The Microenvironment and Drivers of Changes

Apple is one of the few luxury electronics brands, making it one of the greatest success stories. According to this criterion, the company provides high-quality and innovative products. This moment has led to fierce competition in the industry, with price being the main differentiator. Apple’s talented research and development team has helped the company’s products lead the market in innovation, performance, and reliability. Compared to other market products, Apple develops and sells cutting-edge hardware, software, and Internet products to give consumers, students, educators, and creative professionals the best personal computing experience worldwide.

PESTEL Analysis

Political and Economic Factors

The company’s financial strength and brand recognition restrict its geopolitical control. The corporation cannot manage terrorism, political instability, taxes, labor restrictions, or import laws (Peterdy, 2023). Apple’s markets are primarily in emerging nations, where political stability has led to minimal government involvement, which is beneficial for business.

Apple will gain new markets if developing countries strengthen free trade policies (Peterdy, 2023). Ultimately, the strength of the economy is a key factor in determining purchasing power and needs. Recent increases in unemployment rates worldwide have led to a decline in global Apple product sales.

Social and Technological Factors

Apple’s competitive edge is primarily based on design and quality, making its products attractive to prospective buyers. However, the high cost of the brand’s goods makes it difficult for most people to afford them (Peterdy, 2023). Since high-end users are the brand’s intended market, developed markets with sizable middle-class and first-class populations have seen the brand enjoy massive sales volumes. As a leading technology company, it has generated substantial profits.

Massive expenditures in R&D have enabled the corporation to be inventive and its products exceptional. Due to the increasing popularity of applications, cloud technology, and technological integration, the organization is facing challenges. Cloud-friendly gadgets would capitalize on the new technology. The firm should also offer goods with easy connections to promote interaction with the growing app industry and increase its presence in the app store.

Ecological and Legal Factors

Global environmental awareness requires eco-friendly corporate practices and environmentally friendly goods and services. Apple’s product recycling is a green business leader. The firm is also researching energy-efficient goods (Apple, 2020a). The business is exploring ways to minimize product heat and utilize sustainable energy sources, such as solar and wind.

The primary legal concerns that the corporation must address are the new privacy laws. It is not easy to keep information-transmitting gadgets private. This enables Apple to develop devices that provide enhanced privacy protection, which the market would find appealing (Peterdy, 2023). Several governments enforce stringent telecom laws, which will undoubtedly endanger the business.

Opportunities

Opportunities may impact an organization’s current and future conditions. With the world’s population expanding rapidly and the average person’s purchasing power increasing, there is an opportunity to develop new markets where customers may seek or be inclined to purchase high-end Apple products. The company’s internet sales and collaborations with other organizations have increased in recent years. The target market for future products might be the youthful population, which has a fascination for new technological devices. Products like the most recent iPhones have generated a new group of prospective clients.

Threats

Apple Inc. has faced stiff competition from Dell, Sony, HP, and Toshiba in the laptop market over the past few years. Another risk is that users may download music for free instead of purchasing it through iTunes. Since cheaper alternatives are available, the product’s high price is a threat. The long-term recession might harm its goods.

Uncertainty/Impact Analysis and Scenarios

Coronavirus Pandemic

In the 3rd quarter of 2020, Apple Inc. experienced a 21% decrease in iPhone revenues, resulting in a severe decline in profit. This confirms the fact that Uncertainty and Impact are at a high level (Apple, 2020a). The coronavirus pandemic has significantly impacted the global situation and altered the lives of many. People were forced to change their life habits and adapt to a new environment.

Megatrend of Sustainable Future

Long-term sustainability trends reduce uncertainty to a medium level. The effect on Apple Inc. and its rivals remains considerable (Apple, 2020a). The latest iPhones are 98% recycled, 93% of the packaging is fiber-based, and chargers and earpods are not included in the initial sales package.

