Abstract

The paper reports on findings of the following research questions. How do threats to the economy like terrorism and financial crisis affect growth and development of the transport and logistics sector? How does the transport and logistics sector management help in correcting negative economic growth? What are the main factors affecting the management of transport and logistics today, in relation to economic policies of the federal government its security policies? It reviews the economic and security parameters that management in the transport and logistics sector in the U.S. will consider for the sector’s and specific business growth. Findings shows that the future indicators for the sector are positive and managers will need to consolidate gains in security and competitiveness then seek additional ways of curbing costs and address capacity responsiveness issues.

Transport and Logistics in the U.S

After the financial crisis of 2008-2009 and the consequent meltdown of many markets in the years that follows, the world needs new ways that allow it to face traditional issues and the emerging one such as those that lead to crises. In the same way that markets play a major role in facilitating capital distribution in an economy, transport plays a big role in the movement of labor and goods in an economy. Crippling the transport sector is akin to crippling the backbone of the economy. After 9/11 terrorist attacks, the United States became extra vigilant on its transport and logistics sector with many companies and institutions making additional security consideration for typical activities, deployment, and designs or operations in the sector. Nevertheless, security challenges are becoming bottlenecks to the effective functioning of the sector and are therefore acting as a barrier to its contribution to economic success.

Businesses keep on adding new costs to operation about the importance of these cost areas to the success of their business. Divesting in different markets became a priority after the financial crisis. Similarly, security as part of transport and logistics became a priority after the 9/11 attacks (Plant, 2006). As much as private enterprise can work alone in contributing to economic development and realizing independent goals, the involvement of federal government into policymaking and implementation to safeguard business interest has increased in lieu of the threats to business.

Problem statement

Many studies looking into transport and logistics problems consider a single or a few features of the industry and analyze their relationship. For example, studies focus on transport, logistics management, supply chain security, professionalism, and risk management in the industry. Economic studies consider the impact that transport and logistics are having in the entire economy. While such studies are helpful in shedding light and providing information for future decision-making, they do not cover the entire sector. It is important to look at the impact of the economy on transport and logistics to realize opportunities for adapting either economic policies or transport and logistics practices to make maximum progress towards general economic prosperity. Moreover, these effects must be considered in relation to recession, security, transport and logistics challenges.

Research questions

- R1. How do threats to the economy like terrorism and financial crisis affect growth and development of the transport and logistics sector?

- R2. How does the transport and logistics sector management help in correcting negative economic growth?

- R3. What are the main factors affecting the management of transport and logistics today, in relation to economic policies of the federal government its security policies?

Objective of study

The study is highlighting features of the great recession and its effect on logistics and transport systems. It aims to synthesize the literature on the role that the economy plays in facilitating the adequate functioning of transport and logistics activities within it. It will also analyze threats to the economy and the way they transfer as specific threats to transport and logistics operations faced by companies and other stakeholders in the industry. The study will highlight the interdependence of the transport and logistics functioning with the economic policies and outcomes by the government.

Background of the study

The transport and logistics industry became the biggest economic sector focus for security analysts after September 11 attacks. Under the new security measures, the Department of Homeland Security works closely with independent stakeholders to security the sector and people. By definition, transport security is the securing of the flow of people and goods. It covers national highways, railways, airways and waterways (Lake, 2005). Another big challenge for the sector was the economic recession following the financial crisis of 2008/09. Measures to curb these threats in the economy and to the sector have been costly. According to Russell and Saldanha (2009), the cost of coping with security requirements to lower terror threats amount to about $65 billion annually for the sector.

Literature review

The U.S. is home to one of the largest infrastructure projects in the world for transport and logistics. Demands for effective management will continue to grow in the next decade. According to Hyunwoo and Jean-Claude (2008), the growth in some users for existing and new features of the sector calls for good strategic management of the sphere of transport and logistics. Besides, the government relies on the existing economic conditions to invest in the necessary infrastructure. Meanwhile, investment in such infrastructure under transport and logistics also offers avenues for economic growth. The interdependence was identified by O’Connor (2010) bringing up the realization that many spheres of logistics can be actualized when there is the overall growth of the U.S. economy.

