Executive Summary

Venezuela is located in Latin America, and its gross domestic product (GDP) significantly depends on the country’s oil and gas industry. The current economic and political situation in the country is unstable, characterized by hyperinflation, high levels of bureaucracy, governmental restrictions for businesses, high levels of poverty and unemployment, and a low ratio of economic freedom. It is important to note that the country has not been able to overcome its economic crisis over the last several years, and inflation is continuing to grow. Venezuela’s economy is built on the contributions of key industries that include petroleum, construction, the production of minerals, and agriculture. Thus, foreign direct investment is mainly to be found in these industries. In light of these facts, it is possible to recommend expansion to Venezuela only for those Canadian companies that operate in the oil and gas, construction, and mineral production sectors.

Venezuela’s Macro Environment

Country Description

Venezuela a leader among other Latin American countries in developing its oil industry (comprising 95% of export earnings), and its economy is significantly vulnerable to fluctuations in global oil prices despite the potential for further stable economic growth. Other important industries in Venezuela are related to construction, machinery and transport equipment, agricultural products and food, and chemical and steel products in addition to oil and petroleum products (“Doing Business in Venezuela” 2018). During the period between 1998 and 2013, the country achieved significant decreases in poverty and inequality levels. However, the period 2014–2017 was characterized by a decline in oil production and negative changes in oil prices. Venezuela’s GDP was $380.7 billion in 2017, but its fiscal deficit is hovering at about 20% (“The World Factbook: Venezuela” 2018). Currently, the level of development and wealth in the country is low, and its economy is experiencing stagflation.

While the country’s infrastructure has not been developed efficiently, the overall picture shows some bright spots, including Venezuela’s 11 international airports. Information technologies continue to develop, benefitting from oil sales, but e-commerce is not supported significantly. Venezuela is a founding member of OPEC, and its economic ties also cover Brazil, the United States, China, and since 1953, Canada (“Doing Business in Venezuela” 2018). Notably, the recent crisis in the country has affected foreign investment because of the associated restrictions (Koivumaeki 2015). The country’s economic crisis has also caused some multinational firms, including US companies, to reduce their operations in Venezuela. In addition, the level of corruption in the country is reported to be high and is connected to the government’s control of the oil and gas industry.

Political Situation and Stability

Venezuela is a federal presidential republic. The political situation in the country is viewed as unstable despite President Nicolas Maduro’s reforms in the areas of politics and economics. The proposed reforms were not successful in overcoming the crisis of 2014, and the public’s opposition to the current government is continuing to grow (“Doing Business in Venezuela” 2018). The political stability index for 2016 was -1.03, indicating that the current government cannot effectively control destabilizing processes and is at risk of being overthrown (“Venezuela: Inflation Forecast” 2018).

Legislation

In Venezuela, foreign investments are regulated concerning various laws and policies. Such types of exports as cosmetics, medications, and medical devices require approval and registration. Importing agricultural products requires certification. Furthermore, the legislation has partially restricted the activities of the private sector in the country, limiting the attraction for foreign direct investments and increasing tariffs for partnership despite a legal course of promoting investment (“Economy – Venezuela” 2018). To regulate trade and the balance of exports and imports, the established tariff rate is about 10%. In addition, currency exchange requirements and control can also limit foreign investments, affecting local businesses and creating informal trade barriers for other countries (“Doing Business in Venezuela” 2018). It is also important to note that the country’s financial sector is highly regulated and controlled by the government, as well as affected by the political situation in Venezuela.

Economic Conditions

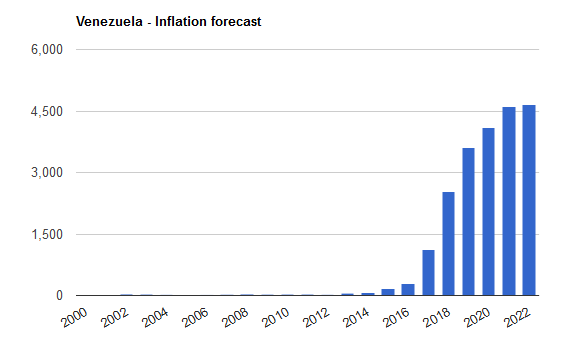

Venezuela’s economic situation is unstable because of hyperinflation; the country’s average annual inflation rate has rocketed to between 1,100% and 2,000% in recent years despite strict currency controls. In terms of economic growth, Venezuela occupies the last place among the 32 countries comprising the American region (“The World Factbook: Venezuela” 2018). The country’s currency is viewed as highly unstable because of these processes, and the inflation level shows a continuing upward trend (Figure 1; “Venezuela: Inflation Forecast” 2018). As a result, companies have limited access to external financing associated with price and currency controls.

As a consequence of the dual exchange rate system in the country, about 20% of the country’s population lives below the poverty line, and shortages of basic consumer goods and resources are common (“Economy – Venezuela” 2018). It is important to note that the government has responded to the economic crisis by intensifying state control over the country’s economy. Venezuela’s Index of Economic Freedom, a figure that demonstrates the level of economic autonomy in the country from state control, is 25.2 out of 100, an extremely low number. Furthermore, the risk rating for the business environment is high (E) (“Venezuela: Government” 2018), and the unemployment rate in the country is 24.6% (“The World Factbook: Venezuela” 2018).

Cultural Issues

Business communication in Venezuela is based on the principles of open and direct interaction. Venezuelans prefer to discuss working questions openly, and they try to get right to the point when arguing and participating in business discussions. Negotiations can take much time, and it is important to avoid confrontation, but interruptions when speaking are possible. The highest-ranking officials usually make the final decision as a result of any conducted meeting or negotiations (“Economy – Venezuela” 2018). Venezuelans’ skills can be characterized as being less developed than those of citizens in other Latin American countries because of the population’s limited access to education and training (Hill, Hult, and McKaig 2018).