AI/High-tech Trends

AI algorithms, robotics, and High-Tech are sophisticated technologies that require time and enormous effort for development and testing. Therefore, uncertainty is low, while the impact is medium, as there is no massive production yet. With the continuous development of technology, Apple is expected to keep pace with the times and introduce more advanced and unprecedented innovations (Apple, 2020a). There are rumors that Apple plans to enter the car industry and produce its own smart, autonomous cars in the future. They have collaborated with Hyundai to work on self-driving car design and development. It is expected to be introduced between 2025 and 2027.

Rise of Contactless and Mobile Payments

Apple has already introduced contactless payment possibilities in most countries. Moreover, Apple introduced Apple Pay Cash in the United States. This feature allows iPhone users with iOS 11 or later to transfer money via iMessage to contacts without needing to use banking apps. In the near future, Apple may consider expanding Apple Pay Cash to other countries, making the lives of its audience members easier and money transfers faster.

Scenario Planning

One scenario that could impact the PC industry is an economic downturn. In this scenario, decreased consumer spending due to an economic recession could lead to a decline in demand for PC products and a corresponding decrease in revenue for companies like Apple. To respond to this scenario, Apple may need to focus on cost-cutting measures and product innovation to maintain market share and revenue (Apple, 2020a). This could involve reducing production costs, streamlining operations, and developing new products that meet the changing needs of consumers during an economic downturn.

PC Industry Analysis

Apple’s History in the PC Industry

The absence of extra hardware and compatible software for Apple’s products was one of the key reasons the company struggled in the PC business. Apple has used both horizontal and vertical integration. The business relied heavily on its research and development, and did not allow third parties to certify its technology. Additionally, the cost of PCs was a problem for Apple (Apple, 2020a).

Early in the PC era, Macintosh had a devoted following that enabled it to command a high price for their products. The development of Wintel was another factor contributing to Apple’s struggles. Wintel, which combined Windows with an Intel CPU, ruled the market (Apple, 2020a). Around the foundational components of Microsoft and Intel, thousands of PC manufacturers have constructed PCs. Apple struggled to compete fiercely with rival PC makers like Lenovo, HP, and Dell.

Porter’s Five Forces Analysis

The five competitive forces are threats from new competitors, consumer bargaining power, the prospect of replacement goods, supplier bargaining power, and competition among competitors within an industry. Determine Apple’s market position using Porter’s Five Forces framework.

The Intensity of Rivalry Within the Industry

The fierce competition in the IT sector gives Apple an advantage over its competitors due to its commitment to providing consumers with greater technical support, fostering customer loyalty, and ultimately producing better products. The fact that Apple has never had to put its goods on sale demonstrates the competitive edge the business enjoys over its rivals. This results from the company never discounting its goods to produce better goods.

Bargaining Power of Suppliers

Samsung is Apple’s leading component supplier, making it a direct rival. This gives the suppliers significant negotiating strength. To break Samsung’s monopoly, the business is attempting to increase the number of suppliers while simultaneously reducing the negotiating leverage its suppliers have.

The Bargaining Power of the Buyer

Segmenting a consumer base to satisfy their demands is a brilliant idea for a business. By categorizing clients based on shared wants and preferences, or segmentation, a business can better understand its customers and develop goods that cater to their demands. Due to great consumer loyalty, purchasers have less negotiating leverage.

The Threat of New Entrants

Introducing new firms into the IT industry indicates a potential decline in Apple’s market dominance. However, the exorbitant costs of entrance make the danger of new competitors to Apple relatively modest. Additionally, it is more difficult for new competitors to threaten the company due to its strong financial position, excellent customer loyalty, and excellent brand image.

The Threat of Substitute Products

There is a significant likelihood of replacement if the customer’s requirement is universal. The danger of replacement results from considering the product’s pricing or performance. These are the main factors influencing consumers’ decisions to purchase and switch brands.

The risk of replacement based on performance is minimal with items that provide excellent quality. However, the high cost of its products, which deliver performance nearly identical to or better than that of its competitors, increases the likelihood of replacement. However, the brand’s strong customer loyalty reduces the risk of competition.

