Introduction

The United States of America has instituted various fiscal and monetary policies to ensure that the economy remains competitive. According to the Bureau of Labor Statistics, the economy is the largest in the world although it faces numerous challenges. Since the global financial and economic crises of 2007 and 2008, the country’s economy has been unpredictable and fragile.

High deficits due to the rising federal debt and high rates of unemployment have hurt the overall performance of the economy. To cushion the citizens against the high levels of unemployment and decelerated economic growth, the government has enacted fresh fiscal and monetary policies (Zeng 2008, p. 19).

This is an analysis of the US economy in recent history. The paper will focus on macroeconomic indicators such as GDP, exports, imports, unemployment and government spending.

United States Economy

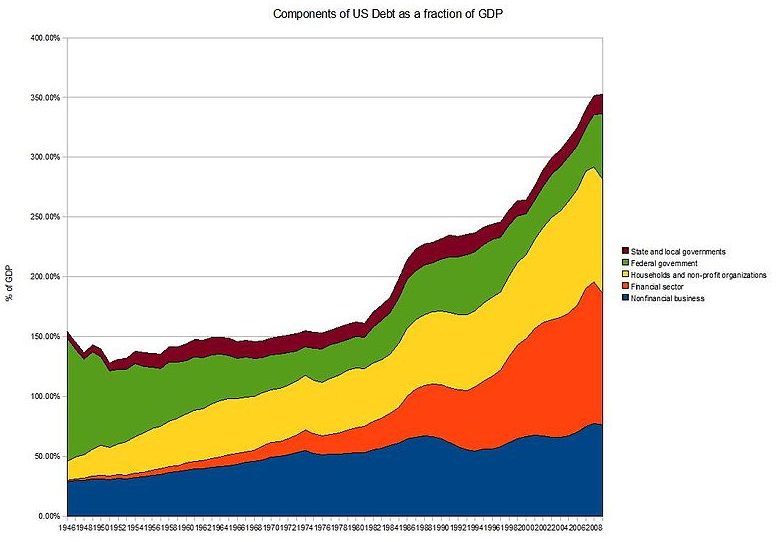

The economic growth has been marginal for the last fiscal year. Gross Domestic Product (GDP) shows that the country grew by a minimal 2.3% in 2012. It was well above $15 trillion by the end of the financial year. The slowed growth has resulted in increased pressure on the economy that has already experienced the effect of increased government spending and the accumulation of federal debt.

In the first quarter of the current fiscal year, the revised figures show that the economy grew marginally by around 0.1%. Despite the formulation of policies to stimulate economic growth, the economy is still struggling to recover from the adverse effects of 2008 financial and economic crises (Reinhart & Rogoff 2009, p. 468). In 2010, the economy recorded negative growth in the economy as indicated in the figure below.

Fig. 1: United States GDP since 2004

Undoubtedly, the current economic growth is weak. The rationale is that the economy has an imbalance of payment where the imports were more than the exports in 2012. Economists assert that the imports of the country amounted to approximately $$2.3 trillion while the exports were around $1.7 trillion in the same financial year (Lipsey & Chrystal 2011, p. 53).

Besides, the country has to grapple with the recession that ensued after the infamous financial crises of 2008. The current authority has exacerbated the economy considering the increased government spending that reflected 45% of the entire GDP in the year 2011(Reinhart & Rogoff 2009, p. 470).

Also, the public debt soared immensely and surpassed 100% of the gross domestic product during the same period. Nonetheless, the election of the Republican Party as the majority party in the House of Representatives instituted policies to allow limited government spending (Lipsey & Chrystal 2011, p. 59).

Questions about the rule of law within economic realms have been apparent in the US macroeconomic environment. Although every individual has a guarantee on property rights, the bailouts that were clear during the 2008 economic crunch have raised eyebrows across the economic spheres (Zeng 2008, p. 25).

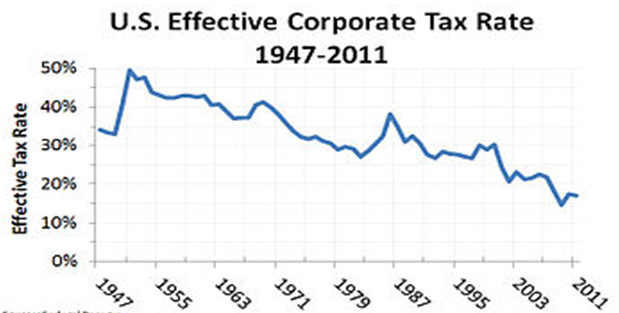

The rationale is that the bailouts were perceived as a form of corruption that could undermine the integrity of institutions. This could worsen the economic recovery path. Despite attempts by the government economists to institute tax reforms as an antidote to the recession, the tax rates remain at 25% in the last financial year.

