is wasted. Moreover, an input of one barrel of crude oil that consists of 42 gallons, in the oil refinery gives an output of 44 gallons. The main product being gasoline, the by-products include diesel, jet fuel, heating oil, Liquefied Petroleum Gas, heavy fuel, plastics, rubber, solvents, and bitumen.

Executive Summary

Akin to the prices of different commodities, the prices of crude oil also relate to the worldwide demand and supply. Several geographical and political factors also play a pivotal role in the crude oil price fluctuations. According to Nadine Pahl and Anne Richter, “The price of crude oil is mainly a question of supply and demand.” (Pahl et al 14). In his research, Bassam Fattouh determines “three main approaches for analysing oil prices: non-structural models, the supply–demand framework and the informal approach” (2007).

The ‘Seven Sisters’ played an important role in the crude oil market until the late 1950s. Seven Sisters consisted of Standard Oil of New Jersey, Standard Oil Company of New York, Standard Oil of California, Gulf Oil, Texaco, Royal Dutch Shell, and Anglo-Persian Oil Company. Each one of these seven companies controlled functions like production, refining, and marketing in their respective domains.

The motive was to avert downfall in the prices prevent the independent sellers to hold too much stock of crude oil to sell to the buyers. This was done to avert the downfall in prices due to competition between the sellers. According to Salvatore Carallo, “It is not even comparable with the apparently similar events of 1986 and 1988 when the forward Brent market collapsed to $9 per barrel. At that time the oversupply of OPEC crude oil was real and the level of stocks evident.” (Carallo, 2011)

In the late 1950s, the supremacy of the Seven Sisters was defied by the advent of independent oil companies. In September 1960 the Organization of Petroleum Exporting Countries (OPEC) was founded in Baghdad. The founding members were Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Initially, the headquarters of OPEC was located in Geneva, Switzerland that was shifted to Vienna, Austria in September 1965. The objective of OPEC was to safeguard the interests of the member nations about the reasonable and unwavering price of crude oil. According to an article in BBC, “OPEC aims to control the amount of oil it pumps into the marketplace to keep the basket price within a predetermined range.” (BBC)

During the 1970s OPEC was at the pinnacle of the crude oil trade, with its member countries taking control of their respective country’s oil production. The Arab oil embargo (1973) and the Iranian Revolution (1979) consequently resulted in a steep rise in oil prices. These incidents had a great financial impact on the poorer countries and as a step towards international co-operation OPEC Fund for International Development was formed in 1976. According to Walter C. Labys (2006), “While positive price swings have led to rising export earnings and domestic income growth, negative price swings have lowered income growth and disrupted related programs.” (Labys)

Owing to the price rise, there was a downfall in the sales of crude oil and consequently, there were huge reserves of crude oil lying unsold with the member nations. Due to this, many member nations started facing a financial crisis and crude oil prices came down. According to Paul Stevens, “Integration helps to balance a company’s operations and protect it from the inherent instability of the market, so when crude prices are low, refining and marketing margins can generally be expected to be positive.” (Stevens 54)

Appropriate and opportune action of OPEC facilitated the reduction of Middle East antagonism over the crude oil market in the initial years of the 1990s but overall, the 1990s were governed by lower prices of crude oil. Moreover, the South-East Asian economic slump and the mild Northern Hemisphere winter further reduced the prices of crude oil.

During the early years of the 2000s, OPEC pioneered some impressive crude oil price policies that strengthened and stabilized the crude oil prices. In 2008 the crude oil prices ascended to record levels but owing to the global fiscal mayhem and the financial slump, the crude oil prices collapsed. Between September 2010 and June 2011 the crude oil prices again soared.

According to Nadine Pahl and Anne Richter (2009), “Oil prices are an important determinant of global economic performance.” (Pahl et al 1)

Movement in oil prices in terms of short-run

For the last 50 odd years, US Dollars has been the currency for crude oil prices and transactions. There have been fluctuations in the exchange rate of US Dollars. Moreover, due to the initialization of new and prominent currencies like the Euro, there is a possibility of OPEC shifting from a quotation system based on the US Dollar to either the Euro or a combination of various currencies. This shift could have a great negative impact on crude oil prices in the short run.

In 2011 the crude oil prices rose to $100 a barrel (an increase of 7%) based on the Brent Crude categorization. West Texas Intermediate (WTI) is another benchmark for crude oil prices. There was an increase in this benchmark as well. Paul Stevens (1998) wrote,” Price is in fact determined by two crude flows, Brent and West Texas Intermediate (WTI) that are very small relative to the huge quantities that are exchanged internationally at arm’s length.” (Stevens 41). Due to the increased demand, the prices are expected to be on the higher side.

