Executive Summary

After a long heritage of colonial exploitation, Singapore has evidenced as a high per capita ranged country and a remarkable free trade zone with significant economic development. Thus, it is necessary to study the political economy of Singapore. This paper has involved doing so with starting form country overview, historical overview, geographic & demographic overview, government/political structure overview, economic strategies and country reforms, Singapore’s path to globalization and the Singaporean exports imports. The paper also analysed trade balance, direction of trade, direction of exports, and direction of imports, balance of payments, and foreign direct investment in Singapore.

Introduction

Historical Overview

Singapore is a small island and the name of this island was “Pu-luo-chung”, ruled by the Malayan Buddhist Empire of Sumatra. From 1826 to 1867, Singapore was a British colony and from 1963 and 1965, it was an integral part of Malaysia, which became separate from Malaysia and got independent in 1965 (Library of Congress 2006). According to the country profile, it has highly developed and successful free-market economy and at this moment, it is one of the world’s most prosperous countries with strong global trading links (considering financial resources and capabilities).

Geographic & Demographic Overview

According to the World Wealth Report and World Economic Report, Singapore is now the ideal place for multinational companies to do business as it is situated in Southeast Asia (between Malaysia and Indonesia), which has link with the Indian Ocean and the South China Sea by Malacca.

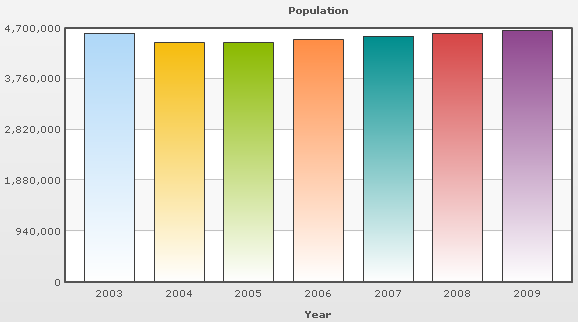

IndexMundi (2009) reports the data of the population of Singapore is approximately 4,657,542 (July 2009) and it was 4,608,167 in 2008. The population growth rate is very low, for example, in 2004, 2005 & it was 0%, -3.97% gradually and now the growth rate is 1.07 %.

In the beginning, most of the people were Malays but now there are many ethnic groups. After the arrival of Sir Stamford Raffles, Singapore became a magnet for the people of the rest of the world due to British Trade Post. The list below demonstrates the percentage of the various groups of people, Life expectancy, Age groups –

Government/Political Structure Overview

Library of Congress (2006) states that Singapore is the short form of formal name Republic of Singapore, which has maintained parliamentary system to elect members of the cabinet (elected by general voting) and it is using Westminster model. Parliament has passed all the legislation, which proposed as a bill. However, Parliament sits for five years, appoints speakers and non-constituency members. In addition, there is a Post for the president who works as the head of the state but has limited power, for instance, he does not have any decision making power. He appoints maximum nine nominated member from nine sectors and chief justice on the advice of the prime minister. The Prime minister is the head of the cabinet and the cabinet is responsible for all government rules and regulations.

Economic Strategies and Country reforms

Singapore has a highly developed economical environment though Singapore is a small country because it has planned carefully and implied honestly by using the facilities of corruption-free environment, stable prices, and a per capita GDP. The currency of Singapore is “Singapore dollar” (SGD or S$), where 1 dollar is equals to 100 cents, all currencies are in notes and coins, which issued by board of commissioners of currency.

From 1970s to the 1990s, it has experienced continued financial growth and it was one of the “Four Tigers” of Asian economic prosperity (Library of Congress 2006). It has traditional strength in trading, shipping and tourism but now it becomes diversified its banking and financial sectors though it has faced Asian financial crisis 1997-98. In 1998, the government of Singapore had countered weakness in their currencies by selling foreign exchange reserves and raising the interest rates that resulted recession and prioritized the interest-bearing securities than equities. In 2008, national economic condition has also adversely affected due to global financial crisis and these phenomenon weakened the banking and financial institutions.