Zeng (2008, p. 27) postulates that the lack of comprehensive reforms in the taxation entity of the government has made the individual and corporate rates of taxes to remain unchanged. Considering that the total taxes collected by the federal government amount to about 25% of the GDP, the budget deficits continue to grow due to government spending that has exceeded 40% of the GDP.

Hence, the economy has experienced a growth in deficits of not less than $1 trillion for every financial year since 2009.

Fig. 2: Showing historical taxes of US

Other regulatory frameworks and policies that have come up to aid the recovery of the economy have been counterproductive. Particularly, the procedures involved when starting a business have been effective after the institution of over hundred regulations since the onset of financial crises. However, the regulations have increased the operational costs of businesses that have continued to grow.

Indeed, the Bureau of Labor Statistics articulates that the annual costs associated with regulations reached a high of $46 billion in 2009. The bureau also warns that a lack of adherence to the financial and monetary policies have led to price imbalances and distortions. These distortions predispose the economy to future and long-term inability to deal with inflation.

Further, the country has lost its competitive edge in the international markets. Vishesh (2012, p. 38) points out that the country has increased limits in some sectors using policies such as anti-dumping rule as well as advocacy to buy locally produced goods only. Although the effects of the policies are emerging gradually since their enactment, they are likely to heighten costs for businesses and further increase the unpredictability of the economy.

Effects of 2008-2009 Global Financial Crises on the US Economy

Reinhart & Rogoff (2009, p. 473) assert that the financial crises of 2009 affected the economy in a huge way. Some economists argue that the fall of stocks in the US led to the crises in other parts of the world in addition to high rates of unemployment.

To illustrate the situation of 2009 in the US, it is important to analyze such factors as lowered rates of mortgages and high-risk practices by banks that exacerbated the financial situation (Greenlaw et al. 2013, p. 237). Banks allowed numerous mortgages without considering the ability of the debtors to repay. The rationale behind the banks’ behavior is the anticipated high profits.

Nonetheless, when the banks crashed, the rest of the economy felt the effects. Bohn (2001, p. 282) highlights that the federal government instituted measures to save a handful of companies that were at the threshold of collapse. Bailouts became a norm, and the economy continued to plunge into recession. Indeed, the effects of the 2009 crises led to a negative growth of the economy in 2010 (Vishesh 2012, p. 39).

Unemployment rates began to soar since many companies were attempting to cut their labor costs while others liquidated. In 2010, the unemployment rates surpassed 10% in most states. However, the economy has attempted to keep the unemployment rates at their very minimum both in the short term and in the long term (Cukierman 2012, p. 33). Bureau of Labor Statistics indicates that the current unemployment rates are just shy of 8% mark standing at 7.9% by January 2013.

Fig. 3: US Financial Position

The federal government has instituted measures to curb rising government spending. Besides, the policies target an increment in taxes and other tax reforms. The amount of savings that the government anticipates in the next ten years is about $3.5 trillion (Bohn 2011, p. 286). If the government does not rollback the policies and measures, the current economic growth looks sustainable in the long-term.

The rationale is that the federal government will be in a position to balance the ratio of debt to gross domestic product. However, economists warn that the spending will remain well above 40% through 2020 (Lipsey & Chrystal 2011, p. 63). This implies that the country will still have to grapple with slow economic growth and relatively high levels of unemployment.

The rationale for the prolonged and slowed economic is the effect of current policy that increases government spending on healthcare and pensions (Greenlaw et al. 2013, p. 232) In late 2010, the country adopted the unemployment bill to curb the rising crises in the labor market. Despite the policies, the levels did not go down as the formulators had anticipated.

Particularly, economists say that the measures did not capture the importance of stimulating the domestic economy to absorb unemployed citizens (Cukierman 2012, p. 34). Further, the global business environment has presented the United States with momentous challenges. First, the continued practice by multinationals in the country to source for labor has resulted in ‘labor importation’ that has worsened the unemployment situation in the country.

Many companies in the US have continued to source in countries where labor is cheap implying that they have headed east. For instance, Apple has continued to assemble and manufacture chips in China and Asian countries where the cost of labor is substantially low than in the US. Second, Vishesh (2012, p. 35) says that the unemployment bill failed to capture the need to absorb local laborers in the economy.