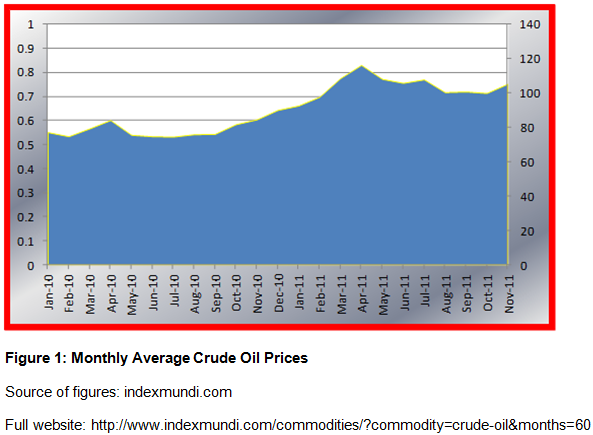

Higher crude oil prices can thwart the financial growth of the countries where the consumption is more. Like in the US the increased prices of crude oil had a considerable impact on the consumers. On average, each household had to shell out $60 extra per month to meet their daily expenses. Another example of the effect of the price rise on the consumers is the hike in the air ticket fare. Although the prices seem to have come down, yet they are still on the higher side as compared to the historical figures. The following chart depicts the fluctuations in crude oil prices since January 2010.

The crude oil price rise can have an even greater political impact as well, like most of the investors took out their investments to the tune of $7 billion. This could create financial flux and political turbulence. The developments in Egypt and other events during January 2011 resulted in higher crude oil prices. The prices rose because of the panic that Egypt might close the Suez Canal resulting in the blockade of the route through which Middle Eastern countries used to transport oil. But despite the political turbulence, Egypt did not stoop to this level and the Suez Canal remained open. Some alternate routes were also explored.

But owing to the longer distance, these alternate routes would result in higher transportation costs and hence there could be a price rise. The fear of the political turbulence spreading to the Middle East and North Africa further inflated the crude oil prices. Further, reports from Wikileaks that Saudi Arabia might have reached its production height meant that in the future Saudi Arabia would not be able to supply the required crude oil to stabilize the prices. This information further increased crude oil prices.

In February 2011, with the announcement from China about an increase in the interest rate, the prices were brought down. The prices came down because the investors felt that there will be a drop in demand. Despite the political unrest in the Middle Eastern countries, several such efforts were made to prevent price inflation. But such efforts were able to affect the prices for a short span only. The investors realized that owing to the swift developments being carried out in China, the demand for crude oil would not decrease and there will not be a great effect on the interest factor.

Another event that dropped the prices of crude oil was the announcement by the US government that it had enough stocks to cope up with the demand. So probably there would not have been a requirement of crude oil from the US. So according to the demand and supply theory, the prices came down. Also, the announcement of Hosni Mubarak that he was stepping down as Egypt’s President further brought the prices down. This was because the investors were now confident that there would be no further political unrest and that the supply of crude oil will not be hampered.

According to Nadine Pahl and Anne Richter, “ Changes in oil prices have a small, and usually insignificant, effect on demand for crude oil, especially in the short run.” (Pahl et al 14)

Movement in oil prices in terms of long-run

The average world oil prices since 1869 were $24.58 in comparison to the US price of $23.67 per barrel. According to an article in WTRG Economics, “Fifty percent of the time prices U.S. and world prices were below the median price of $24.58 per barrel. If long-term history is a guide, those in the upstream segment of the crude oil industry should structure their business to be able to operate with a profit, below $24.58 per barrel half of the time.” (Williams, 2011)

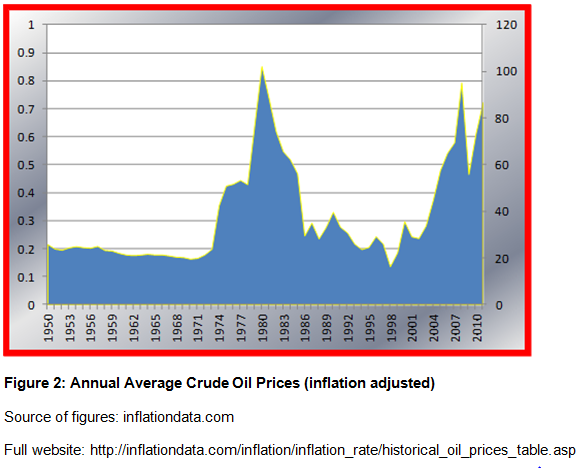

According to the post-1970 figures, the average price for US crude oil was $34.77 and that of the world was $37.93 with $32.50 being the median price. The prices almost doubled to $56.35 in 2009 and $57.00 in 2010.

