Introduction

The economic theory of investing pays much attention to the phenomenon of financial bubbles. In a general sense, bubbles are understood as an unreasonably sharp increase in the price of assets on the stock market, followed by a sharp decline when the bubble “bursts.”This is reflected in the terminological description of a bubble offered by Cambridge Dictionary: “an economy that becomes very successful very quickly, and which usually fails very suddenly” (Cambridge Dictionary, n.d.). The phenomenon of financial bubbles leads to the market having more influence over the real economy, although, under normal conditions, it should be the other way around. It is important to emphasize that the bubble effect is only valid for markets whose goods (assets) can be resold to speculate on the difference in value. It is noteworthy that the reasons for such bubbles are usually the same – it concerns speculative interest in assets that are probably new to the industry market; when they reach a high point, herd investors start to take profits, which causes the bubble to burst and the price of the asset to fall to its fundamental value. These are basic principles that are generally true of any financial bubble; among other things, this characterizes the cryptocurrency market and the meme stock market. This essay aims to critically examine and detail the phenomenon of one of the most recent economic bubbles, identifying lessons that can be learned from it.

Background

In a world of technology, the economy has long ceased to be tangible and has moved almost entirely to the digital value. Statistics show that by 2021, less than 10 percent of people worldwide used cash, with 80 percent of respondents clearly preferring the use of credit cards (Shepherd, 2020). One consequence of this trend is the fact that increased people are switching to the digital economy, prompting the development of new forms of cash equivalents — not the least of which are cryptocurrencies.

Cryptocurrencies are commonly referred to as digital currencies, which aim to decentralize the payment system. Thus, one of the characteristics of autonomous cryptocurrencies is the complete absence of an internal or external administrator, which means that the agenda of the stock market depends entirely on the behavior of cryptocurrency holders. The phenomenon of cryptocurrencies, which encourages users to invest real money in the “electronic number,” consists in complete independence and not being under the control of the authorities of any country so that no one except the holder of the decryption key has access to the individual’s assets. Consequently, one of the reasons for the active growth of the cryptocurrency market is the development of the dark Internet, in which illegal transactions are carried out without the knowledge of the responsible authorities (Ahvanooey et al., 2021). Social media and news feeds often report on the frenzied growth of cryptocurrencies, as a result of which the user can quickly become rich. For example, it is reported that a $1,000 initial investment in a cryptocurrency at the end of 2020 would bring the user over $287 million (Malone, 2020). Thus, cryptocurrency was one of the manifestations of the general liberalization of the Internet, which interested a large number of users who want to get rich relatively quickly, in their opinion.

Another the recent phenomenon of the digital economy was the emergence of meme stock, corresponding to the shares of companies that have become highly popular online. The central term in this name is “meme,” which means a unit of culturally relevant information. The term first appeared in the seminal work of biologist Richard Dawkins, but lately, it has taken on a slightly different context. Thus, the modern Internet meme corresponds to any digital information in any style of visualization that is transmitted between users, usually for entertainment purposes; if it reaches a rapid pace, such a meme is called a viral meme. This allows the formation of influential communities in which people share memes with each other in addition to essential communication.

The meme stock effect is based on the phenomenon of such communities. Community users, usually Reddit r/wallstreetbets, collectively select new companies worth investing in, as it has a predictable, rapid rise in profits. As a result, inexperienced users, motivated by the desire for quick wealth or entertainment, invest massively in the shares of a particular company, which, according to the laws of classical economics, leads to an increase in the price of those shares. That is, the shares are now trading at a price that is significantly higher than the fundamental value of the company’s stock prior to the collective investment.

