Abstract

The rising inflation affects the UK housing market and has caused significant fluctuations. Research findings report that the current inflation rate is 9%, an increase of more than 1.5% from the previous year’s recorded rates. However, the trend in the increasing rate of inflation has been experienced for the past decade, and economic analysts project that this rate may remain the same but keep increasing.

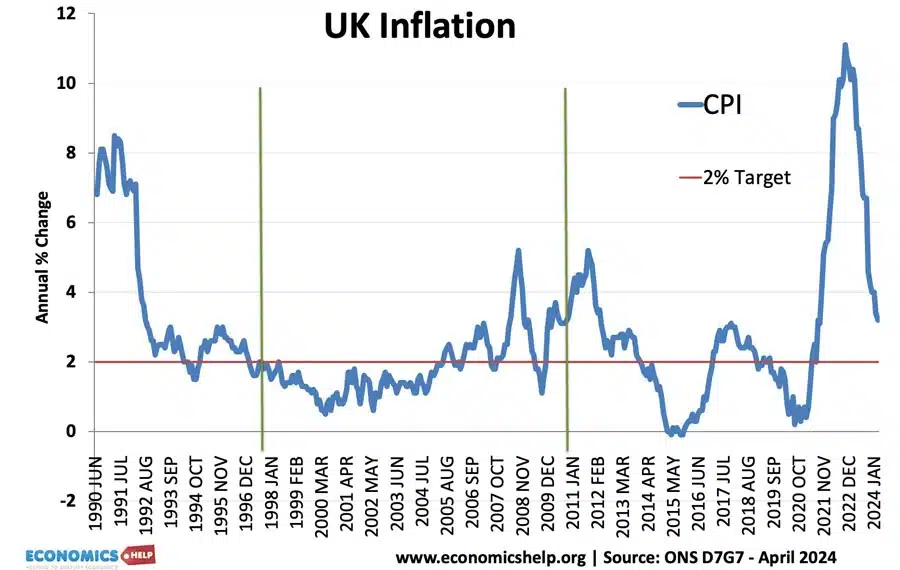

Although targeting an inflation rate of zero is nearly impossible, it is paramount to lower the current rate to a reliably low level (see Fig. 2). An inflation rate below 5% can significantly reduce the cost of livelihood. While an increasing inflation rate generally affects all industries, the housing market has experienced ups and downs following the current inflation rate. The overreliance and dependence on other industries have caused the housing market to experience the impacts of inflation extensively. Due to the high cost, it is challenging to own a property, especially a house. First-time investors are the most affected by these challenges, while those already established continue to enjoy high returns from their investments.

This paper explains how the high inflation rate has generally affected this industry. The study found that the high cost of living has affected the affordability of houses as potential investors spend more on consumer goods, leaving little to save for investments. Additionally, the cost of construction has significantly increased, making the price of owning a house go up.

Second, the high wealth-to-income ratio as a result of inflation has made owning a property more challenging, especially for first-time investors. Employment insecurity and low wages are some of the reasons why property ownership is more challenging. The study also found out that the mortgage and loan interest rates are currently high and will continue to increase should the inflation rate remain high. This will limit credit accessibility for some potential investors. Lastly, inflation is affecting the supply-demand chain, and as a result of scarcity, the housing market prices will constantly remain high.