External factors affecting the U.S. economic policies will end up affecting management decisions areas in transport and logistics. These include world oil prices, and overall balance of trade and valuation of the U.S. dollar (Yilmazkuday & Kingsley, 2013). Advancement in technology has helped deal with challenges of the sector. Nevertheless, technological investments are expensive and not readily applicable to all industry players. They require additional investment in personnel. The pace of advancement is also fast, making it risky to invest without a long-term strategic insight. On its part, the government aligns mechanisms for efficient management of the sector to boost efficiency and make it a significant resource for overall economic competitiveness (Dhami & Grabowski, 2011).

Economic growth eventually leads to increase demand for transport and logistics services and goods. However, threats to either economic growth or transport and logistics sector introduce challenges of realizing expected benefits. As technology and infrastructure help to ease challenges, security measures such as checkpoints, packaging rules, certification programs, and declaration demands increase the complexity of transport and logistics. They also add new costs that affect the competitiveness of the industry and its ability to become an anchor resource for overall U.S. economic competitiveness.

Outcomes

Studies and reports on different aspects of logistics and transport management reactions to threats of security have come up with recommendations. They help to direct expectations of this study’s findings. First, there are adjustments that must happen in the sector, especially with operators to ensure that their partnership with the government remains successful. Partnerships introduce several decision-making points, which can introduce bureaucratic challenges that negatively affect policy enactment. Given that cost of dealing with security challenges is a major issue affecting efficiency, it will be interesting to point out new measures by either government or the transport and logistics operators to combat the problem and realize their objectives. Alliances in transport and logistics stakeholders now encompass the government (Russell & Saldanha, 2009).

The impact of the Homeland Security Act of 2002 on the functions and effectiveness of transport and logistics will be an important addition to available information on the impact of government policy on the sector. The inherent nature of transport and logistics services to transverse state and national borders and the consolidation of border security activities under one department have created significant changes in the way of doing business for both service providers and clients. Transport operators now actively communicate with government security agencies for compliance and for safeguarding their security interests (Plant, 2006).

The ability of private companies to impact federal economic and security policies is making them major contributors to economic recovery. Nevertheless, their ability to do so relies on urgency created by economic effects on private business. In addition to the cost of security, other factors like interest rates, taxation and subsidies on fuel can be important influencers of the transports and logistics sphere (McCreery, 2013).

How do threats to the economy like terrorism and financial crisis affect growth and development of the transport and logistics sector?

Transportation and logistics companies need to consider security concerns when they choose their business routes and locations. They have to look at their dependence on particular logistics hubs and the security threats that are affecting the functioning of the hub or checkpoint. In addition, the companies in the sector have been looking at ways to reduce their exposure to threats in the given locations and to establish mechanisms that support quick response and recovery from attacks. The level of fabricated attacks on supply chains continues to increase and that is why security overall has become a big risk factor for consideration on any business strategy taken by a transport and logistics firm (PwC, 2011).

The sector has been forced to make decisions about threats based on the probable and the possible, always looking for opportunities to safeguard exposure against wildcard events like terrorist attacks and cyber-attacks. As a result, the investment in secure ICT systems has become paramount. The businesses in the sector have to ensure that their employees are capable of detecting and handling breaches in system security caused by external and internal malice intentions. Their goal is to support a reliance supply chain. On the other hand, the enforcement of strict standards has also helped the sector to remain responsive to the growth of threats. Working according to recommendations and guidelines of the Department of Homeland security is one way of ensuring that the sector remains immune to majority of security threats. In the airline freight section of the industry, the Certified Cargo Screening Program initiated by the federal government in response to terror threats has increased the cost of doing business. Airlines, freight forwarders and shippers now assume the cost of the security measures (Rodrigue, Comtois, & Slack, 2013).

In addition, the use of security audits along the entire supply chain has been a good incentive for overall investment in services and products that protect the entire sector. The sector however recognizes that being 100% secure is not possible. The threats are always changing and so must the approaches at security. Nevertheless, the gap between security measures taken and the possible or probably security threats should be minimized at all costs. Terminals serve as areas where freight and passengers assemble and disperse and they are a major focus of homeland security. The response of the sector to security threats has focused on safety and theft. This has included the setting up of procedures that help to maintain the integrity of cargo such as the use of inspections, the securing of facilities and personnel as well as investment in data security (Rodrigue et al., 2013).

