Abstract

Accounting and finance are critical elements in the efficient management of a company. The information gathered from accounting analysis helps a company or an organization make day-to-day decisions. This study’s objective is to determine how effective accounting and finance are in eradicating or reducing risks from a company’s operations. The current study formulated the data collected analyzed it, thus helping in getting the intended results. The outcome of the analysis conducted was then used to conclude on the relevance of accounting and finance in business. This indicated the vital role of accounting, which helps mitigate the financial problems that may make a company lose its position in the industry it occupies. The present research recommends that businesses should treat accounting with utmost concern as it affects the way companies perform in different periods.

Introduction and Mini-Literature Review

Accounting refers to the process in which a company undertakes its financial transaction records. According to Zeff and Dyckman (2020), the process involves summaries, analyses, and reports of every financial activity within the organization over a specified period. The information can then be relayed to different stakeholders such as agencies, taxation authorities, and regulators. These financial summaries enable an organization to understand its operations over the time of its operation, for instance, enabling the firm to understand its financial and investment health and cash flows (Ionescu, 2017). Consequently, accounting acts as an oversight on a business’s performance by monitoring financial and accounting rules and directives, which safeguard the quality of institutions’ finances and ensuring the integrity of accounting error financial statements. Supervising a company’s financial performance ensures that it uses its funds according to its needs, reports them for proper documentation, and avoids possible risks on a company’s pension plan (Phan & Hegde, 2013). Therefore, accounting and financial processes are essential in a company as they help the organization mitigate any risks that may arise within a company.

Research Questions

The current research utilizes the following research questions to understand the concept of account and financial processes of an organization.

- To what extent can companies’ financial characteristics determine pension asset allocations?

- Can these models based upon accounting and finance data be improved by including corporate governance information?

- Given the timeframe of your analyses, what evidence can you provide as to the main cause(s) for companies change their pension asset allocations?

Financial Characteristics

Several financial characteristics relate to a company’s revenue across its different shareholders, income, expenditure, and grants or loans. According to Kingwell and Xayavong (2017), the main principles common in all these features are relevance, comparison, integrity, flexibility, and accuracy. However, each of these features can vary from one financial aspect to another from organization to organization. Moreover, the analysts’ approach may make them differ in terms of structure and data.

The relevance of any financial information is critical, especially when it is supposed to be presented to investors and regulators. According to Perevozova et al. (2020), the basic formula of the planning and implementation of established accounts sets out that the information supplied by the commercial institution to the consumer’s judgment needs must be applied to be helpful. The knowledge is pertinent as the judgmental economic consumer is affected by the evaluation, validation, or correction of historical, current, and future events. However, all pertinence is doubtful by some scholars, such as Ouda (2021) and Guragai et al. (2017), who opine that some information that is relevant to the vendors or consumers are not disclosed. Therefore, the accounting information given by a financial expert should reflect on the need of the consumer of such data.

The essence of providing financial data to the investors or regulators is to enable them to compare how one organization performs relative to another. According to Guragai et al. (2017), the general structure of the preparation and presentation of financial statements must allow consumers recognize financial situation and performance trends, which depict performance trends of their entities. Turner et al. (2020) reveal that enabling the ease of comparability requires the analysts to employ field and evaluation techniques, which enable the targeted consumer to distinguish correlations and variations, thus characterize the different time frames or organizations within the same industries. Therefore, it is critical to note that providing comparable information requires consistency in the approach taken by the company’s accountants.

One of the most fundamental elements of accounting is its integrity. According to Alamad (2019), accounts must be honest and forthright with their consumers of the financial data they prepare. In addition, the accountants must refrain from targeting possible personal gain loopholes or take advantage of the confidential information they retrieve from the firm’s financial performance. However, there are times when there could be differences in the applicability of the various accounting laws. In such cases, accountants must avoid any possible intentions to seize an opportunity that can make them deceive or manipulate the financial information they are required to prepare.

Flexibility in financial information is critical for consumers. Therefore, the financial analyst should design the accounting approach to accommodate subsequent changes that may result from the company’s future operations. This enables the company to take advantage of future developments in the industry without incurring additional costs (Ali & Oudat, 2021). Thus, the company can find better ways to expand and dominate new and emerging markets.