Introduction

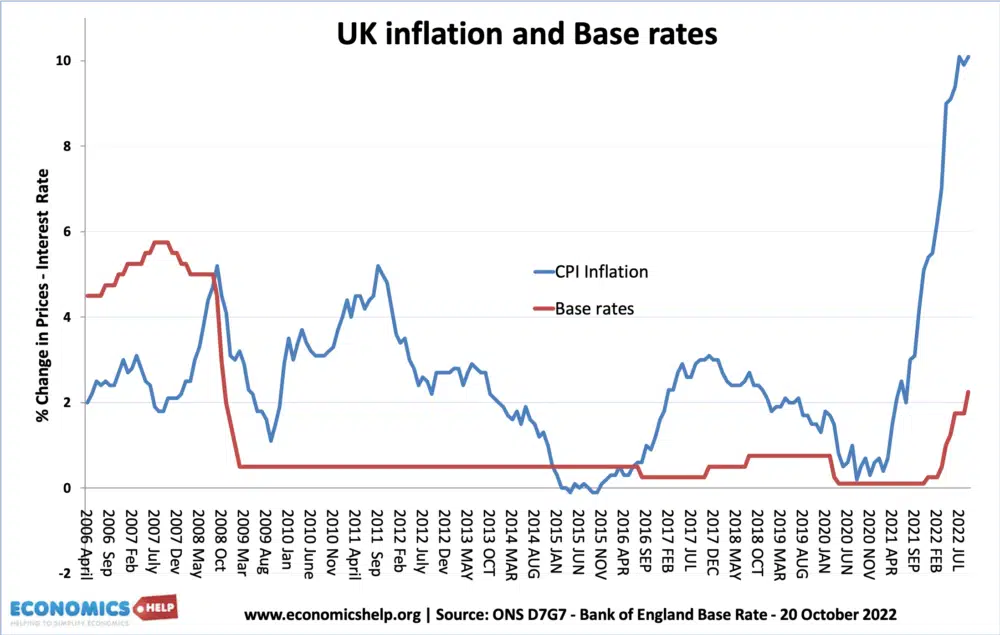

Inflation is increasing, which significantly impacts the property market in the UK. As a result, it is becoming increasingly more work for people to purchase homes. Approximately 5.5%, a minor decrease from the 6.5% recorded in February 2023, is a 40-year high for UK inflation rates (Borgersen, 2022). The highest inflation rate is being experienced in the UK, and the trend over the last few years demonstrates consistency in the fast-increasing inflation rate. Fig. 3 depicts the historical fluctuations in the inflation rate. The UK government has implemented efforts to lower the inflation rate, which has increased above the mandated 1-4% that was upheld in previous decades, to solve the problem (Zhu, 2021).

The supply chain has undergone significant changes due to the inflation rate increase, which has an equal impact on the housing and real estate industries. Housing interest rates have steadily risen due to inflation, and significant future mortgage returns are projected. The economy is vulnerable to recession because it has also led to increasing interest rates and decreased the cost of servicing debt (Eldomiaty et al., 2020). Therefore, many people are spending more on necessities and saving considerably less for investment plans due to the increasing cost of living.

With a gross domestic product of $3.1 trillion in 2022, the UK is one of the developed economies in the world that is experiencing significant rates of inflation (Zhu et al., 2021). The country’s inflation rate has fluctuated throughout the last ten years, and if the proper steps are not taken, it is expected to rise. The cost of goods, interest rates on mortgages and loans, and the general purchasing power of the populace have all been impacted by this high inflation rate. The Bank of England forecasted 2% inflation, which is less than the current rate of 5.5%, according to Borgersen (2022) and Low & Mortimer-Lee (2023).

As a result of the high rates of inflation, people’s purchasing power is compromised. The article aims to investigate how the country’s housing market is impacted by rising inflation. The essay seeks to clarify how rising inflation has influenced interest rates, high construction costs, high wealth-to-income ratios, low savings rates, and other factors that impact the UK housing market. It also looks at prospective developments in the industry in the future.

Literature Review and Discussion

With an average price of £288,000, the UK has some of the highest residential place prices in the world (Zhu et al., 2021). Residential real estate has remained expensive to buy and rent during the previous few years, rising to double the price of similar residences in England ten years ago (Fuller, 2019). Housing market trends suggest that prices will increase or stay the same shortly. In the most recent annual study by the research company, according to Borgersen (2022) and Frcz et al. (2023), London is currently the second-most expensive city in the world, behind Hong Kong. Based on the price of housing, Sydney, Oxford, and Liverpool are among the other cities that rank as the most expensive.