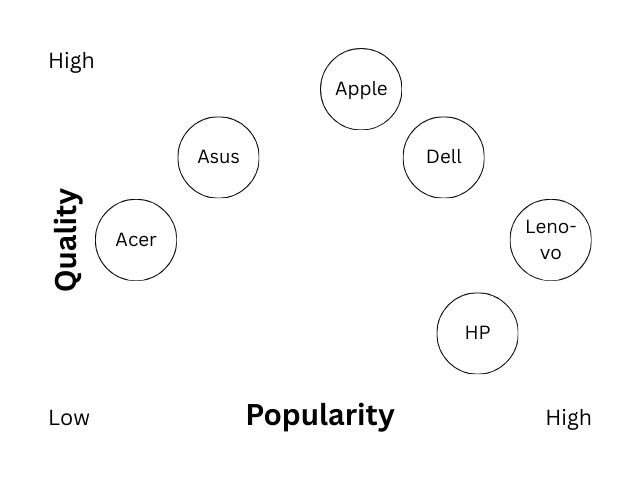

Strategic Group Map and Position

Apple’s strategic group position in the premium segment of the PC industry is favorable. There is an opportunity for enhancement, such as gaming PCs, but there needs to be proof that it would benefit current audiences and the brand image. Apple’s premium position allows the company to maintain its high pricing strategy and focus on design and user experience. This approach has been successful in creating a strong brand identity and loyal customer base, as consumers are willing to pay a premium for Apple’s products. Additionally, Apple’s focus on premium products allows the company to differentiate itself from its competitors and appeal to a specific segment of the market that values high-end design and quality.

Competitive Advantage

Apple has led the PC industry due to various competitive advantages. They are innovative. The groundbreaking, easy-to-use Apple 2 transformed the PC world. It drove PC sales to $1 billion three years after its 1978 launch (Apple, 2022). Due to its horizontal and vertical integration, Apple has control over product software, hardware, and operations. The firm creates and licenses its software. The 1984 release of the Mac, with its user-friendly interface, outstanding industrial design, and technical proficiency, enabled Apple to enter new markets, such as education.

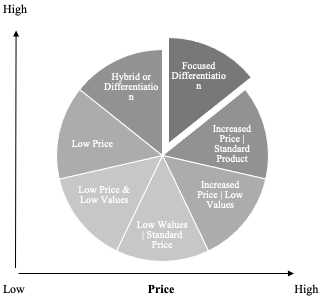

Strategy Clock

Apple’s strategy is “Focused differentiation” on Bowman’s Strategy Clock. The strategy explains this fact because the company provides its customers with distinctive product features. Apple Watch and smartphones enable users to conduct commercial activities, providing them with a distinct competitive advantage. Apple’s creativity has elevated the brand’s positioning to new heights. Customers often get a distinctive experience from Apple. Apple’s gadgets and accessories provide its customers with a human touch, enabling them to interact with these products.

Resources and Capabilities Underpinning Apple’s Competitive Advantages

Apple’s hardware and software integration, which prohibits third-party purchases, is crucial. Apple’s design teams, software developers, and hardware designers provide this capacity, which is hard to replicate. Brand equity enables a corporation to maintain its market leadership and client base through trust and exceptional customer experiences.

Apple is a customer-focused leader. Quality and customer service drive sales and brand awareness. Apple’s excellent market image benefits its marketing efforts. Apple’s quality and innovation make it a market leader.

Apple has always offered innovative goods and services. Despite their exorbitant prices, their items are popular. Apple’s marketing is so successful that rivals want to match its worldwide popularity and revenue growth. Apple’s “Think Different” attitude fosters innovation and drives the development of new products and technologies across all departments.

Resources

The majority of Apple’s resources are simple. The corporation is robust and competitive due to its physical resources (retail outlets), human resources (top management, staff, and suppliers), financial resources, plant and equipment, and technology. Apple then established a comprehensive distribution and supply chain infrastructure (Apple, 2022). Additionally, it maintains delicate relationships with Dell in the distribution industry and Microsoft in the software industry, which are both ‘win-win strategies’ between rivals.