In summary, the data provided by an accountant should be accurate and give the completed records, which a company needs to run correctly. This indicates why the financial analysts need to ensure that the data is relevant and provides ease of comparability from the beginning. Moreover, it must be flexible to meet the future needs of the business since, according to An et al. (2014), the forecasts should enable the company to meet or exceed its financial obligations. The figures produced should be accurate and consistent when run or performed by several accountants. Professionals in the accounting sector must understand the value of their integrity when working with a company.

Methodology

The research plan is described as a model for performing an analysis that maximizes influence over variables that may impair the validity of conclusions. Scholars use survey and post-facto analysis architecture. The survey analysis architecture allows research, while the Ex-post de facto design has been used to collect input from the company’s employees, so researchers manipulate this data instead of primarily studying the variables that provide answers to the research questions that have been considered. The study utilized 1405 employees of Company Echo from five (5) departments, who were given the primary data in a questionnaire with a return of 364.

The contingency theory informed the approach taken in the present study’s data collection. Hofstede (1967), as cited in Venkateswaran and Ojha (2019), is a classical model for this study based on a contingency theory advanced by Fred Riedler (1958), which focused on the adequacy of accounting information for the making of indecisiveness in the management of aid and one of the earliest works on management accounting research with an immediate perspective. The principle of contingency was also generalized to the subunits of companies since the factors derived from accounting details such as dividend, earnings per share, stock return, return on asset were all used by management to assess performance. The model of regression below was used:

AIA = f (ROA, ROE, EP) …. (1)

Where:

- AIAM = Accounting Information Availability to Management

- ROA = Return on asset

- ROE = Return on equity

- EPS = Earnings Per Share

- The ordinary least square of the equation is stated thus:

- AIAM = bo+ b1ROA + b2ROE + Beps3 + e…. (2)

Where:

- AIAM = Dependent variable

- ROA, ROE, and EPS = Independent variables

- bo = unknown constant to be estimated b1, b2, and b3 = unknown coefficient to be estimated

- e = stochastic error term

Data and Analysis

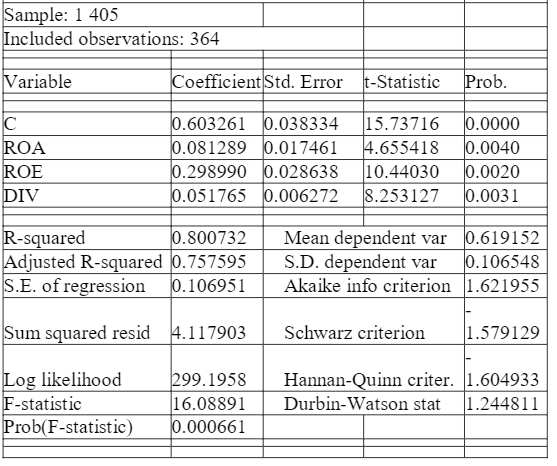

This section presents the findings from the analysis conducted based on the data collected. Table 1.1 below shows the output from the analysis and subsequent explanation of every variable used in the analysis.

Considering: R2, Adjusted R2; t-statistics; and F-statistics, Durbin-Watson statistics. These statistics have been used in measuring the effects of accounting knowledge on management decisions. The Adjusted R2 illustrated the fitness of the regression model used for this analysis and demonstrated how the dependent variable was different. The modified R2 is very significant in this analysis since it is multiple regression and is the standard for this type of research. The t-statistics were used to study the impact of the independent variables on the dependent variables. The F-statistics were applied to measure the significance and auto-correlation of first-order random variable explainable variables as a whole, and the Durbin Watson statistics were used.

Table 1.1 presents the analytical consequence of the Ordinary Lower Place (OLS). The results indicated in Table 1.1 that a 0.80 R2 and 0.76 R2 have been adjusted, revealing that 0.80 of the dependent (ROA, ROE, and EPS) variables (remaining 20 per cent) were defined by the standalone knowledge management variable, while stochastic mistake or other variables not included in that model were captured by the remaining 20 per cent. The modified R2 further confirms that the parameters of approximation are correct. The exact variance described by the independent variable is seen (accounting information available to management).