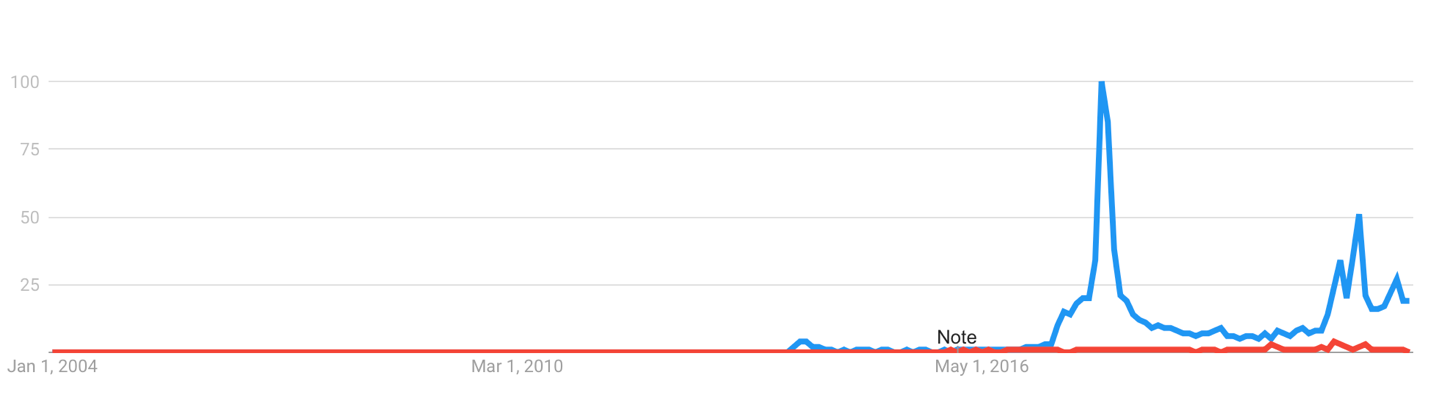

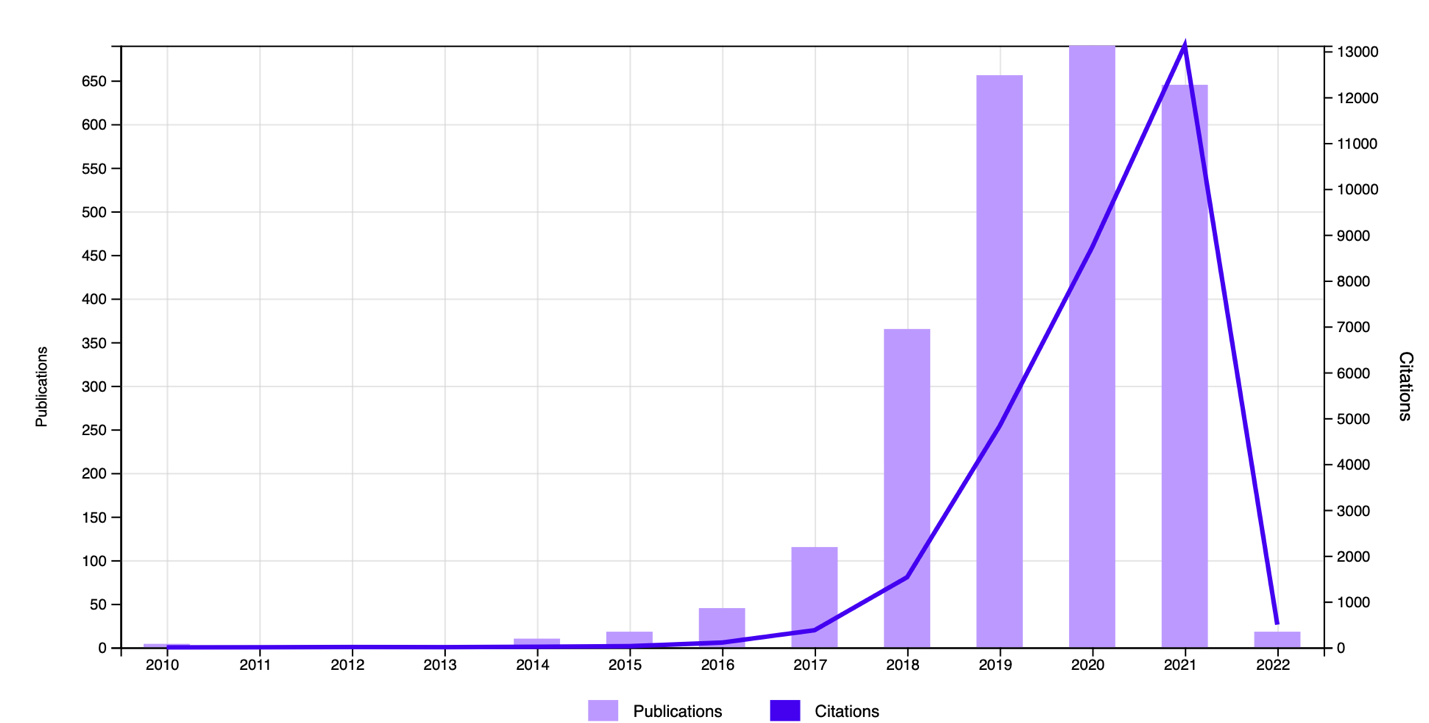

It is clear that both cryptocurrencies and the meme stock have only become relevant in recent decades, but more detailed analysis shows that the rise in popularity of such stock markets came even in the second half of the tens. Figure 1 perfectly demonstrates that cryptocurrencies have become especially popular with users after 2016, as the research dynamics in Figure 2 also confirm. In addition, Figure 1 shows that the meme stock has become a more recent phenomenon compared to cryptocurrencies. Much of this newness and increased popularity was due to the effects of the COVID-19 pandemic, which left many users locked at home: the only entertainment they had was related to social web communities.

Digital Bubbles

The above effects are perfectly reminiscent of how financial bubbles develop according to fundamental theory. Any gregarious investment in a short period of time does lead to a sharp increase in the price of a stock, multiples of its initial value. However, speculative interest is highly volatile, which means profit taking bursts these bubbles. The cryptocurrency bubble is rightly called one of the largest in the history of finance — exceeding even the dot-com bubbles. Indeed, the number of cryptocurrencies is constantly growing, and more new investors are actively investing their real money in such an alternative value. Many authors often compare such a market to tulip mania and pyramid schemes, calling these schemes fraudulent and lacking actual economic value. Drawing analogies, experienced investors and economists believe that the cryptocurrency market will not last forever: “do think that bubble is eventually going to burst” (Ferré, 2021, para. 3). Consequently, the two trillion dollars globally invested in this market may depreciate in a moment, leading to a serious economic crisis.

However, it is true to admit that not all reputable sources perceive cryptocurrencies as a bubble. For example, Orsini pointed out in his article in Forbes that although cryptocurrencies are associated with risks — just like any other investment — it is gaining solid consolidated value, and more multinational companies are turning to use cryptocurrencies (Orsini, 2021). Elon Musk and Mark Zuckerberg, opinion leaders and some of the wealthiest people on the planet, also own cryptocurrencies (Mukherjee, 2021). Among other things, cryptocurrencies are gaining legislative validity, and national governments are turning to the use of cryptocurrency as local money. Thus, cryptocurrencies have already become the new mainstream, meaning that a sharp drop in speculative interest in them is unlikely to occur.