Adkins (2019) claims that the rapid rise in housing costs has not kept pace with the minimum wage’s sluggish expansion in many Anglo-American cities. While house prices rose by 7.55% in the ten years ending in 2019, salary growth was only 3.10%, according to these writers. Despite the high inflation rate, earnings only increased by a small amount. The poor income growth can be related to the rising cost of living, which puts a financial strain on tenants and buyers.

First, the growing inflation rate has impacted the UK’s housing affordability. The price of consumer items has significantly increased along with the overall living expense. Fuller et al. (2019) claim that the market prices have dramatically increased from £153,000 in 2009 to £267,059 in 2022 due to the high cost of manufacturing and supply. Although this has been the pattern, the previous five years have seen high commodity prices. Economic researchers also note that despite the rise in the cost of living, market prices are not expected to drop soon due to the high level of inflation (Frcz et al., 2023). Even though all businesses are often impacted by inflation, the tendency has substantially affected the housing market.

In the last ten years, the price of owning real estate in the UK has increased from its starting range. For instance, Grzybowski et al. (2017) suggest that first-time purchasers may put off saving and investing in the home market because of the high cost of living. For instance, if a person in Manchester on an average wage of £26 586 wanted to buy a house for £238,519, it would take them 16.6 years to save the 15% down payment needed (Frcz et al., 2023). People are spending more and saving less as a result of the prolonged length of savings as well as the rising cost of goods.

Additionally, because of the high rate of inflation, people in the UK struggle to balance their investments in the property sector with their basic needs. Particularly for those with a meager or erratic source of income, renting and even buying homes might be more challenging. The rising expense of life and depleted financial resources are to blame. According to Grzybowski et al. (2017), the high cost of goods has added additional stress as people attempt to meet their daily necessities.

While unemployment has decreased over time, prices for necessities have been rising since 2008 (Diamond, 2023). According to Agnello (2019), mortgages with high levels of development and securitization have shorter housing booms, which lower the number of missed payments. Similarly, financial institutions are wary of lending to individual investors as the rate of missed payments keeps rising (Diamond, 2023). The high cost of living and job uncertainty were two issues mentioned as being the primary causes of missed mortgage payments. This situation has worsened due to inflation, as many individuals are now spending a lot of money on necessities like food and have very little left to save for investments.

Finally, it is projected that the cost of the building will keep rising along with inflation. Purchasing land, constructing supplies, and labor is considerably more expensive than in past years, which forces the expense to be passed on to the customers. Increased financing costs, a delay in the building of new homes, and a drop in mortgages are all implications of increased interest rates. Additionally, since renting is generally more affordable than buying a home, it suggests that individuals will rent for longer. However, renovating an old house can be expensive (Teague & Donaghey, 2018). As a result, there is a massive imbalance between supply and demand. Existing homeowners take advantage of the high rent prices while new investors remain cautious and rent for residential regions. However, even if fewer homes are being built, there is still a high demand for housing, and despite the high cost, many people are still renting flats.

Second, by changing the wealth-to-income ratio, inflation indirectly impacts the UK property market. According to Fuller et al. (2019), while the cost of owning property has climbed annually by 7.55%, the average rate of wages is currently at 3.10%. Due to the cheaper rental expenses, more people are renting than buying homes. As a result of this increase, house prices have skyrocketed relative to overall incomes, leading to a high-cost wealth-to-income ratio. Similarly, according to (Grzybowski, 2017), there has been a significant difference in the previous ten years between the cost of housing and wages. In his study, Alqaralleh (2019) emphasizes that rising interest rates are expected.

Generally speaking, this will reduce people’s ability to purchase goods and services, making them unaffordable due to the rise in money that must be paid back. The average household income is nine times higher than a home’s price, and most people continue to carry mortgage debt into old age (Chau, 2018; Collett, 2018). The high inflation and interest rates currently in effect are strongly related to the current mortgage trend (Collett, 2018). Most UK people don’t have stable employment, so these rates are significant (Teague & Donaghey, 2018). However, given the steps policymakers take to control inflation, it is crucial to recognize the reasonably sustained nature of property inflation.