Singapore’s Path to Globalization

Due to long rooted colonial heritage, Singaporeans are not conservative to uphold their national sentiments rather than welcoming the foreigner’s ethnicity. The Ministry of the Environment (2004) addressed that Singaporeans consider that the path to its future economic endurance is to welcome and become accustomed with globalisation rather than trying to resist it. Thus in 2001 the government of Singapore formed ERC (Economic Review Committee) to suggest the pathway to renovate Singapore as a most significant global city being an Asian focal point of global economic networks as well as a diversified entrepreneurial role among the Asian nations. With such a realisation, the GOS (Government Of Singapore) set up its mindset to develop into a top global city with its own competence to meet up the challenges of globalisation to achieving the goals as –

- To be an entrepreneurial and innovative inhabitants take hold of global opportunities,

- To turnout responsive, flexible and supportive legislation,

- Maintaining a elevated standards of corporate governance and corporate social responsibility,

- To ensuring the success of Singapore companies in the global context.

To gain the dreams of globalisation, the ERC has suggested following critical areas of strategies for further development –

- Setting External Ties with the major players,

- Developing Competitiveness both in public and private sector with Flexibility in regulation,

- Improving Entrepreneurship among the Singapore Companies with global standard

- Twin Engines from Manufacturing and Services by mounting business services sector as a diverse industries

- Integrated skilled human resource mobilisation and

- Reformation of existing system.

Luu (2009) mentioned that it has gone through hard pressure of concentrated economic, urban reformation and social change to handshake with globalisation and it has effectively faced up to the pressure of change to come out as an Asian Pacific economic superpower contemporary to Malaysia and China. This speedy enlargement is a product of the interaction among the global economic reformation and urban preparation as well as management strategies for escalating strength of global economic amalgamation and interface that Singapore has managed as well. Globalisation has first been motivated by the frenetic rapidity of international economic growth, and effects insightful shifting in the improvement of cities that Singapore has fruitfully modified its urban policies to take advantage of the abundant opportunities placed by globalisation. Singapore has proved its competence to sustain a sound intensity of economic intensification devoid of supporting corporate social responsibilities for urban planning.

Leong (2007) added that the flow of globalisation has facilitated the business services sector of Singapore to keep 12% contribution in the national economy creating employment opportunity and skilled workforce and professionals.

Luu (2009) also criticised the reimbursement of economic and social changes that have been persuaded by amplified globalisation has not been traced as a dilemma though the negative social consequence may happen because of the changes. National agencies have turn into vague in the extent of their uniqueness, clarification of nationality has carried no longer weight, where the market forces have broken through the regular life to generate consumption based identity and culture. Thus, globalisation in Singapore has enhanced material quality of life but ruined the national traditions.

The Singaporean Exports

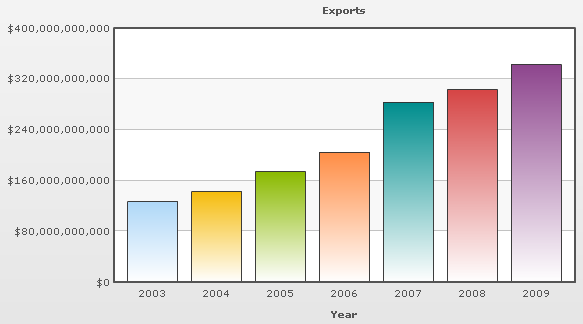

Dewett (2005) said that exporting means the promotion and direct sale of a locally manufactured product in a foreign market and it is a well-established and conventional form of strategy to acquiring foreign markets. Therefore, export is the core basis of revenue for the Singapore’s financial system as it generates huge amount of money from this segment, for example, Singapore’s exports totalled US$ 342.7 billion in 2009 (IndexMundi 2009).

According to the Library of Congress (2006), electronics and manufacturing are the main sectors but it has purchased raw materials to refine for re-export. However, besides these segments, it has not produced oil or gas but after redefining, it also exports following products and services –

- Food and live animals;

- Beverages and tobacco;

- consumer goods;

- electricity & natural gas;

- chemicals, mineral fuels and petroleum products;

- Animal and vegetable oil;

- Machinery and transport equipment;

- various manufactured articles;

- textile/garments, telecommunication device;

- medical support and world class health related facilities.

