Executive Summary

This paper proposes an internalization strategy for an Indian telecommunications firm (Empire) that aims to benefit from technology transfer through R&D investments in Europe. It suggests that the company should collaborate with an established UK telecommunications firm if it intends to benefit from the country’s advanced technological environment.

Similarly, this study proposes that the UK subsidiary should have the controlling stake in the partnership because this structure supports a forward linkage model. Although such a partnership may have institutional and cultural differences, this report suggests that both firms should sensitise their employees about their cultural and institutional differences. Comprehensively, these strategies should support Empire’s technology transfer goal.

Introduction

Technological and innovative competencies are important strengths of global companies. Multinational companies know this fact and strive to improve their competitiveness by directly investing their research and development (R&D) processes in countries that have these competencies (Seretis & Tsaliki, 2012; Chung & Hrazdil, 2014). For example, for a long time, China has improved its technological competence by expanding its R&D processes in western countries (Zhao & Zhang 2006; Tisdell 2001).

Theoretically, scholars affirm existing technological transfers through backward linkages, forward linkages, imitation, employee induction, and R&D relocation (to technologically advanced economies) (Chou & Passerini 2009). This paper focuses on the last strategy (relocating R&D activities to advanced economies) by explaining the issues that may affect the technological transfer between Empire and a European company.

Empire is a fictitious telecommunications company in India. The company operates in the telecommunications sector and specialises in two main business segments – mobile services and internet data services. The company operates in several markets around the world, including Australia, Africa, and Asia. Empire aims to venture into the European telecommunications market to develop its R&D capabilities. Through this strategy, the company intends to improve its local competitiveness by developing its products and product development processes.

Using the same strategy, the company aims to expand its exports to America and Europe. This report explains the details surrounding its internalisation strategy by explaining why the UK is an appropriate host country. Similarly, this study explores the institutional and cultural differences that exist between UK and Indian firms and the proposed organisational structure of a proposed partnership. The last section of this report is a reflective analysis that summarizes my experiences when developing this report.

Selection of European Country

The European telecommunications industry has experienced extended periods of industry liberalisation (European Foundation for the Improvement of Living and Working Conditions, 2005). These changes have made it easier for foreign companies to venture into the industry. This section of the report proposes that the legislative and technological environments outline the main issues informing the country selection process.

Legislative Environment

Different European countries have unique sets of legislations that affect the operations of foreign and local companies. For example, some European countries are part of the European Union. Therefore, they are subject to industry controls by the European Commission (Varona, 2005). These controls affect international trade with foreign countries. Currently, the free-market legislative environment in the UK allows Empire to venture in the UK telecommunications industry with minimal legislative hurdles.

Technological Environment

Since Empire aims to benefit from improved technology through its European venture, the different levels of technological developments in European countries affect its foreign destination choice. For example, some European countries do not offer 4G (broadband wireless) technologies, while others do. Therefore, Empire cannot benefit from technology transfer in countries that do not enjoy advanced technology. Stated differently, the company needs to operate in a country that enjoys advanced mobile telephony services.

Which Country is Best Suited?

Based on the above industry-specific factors that affect Empire’s entry in the European telecommunications market, this paper highlights the UK as the best European market for the Indian company. Globally and regionally, the UK telecommunications industry is among the most advanced and open markets. Deregulation has made it easier for foreign companies to enter the market and learn new knowledge. The high numbers of merger and acquisition (M&A) activities support this fact.