Factor Endowments

In Venezuela, the key factors of production include mineral resources, natural raw materials, and labor. As the country is a leader in the oil and gas industry in the region, the Venezuelan government is interested in attracting resources to this sphere in terms of foreign capital and a professional labor force. Even though the government highly regulates the production of petroleum products and natural gas, several options for attracting foreign direct investment to this industry remain open (“Economy – Venezuela” 2018). Furthermore, a development that involves exploiting deposits of iron and other minerals in the country is attracting much attention.

However, this area is not currently viewed as appropriate for attracting foreign capital, even though Venezuela offers mineral resources that include not only iron but also bauxite, nickel, limestone, copper, zinc, lead, and phosphates. Foreign investors are also interested in other natural resources found in Venezuela, including gold, coal, and diamonds. Such industries as the hydrocarbon industry, the exploitation of minerals, and the production of chemicals, as well as construction, are viewed as having the potential to benefit the country’s economy (“The World Factbook: Venezuela” 2018). Still, a range of barriers for investors is associated with the fact that these industries are nationalized and highly regulated by the government.

Much attention should be paid to analyzing the available labor force in the country. Although the poverty level has decreased in comparison to the country’s situation in the 1990s and school enrollment has increased, the percentage of poorly educated individuals in the country remains high. More than 40% of the country’s population is aged 25–54 years, and they represent the workforce in Venezuela (“The World Factbook: Venezuela” 2018). In addition, the majority of middle-aged individuals belonging to the middle class have emigrated in recent years. The gap in the educated and professional labor force can be attributed to such key reasons as the unstable political and economic situation in the country, hyperinflation, and unemployment. Oil and gas engineers are choosing to migrate to the United States and Canada, while the oil and gas industry of Venezuela is attracting unprofessional migrant workers from other Latin American countries.

Analysis

In the process of focusing on the findings related to the assessment of the country’s macroeconomics and factor endowments, it is essential to determine certain risks and benefits of expanding to Venezuela shortly. First, it is important to concentrate on the attractive features of doing business in this country. These include the presence of natural resources and minerals, the promoted oil and gas industry, and an available youthful and cheap unskilled workforce. Furthermore, the country’s infrastructure in terms of the number and quality of available airports is also appropriate for supporting trade relations.

Thus, the country primarily attracts multinational corporations operating in the oil and gas industry. Furthermore, Venezuela is attractive to companies involved in manufacturing iron, bauxite, and coal, and firms working in the hydrocarbon industry can also try to develop partnership relationships with Venezuelan companies (“The World Factbook: Venezuela” 2018). Even more important, investors may also find legislation regarding the attraction of and support for foreign direct investment interesting because no discriminatory practices are being aimed at foreign investors. However, some important regulations still must be taken into account when investing in the country’s governmental sectors.

Risks associated with expanding to Venezuela include strict governmental control over exchange rates and financial operations, political and economic instability, bureaucracy, a lack of transparency, and scarcity in terms of a skillful workforce. Furthermore, the level of IT development is a limiting factor in attracting online businesses to the country (“The World Factbook: Venezuela” 2018). From this perspective, negative political and economic factors are leading to a decrease in the purchasing capacity of consumers as well as hyperinflation, and strict regulations regarding business operations are making the country unattractive to different foreign firms and investors, except companies operating in the oil and gas industry (Koivumaeki 2015). The country’s Index of Economic Freedom is low, and potential risks associated with corruption and bureaucracy are high. As a result, Venezuela can be viewed as an attractive market only for companies in the oil and gas sector, the construction industry, and the production of minerals.

Recommendation and Conclusion

The analysis of risks and benefits of expanding the Canadian company’s business operations to Venezuela indicates that this market is currently inappropriate for investment. Although the country’s legislation supports foreign direct investment, Venezuela provides opportunities for entering only the oil and gas industry, highly regulated by the government, and the construction and hydrocarbon industries. Those industries associated with innovation, retailing, tourism, and information technologies are not appropriate for investment and expansion at the current stage of the country’s economic development. The problem is that Venezuela’s prolonged economic crisis, political instability, and inflation, along with the government’s control over exchange rates, are harming attracting foreign capital to the country.

Therefore, it is possible to recommend that the Canadian company pursue an expansion to the country only in the form of operations in the oil and gas, construction, and mineral production industries. These industries are promoted in Venezuela, and the presence of a cheap labor force holds the potential for receiving certain revenues. On the other hand, this country is unattractive for firms that specialize in producing consumer goods because of the problematic social situation in the country and the low purchasing capacity of its citizens. From this perspective, the possibilities for expanding to Venezuela are limited, and its current political and economic situation strongly negates considering its markets as attractive for different types of investments.

References

“Doing Business in Venezuela.” 2018. The World Bank.

“Economy – Venezuela.” 2018. Government of Canada. Web.

Hill, Charles W. L., Tomas Hult, and Thomas McKaig. 2018. Global Business Today. 5th ed. New York: McGraw-Hill Irwin.

Koivumaeki, Riitta-Ilona. 2015. “Evading the Constraints of Globalization: Oil and Gas Nationalization in Venezuela and Bolivia.” Comparative Politics 48 (1): 107-125.

“Venezuela: Government.” 2018. Global Edge.

“Venezuela: Inflation Forecast.” 2018. The Global Economy.

“The World Factbook: Venezuela.” 2018. Central Intelligence Agency. Web.