The following table has shown the earnings from export sectors –

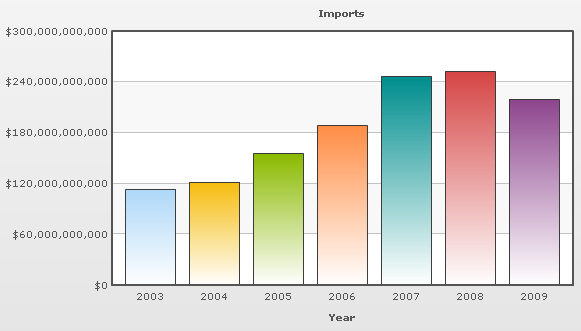

Imports to Singapore

It has imported the raw materials for refining and its main imported commodities are–

- Machinery and equipment;

- mineral fuels, chemicals, lubricants and related materials;

- Machinery and transport equipment;

- Foods as well as Beverages (Library of Congress 2006).

Trade Balance

As Singapore exports most of the imported products, it can upholds positive balance of trade, for instance, in 2008, exports totalled US$ 302.7 billion, where imports of US$ 252.0 billion.

Direction of Trade

According to the report of Library of Congress (2006), for both exports and imports, Singapore’s three most important trade partners are Malaysia, EU, and the USA.

Direction of Exports

Direction of Imports

Balance of Payments

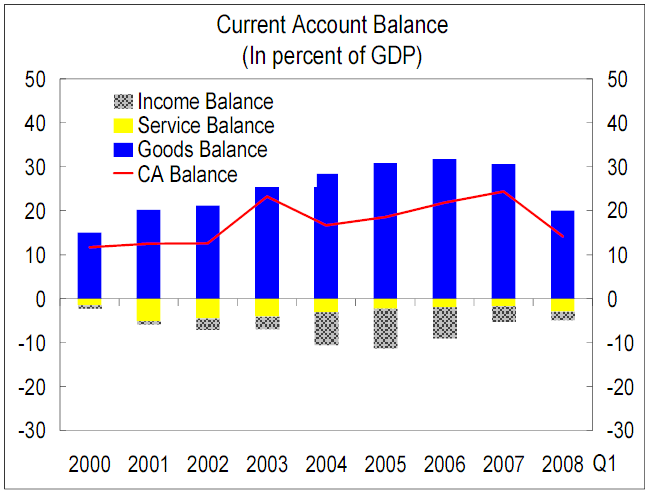

IMF (2008) mentioned that the Balance of payments of Singapore has gained concerning 24 % of GDP in 2007 but in 2008 due to global financial crisis the account surplus jump down to approximately 14 % of accustomed GDP when the trade balance reduced in size with relation to developed countries. Now it has been experiencing a rush forward in capital inflows though the official reserves are continuously rising.

Ouyang & Rajan (2009) has summarised the characteristic of balance of payments of Singapore from 1990 to 2008 and analysed that the Singaporean dollar has fluctuated in relation with US dollar at the time Asian Financial Crisis in and other than this the Singaporean dollar is relatively enough stabile. In consideration of last fifteen years, the reserves grew patiently without any affect of Asian recessionary impact of 2001-2002. It is also remarkable that Singapore has evidenced a high foreign reserve of US$ 175 billion at end of 2008 and the balance of payments evidenced enough surpluses for huge increase in current account surplus and growing FDI inflows.

Samuelson & Nordhaus (2005) and Ouyang & Rajan (2009).stated that the surplus of ostensible basic balance including current account and FDI are the counterbalance partially via huge outflows of portfolio investment as well as investment in banking and non-bank sectors has influenced the Asian Dollar Market.

Foreign Direct Investment in Singapore

GOS (2009) pointed out that in Singapore FDI determines the total sum of investment made by the investors of overseas countries in Singapore where the foreigners have minimum 10 % of paid up capital which is suggested by the BPM5 (Balance of Payments Manual 5th Edition) of IMF(International Monetary Fund). For the Foreign investment, less than 10 % by the investors of overseas countries have measured as foreign portfolio investment in Singapore. It is notable that FDI excludes investment in the course of purchase of shares. GOS (2009) argued that the investment commitments made by the foreign investors are also a further determinant of FDI in terms of fixed assets but the reinvested earnings of the foreign companies and their reserves are not at all accounted as investment commitment but the reinvested earnings and reserves have been integrated in FDI.

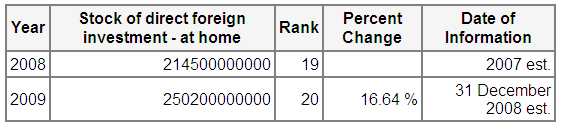

IndexMundi (2009) mentioned that the foreign direct investment in Singapore has measured as US$ 250.2 billion at the end of 2008, which was US$ 214.5 billion in 2007. This huge FDI entry provides the increasing US dollar value of all investments in Singapore, which has prepared directly by foreign residents or foreign companies.

