Zappos is an active business entity that conducts its operations online. The organization stocks a wide range of products, including shoes, clothes, and appliances (Askin & Petriglieri, 2016). Accordingly, Zappos is a subsidiary of Amazon but operates independently. The following section covers the online retail firm’s financial consideration by focusing on its startup costs, sales forecast for the years 2023 and 2024, break-even analysis, profit, and loss analysis, and funding requirements.

Startup Costs

Being an operational business means Zappos does not involve many fresh costs like other startup enterprises. However, several items require appropriate budgeting for the entity to operate successfully. Such facets fall under two broad groupings; assets and expenses, as shown in Appendix 1. Inventory and equipment outlay constitute the asset’s cost, amounting to $12,000 a month. Moreover, some of the establishment’s basic expenses worth budgeting include marketing, web hosting, rent, insurance, utilities, payroll, repairs and maintenance, and organizational dues. Each of these expenses has a monthly budget, stipulated in Appendix 1, with the total budget for the expenses amounting to approximately $8,000. Accordingly, Zappos will require at least $20,000 monthly to finance its elementary operations. The inventory forms the largest part of such a monthly financial plan due to the aspect’s criticalness in online dealings. Nonetheless, the budget for monthly inventory concerns new stock since Zappos is already doing business. Marketing and payroll expenses form the other expensive budget features for Zappos. That is because the entity culture seeks to set the firm as one of the most caring online retailing organizations per Tony’s plans.

Sales Forecasts

Zappos earns by bridging a market gap concerning attire and appliance supply. Initiated before the twentieth century, the organization depends on Tony’s customer service brilliance to reach out to millions of consumers all over the U.S. and other parts of the world, mainly Europe. As per Askin and Petriglieri (2016), Zappos’ best previous sales before the acquisition exceeded $1 billion. Consequently, this sales forecast relies on the preceding records to establish probable and viable projections. Therefore, Appendix 2 shows Zappos’ likely sales for 2023 and 2024 as $2 and $2.3 billion, respectively. Being part of Amazon, a trusted online player with an extensive network, coupled with the provision of specialized items, makes the estimates substantially reliable.

Break-Even Analysis

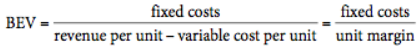

Businesses use different approaches to undertake break-even examination, including the break-even quantity or volume method. In this slant, the investor, especially those dealing with multiple products, identifies a specific primary item to utilize for the analysis (Gallo, 2019). For example, Zappos can use its original products; shoes, to find the number of pairs the firm must sell to return all the costs involved in the acquisition and daily operation since the Amazon buyout. Appendix 3 gives the equation for this calculation, where Zappos’ annual fixed costs immediately after the acquisition (figuring out the $1.2 billion takeover fee) totaled, approximately $2 billion. The entity sells a pair of shoes at about $50, making a profit of approximately $15. Subtracting variable cost per unit of $6, the BEV will be above 181 million pairs of shoes.

Projected P&L

The profit and loss statement shows an organization’s profitability by reporting a business’s earned profit or experienced loss within a specific trading period. The statement does this by comparing income and expenditures. Appendix 4 shows Zappos’ projected P&L based on the projected earnings and expenses for 2023.

Funding Requirements

Zappos requires at least $3,000,000,000 to finance its operations effectively. This amount includes the $1.2 billion utilized during the buyout by Amazon and the subsequent expenses necessary for the firm to function as a real subsidiary of the acquiring retail giant. Correspondingly, part of this sum will cater for the payroll and other basic purchases before Zappos can generate adequate finances to operate independently. Appendix 5 provides information about this figure and where it comes from, based on the fact that Amazon is an already financially stable online retail business.

References

Askin, N., & Petriglieri, G. (2016). Tony Hsieh at Zappos: Structure, culture and change [PDF document]. Web.

Gallo, A. (2019). A Quick Guide to Breakeven Analysis. Harvard Business School Publishing. Web.

Appendices

Appendix 1: Startup Cost Analysis

Appendix 2: Sales Forecast

Appendix 3: Break-Even Analysis