Introduction

Precision Electronic Parts (PEP) serves as an average privatized entity. Due to the expansion of lines of production for electronic materials, there is an issue with invoices management by the finance department. The modern payment and billing system must have the capability to solve the problem highlighted due to its superior functionality. The proposed system requires improved control of creating invoices, charging, and remittance collection.

Proposed System

Functional Requirements for the Inputs and Outputs

The function prerequisites are grouped into the expected outputs from the presented system, the needed inputs, and the demanded processing. They are all geared towards ensuring that the issue faced by the finance division of the PEP company is significantly reduced.

Output Requirements

The following three main primary output requirements are present at the PEP company:

- Every month client invoicing report: It will manifest the existing state from the marketing department as they control the pricing and item codes deployed by the invoicing database on the 15th of every month.

- Accounts receivable (A/R) report: By the 10th of every month, all the received lump-sum payments from clients are due to PEP and the A/R department is responsible for processing the payments and update the customer account records upon receiving payments.

- Overdue collection report: The role of pinpointing overdue accounts is given to the invoicing department, which then sends them to the sales and A/R departments.

Input Requirements

There are crucial data components demanded when creating the accounts receivable, overdue collection, and monthly customer invoicing output reports.

The primary data elements for each month’s invoicing report include:

- The name of the company

- The address of the entity

- City

- State

- Zip code

- The date of ordering

- The name of the products

- Quantity of the required items

- The price per unit

The vital data components for the production of the accounts receivable report:

- The name of the organization

- The date of ordering

- Products ordered

- Specified quantity

- Calculated price

- Price per unit

- Paid amount

- Date reimbursed

Data details embedded for producing the overdue collection report:

- Client’s organization name

- Customer’s street address

- City

- State

- The zip codes

- First contact name

- Initial cellphone number

- Primary customer email address

- Second contact name

- Secondary phone number

- Email address

- Date of ordering

- The products ordered

- Quantity

- Total price

- Price per unit

- Amount paid

- Amount due

- Payment date

- 30 days amounts overdue

- 60 days amount overdue

- Amount exceeding 60 days overdue

- 2 percent of the overdue amount

Processing Requirements

- For making each month’s invoicing report

- For generating the accounts receivable (A/R) report

- For creating an overdue collection report

Technical Requirements

The rationale for the technical prerequisites involves showcasing how the proposed system would appropriately and sufficiently interface with the prevailing one. Without the technical requirements, the proposed system cannot work, making the finance department continue facing the issue with invoice billing and payment (Torrecambo, n.d). The main technical areas tackle various aspects, including security, performance, controls, and the system’s sustainability.

Security Requirements

Safeguarding the client’s database offers massive benefits to enhance PEP compliance with government policies and gain much-needed confidence from the customers (Conger, 2008). Client trust determines the duration of the company’s business operation in the market through customer retention. The most crucial prerequisite statements for security are:

- The credentials by the system users

- Network securing embedded with protection protocols to avert vulnerability

- Frequent maintenance by keeping the security measures and the system up-to-date

System Control Requirements

The control requirements are inevitable as they ensure that the system operations match the projected expectations. To a greater extent, the phenomenon ensures legal compliance and reliability (Conger, 2008). The three most crucial statements involved in the system control include:

- Change management

- Uncertainty regulation

- Disaster recovery

Performance Requirements

The performance prerequisites define how effectively the proposed software system would attain particular functions under certain conditions. They provide crucial service levels, including response speed, storage capacity, execution time, and throughput grounded on reinforcing end-user activities (Torrecambo, n.d). The senior executive of PEP has pinpointed the following key areas to measure the system performance:

- The system handles a significant quantity of work to avoid workload issues

- The response time is between 1 to 2 days

- Scalability is ensured to serve several users. Simultaneously during off-peak and peak durations

Business Continuity Requirements

The PEP firm must reasonably design the business continuity plan (BCP) procedures to meet its client obligations. It should disclose to its consumers how the BCP addresses the likelihood of a substantial venture disruption and plans to react to events of different degrees (Torrecambo, n.d). The following steps must be accomplished to achieve the business continuity requirements:

- Designing a venture continuity strategy

- Executing the business continuity plan

- Maintenance of the proceeding blueprint

System Scope Diagrams

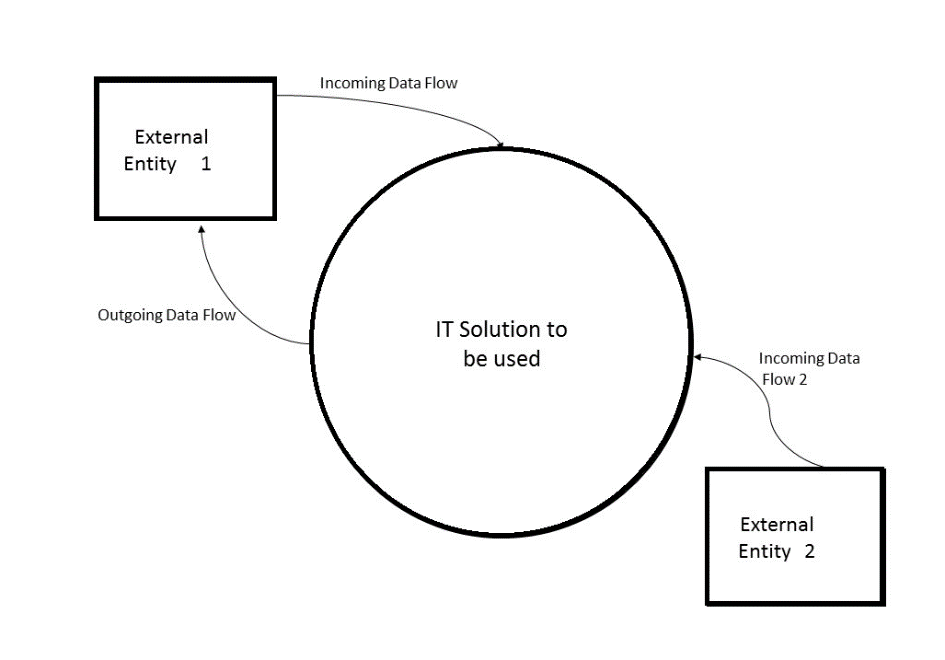

The system scope explains how the existing systems are expected to be replaced with the needed application package. All the issues presented must be addressed by the scope of the proposed database system. The incorporated process and phases must be cautiously implemented to evade worthless costs and delays. The use case and the context diagrams effectively depict the system scope in Figure 1 and Figure 2.

Context Diagram

Use Case Diagram

Data Flow Diagram

The data flow diagrams manifest how the database would stream from the start to the end. The PEP enterprise would visualize the workflow in the information technology system and entirely in the system’s daily processes as shown in Figure 3.

Data Flow Diagram

Process Models

For the PEP to make highly informed decisions and choices concerning the demanded requirements, it must utilize the process models. The three process models set for the decision to launch the proposed system successfully offer a crucial database to make both the analysts and the users comprehend the system adequately.

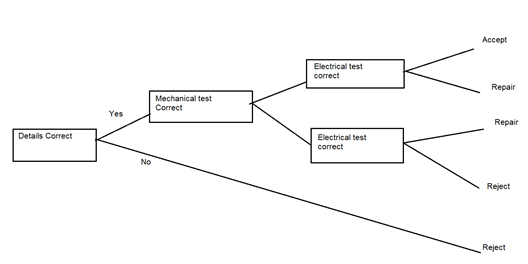

Structured English

This approach explains the system database pattern, selection, and process iteration to a greater extent. The data flow as follows:

Start

↓

IF the details are not Correct

Reject item

ELSE (Accept)

IF the mechanical test is correct

IF the electrical test is correct

Pass product

ELSE (electrical test incorrect)

Repair product

ENDIF

ELSE (mechanical test incorrect)

IF the electrical test is correct

Repair product

ELSE (electrical test incorrect)

Repair product

ENDIF

ENDIF

End.

Decision Table

Decision tables act as brief visual representations for highlighting the actions under specific conditions. The display several options and payoffs for various choices made by the system. Table 1 illustrates the decision-making process within the proposed system.

Table 1. Decision table

Decision Tree

The decision tree showcases the methods of approximating the projected choice turnout points. The decision tree for the PEP case scenario is as shown in Figure 4.

Conclusion

PEP company’s proposed billing and payment system has several components, including the functional and technical requirements, process models, system scope, and data flow diagrams. The proposed IT solution cannot function without technical requirements, making the PEP fiancé division escalate with the remittances and invoice billing problem. The process models help comprehend the information displayed by the modern system.

References

Conger, S. A. (2008). The new software engineering. Course Technology Press.

Torrecambo, D. (n.d). Systems requirements specifications. Project Management. Web.