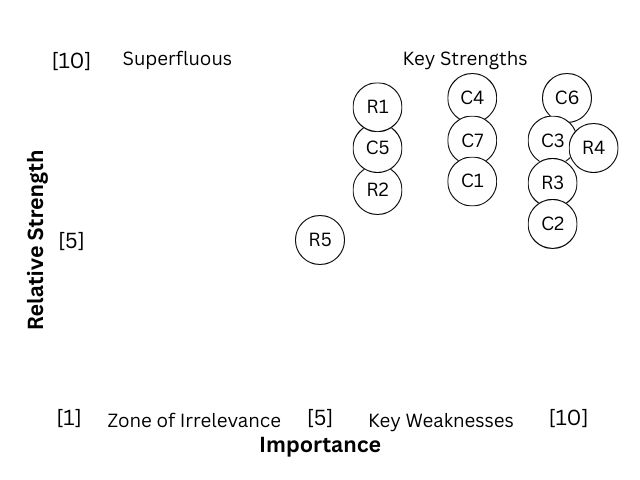

R. Grant “Strengths/Importance” Model to Assess Resources and Capabilities

Sustainability of Competitive Position in the Smartphones Industry

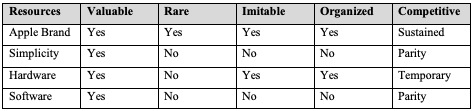

VRIO Model

The VRIO model is a resource-based perspective that analyzes a company’s potential to gain a competitive edge by strategically utilizing its resources.

Apple Inc. has dedicated attention to its internal advantages in producing iPhones, including its well-known brand name, cutting-edge technology, and intuitive user experience, to obtain an edge over its rivals.

Value

Apple’s biggest asset is its cutting-edge technology, easy-to-use gadgets, and portability. The goal is to consolidate several functionalities into a single product, providing Apple consumers with added value. Apple’s OS aesthetics also contribute to its product design and brand awareness. Its marketing staff and distribution channels—including iTunes, the Apple Store online, and its physical Apple Stores—are well-developed.

Rarity

They were the first business to make the smartphone commonplace. Apple’s products are entirely its own, owing to patents, which it vehemently defends in court. It includes the company’s operating systems, customer ecosystem, and design. The iPhone’s design is distinctive, high-quality, and simple to use, and it has become a status symbol among young people because of the rare and exceptional technologies that went into its creation.

Imitability

It is pricey and practically difficult to copy Apple’s resources and skills. Samsung, for instance, has several iPhone-like features. iTunes was created by record labels and artists to work with all Apple devices. However, companies that have identified the iPhone’s flaws can improve their designs and create better products, which could threaten Apple Inc. For instance, Google launched the T-Mobile G1, which might challenge the iPhone.

Organization

Despite lacking any early advantages, Apple was able to enter and dominate the portable music listening industry because of Tim Cook’s clear leadership, strong brand name and image, favorable business culture, and high level of organization (Apple, 2022). However, future iterations of its flawless designs and high-caliber products will still be able to produce them, so Apple should capitalize on the app market. Apple, therefore, commands a sizable and steady market. However, to advance, it must constantly update its techniques and technologies.

Apple’s Strategy for Apple Watch

Apple has dominated the smartwatch industry since 2015 with its Apple Watch approach. Tim Cook has promoted the Apple Watch as a fitness and health gadget rather than a smartphone attachment. Heart rate monitoring, activity tracking, and exercise tracking are reflected in the device’s design and functionality.

Apple’s emphasis on ecosystem development for the Apple Watch has been a strength. Apple has made the watch’s user experience smooth by connecting it with the iPhone and Mac. Apple’s collaborations with health and fitness companies, such as Peloton and Strava, have also helped establish the Apple Watch as a go-to gadget for fitness enthusiasts. Product design is another strength of Apple’s strategy. The Apple Watch is both beautiful and valuable, offering numerous customization options to suit individual preferences. This has broadened the Apple Watch’s appeal beyond techies and early adopters.

Investments

Because Apple Inc. positions itself as an independent company offering premium products with unique designs that appeal to changing trends in technology and consumer tastes, two investment options should be considered further: the development of Apple TV+ or the acquisition of a close competitor, such as Netflix/Disney+.