In order to calculate the impact on management judgment of the Accounting Facts, the following statistical parameters were considered: R2, Adjusted R2, t-statistics, F-statistics, and Durbin-Watson statistics. The research was conducted using the R2 to calculate the correlation degree of the dependent variable to the independent variables or the variance level of the dependent variable, which was captured in the study by the independent variables. The Adjusted R2 explained the goodness of the fitness of the regression model used in this analysis and the individual variance of the dependent variable that the independent variables explained. In this work, the modified R2 is very significant as it is a repeated regression, which is the norm for this nature analysis. In t-statistics, the importance of the independent variables on the dependent variables was examined. For a first-order auto-relationship evaluation of the random variables, F-statistics is used to test the significance of explicatory variables as a whole on the dependent variable and Durbin-Watson statistics.

Results

Table 1.1 shows the empiric outcome of the Ordinary Last Square (OLS), revealing that R2 is 0.80 and R2 is 0.76 changed. This means that the real change (accounting knowledge available for management) explained in the independent variable is 0.76 per cent of the contingent (ROA, ROE), while the rest is 24 per cent of the stochastic error. With a positive sign of 15.73716, the constant word entered in the model is relevant with a meaning level of 5 per cent. The constant word entered the model with a positive sign and individual t-statistics in order to test the statistical importance of the econometric variables used in the analysis using the t-statistics or the individual parameters of the model.

The outcome of an F-statistic is the table value 16.08891>2.93, which reflects the general importance of the econometric model as per ANOVA on the F-statistic. The model used in the analysis suits the data well and is consistent with the principle of econometrics. The statistics for Durbin Watson vary from 0 to 4, and the law of choice is that a value of around 2 is not automatic; a value to 0 is positive self-relationship, and a value to 4 shows a negative self-relation. DW=1,244811, d1=0,525 and DV-2,016 were computed because K= 4 factors, n=10 years at 5% significance levels. The model, according to the laws, is within the acceptable range and therefore free from auto-correlation.

Based on the analysis conducted, companies’ financial characteristics are critical determinants of asset allocation. The R2 was used to calculate the extent of the correlation from the dependent variable to the independent variables or the extent of the variability from the dependent variable, which was measured in the independent variables used in the study. This shows that the relevance, comparison, integrity, flexibility, and accuracy of any accounting process are critical in pension asset allocation.

Asset allocation is one of the most critical decisions made by the pension schemes based on the significant effect on the scheme contribution rate and financial position and the total ratio of the sponsoring organizations. In this analysis, the R2, Adjusted R2, t-statistics, F-statistics, and Durbin-Watson statistics indicate that asset allocation has a significant effect on investment performance and depends highly on the knowledge of the company’s management.

The current study has also revealed from the analysis that several factors can affect how companies can change their pension asset allocations. In particular, the Tepper and the tax arbitrage strategies of black are the most common as revealed in the analysis, especially from understanding the role of a company’s management in asset allocation (Anantharaman & Lee, 2014). The management’s decisions are critical, especially in the context of the shift in market equity, which significantly affects the company’s fund. It can be inferred from the analysis that the structure of the scheme liabilities also affects pension asset allocation since some DP schemes are mature with few or no active members, while others are immature with primarily young members.

Conclusion

During this report, several works were examined, within different departments, showing a connection between the availability of accounting information and corporate success. The findings of the analysis found that the provision of accounting knowledge for management has a pleasing effect on the success of Company Echo. The success of accounting factors like ROA, ROE, and EPS is a feature of the management’s strategic judgment.

The report’s stance is consistent with many of the analyses undertaken by academics and analysts based on accounting indexes, which often comply with the conclusion of the analysis, in and outside a company. It is also critical, in short, that any organization is well-structured and accountable since any prediction that is considered in the future depends on the knowledge the management may have.

References

Alamad, S. (2019). Financial and accounting principles in Islamic finance. Springer International Publishing.

Ali, B. J., & Oudat, M. S. (2021). Accounting information system and financial sustainability of commercial and Islamic banks: A review of the literature. Journal of Management Information and Decision Sciences, 24(5), 1-17. Web.

An, H., Lee, Y. W., & Zhang, T. (2014). Do corporations manage earnings to meet/exceed analyst forecasts? Evidence from pension plan assumption changes. Review of Accounting Studies, 19(2), 698-735. Web.

Anantharaman, D., & Lee, Y. G. (2014). Managerial risk-taking incentives and corporate pension policy. Journal of Financial Economics, 111(2), 328-351. Web.