Figure 2 depicts the world crude oil prices from 1950 to2011.

Factors responsible for the price fluctuations

Pre-Embargo Period (post World War II)

From 1948 until the end of the 1960s, the prices of crude oil were almost stable and ranged from $2.50 to $3.00.But relating the prices to 2010 dollars, the fluctuation was from $17 to $19. The crude oil prices were stable between 1958 and 1970. The price during this period was around $3.00. But actually, the prices had fallen from $19 to $14 per barrel. When inflation was adjusted, the prices of crude oil were lower. Moreover, due to a weak US dollar, the producers had to suffer a lot.

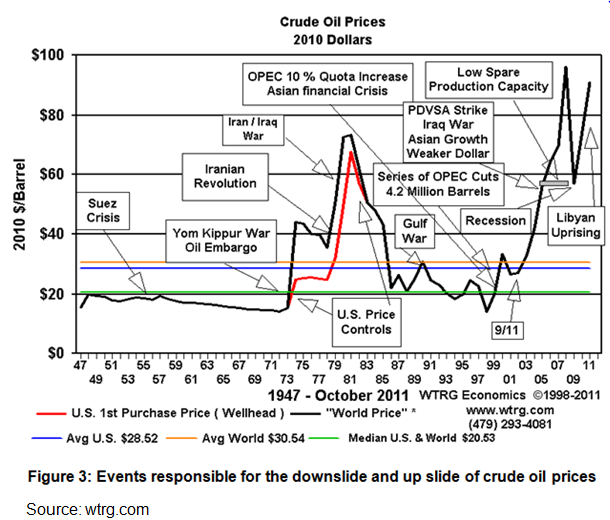

Following figure 3 depicts the main events responsible for the price fluctuations.

In 1960, Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela formed a group that was called OPEC. Six other nations namely, Qatar, Indonesia, Libya, United Arab Emirates, Algeria, and Nigeria joined OPEC in the year 1971. Until 1972, the member nations faced a downfall in the prices of crude oil. After World War II, there was an increase in demand for crude oil but the purchasing power of a barrel of oil decreased. In March 1971, the crude oil price control shifted from the United States to OPEC. It is then that the power of OPEC was realized.

Arab Oil Embargo

In October 1973, Syria and Egypt attacked Israel. The war was called the Yom Kippur War. Israel got support from the United States and other western world countries. As a result, most of the Arab countries that exported crude oil put an embargo on the countries that were supporting Israel. They curbed their production by 5 million barrels per day. On the other hand, the countries that were not involved in the embargo increased their crude oil production by one million. The difference of four million barrels per day continued until March 1974 and by the end of this year, the price of crude oil had become $12.00.

Between 1974 and 1978, the crude oil prices were almost stable, ranging from $12.52 to $14.57 per barrel, and the production of OPEC member nations, on an average, was 30 million barrels per day and that of the non-OPEC nations was 31 million barrels per day.

Iran Iraq Crisis

Due to the Iranian revolution (1979-1980), the production of Iran suffered by 2 to 2.5 million barrels per day, and there came a time when the production was negligible. During this period, the prices rose to a record level after World War II. After the revolution, the crude oil production of Iran became four million barrels per day. But problems resurfaced when Iraq attacked Iran in September 1980. The effect of the war was that by November, both the countries’ total daily production was only one million barrels. This almost doubled the world crude oil prices.

US Policy

The United States imposed price controls on the crude oil production of the country. The demand being more than the production, crude oil had to be imported and as result, the prices soared. It meant that the US producers were able to garner lesser prices for their oil as compared to the average world oil price. According to James Williams, “Higher petroleum prices faced by the consumers would have resulted in lower rates of consumption.” (Williams). Also, according to Frank R. Wyant, “Together, these concerns led to repeated government efforts to bring companies under national control in order to protect or extend sovereign interests and objectives vis-a-vis other nations.” (Wyant)

Crude Oil price structure during the 1950s and 1960s

This period can be termed as the Pre-Embargo Period. During the 1950s, the ‘Seven Sisters’ nations controlled the prices. The production of crude oil was also under this organization. The sellers were not allowed to hold much stock so that they could not dictate their terms regarding the price. In 1960, OPEC was founded and this further controlled the prices to safeguard the monetary interests of the member nations. The OPEC also tried to make the prices stable. According to an article in Mygeologypage, “In fact, profit margins increased enormously in the 1950s and 1960s while production costs decreased.” (Mygeologypage)