Developing Apple TV+

According to the investigation, Apple TV+ has excellent potential in the market, thanks to its exceptional tools and sophisticated design. The Apple TV+ supports Dolby Atmos sound, and its original series are available in 4K HDR (Anderson, 2019). Following the customer experience, Apple TV+ has an excellent performance in terms of quality assurance, with no glitches, lag, or other work-interfering problems (Anderson, 2019). It is an incredibly reliable and long-lasting service. As a part of the PR campaign, Apple offers a free year-long subscription to new customers (Anderson, 2019). The primary disadvantage of Apple TV+ is its limited program selection in the catalog.

Acquisition of Netflix and Disney+

As Apple’s current CEO, Tim Cook faces the challenge of identifying new areas of growth for the company beyond the iPhone, which has been a key driver of the company’s success over the past decade (Yoffie & Baldwin, 2018). Competitors like Netflix and Disney+, who have seen success in the industry, may be very advantageous for Apple to acquire. The Walt Disney Company announced that Disney+ has approximately 74 million members globally as of the last quarter of 2020, while Netflix reported that its total income in the third quarter of 2020 was over $6.44 billion U.S. Warner Bros., Universal Pictures, and Sony Pictures Entertainment are just a few of the companies with whom Netflix now has exclusive pay TV agreements. With 1,326 TV Shows and 4,339 movies, Netflix and Disney+ offer unique and original entertainment. On the other hand, Netflix’s geographic selection is limited due to the reduction in the number of movies and TV shows available outside the United States.

Additionally, a wide range of violent TV shows is available on Netflix, which alters how people view the world. For the youthful market sector, it is essential. In terms of Disney+, it is not designed specifically for adult material and is more oriented towards younger and family-friendly viewers. Apple Pay is already a successful product for the company, and there is potential for further growth in this area. Apple could expand its offerings to include additional financial services or partner with other companies in the payments industry to capture a larger market share.