The high wealth-to-income ratio has also substantially impacted the purchasing power of most UK citizens, resulting in a massive disparity between supply and demand. The few people who can still buy real estate despite rising inflation do so at extravagant prices. However, many property owners continue to cling to their houses, expecting interest rates to increase, bringing them better returns due to the unprecedented shifts in future pricing. Housing prices could, however, decline if future inflation rates are unpredictable, given that they haven’t been constant over the past ten years. Thus, the wealth-to-income ratio is a crucial aspect that is impacted by inflation and, consequently, by changes in the UK property market.

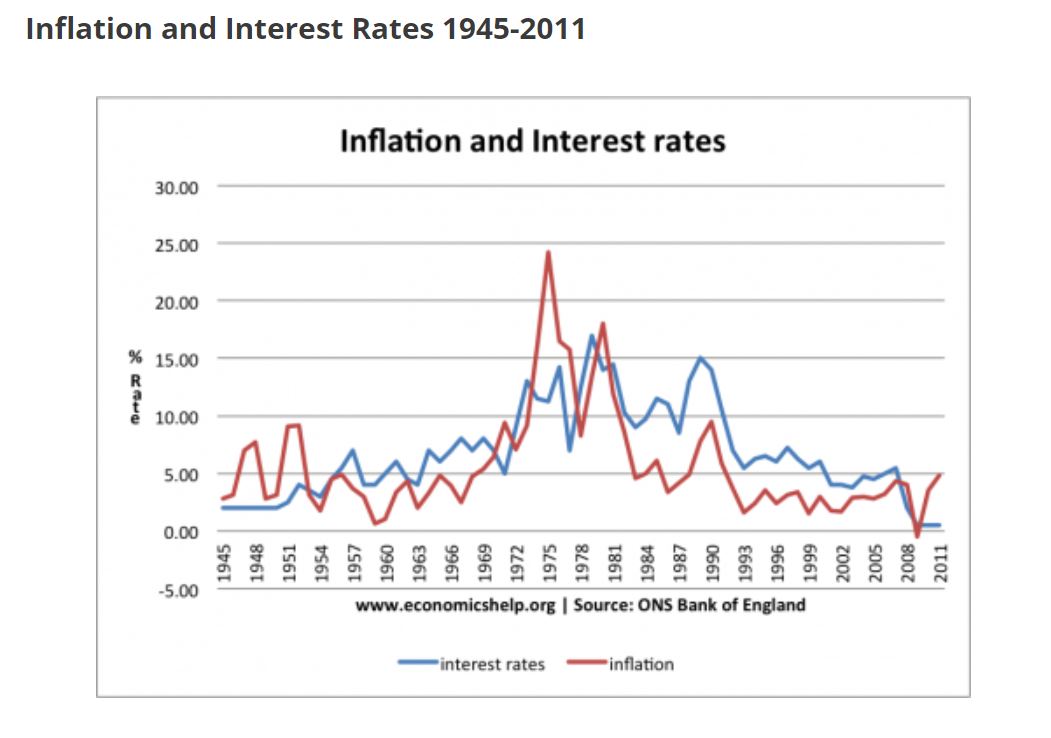

Third, high interest rates on loans and other types of debt are linked to inflation. The alterations to the UK tax system are one of the elements that have contributed to higher interest rates (see Fig. 1). These modifications have considerably influenced both the inflation of asset prices and the slowing of wage growth. As the distribution of mortgage lending is altered, the new regime benefits investors. For instance, between 1990 and 2005, the credit for owner-occupiers expanded by up to 642%, while the credit for investors grew by 2184%. However, the landlord mortgage credit was only 28%. With increasing inflation, these interest rates have been climbing steadily. In contrast to other industrialized nations, the UK housing market is heavily influenced by first-time investors. Smaller businesses and individual investors will continue to be wary of making real estate investments due to the high interest rates on credit loans.