Recent Crude Oil Price Rise

It has been noticed that there has been an up slide in the crude oil prices although the world hasn’t come out of the recent recession. Various factors have been responsible for this fiasco. The confrontation between Iran (OPEC member) and the West over Iran’s nuclear program led to the destabilization of the forecasts for the supply of crude oil. The European Union now has plans of boycotting the Iranian crude oil. As a protest, some people ransacked the British embassy in Tehran. Consequently, officials from the Iranian embassy in London were expelled. This has further deteriorated relations.

The US has decided to impose penalties on companies doing business with the Iranian bank. The oil prices have been above $100 per barrel due to this instability and also due to the Libyan unrest and Asian growth. According to Salvatore Carollo, “The crude oil futures market has risen tenfold an the last 10 years, closely following the entry of the great financial institutions in this field and the change in the attitude of the traditional oil players.

This has caused the complete disruption of the internal dynamics of the oil market.” (Carollo, 2011). Also, according to Salvatore Carallo, “There are always overreactions due to the enormous flow of money and number of transactions on the futures market. What in the past would have caused a price fluctuation of a few cents per barrel, nowadays can produce a price change of many dollars per barrel.” (Carallo, 2011)

Summary

During the last few years, there has been a change in the fundamentals. Due to the invention of modern technologies, there has been unending progress in the world financial system. Crude oil, being a source of power, plays a crucial role in the development process. The production and supply of crude oil have not been able to sustain the demand. Substitutes for oil have been invented but those are not sufficient and as such the crude oil market has witnessed a steep rise in prices.

Moreover, the multinational corporations are day by day increasing their respective productions resulting in increased demand for oil with each passing day. According to Frank R. Wyant, the role played by multinational oil companies in the tremendous expansion of world petroleum consumption and trade has been one of the great business successes of modern times (1977).

Recommendations

Oil is a precious and necessary commodity. World development is based on oil to a great extent. Oil is related to luxuries as well. But likewise other commodities, oil reserves also have a limit. It’s not that Mother Earth will keep on producing oil to satisfy mankind’s needs. One day will come when the earth’s oil reserves will be exhausted. So it is up to us to take preventive measures. The best we can do is to minimize consumption. We, as individuals can contribute a lot to the conservation of oil. As far as the government’s responsibility is concerned, more substitutes for oil, as a means of power, should be developed.

Works Cited

BBC. BBC Mobile. BBC News, 2007. Web.

Carallo, Salvatore. Understanding Oil Prices: A Guide to What Drives the Price of Oil in today’s Markets. West Sussex, UK: John Wiley & Sons, 2011. Print.

Eden, Richard John et al. Energy economics: Growth, Resources, and Policies. USA: CUP Archive, 1981. Print.

Fattouh, Bassam. The Drivers of Oil Prices: The Usefulness and Limitations of NonStructural Model, the Demand–Supply Framework and Informal Approaches. Discussion Paper. Department of Financial and Management Studies, SOAS University of London, 2007. Print.

Gary, James H. and Glenn E. Handwerk. Petroleum Refining: Technology and Economics. 4th ed. USA: CRC Press, 2001. Print.

Indexmundi. “Crude Oil (petroleum) Monthly Price – US Dollars per Barrel.” indexmundi.com. n.d. Web.

InflationData. “Historical Crude Oil Prices (Table)”. InflationData.com. 2011. Web.

Jovinelly, Joann. Oil: The Economics of Fuel. New York, NY: The Rosen Publishing Group, 2007. Print.

Labys, Walter C. Modelling and forecasting Primary Commodity Prices. Hampshire, England: Ashgate Publishing, Ltd., 2006. Print.

Mygeologypage. OPEC and Crude Oil. My Geology Page. N.d. Web.

Pahl, Nadine, and Anne Richter. Oil Price Developments – Drivers, Economic Consequences and Policy Responses. Germany: GRIN Verlag, 2009. Print.

Stevens, Paul. Strategic Positioning in the Oil Industry: Trends and Options. Abu Dhabi, UAE: I. B. Tauris, 1998. Print.

Williams, James L. WTRG Economics. WTRG Economics, n.d. Web.

Wyant, Frank R. “The Role of Multinational Oil Companies in World Energy Trade.” Annual Reviews 2 (1977): 125-151. Print.

WtrgEconomics. Wtrg.com. Wtrg, n.d. Web.