The financial crisis affected overall economic demand and freight business in all channels of logistics. In the subsequent years of economic recovery, logistics and transport companies continued to struggle as they sought to boost their efficiencies and improve their trading margins. The biggest challenge in the aftermath of the crisis was the uneven freight demand that affected effective utilization of the available capacity in the sector. The end of the financial crisis period and the subsequent economic recovery that picked in 2014 led to improvements of the prospects of the sector. The following infographic highlights the composition of logistics and transportation costs as a factor in the GDP expenditure for the U.S. businesses in 2013.

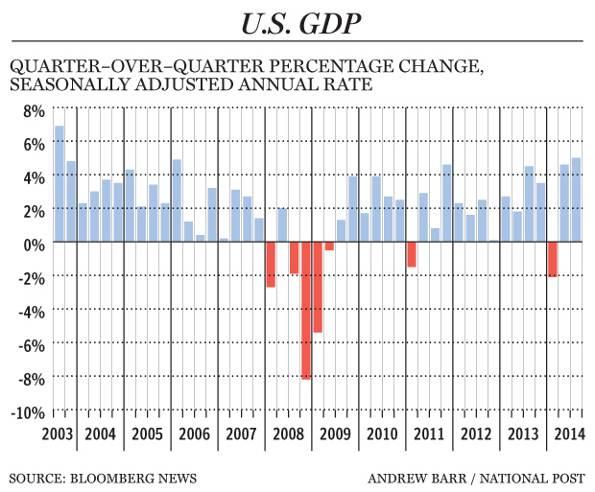

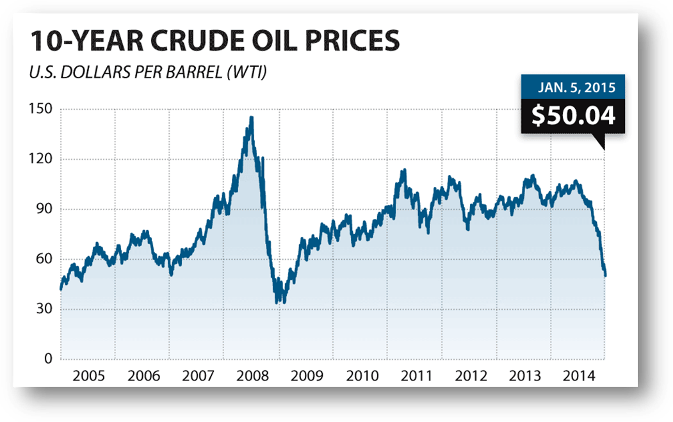

The following figures show the growth of the GDP of the U.S. economy, and it is important to compare it with the 10-year graph of crude oil prices. A drop in crude oil prices has corresponded to an increase in the U.S. GDP.

How does the transport and logistics sector management help in correcting negative economic growth?

In answering this question, the discussion focuses on the role that management takes and the way the overall operations in the sector end up balancing the economic effects of a recession. The sector has the capacity to improve overall economic productivity by making better selection, delivery and operation choices. An efficient logistics and transport sector supports long-term economic growth by acting as a pillar for resource intensive manufacturing sectors. These sectors include metals, pulp and oil refinery products (Lund, Manyika, Nyquist, Mendonca, & Ramaswamy, 2013).

The reduction in costs of services offered by companies leads to ripple effects on the economy. In addition, investment in facilities, technologies and resources that reduce the travel times and help to lower risk events also help with overall business productivity in the economy. The reduction in disruptions due to security threats and other business threats ensures that many U.S. businesses are able to recover quickly after a risk event such as bad weather or a cyber-attack to their operations. They can rely on a solid partnership with logistics and transport companies that have invested in security and use sufficient security protocols for operations to become hinge points for recovery of their clients’ businesses. Notably, the increases in cost of doing business for freighters due to implementation of the security requirements has shown that in most case managers prefer to hold on to the cost rather than pass them to end users and this acts as a cushion for the general economy against ripple effects of high cost of operations. These would jeopardize opportunities for quick economic recovery in other sectors (Rodrigue et al., 2013).