Early in the new millennium, affordable finance was made available, allowing most people to buy homes rather than rent them (Egan & McQuinn, 2023). As a result, fewer new residences were being constructed during that time. House prices increased from £100,000 in 2000 to £225,000 in 2007 due to a change in supply and demand (Egan & McQuinn, 2023). The 2008 financial crisis, however, caused a sharp decline in housing values. Even if renting an apartment is expensive, the high interest rates could keep potential investors from investing in the industry.

According to Dungey et al. (2018), most investors in the property market are either middle-aged individuals with high earnings or members of compact family units. Despite having high interest rates, these can profit from loans and mortgages. The category mentioned above is investing in the housing market in a significantly different way from low-income individual investors. Instead of encouraging wealth creation, the expansion of real estate investment introduces a skewed distribution within the income scale itself (Hochstenbach & Aalbers, 2023). As a result, tax breaks for investing lead to increased high-income and capital gain income. In other words, those who stand to gain the most from asset price inflation have the highest incomes.

Although high loan and mortgage interest rates are linked to inflation, it is admirable to note that this will favor the housing industry. Lending businesses will reduce the risk of bad debts while maximizing the profits from the trusted clients who can repay the borrowed money, notably the corporates, as the borrowing capacity of individual investors declines due to rising yields. Due to the substantial reduction in competition in the housing markets, many investors who would otherwise refrain from investing do so because of financial difficulties.

Finally, the growing inflation rates have also impacted the industrial and banking sectors, indirectly supporting the housing market. The first is that the banking sector engages in lending activities. Specifically, many investors take out loans from banks and other financial institutions and pay them back with a set interest rate. As mentioned, interest rates in UK financial institutions have dramatically risen across the board. Therefore, a significant mismatch between supply and demand is a problem for organizations like banks that provide loans and mortgages. Munro (2018) asserts that money-lending businesses have lost over half of their clientele because of inflation. The institutions anticipate losing more customers as inflation rises, which has been connected to this pattern of increasing loan interest rates. The pattern is consistent with the supply and demand hypothesis for mortgages, according to which rates rise as customers grow. Therefore, all investors who rely on these institutions to obtain financing for real estate ventures are expected to accept the high interest rates or refrain from taking out loans.

Conversely, there needs to be more raw resources for the industrial sector. Some smaller businesses need help to meet market needs as the price of commodities rises (Hochstenbach & Aalbers, 2023). Depending on the organization’s size, the manufacturing industries frequently procure raw materials directly from the producers. Few people can afford the rising demand caused by the providers’ price increases due to the low purchasing power. Due to the forced increase in construction costs, the building industries cannot build the desired number of homes. In the product cycle, an increase in the price of one commodity drives the price of others to rise.

On the other hand, some reputable manufacturing firms continue to profit from this scarcity, driving up the cost of commodities. The high prices are a result of the dearth of and elevated costs of raw materials and other necessities for real estate businesses. Munro (2018) claims that the present rate of inflation is impacting all UK industries, not just the housing industry. As an increase in one commodity affects the production of another, industry interdependence has greatly contributed to inflated market prices.

Conclusion

In conclusion, the UK housing market is strongly impacted by growing inflation. Inflation is rising, leading to substantial effects on the property market in the UK. Consequently, purchasing homes is becoming progressively more challenging for individuals. The UK’s inflation rate has increased from the previous year’s average of approximately 7% to a 40-year high of about 9%. Based on the trend in past years, these numbers are predicted to increase. The entire cost of living has increased due to the high inflation rate. First, the high cost of living has reduced people’s disposable income by forcing them to spend more on necessities like food, shelter, and clothing. Although consumer items are becoming more expensive, income sustainability is declining. Low income and high living standards have led to a decline in real estate investment.

The housing market’s prices are anticipated to rise due to the inflation rate. As was previously noted, the high construction cost due to rising commodity prices will result in price inflation in the housing market. Another aspect of inflated market pricing to consider is the maintenance expense. On the other hand, the shift in the demand-supply curve will result in fewer investments while also raising prices. Rental rates are rising because there is a great demand for rental space but a limited supply.