The onset of the global crises saw many companies fail to meet their financial obligations. To remedy the situation, innumerable companies have continued to reduce labor costs as a measure of stabilizing their financial situations in the short term (Vishesh 2012, p. 38). This is in terms of downsizing and job cuts. The current policies have done little to reduce the high unemployment rates.

The Role of Policy Makers in the US

The economic performance of the US remains bleak. Coming out of the financial and economic crises, the country is facing a recession. The lawmakers have enacted policies to ensure that the economy remains stable both in the short term and in the long-term (Lipsey & Chrystal 2011, p. 73).

Particularly, the passage of the bill to increase the national debt of the country was the first policy to enhance increased activities in the domestic economy. It allowed the economy to stimulate local industries and ensure that the effects of the crises do not exceed the fiscal year 2015 (Reinhart & Rogoff 2009, p. 466).

Nonetheless, government spending and debt lead to periods of slow economic growth. This implies that the policy was counterproductive. It did not take long therefore before the government instituted measures to decrease spending. The USA seeks to decrease its spending and increase taxes in the next ten years. This way, the country will experience slowed macroeconomic environment due to the government spending on health and pensions.

Reinhart & Sbrancia (2011, p. 217) say that the government will also reduce tax rebates given to local companies to increase their manufacturing and production capacities. To that end, the economy is headed for a long period of slowed economic activity typical of increased tax rates and reduced government spending.

The interest rates have continued to be high due to the lending risks. Besides, the economic meltdown has also scared investors and bondholders who play a crucial role in ensuring the stability of the economy (Cukierman 2012, p. 44). Additionally, it is worth mentioning that the federal government was able to avert the impending tax cliff crises.

Through sound policies and laws, the government has been on the forefront to agitate for reforms that do not only promise to end the recession but also increase the competitiveness of the economy at the global market (Bohn 2011, p. 290). Further, the government is yet to institute policies to stimulate the export function of the macroeconomic environment.

Increasing the ability of the companies and organizations to produce for exports will decrease the imbalances that are apparent within the international trade. Besides, it is almost impracticable to curb the unemployment rates and inflation when the imports are way above the exports.

Although the recession in the economy will continue for the next couple of years, it is vital for the policymakers to come up with a policy that does not only increase the competitiveness of US economy but also boosts investor confidence (Cukierman 2012, p. 34). This way, the country is likely to shrug off the effects of the recent financial crises.

Conclusion

In sum, the US economy is the biggest in the world considering its GDP. Despite its stature in the world economy, the country has experienced a myriad of challenges since the onset of the financial crises of 2008 to 2009. High rates of unemployment that peaked in 2011 and decelerated economic growth have plunged the economy into a recession.

The current GDP growth stands at 2.3% with the first quarter of the fiscal year 2013 recording a marginal growth of 0.1%. Various policies have come in place since the financial crises. They target tax reforms, high rates of unemployment and stimulation of exports. However, some of the policies have been counterproductive. As such, there is the need to enact other policies to cushion the economy from reduced spending amid rising tax rates.

References

Bohn, H 2011, ‘The Economic Consequences of Rising U.S. Government Debt: Privileges at Risk’, Public Finance Analysis, vol. 67 no. 2, pp. 282-302.

Cukierman, A 2012, Central Bank Strategy, Credibility, and Independence: Theory and Evidence, MIT Press, Cambridge, Massachusetts.

Greenlaw, D., Hamilton, J., Hooper, P. & Mishkin, F 2013, ‘Crunch Time: Fiscal Crises and the Role of Monetary Policy’, U.S. Monetary Policy Forum, vol. 7 no.7, pp. 231-48.

Lipsey, R. & Chrystal, K 2011, Economics, Oxford University Press, Oxford, UK.

Reinhart, C & Rogoff, K 2009, ‘The Aftermath of Financial Crises’, American Economic Review, vol. 99 no. 3, pp. 466-72.

Reinhart, C & Sbrancia, B 2011, ‘The Liquidation of Government Debt’, National Bureau of Economic Research, vol. 7 no. 8, pp. 212-245.

Vishesh, K 2012, ‘Is Raising U.S. Debt Inviting Trouble? Ask Japan’, Daily Finance, vol. 4 no. 3, pp.34-39.

Zeng, M 2008, ‘Bailout Funding Promises To Pressure Treasury Prices’, The Wall Street Journal, vol. 6 no.2, pp. 13-29.