Managers in the transport and logistics industry have an important task of leading businesses to sustained economic performance amid the threat events as well as economic upturn and downturn pressures. The management decisions areas include outsourcing, selection of staff and recruitment, management of technology, and protection of market share (Dartez, 2013). Economic growth amid low or stable operation costs is a good environment for transport and logistics companies. As highlighted in the discussion on the effect of the financial crisis on the sector, the evidence shows that improved economic growth leads to increase volume of freight and that leads to full utilization of transport capacity and logistics services within the economy. This leads to predictable operations in the short-term and profitable growth for individual businesses.

However, another realization is that many businesses had shrunk their operations in the recession and might not handle an upsurge in demand for their services effectively. They need to first invest in more capacity and address other supply issues in the transport and logistics sector before full advantage of the demand-side upturn is realized. Thus, management’s key task will be in finding rapid scaling opportunities and resources amid the economic conditions such as high interest rates, high dollar currency value. Another parameter to consider is the changes in security requirements for businesses such as need for investing in technology systems for improving monitoring and security of people and resources. There is also a need to comply with government directives on protection against terror threats.

The challenges of operating in a highly secure environment will also be considered by management in both upturn and downturn economic periods. The challenges are not due to the threat events such as a terrorist attack, but the responses that governments and business take to recover and prevent future attacks. For example, the government closes borders, restricts movement of goods and services, and increases surveillance requirements, which can be costly to businesses and issues traffic policies for different locations around the country (Ekwall, 2011). Some other threats that will be considered by management include hijack, robbery, and theft from vehicle, theft of vehicle, fake police, fake accidents and deception. Most of these risks are due to trusted insiders that are involved with about 60 percent of losses affecting the businesses (Ekwall, 2011).

Managers have worked on the improvement of terminal security to enhance the reliability of freight transport. Increased linkage of terminals and monitoring of goods on transit is helping to curb most security threats in the sector. The increase in use of measures against opportunistic crime is also helping the sector comply with security policies of the federal government. The same zeal is needed in the adaptation of the sector to the changes in the economy.

The transportation sector is responsible for sustaining employment in an economic downturn and upturn. In 2013, there were more than 7 million employees in the sector. In addition, the business contributes directly to state and federal economies by paying highway user fees and other levies. It provides predictable revenue for governments at state and federal level unlike other sectors of the economy that can fluctuate and take time to recover from downturns. Nevertheless, the consideration for labor rules in the sector will continue being a decision area for management. For example, the 2013 changes in hours of service regulations for motor carriers affect transportation modes in the industry.

When combined with effects of bad weather and other constraints of the business, they lead to difficult operating environments that affect management’s ability to respond to demand changes. During economic downturn, business volume is low and management has to be more critical at shifting loads from one channel of transportation to another as each channel has a different breaking even point for volume of goods moved. For example, in winter when rail networks clog, most logistics companies will prefer road networks, but if the volume of freight is not sustainable, then they must alter their operation schedules to adapt to the changes (Berman, ATA’s American Trucking Trends reports an increase in trucking’s percentage of all domestic freight, 2014).

The sector is a major stakeholder in port and shipment business. The sector’s improvement in its overall efficiency and security improves the competitiveness of the U.S. as a trade and manufacturing location. The Homeland Security Act of 2002 and subsequent legislation and government policies introduced expensive cost element for the industry. For example, all containers shipped to the U.S. need screening and the investment in security facilities at U.S. ports, the outcome has been that these ports are more competitive than foreign ports without screening. Global business will readily prefer moving goods through secure ports therefore contribute to economic growth (Rodrigue et al., 2013).

What are the main factors affecting the management of transport and logistics today, in relation to economic policies of the federal government its security policies?

The transport and logistics sector in the United States still relies on oil, which exposes it to the turbulence of the oil prices across the world. Nevertheless, the sector has recently had room for growth due to favorable period where oil prices have remained stable and lower than they were about three years ago. According to a report on the forecast of logistics and transportation industry for 2015, the drop in the price of oil is a boom because it leads to extra money in consumers’ pockets. This availability of cash leads to an increase in the demand of goods and services in the economy. As a result, logistics and transportation business grow as they feed their services to the rest of the economy.