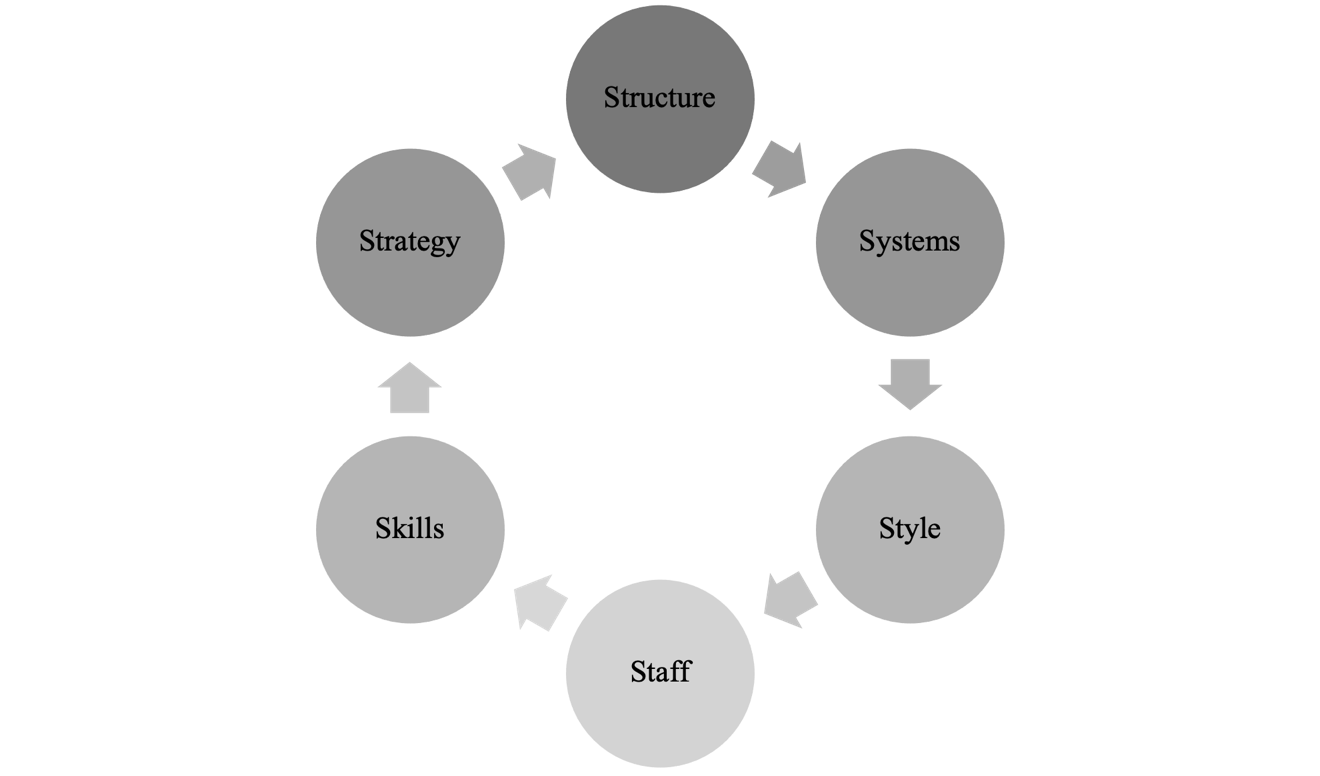

7S Model for Today and Future

Hard Strategies

Strategy

Apple differentiates itself via product design, innovative features, and capabilities. The company’s AirPods Max, the first over-ear headphones with bigger speakers, Apple’s Digital Crown, additional color choices, and longer battery life, is an example of improving everyday items (Patel, 2019). High client switching costs enable the organization to maintain and enhance connections with current customers, thereby providing more goods and services.

Apple Inc.’s exclusivity limits distribution. The firm carefully chooses its approved merchants. Apple can only offer new goods or services by potentially damaging its brand, as it faces high expectations for the end-user experience (Patel, 2019). Apple needs more experimentation to develop as quickly as Google in services and Samsung in hardware.

Structure

Apple Inc. is hierarchical and product-based. Software and hardware teams work together. Apple has product divisions. Thus, the company manages specific products or components for target customers (Patel, 2019). The hierarchical organizational structure gives top management significant control. Promotion possibilities and defined corporate roles motivate employees (Patel, 2019). However, business inflexibility and poor communication are drawbacks.

Systems

The company’s operational system covers staff selection, recruiting, assessment, team development, and orientation. Apple’s “Fellowship program” rewards strong contributors to motivate them (Patel, 2019). This helps the firm succeed. Apple makes high-quality goods using complicated and non-routine research techniques. Apple also utilizes a knowledge management system to store and retrieve its information/experience, thereby increasing understanding, cooperation, and achieving business process goals to promote performance (Patel, 2019). Apple restricts product specs and secrecy.

Soft Strategies

Style

Apple’s top management agrees on major business choices. Apple employs managerial leadership techniques. Managers inspire people to think creatively (Patel, 2019). Employees may conduct their own research, which fosters competitiveness and identifies innovative opportunities. However, deadlines, challenges, and the need for continuous improvement can increase staff anxiety and stress.

Apple managers inspire teamwork by showing empathy, trust, and respect. Apple’s transformative leadership approach allowed it to outperform rivals in product and service innovation (Patel, 2019). Their leadership approach inspires colleagues to share ideas and satisfy consumer demands. Managers support training and development to ensure their personnel can influence client purchasing behavior.

Skills and Staff

Apple is known for its innovation, quality, and R&D. The company’s value propositions are futuristic and distinctive. They can also predict and meet their clients’ needs for their goods. Apple staff must learn to operate under pressure to succeed. Motivated teams, accountable workers, innovation, and quality define the culture (Patel, 2019).

Apple encourages workers to communicate with all levels of management and provide ideas to enhance performance and quality (Patel, 2019). Apple’s recruitment procedure consists of an online application, a telephone interview, an assessment center, and a final interview. Thus, potential employees undergo several stages of recruitment to find the best fit for the company’s vision.