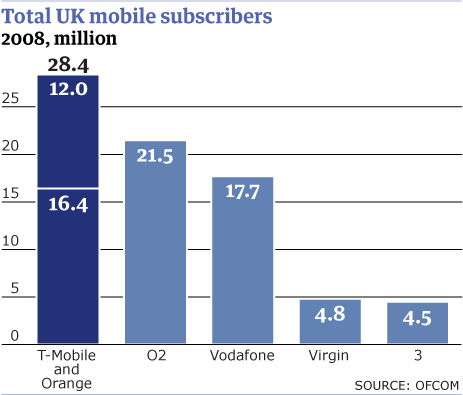

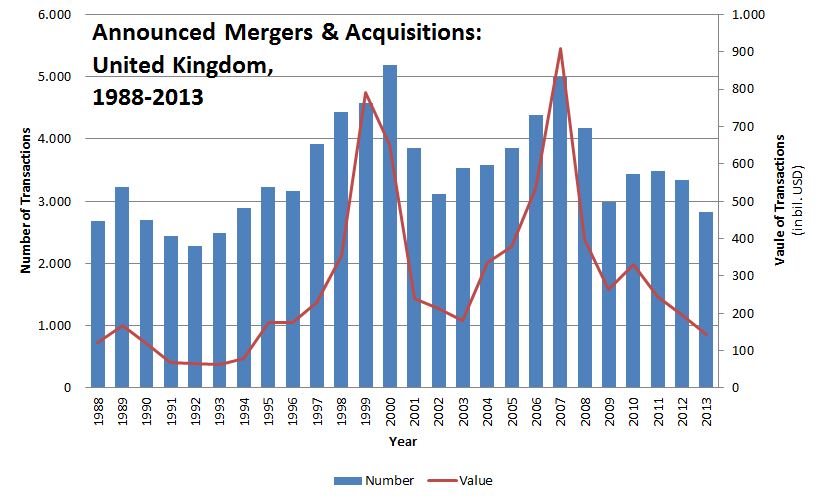

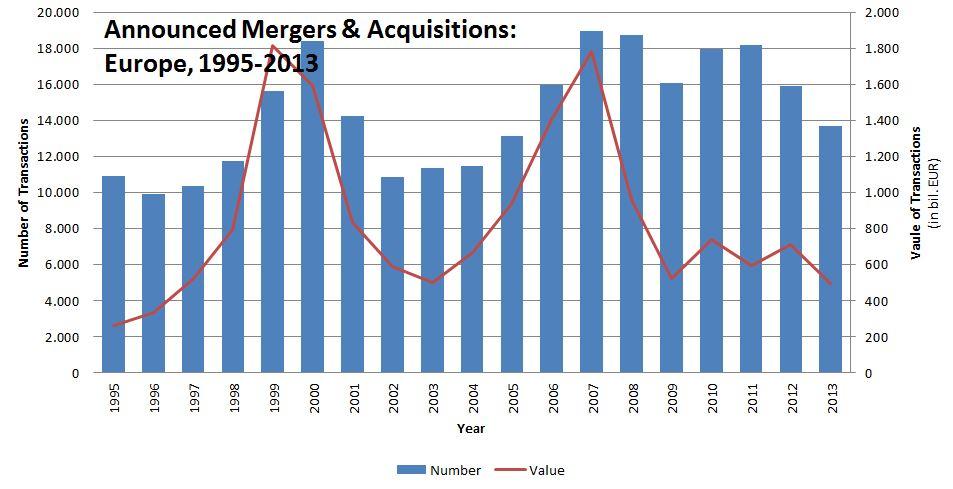

For example, Figure 2 shows that the volume of merger and acquisition (M&A) activities in the western European country has significantly increased, since the 1980s (Institute of Mergers, Acquisitions, and Alliances, 2013). This increment stems from the increased deregulation of the industry. Similarly, liberalisation has made it easier for companies to increase their levels of technological sophistication, thereby increasing their capacity to develop competitive products. These developments have led to increased growth in the industry. The diagram below shows the growth of the UK telecommunications market, in terms of subscriber numbers.

Empire telecommunications can benefit from venturing into the UK telecommunications industry because of minimal barriers of entry and the high number of industry peers in the market. These conditions provide a good environment for improving its R&D activities.

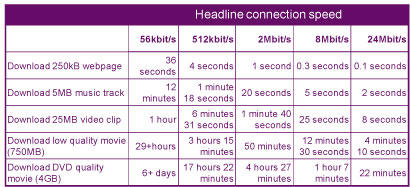

Furthermore, UK telecommunication companies offer among the best technologies in the market. For example, Figure 4 shows the high internet connection speeds that UK telecommunication companies offer their customers (OFCOM, 2013). Figure 3 also shows that the UK telecommunications industry is highly profitable and expansive. These attributes show that this industry could offer the best technology transfer capabilities to Empire.

Institutional and Cultural Factors

Since Empire is an Indian company, its UK venture would create significant cultural and institutional issues. For example, in terms of institutional structures, Indian and UK companies have significant differences. For example, Indian companies practice favouritism and UK companies are highly formal (MBT, 2013). This difference has significant implications for UK and Indian companies. For example, in the UK, an employee’s competence informs a manager’s decision to promote him.

Comparatively, Indian managers use closeness to power and cronyism to promote employees (MBT, 2013). MBT (2013) also says Indian and UK companies have different attitudes towards change and new technology. It says Indian companies often have a slow adaptation to change. Similarly, they have strong beliefs on auspicious time and similar factors (MBT, 2013). However, UK companies are more adaptive to change and disregard auspicious activities. Such differences significantly influence management practices and employee attitudes.