Another factor affecting the sector is the value of the U.S. dollar in relation to other major currencies. Part of the business in the U.S. is tied to international trade and movement of people, which follows dollar values. A strong dollar hurts U.S. exports and cause more companies to focus on the domestic economy as they realize they can earn high revenues at home than abroad. With the shift in focus, the demand for logistics and transportation in the local economy increases, this will continue burdening the already crowded rail system. On one hand, a focus on the local economy improves local business prospects. On the other hand, the sector also gets increased demand that pressures its resources to their maximum capacity. Firms will need to expand rapidly and maintain agile strategies to support the increase in demand. Unfortunately, for the expansion of fleets and purchase of other assets necessary to improve capacity of transport and logistics in the U.S., domestic prices will be high because of a U.S. dollar strengthening that led to high domestic demand for overall goods and services. Although prices may remain the same as they were during the low-value dollar periods, their expensiveness is in relation to available options for importation of the same goods and services.

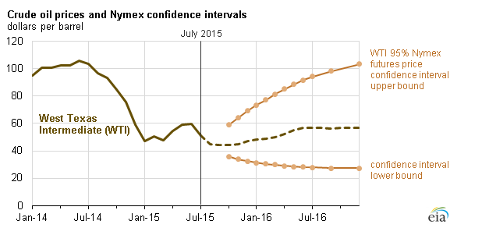

Either way, the present low oil prices and a strong dollar show that the sector has adequate circumstances for improvement. The general import bill for oil in the United States has also reduced. The U.S. Energy Information Administration forecasts for oil prices in 2016 show that there will be a stabilization of the prices around the current 50 to 60 dollars per barrel mark as shown in the graph below. The agency says that West Texas Intermediate crude oil prices will average $49 in the present year and increase to $54 in 2016 (EIA, 2015).

The analysis of the impact of oil prices on the U.S. economic upturn is significant to the logistics and transport sector. The main reason is the role that it plays in sustaining economic growth, and the effect that overall economic activity has on the sector as highlighted in previous paragraphs. Nevertheless, revisions of predictions of oil prices and value of the U.S. dollar can happen and the predictions only offer the potential business environment for the coming years.

As the U.S. dollar stays strong, the devaluation of any other global trade partner will lead to loss of competitiveness of the U.S. economy. An example is China’s recent decision to devalue its currency by two percent, which instantly makes Chinese goods more competitive by the same margin. Unlike the U.S economy that can survive with a high domestic consumption level, such that it would sustain a strong dollar, the Chinese economy has been heavily reliant on exports to drive growth, and has used the value of its currency as the main instrument for improving its exports volume and value (Berman, 2015). On a deeper analysis, beyond the possible high demand for import of Chinese goods into the U.S. economy, the news is an indication of the slowdown of the Chinese economy. A major trading partner and a significant player in the global economy, slowdown of the Chinese economy spells doom for a strong U.S. dollar. In extension, it heralds a period of low demand for transport and logistics sector in the U.S. after the initial short-lived boom that will come with cheap Chinese imports.

Still, the U.S. economy may actually wither the influence, as its import patterns are long-term and less reactionary to a slight dip of one country’s currency value. In both outcomes, the trade volumes that support growth of transport and logistics sector will persist. It takes long for supply chains to adjust for manufactured products and this time will be sufficient for the logistics and transport industry to adjust. Therefore, the slight devaluation of the Chinese currency is not a major threat in the short run (Berman, 2015).

Logistics companies in Europe welcome a drop in the value of the Euro against the dollar, especially for their operations in the United States. An article by Jolly (2015) on the New York Times shows that the decrease in the value of the earning currency, against the value of the accounting currency is positive for the logistics company. For a U.S. company with operations being paid in Euros, the decrease in the value of the Euro will be a loss, because when the earnings are converted to Dollars for accounting, they lead to low revenues. Thus, overall decline in values of other currencies against the Dollar lead to less international earnings for the U.S. logistics and transport companies (Jolly, 2015). Nevertheless, this remains true only when the companies are accepting other currencies for payment. When using the dollar, the changes in other currencies’ value are not felt. For example, clients paying for international distribution of goods to a U.S. logistics company using dollars will allow the company to sustain its earnings even when the operations are in another country where the local currency is significantly lower in value than the dollar.