Guragai, B., Hunt, N. C., Neri, M. P., & Taylor, E. Z. (2017). Accounting information systems and ethics research: Review, synthesis, and the future. Journal of Information Systems, 31(2), 65-81. Web.

Ionescu, L. (2017). Productivity accounting and business financial performance: a review of current evidence. Economics, Management, and Financial Markets, 12(2), 67-73. Web.

Kingwell, R. S., & Xayavong, V. (2017). How drought affects the financial characteristics of Australian farm businesses. Australian Journal of Agricultural and Resource Economics, 61(3), 344-366. Web.

Ouda, H. (2021). Accounting and politicians: A theory of accounting information usefulness. In Practice-Relevant Accrual Accounting for the Public Sector (pp. 255-306). Palgrave Macmillan, Cham.

Perevozova, I., Horal, L., Mokhnenko, A., Hrechanyk, N., Ustenko, A., Malynka, O., & Mykhailyshyn, L. (2020). Integration of the supply chain management and development of the marketing system. International Journal of Supply Chain Management, 9(3), 496-507. Web.

Phan, H. V., & Hegde, S. P. (2013). Corporate governance and risk taking in pension plans: Evidence from defined benefit asset allocations. Journal of Financial and Quantitative Analysis, 48(3), 919-946. Web.

Turner, L., Weickgenannt, A. B., & Copeland, M. K. (2020). Accounting information systems: Controls and processes. John Wiley & Sons.

Venkateswaran, R. T., & Ojha, A. K. (2019). Abandon Hofstede-based research? Not yet! A perspective from the philosophy of the social sciences. Asia Pacific Business Review, 25(3), 413-434. Web.

Zeff, S. A., & Dyckman, T. R. (2020). Accounting and business research: The first 50 years, 1970–2019. Accounting and Business Research, 50(4), 360-395. Web.

Appendices

Appendix 1: The Questionnaire

The questionnaire presented here is used to collect data which was majorly and only used for academic purpose. The information gather is treated with uttermost confidentiality. No names or any kind of identification shall be written or inserted. Attempt all the questions presented by either selecting the checkbox or writing.

First Section: Biological Data

State your gender:

- Male ☐

- Female ☐

Department working under at Company Echo …………… ………… …………… ……………

The during you have worked in the department mentioned above

- 1 to 5 yrs ☐

- 5 to 10 yrs ☐

- 10 to 15 yrs ☐

- excess of 15 yrs ☐

Highest level of education ………. …………………. …………… …………… ………………

State your job group ………… …………… ……….

Which position do you hold in the company ………… ……… ?

To which level are you agreeing that Accounting Managing Systems have helped you perform better or simplified your work?

- Strongly agree ☐

- Agree ☐

- Not sure ☐

- Disagree ☐

- Strongly Disagree ☐

What is the type of AMS do you use?

- IFMIS Internet Banking VMS

- IFMIS – Integrated Financial Management Information System

- VMS – Virtual Management System.

Second Section: Assessing and Determing Risk

State to the extent the assessment and determination of the involved risk may affect the deployment of RBIA (Risk Based Internal Audit) at Company Echo:

- No extent ☐

- Great level of extent ☐

- Very Little ☐

- Moderate level of extent ☐

- very great level of extent ☐

Check by marking a mark the level to which you agree with the listed statements which relate to the risk assessment and RBIA determination at Company Echo.

In your own words, what do you think should be improved in risk assessment putting into perspective the Accounting Management System?

……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ……………… ………………… ……………… ………… ………………… ……………… …………… ……………… ………..

Third Section: Employee’s Attitude and Views

Using your own words, to which extent do you think the attitude of the employee’s adaptation of the Accounting Management System?

……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… …………….

Choose from the table the level to which you think you agree with the statements listed in regards to attitude of employees and adoption of accounting management system.

Have you encountered a challenge using the accounting management system due to your colleague attitude?

……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… …………….

What do you see fit to be done to improve employee’s adoption of the accounting management system?

……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… …………….

Fourth Section: Monitoring and Evaluation

What do you think is the extent to which monitoring and evaluation may affect the adoption of accounting management system?

- No extent ☐

- Great extent ☐

- Little extent ☐

- Very great extent ☐

In your own words, suggest what you think is best to be done in regards to awareness in your department to enhance accounting information system.

……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… ……………………… …………….