Empire could overcome some of the above-mentioned institutional and cultural differences by understanding the cultural differences that exist between Indian and the UK companies. They could adopt different measures of overcoming these barriers. For example, in a non-threatening environment, they could expose their Indian employees to the UK culture (Choi & Hartigan, 2008; White, 2010).

This interaction should familiarise both sets of employees with the acceptable organisational culture that works for them. The organisation should also formulate policies and procedures for managing cross-cultural conflicts. Such policies and procedures should include how every employee group would manage conflict. These proactive measures should minimise cultural conflicts.

Organisational Structure and Control Strategies

An organisational structure defines how a company plans its activities to meet existing strategic goals. This structure defines organisational processes, such as task allocation and coordination. Comparatively, control strategies refer to tracking and detecting problems associated with the proposed strategies. Based on the cultural and institutional differences highlighted in the above section of this report, Empire Telecommunications should adopt a “merged” organisational structure that involves both Indian and UK managers.

However, UK managers should mainly dominate the management structure because Empire aims to learn from the UK industry, and not the other way around – UK learning from India. Therefore, the Indian managers should play a secondary role to the UK managers. This organisational strategy significantly affects the cultural and institutional differences discussed in earlier sections of this report. For example, this report proposed that both Indian and UK employees should learn the cultural practices of each group. However, based on the proposed organisational structure, the Indian employees need to adapt to how the UK employees conduct business. This strategy would provide the best environment for technology transfer.

Empire should adopt the strategic surveillance control strategy when engaging with its UK subsidiary. This strategy aligns with its primary goal of technology transfer because it involves surveying several environmental factors that could affect the organisation’s strategic focus (Adams, 2014). For example, by surveying new R&D outcomes in its European subsidiary, the company can change its strategic focus in the Indian market. The strategic surveillance control strategy bases its principles from the idea that a company can uncover crucial and unanticipated information by surveying its working environment (Adams, 2014).

Proposed Entry Mode

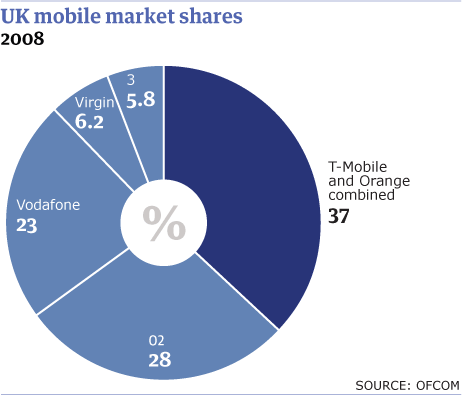

In international business, an organisation’s entry mode often influences its success, or failure. Based on the main goal of improving R&D competencies in Europe, this paper proposes that Empire should pursue a partnership agreement with a UK telecommunications firm. A partnership agreement is right for the Indian company because it needs to improve its R&D processes by learning from an existing European company. The diagram below shows the main players in the UK telecommunications market

The above diagram shows the best corporate partners for Empire. Forging a partnership with any of the above companies would be a right strategy for the Indian company because they lead the industry in technological innovation (Wray, 2009). Many organisations have pursued different types of partnership agreements in the European market (cross-sector analysis).

Most of these agreements are M&A activities. Figure 6 shows the volumes of M&A transactions in the EU (Institute of Mergers, Acquisitions, and Alliances, 2013). Disagreements between partners are the main disadvantages of pursuing a partnership agreement. Similarly, such an agreement could potentially increase the liabilities of the Indian company because it would share the liabilities of the UK entity as well (Tasmanian Government, 2014).

General Issues

While signing a partnership agreement between Empire Telecommunications and a UK company is a good idea, some general issues may emerge in the agreement. For example, Indian and UK companies have different ethical guidelines that inform their business practices. Adopting CSR practices is one such issue that fits this profile because some UK companies require foreign companies to adopt CSR practices, while some foreign companies do not share the same CSR perspective. Moreover, companies are not legally obligated to engage in CSR practices.

To overcome the above challenge, Empire needs to conform to the existing CSR practices of the UK telecommunications industry. Particularly, the company needs to recognise the advantages of engaging in CSR practices in its UK and Indian subsidiaries. Moreover, since the company is a global organisation, it needs to adopt international best practices (CSR).