However, little insight exists as to whether the meme stock will become the new bubble. The comparatively recent emergence of this phenomenon has led to the meme stock often being referred to as a silly fad or insanity that has nothing to do with fundamental investing (Hayes, 2021). However, practice shows that the collective efforts of users help revive companies, as in the case of GameStop. Figure 3 shows the dynamics of share prices after herd investing: even in moments of decline, share prices were at least five times higher than before the takeoff. Thus, to form a consensus on what the meme stock really is, bubble or mainstream, requires additional time to observe, even though the practice of the meme stock remarkably resembles bubble behavior.

Behavioral Investing

Both cryptocurrency assets and the meme stock are directly associated with the principles of behavioral investing studied this semester. Thus, one of the main pillars of these investors is herd mentality, which makes individuals unable to make critical, informed decisions but willing to listen to the crowd. In stock markets, this herd mentality is one of the key predictors of bubble bursts. The emotional component of investing in the meme stock or cryptocurrencies cannot be ignored either. Thus, low-income and middle-income people can permanently wish to increase their capital. This is especially true for residents of poor regions and people who have dramatically lost their money, for example, due to the detrimental effects of COVID-19. Motivated by multiple success stories and examples of opinion leaders, such people on emotion decide to invest their last money in cryptocurrency or short-term investing according to the instructions of the meme stock. Emotional investing, as well as herd investing, is not associated with a critical evaluation of investment strategies but is aimed at satisfying the immediate needs of the individual. As a consequence, it creates the problem of irrational investing, which can lead to success only if one is lucky; otherwise, the individual may part with his or her money, which has an even greater impact on emotional well-being.