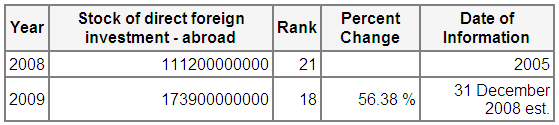

On the other hand, Singaporean company’s investment in abroad where they have 10 % of equity are treated Direct Investment Abroad (DIA) of Singapore. The dollar value of all investments of Singaporean nation in overseas countries invested directly by residents or companies of Singapore has indicated as DIA but it excludes the investment by means of purchasing shares. The Singaporean companies have DIA of US $173.9 billion at the end of 2008 and US $169.9 billion in 2007.

Singapore and its GDP

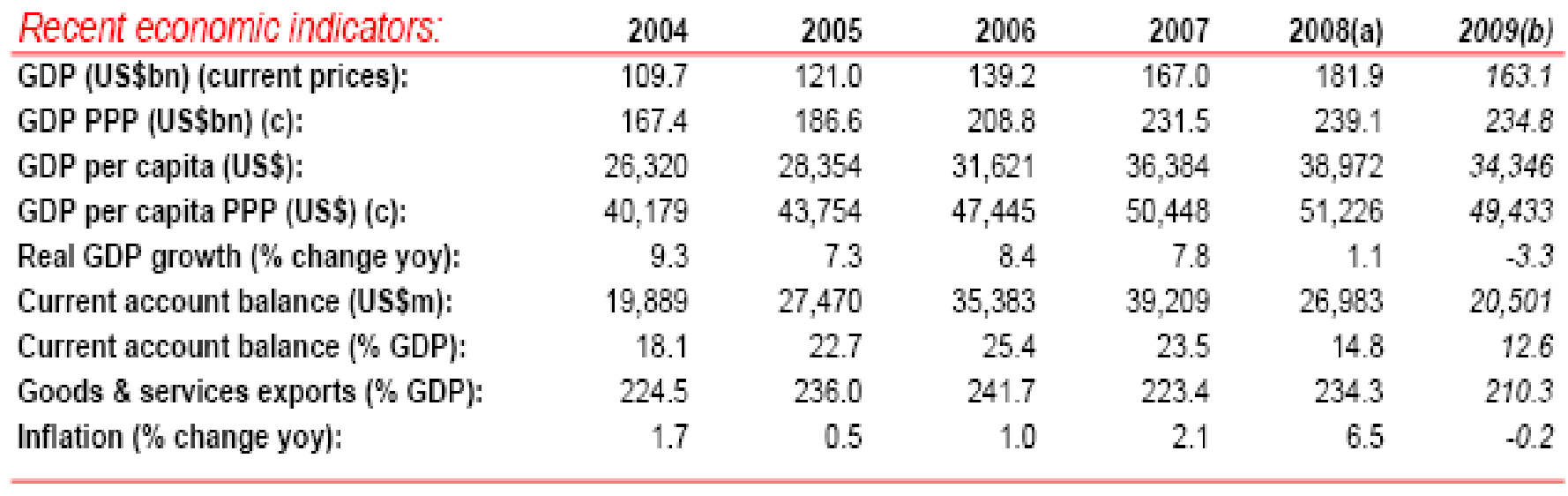

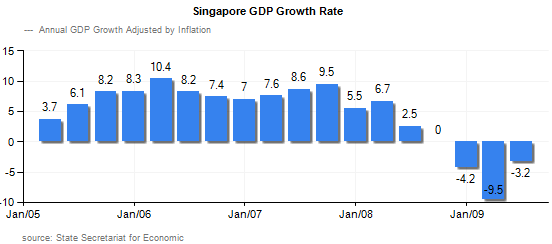

Trading Economics (2009) illustrates that the economic condition of the country is much more stable than any other countries in the world as its GDP for 2005, 2006, & 2007 were US$ 121.0 billion, US$ 139.2 billion and US$ 167.0 billion. This rate has also increased in 2008 and it was US$ 181.9 billion that year but in 2009, it was US$ 163.1 billion. Due to global financial crisis, the real growth rate has decreased surprisingly from the year 2008, for example, in 2004 the real growth rate was 9.3% where as it is now -3.3% only (Anon 2009, p. 1). As said by Singapore’s official government statistics, purchasing power parity GDP in 2008 was US$ 239.1 billion up from US$ 167.4 billion in 2004 and US$ 186.6 billion in 2005. After Japan, this country has the second-highest per capita GDP in Asia, such as, in 2009, per capita GDP was US$ 34,346, and in 2008 was US$ 38,972 up from US$ 26,320 in 2004. As GDP demonstrates the main economic strength of the country, it is essential to compare the recent data with previous years and after comparing the data with 2008 & 2004, it can say that though the rate of GDP has fall but it is still stable position.

The above table compares the last 6 years data and the figure 2 shows the GDP growth rate for previous five years.

Change in Singapore’s Trade Policy

U.S. Department of State (2002) reported that Singapore always strive for an open-trade economic policies those have facilitated it to triumph over land, labour as well as resource scarcity to turn into second competitive economy of the planet and achieved the fifth position for its per capita income where the trade policy has faced tremendous changes and amendments as needed. These changes enacted a progression of legislation to amendments to existing rations modified with the vision of rendering rule fully dependable to complying with WTO.

The landmark changes in trade policies and legislation as amendments to its Trade Marks Act -1999, Medicines Act -1998, Registered Designs Act -2000, Copyright Law- 1999, and Designs of Integrated Circuits Act 1999 and so on. It has also concerned with Berne Convention – 1998, Madrid Protocol in 2000, and U.S. Special 301 (U.S. Department of State, 2002).

