Introduction

Selection of market securities that would be included in a certain investment portfolio requires scanning of various instruments in diverse financial markets. The markets from which the market instruments are picked include the capital market and the money market (Jordan, Miller, & Dolvin, 2012).The capital market is involved in the sell and purchase of long-term market securities while money market is concerned about trading of short-term securities. Selection of the best financial instruments is tiresome, as it requires adequate time to assess the performance since one has to scan the performance of various industries, as well as individual firms. In addition, one has to compare the performance of debt instruments in various debt markets in order to choose the best performing bonds, which should be in line with the taste and requirements of customers. All this activities are streamlined towards increasing the level of returns while minimizing the level of risks.

In this view, we should use a concept put forward by Markowitz, who emphasized on determining the level of risks and returns for various market securities before investing in any single market instrument (Anand, 2007). His concept was based on the expected return and variance where variance measures the level of risk an index is exposed to. We should use this concept in constructing an investment portfolio consisting of equities (common stocks) from four companies and the US Treasury bill worth $10,000. The report will start by presenting an Investment Policy Statement.

The report will select four best performing equities based on evaluation taste from ten promising stocks listed in New York Stock Exchange. Given that the available fund for investment is $50,000, an additional $10,000 would be set aside for the US Treasury bill investment. Construction and performance appraisal of financial instruments will follow later.

Investment Policy Statement

Our investment strategy has always and will always begin with identification of the level of market risk and required rate of returns. According to financial analysts, there are two categories of investors that is, active and passive investors (Hubbard, 2007). Active investors focus on obtaining optimal return for their investments while maintaining a certain level of risk. However, passive investors also aim at achieving a return above that of the market and therefore, they will cautiously choose securities that achieve their targets. The $50,000 funds would be invested in market securities that are worthwhile both in short-term and long-term.

The mixed investment portfolio will include four common stocks and the US Treasury bill, which would ensure that the investment is well diversified to the lower risk level, as well as raise the level of return. Shares will be picked from the New York Stock Exchange. The common shares chosen from four companies will be obtained from the same industry, although the industry should indicate high chances of future growth. The firms from which the shares will be picked should have large market capitalization and show the likelihood of future growth and expansion. The objective would be to develop a product that will assure high return on equity while on the other hand mitigating the high level of risks using less risky Treasury bonds (Shan, McGuin, & Waller, 2007).

Due to strict regulations in the financial markets regarding short selling, the short selling strategy would not be used. Derivates will as well not be used and therefore our investment will generally consist of the US Treasury bills and common equities. The final batch will have securities in different weights to attain optimal returns in addition to minimizing the level of risks.

In relation to our objective, which is restricted to accessing accurate and up-to-date information to make a decisive financial decision, the Bloomberg will also be chosen as the trading platform. Its source of financial information pertaining to the market securities will be used effectively. However, the Financial Times and New York Times will be reliable sources of information with regard to financial performance of various sectors of the economy, as well as full disclosure of financial information of individual firms in the diverse industries. The information will be pertinent in predicting the market trends and making relevant investment adjustments.

With various scanning processes, equities will be chosen from four companies with large market capitalization in the New York Stock Exchange. The fund will be invested in medium-term debt market and therefore, the bond index will have a maturity of 1 year to 5 years. The first portfolio, which includes shares from four companies and US Treasury bond, will be scanned through optimization process to find out the most efficient investment among equity shares and the US Treasury bonds for the two portfolios. A further comparison will be done on performance of the market and the investment portfolio with respect to the level of risks and returns. With consideration of the requirements and income targets, the two portfolios will be combined in a way that best suits the target risk/return profile.

Selection Process

The world’s economy still suffers from the consequences of the financial crisis that occurred in 2008. This makes it possible to include inaccurate information that would negatively affect our evaluations. Therefore, care will be taken to exclude such data.

Stock choice

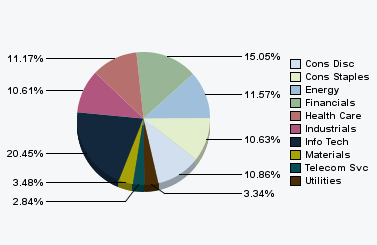

New York Stock Exchange is a leading listing site for the top large and average companies. NYSE adheres to the required standards of listing companies. The NYSE is the best stock exchange since it has the liquid equities in the world stock market. New York Stock Exchange Index is a representation of the main industry segments in the US. The performance of this Index is highly correlated to the general performance of the US economy. If the US economy improves, the NYSE indexes will indicate an improvement, but will automatically fall if the U.S. economic performance declines. In particular, the U.S. Utility sector has grown considerably to attain a growth of 11% per annum from the time when the financial crisis hit various economies. The U.S government released a bailout package of USD700 billion that was expected to encourage economic growth, as well as control the economy from plummeting into more recessions. There was an average increase of 1.5% in stock prices as at December 30, 2011. In accordance to NAESCO (National Association of Energy Service Companies) report, which was released in June 2011, it was anticipated that industrial annual returns would hit $7.0 billion to 7.5 billion by 2011. This would amount to an annual average growth rate of 25% for the last three years

From NYSE Index evaluation, one would conclude that the utility sector of the economy have been performing significantly well and therefore highly attractive.