Shared Values

Apple was founded on the idea that everyone can and should make a difference. They aspired to develop good things and transform society. Apple customizes production (design and technology), PR efforts, and product delivery (retail outlets and internet page). Apple’s mission is to create the finest products and continually improve them to drive growth and development (Rowland, 2022). The company’s products encourage community participation with unique features. Apple culture promotes education (Rowland, 2022). They collaborate with HBCUs, minority-serving institutions, and others via AppleCare to empower students and instructors.

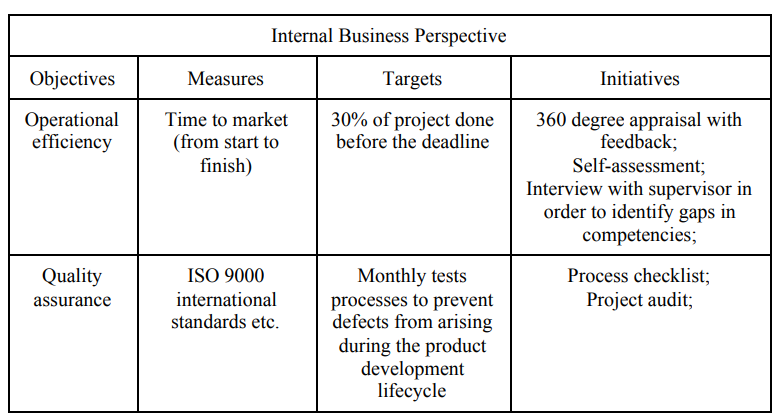

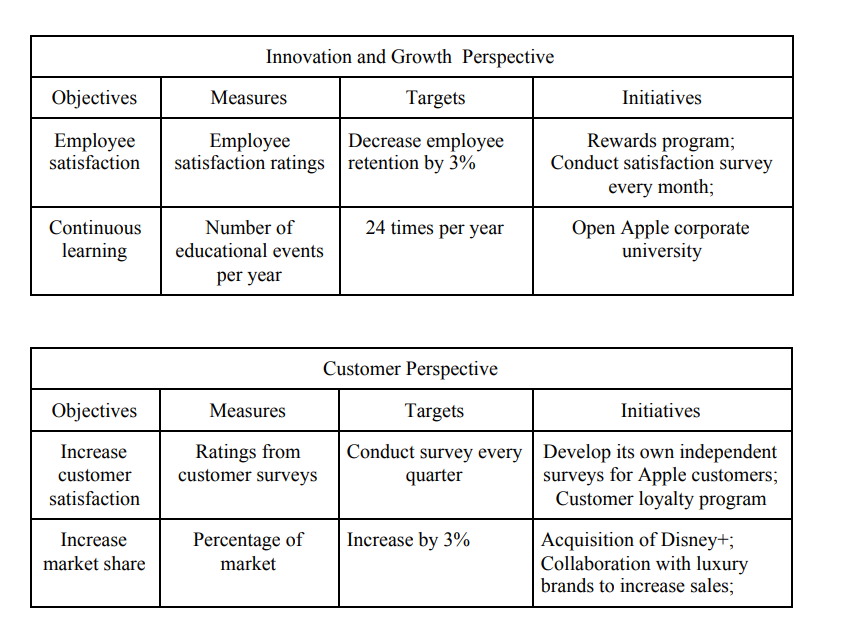

Balanced Scorecards

References

Anderson, J. (2019). Apple TV+ review: It’s cheap entertainment, but not much of it. TechHive.

Apple. (2020a). Product environmental report iPhone 12 Pro date introduced made with better materials tackling climate change.

Apple. (2020b). Apple commits to be 100 per cent carbon neutral for its supply chain and products by 2030. Apple Newsroom.

Apple. (2022). Apple leadership – Tim Cook. Apple.

Kaplan, R. S., & Norton, D. P. (2023). Putting the balanced scorecard to work. Harvard Business Review.

Patel, N. (2019). 7 key strategies that you must learn from Apple’s marketing. Neil Patel.

Peterdy, K. (2023). PESTEL analysis. Corporate Finance Institute.

Rowland, C. (2022). Apple Inc.’s mission statement and vision statement (an analysis). Panmore Institute.

Yoffie, D.B, & Baldwin, E. (2018). Apple Inc. in 2018. HBS No. 9-718-439.