MTI (2007) pointed out that the recent changes in trade act has introduced CPFTA (Consumer Protection and Fair Trading Act) to relate to spontaneous appointment which takes place subsequent to a preliminary contract or even by a message over phone or electronic communication and it also be extended to include financial products and services conducted by laws of the Monetary Authority of Singapore.

Conclusion

Singapore is the ideal place for trade because of its geographic location, business environment and less burden imposed by the government and all legal established products can easily enter the market of Singapore. Besides exports and imports, tourism is one of the main pillars of the Singaporean economy and people from all over the world come here for spend their vacation. However, the entire paper has considered the gross domestic product (GDP), Foreign Direct Investment and Balance of Payments to analyze the economic condition of this country. After above discussion, it would conclude that Singapore is a heavenly place to enjoy free trade zone and global investors would be significantly interested to set up their business network here. From the 1970s, it has maintained the trade balance to enhance the business opportunity and its rules and regulations encouraged the investor to invest more.

Reference List

Anon (2009) Singapore. Web.

Dewett, K. K. (2005) Modern Economic Theory. 22nd ed. New Delhi: S. Chand & Company Ltd.

IndexMundi (2009) Singapore Stock of direct foreign investment – at home. Web.

IndexMundi (2009) Exports, Import& GDP of Singapore. Web.

GOS (2009) FAQ on Foreign Direct Investment & Direct Investment Abroad, Government of Singapore. Web.

IMF (2008) International Monetary Fund Country Report No. 08/280. Web.

Leong, K. M. (2007) Overview of Singapore’s Business Services Sector, Economics & Strategy Division, Ministry of Trade, and Industry. Web.

Library of Congress (2006) Country Profile: Singapore. Web.

Luu, H. (2009) Globalization, and Urban Transformation in Singapore: A City That Works? Web.

Ministry of the Environment (2004) National Assessment Report: In Preparation for the International Meeting on the 10-Year Review of the Barbados Programme of Action Singapore. Web.

MTI (2009) Singapore Hosts Discussions To Advance Asia-Pacific Economic Integration, Ministry of Trade and Industry. Web.

MTI (2009) Explanatory Note on Proposed Consumer Protection. Web.

Ouyang, A. Y., & Rajan, R. S. (2009) Reserve Accumulation and Monetary Sterilisation in Singapore and Taiwan. Web.

Samuelson, P. A, & Nordhaus, W. D. (2005) Economics. 18th ed. Tata McGraw-Hill publishing Company Limited.

Trading Economics (2009) Singapore GDP Growth Rate. Web.

U.S. Department of State (2002) 2001 Country Reports on Economic Policy and Trade Practices: Singapore. Web.