Adopting CSR would synchronise the company’s business practices with its UK subsidiary. The CSR model for the proposed partnership should show the principles of the Boston College Centre for Good Corporate Citizenship (Aoun, 2007). This model premises on three factors – good thinking, good companies, and good practices. The following diagram shows its framework.

Based on the above diagram, Empire telecommunications needs to adopt an external code of conduct that covers the elements of the “triple bottom-line” approach – economic sustainability, environmental sustainability, and social sustainability. This model should align its organisational goals with its international technology transfer goals.

Conclusion

Arguably, technology transfers outline the biggest benefits that most firms in developing countries can benefit from FDI in western countries. Since such benefits are unsecure, prospecting firms should adopt the best internalisation strategy for succeeding in their host countries. This paper suggests that Empire Telecommunications should collaborate with a UK company to exploit Europe’s technological potential. However, both entities could experience institutional and cultural differences because of their different business practices.

To overcome these challenges, this paper proposes that both companies should undertake cultural sensitization processes to acquaint their two sets of employees with cross-cultural business practices. Although this strategy suggests an “equal” arrangement about conflict management, the organizational structure of the partnership should not follow the same arrangement. Instead, UK managers should dominate the managerial board because the Indian company seeks to benefit from technology transfer, and not the other way around (the UK Company benefitting from the Indian company). Stated differently, Empire Telecommunications should follow the stewardship of its UK partner.

Reflective Account

Developing an internationalization strategy is a multifaceted process. The main challenge experienced in developing this report was relating different aspects of the internationalization strategy together. For example, I had trouble developing the proposed organizational structure and control strategies that address the cultural and institutional differences of Indian and UK companies. However, this process was crucial when developing the internationalization strategy.

Therefore, I could not overlook the need to develop a seamless strategy that fits all strategic parts of the proposed venture. Identifying the areas of friction between Empire and the proposed UK firm was also a difficult process because it was speculative. Stated differently, since the partnership was “proposed,” this paper could only assume/predict the potential conflict areas that may emerge when both companies merge. Furthermore, I extrapolated the cultural factors identified in this report from similar factors affecting other Indian and UK firms.

Therefore, it was difficult to identify (correctly) the cultural differences that would emerge when both companies collaborate. Nonetheless, since I had adequate knowledge about the UK telecommunications industry, it was easy to understand the potential organisational fit that exists between Empire Telecommunications and the UK firm. In terms of individual learning, preparing this report has improved my report-writing skills. Similarly, this project has familiarised me with the telecommunications industry, which is a prospective industry I intend to work in. Therefore, the information gathered in this report could be beneficial in a future interview, or a similar career-defining process.

References

Adams, D. (2014) What Are the Four Types of Strategic Control, Web.

Aoun, G (2007) The CSR: A choice or a Must, Web.

Choi, K & Hartigan, J (2008) Handbook of International Trade: Economic and Legal Analyses of Trade Policy and Institutions, John Wiley & Sons, London.

Chou, P & Passerini, K (2009) ‘Intellectual property rights and knowledge sharing across countries’, Journal of Knowledge Management, Vol. 13, No. 5, pp. 331 – 344.

Chung, D & Hrazdil, K (2014) ‘Industry classification and the efficiency of intra-industry information transfers’, American Journal of Business, Vol. 29, No. 1, pp. 95 – 111.

European Foundation for the Improvement of Living and Working Conditions (2005) Trends and drivers of change in the EU telecoms sector: Mapping report, Web.

Institute of Mergers, Acquisitions, and Alliances (2013) M&A Activity: Number & Value of Announced Transactions: Europe, Web.

MBT (2013) India Vs. Uk: Cultural Differences, Web.

OFCOM (2013) Telecommunications, Web.

Seretis, S & Tsaliki, P (2012) ‘Value transfers in trade: an explanation of the observed differences in development’, International Journal of Social Economics, Vol. 39, No. 12, pp. 965 – 982.

Tasmanian Government (2014) Partnership – advantages and disadvantages, Web.

Tisdell, C (2001) ‘Transitional economies and economic globalisation: Social and environmental consequences’, International Journal of Social Economics, Vol. 28, No. 5, Spring, pp. 577 – 590.

Varona, E (2005) Merger Control in the European Union: Law, Economics and Practice, Oxford University Press, Oxford.

White, R (2010) Migration and International Trade: The US Experience Since 1945, Edward Elgar Publishing, London.

Wray, R (2009) Orange and T-Mobile to create UK’s largest mobile phone company, Web.

Zhao, Z & Zhang, H (2006) Multinational Corporations and technology transfers in developing Countries, Web.