The airline market in Australia has a monopolistic market structure. Monopolistic market structures are made up of a few enterprises that operate in a comparable market and provide similar but differentiated items to a large number of clients (Bertoletti & Etro, 2017). They set their prices depending on their market share and the degree of demand generated by each differentiated product. With a market share of 38.2 percent, Qantas Airways is the largest stable airline business in the economy, followed by Virgin Australia at 30.9 percent of total economic airline performance (Ma et al., 2019). Jetstar Airways is a competing and emerging company that is attempting to gain a significant market share.

Within the domestic destinations, there are more than two airline firms operating airline services. These airlines have minimal negotiating leverage on pricing and supply models. As a result, they cannot generate excessive profits in the short run and are all market price makers (Ma et al., 2019). These airlines’ capacity to set their pricing is dependent on the elasticity of the demand model. There is no market concentration since there are just a few airlines that serve the whole country’s economy. Qantas is the leading airline business in this economy and has a competitive advantage over other similar enterprises. This allows the company to make sensible decisions about ticket prices and advertising methods. Based on the business’s market share, it can be assumed that the firm charges comparatively low-ticket prices, which results in large client subscriptions and rising income over time. Increased revenue and operating profits are reinvested back into the company to expand operations and maintain the highest market share and stock in Australia’s airline sector.

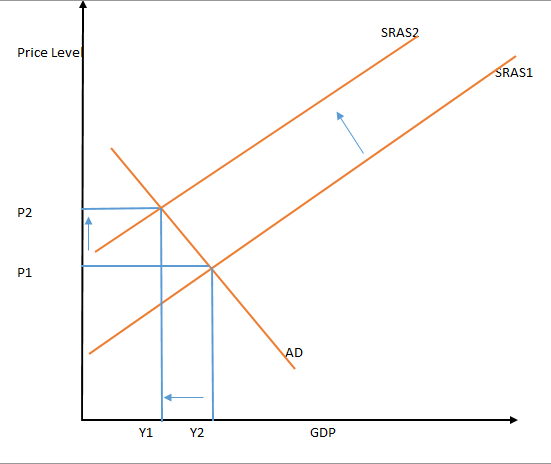

According to economic theory, price and supply have a direct relationship: as the price of a product rises, more businesses will enter the sector, increasing the supply of items in the market. This causes the supply curve to move to the right. In the case of oil, prices do not affect demand or supply. Because oil is used in every area of the economy, its need is never reduced.

If oil prices suddenly rise, demand for the commodity will fall. Consumer disposable income will fall if transportation costs or industrial operating costs rise as a result of price increases (Prest, 2018). This circumstance produces losses in industry and reduces supply. Government income will rise since the government will pursue a contractionary strategy during such times. Looking at the demand curve, price elasticities are seen to vary at different locations along the curve, with some price being extremely elastic while others are inelastic. An inverse demand function has constant elasticity in relation to price (Chung & Lee 2017). If demand is elastic, any price adjustment has a greater influence on demand. If demand is inelastic, a price change will have no effect on the product’s demand.

References

Bertoletti, P., & Etro, F. (2017). Monopolistic competition when income matters. The Economic Journal, 127(603), 1217-1243.

Chung, H., & Lee, E. (2017). Asymmetric relationships with symmetric suppliers: Strategic choice of supply chain price leadership in a competitive market. European Journal of Operational Research, 259(2), 564-575.

Ma, W., Wang, Q., Yang, H., & Zhang, Y. (2019). An analysis of price competition and price wars in Australia’s domestic airline market. Transport Policy, 81, 163-172.

Prest, B. C. (2018). Explanations for the 2014 oil price decline: Supply or demand. Energy Economics, 74, 63-75.