Similarly, rising inflation will lead to higher loan and mortgage interest rates. As a result, fewer people will invest in the property market, particularly those who rely on outside money. The result is a strong demand. However, seasoned real estate investors are expected to continue to earn significant returns on their assets. The high wealth-to-income ratio also prevents potential investors from entering the property market. Many people cannot keep up with the high cost of other goods because of the high cost of properties, especially land and houses. As a result, the UK housing market is suffering from growing inflation.

Recommendations

The UK government can control rising inflation through the following measures.

- The contractionary monetary policy reduces the money supply within an economy by increasing interest rates. This makes credit accessibility costlier and reduces businesses’ and consumers’ spending.

- By increasing the federal funds rate, the government will promote interbank money lending, which will, in turn, control the money supply in the economy. Once inflation is reduced, companies and individual investors can invest in real estate.

- Lastly, increasing interest rates will encourage homeowners to spend more on mortgages. This will generally increase spending and attract savings. As a result, economic growth and inflation will slow down.

References

Adkins, L., Cooper, M., & Konings, M. (2019). Class in the 21st century: Asset inflation and the new logic of inequality. Environment and Planning A: Economy and Space, 53(3). Web.

Agnello, L., Castro, V., & Sousa, R. M. (2019). The Housing Cycle: What Role for Mortgage Market Development and Housing Finance? The Journal of Real Estate Finance and Economics. Web.

Alqaralleh, H. (2019). Asymmetric sensitivities of house prices to housing fundamentals: Evidence from UK regions. International Journal of Housing Markets and Analysis, 12(3), 442–455. Web.

Borgersen, T.-A. (2022). A housing market with Cournot competition and a third housing sector. International Journal of Economic Sciences, 11(2), 13–27. Web.

Diamond, P. (2023). The Resistible Corrosion of Europe’s Center-Left: The Case of the British Labour Party Since the 2008 Financial Crisis. In The Resistible Corrosion of Europe’s Center-Left After 2008 (pp. 45-62). Routledge. Web.

Egan, P., & McQuinn, K. (2023). Regime switching and the responsiveness of prices to supply: The case of the Irish housing market. The Quarterly Review of Economics and Finance, 87, 82-94. Web.

Eldomiaty, T., Saeed, Y., Hammam, R., & AboulSoud, S. (2020). The associations between stock prices, inflation rates, and interest rates are still persistent: Empirical evidence from the stock duration model. Journal of Economics, Finance, and Administrative Science, 25(49), 149-161. Web.

Frącz, P., Dąbrowski, I., Wotzka, D., Zmarzły, D., & Mach, Ł. (2023). Identification of Differences in the Seasonality of the Developer and Individual Housing Market as a Basis for Its Sustainable Development. Buildings, 13(2), 316. Web.

Fuller, G. W., Johnston, A., & Regan, A. (2019). Housing prices and wealth inequality in Western Europe. West European Politics, 43(2), 297–320. Web.

Grzybowski, A., Schwartz, S. G., Relhan, N., & Flynn, H. W. (2017). Correspondence. Retina, 37(9), e106–e107. Web.

Hochstenbach, C., & Aalbers, M. B. (2023). The uncoupling of house prices and mortgage debt: towards wealth-driven housing market dynamics. International Journal of Housing Policy, 1-29. Web.

Low, H., & Mortimer-Lee, P. (2023). Box A: Monetary policy and inflation in the Second Elizabethan age. National Institute UK Economic Outlook, 13-16. Web.

Munro, M. (2018). House price inflation in the news: A critical discourse analysis of newspaper coverage in the UK. Housing Studies, 33(7), 1085–1105. Web.

Teague, P., & Donaghey, J. (2018). Brexit: EU social policy and the UK employment model. Industrial Relations Journal, 49(5-6), 512–533. Web.

Zhu, S., Kavanagh, E., & O’Sullivan, N. (2021). Uncovering the implicit short-term inflation target of the Bank of England. International Economics, 167, 120–135. Web.

Appendices