Thanks to the emergence of cryptocurrency funds, cryptocurrency assets do not have to be bought in their entirety, but one can become the owner of a small share of such an asset. For example, the Robinhood platform allows buying extremely small shares of bitcoins without commission, which motivates people to invest in the growing digital currency. Related to this is one of the patterns of behavioral investing, anchoring, in which, with each income, the user invests a portion of the funds in the cryptocurrency. This helps to slowly but gently increase one’s own cryptocurrency capital, as well as minimize price gaps due to averaging during different periods of buying the asset. From a behavioral perspective, the phenomenon of cryptocurrencies and the meme stock is related to emotional bias. Thus, seasoned investors who remember the tragedies of the early bubbles are biased against cryptocurrencies, cautioning others against investing in them. Emotional bias closes off the ability to critically consider the market opportunities of this asset, which becomes a problem for prudent investing.

Lessons and Objective Representation

In an ideal world where there is a perfectly informed unbiased investor, the situation with cryptocurrencies and the meme stock would surely be a compromise between a bubble and market opportunities. It is impossible to know the outcome of the stock market with certainty, so such an investor would use all the opportunities of the digital economy for personal enrichment but also try to minimize risks. For example, he could use basic investment fundamentals to divide capital between different cryptocurrencies: Bitcoin, Ethereum, and EOS. From the perspective of the meme stock, if an investor knew precisely where this herd behavior would lead, he or she would indeed act on that knowledge. However, the economy always shows surprises, so it is very likely that this investor would be cautious about the meme stock and watch this market for a while. It is absolutely certain that an objective investor would not have missed the opportunities presented by the new economy and would have been devoid of any emotional biases.

This experienced investor’s strategy should be taken as a significant lesson to be used. The practice of cryptocurrency perfectly demonstrates that it is a highly volatile asset that falls or rises meaningfully in short periods of time. Bitcoin, in general, proves to be extremely sensitive to public statements by public figures, which makes the main cryptocurrency even more unstable. However, on a general scale, bitcoin consistently shows strong growth, which means that thousands of investors could have been enriched by using it. Neither cryptocurrencies nor the meme stock are immune to becoming another bubble, in the long run, so another lesson for the investor should be to develop critical thinking when observing asset dynamics. Fixing profits on peaks will prove successful for specific individuals, but globally can lead to serious problems, especially when it comes to bitcoin, which has planetary significance. Finally, personal feelings while investing should be taken into account. One cannot rely solely on emotions or herd instincts, although one cannot deny their usefulness for successful investing. Therefore, the overall conclusion is that an investor should always be aware of the risks and keep them in mind.

Conclusion

In conclusion, the cryptocurrency and the meme stock markets are far from being pure bubbles. This applies not only to the current dynamics and patterns found in these industries but also to the very short time since the emergence of such assets. It has been shown that many experienced investors tend to be biased towards these forms of investing, but this does not mean that these industries do not prove to be effective even in the long term. Many arguments have been made in support of the fact that cryptocurrency is not a bubble. However, one should be especially careful with the meme stock because this type of investment is associated with most of the risks including herding and emotional behavior that can actually cause a bubble to burst.

References

Ahvanooey, M. T., Zhu, M. X., Mazurczyk, W., Kilger, M., & Choo, K. K. R. (2021). Do dark web and cryptocurrencies empower cybercriminals? [PDF document]. Web.

Cambridge Dictionary. (n.d.). Bubble economy. Cambridge Dictionary. Web.

Ferré, I. (2021). Crypto is ‘one of the biggest bubbles ever’: Strategist. Yahoo Finance. Web.

Malone, A. (2020). $1,000 invested in bitcoin in 2010 is worth $287.5 million today (as of the time of this writing). Data Driven Investor. Web.

Mukherjee, R. (2021). Elon Musk to Mark Zuckerberg: Which cryptocurrencies do billionaires own? News 18. Web.

Orsini, A. (2021). Cryptocurrencies: Market opportunity or bubble? Forbes. Web.

Shepherd, M. (2020). Cash vs credit card spending statistics (2021). Fundera. Web.