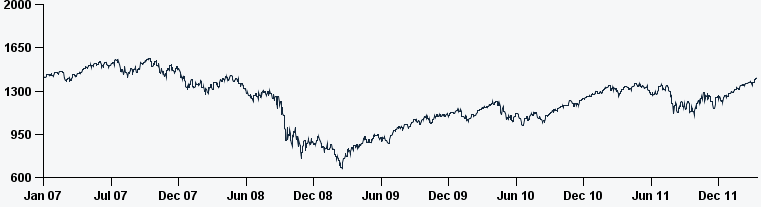

The graph above indicates stock prices of diverse companies, having their investments in the utility sector. The stocks of such companies that have their stocks listed in NYSE Index showed poor performance between the year 2007 and 2010. This was an indication of difficult financial times for most companies. This led to stocks plunging to the lowest level in the beginning of the year 2009, although it started picking up at mid 2009, maintaining an upward trend. In addition, the U.S. economy has specifically recovered at a fast pace, currently experiencing a GDP growth rate of 2.8%.

Data chosen for the first four-equity portfolio are the weekly equities of the last-prices from Dec 31, 2012 to April 30, 2012, covering a period of four months. The investment objective of criteria selection will be maintained. This objective includes concerted effort to establish underpriced market securities, purchasing shares with large market capitalization, selecting equities with a beta less than 1.5 and purchasing shares with price earnings ratio of less than 15, given that the industry’s P/E is averagely 18.

Even though there are systems of evaluating those stocks that are underpriced in the markets, it will be prudent to crosscheck with other financial analysts to identify shares that are considered underpriced. Bloomberg will generally assist in collecting information regarding security market capitalization and the price earnings ratio.

Through a number of examination and selection processes, the following equities that meet our standards requirements were identified.

Bond choice

Bearing in mind that bonds are considered a market security with comparatively low risk, it is no doubt that most risk-averse investors will choose bonds as their investment (Wesalo, 2001). Most investors have used bonds as an instrument of reducing the high level of risks featured in the stocks. Stock investment portfolio is generally volatile and quite unpredictable as compared to bonds (Elton, Gruber, & Brown, 2006). Bonds are characterized by low levels of risks, although owners do not claim ownership in a company that issues the bond. Interest rates are very crucial in determining the price of a debt instrument (Reilly, & Brown, 2007). Moreover, an interest rate is inversely related to the price of the bond. Given the fact that we shall choose stocks from the New York Stock Exchange, basing on the market capitalization and high-required rate of return, we will have to cope with high levels of risks. However, the level of risks will be mitigated by adding the US Treasury bond of $10,000 in our investment portfolio, which will have the effect of stabilizing earnings.

Conclusion

Given that the funds available were $50,000, it was possible to invest $10,000 in the US Treasury. It was prudent to invest in the US Treasury bill that has a maturity period of two years. An amount of $39467.5 was invested in stocks for companies that operate in the utility industry. WEC has investments in both utility energy and non-utility energy sectors.

References

Anand, S. (2007). Optimizing Corporate Portfolio Management: Aligning Investment Proposals with Organizational Strategy. New York, NY: John Wiley.

Elton, E., Gruber, M., & Brown, S. (2006). Modern Portfolio Theory and Investment Analysis. New York: John Wiley.

Hubbard, D. (2007). How to Measure Anything: Finding the Value of Intangibles in Business. New York, NY: John Wiley & Sons.

Jordan, B., Miller, T., & Dolvin, S. (2012). Fundamentals of investments, valuation and management. New York, NY: McGraw-Hill.

Reilly, K. &Brown, C. (2007). Investment Analysis and Portfolio Management. Thomson: Southwestern.

Shan, R., McGuin, P., & Waller, J. (2007). Project Portfolio Management: Leading the Corporate Vision. Basingstoke: Palgrave Macmillan.

Wesalo, T. (2001). The Fundamentals of Municipal Bonds: The Bond Market Association. New York, NY: John Wiley and Sons.