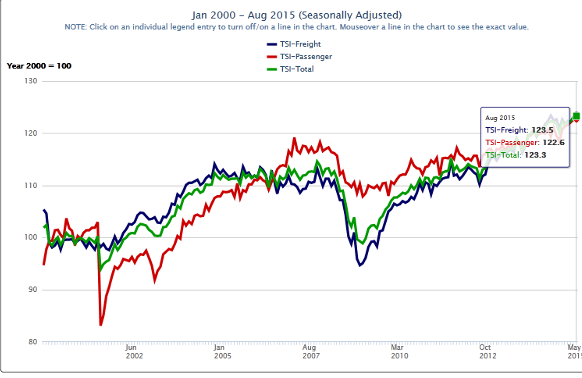

On the other hand, the circumstances affecting the interest rates in the U.S. do not favor a devaluation of the U.S. dollar soon. The increasing rate of employment is leads to support of the high interest rates and this has an overall effect of attracting more capital to the country. However, it reduces the opportunity for borrowing for existing companies, as the rates for payment are high. Therefore, these companies can best rely on organic growth of revenues to fund their expansion plans. Besides the currency and the price of oil, the U.S. infrastructure is a major factor for the profitability of the logistics and transport industry. According to the infrastructure service index trend, there is need for additional infrastructural investments in the U.S. to help meet supply side restrictions that arise out of the increasing demand as shown in the figure below.

Conclusion

Many researchers are interested in bringing out the relationship between movement policy on economic growth or security and industry challenges, opportunities and outcomes of transport and logistics. The U.S. economy has been through a long recession period that followed the great depression. At the same time, global factors such as oil prices have affected government policy on economic growth and investment in transport and logistics infrastructure. On the other hand, security issues post 9/11 continue to affect the organization of the Department of Homeland Security and the arrangement it has with transport operators. Besides being a cost factor, security is also a way to limit the risk of economic losses associated with security risk events. There are additional aspects of the government and transport and logistics sector worth looking at to confirm the role and effect that the former has on the latter. The future indicators for the sector are positive, and managers will need to consolidate gains in security and competitiveness then seek additional ways of curbing costs and address capacity responsiveness issues.

References

Berman, J. (2014). ATA’s American Trucking Trends reports an increase in trucking’s percentage of all domestic freight. Web.

Berman, J. (2015). Devaluation of Chinese currency could have ripple effect on supply chains.

Dartez, R. (2013). Transportation logistics and economic decline – Politics, infrastructure and the recession. Munich, Germany: GRIN Verlag.

Dhami, H., & Grabowski, M. (2011). Technology impacts on safety and decision making over time in marine transportation. Journal of Risk and Reliability, 225(3), 269-292.

EIA. (2015). EIA lowers crude oil price forecast through 2016. Web.

Ekwall, D. (2011). Supply chain security – threats and solutions. In Risk management – Current issues and challenges (pp. 158-184). Rijeka, Croatia: Intech.

Hyunwoo, L., & Jean-Claude, T. (2008). Intermodal freight transportation and regional accessibility in the United States. Environment and Planning, 40(8), 2006-2025. Web.

Jolly, D. (2015). Delight or dread as Euro falls. The New York Times. Web.

Lake, J. E. (2005). Border and trasportation security: Overview of congressional issues. Washington, DC: Congressional Research Service.

Lund, S., Manyika, J., Nyquist, S., Mendonca, L., & Ramaswamy, S. (2013). Game changers: Fuve opportunities for US growth and renewal. Web.

McCreery, A. (2013). Transportation ecoefficiency: Quantitative measurement of urban transportation systems with readily available data. Environmental and Planning Assessment, 45(8), 1995-2011. Web.

Plant, J. (2006). Terrorism and the railroads: Redefining security in the wake of 9/11. Review of Policy Research, 23(3), 293-305.

PwC. (2011). Transportation & logistics 2030 Volume 4: Securing the supply chain. Web.

Rodrigue, J-P., Comtois, C., & Slack, B. (2013). The geography of transport systems (3rd ed.). New York, NY: Routledge.

Russell, D. M., & Saldanha, J. P. (2009). Five tenets of security-aware logistics and supply chain operations. Transportation Journal, 42(4), 44-54.

Yilmazkuday, C., & Kingsley, H. (2013). Transportation capital in the United States. A multimodal general equilibrium analysis. Public Works Management Policy, 19(2), 97-117.