Abstract

This report seeks to analyze the concepts of Islamic banking. Specific topics covered include history, operations, risk management, and barriers of Islamic banking in financial institutions. Islamic banking system has grown globally; new banks are emerging all over the world to cater for Muslims. The bank’s aim is not making profits because it has been prohibited by the Sharia, which is an Islamic law. In this regard, a board has been selected within the Muslim followers to make sure that the bank activities do not go against the Sharia rules and regulations. The setting up of a bank in many countries differs because of political and economic differences. The report also seeks to give the different instruments used in Islamic banks. Many Muslims are depending on Islamic banks and there has been implementation of these banks in many countries, especially those in Arab countries where there is big population of Muslims.

Introduction

Islamic religion not only caters for the spiritual nourishment of its followers but also their ways of living and survival techniques. It is involved with both spiritual and social economic aspects of humans, and that is the reason why the Islam came up with their own banks, which are not focused on interest. In this sense, such financial institutions are called Interest Free Banks (Nomani and Rahnema, 2000). This type of banking is particularly based on the Islamic traditions and cultures, especially in investment and financing. Islamic banking is different from traditional banking because it is centered on Islamic religion’s beliefs. This paper sheds light on the history of Islamic Banking, its operations, the financial instruments involved, and the challenges that the bank has faced within its operations.

The History of Islamic Banking

According to Manhlknecht (2009), in both eighteenth and nineteenth centuries, the European countries colonized the Islam countries. Colonization at that time was a common aspect, and the colonized countries had to stick to the colonial rule. Thus, the Europeans took control of the finances and economy of Islamic countries, which was to their own benefit; and that is the reason why Muslims did not find any benefit to the banking institutions, which were focused on making interest.

People began to have knowledge about their freedom and they started demonstrating on freedom movements, which was towards the end of last century. Many countries fought for freedom and Muslim countries became independent, and thus they were able to manage their finances according to their culture and traditions. Likewise, the international advocacy for freedom of worship and freedom of speech was a major contribution to Islamic banking (Subhi, 1969).

Societies whose aim was saving and giving loans were started in 1940s. Azhar (2006) affirms that Islamic banking came into existence in 1963. A Muslim follower named Ahmad El Najjar started the concept of Islamic banking. The bank’s main objective was to share profits among its members, but not to make profit. This rule was set by the sharia, which is a board that regulates the Islamic bank operations in many countries. In 1976, there were nine Islamic banks in Egypt, and it was a major leap in the banking industry. The bank activities were based on trade where it focused on investments while collaborating with its depositors. It mainly operated as a financial institution, as opposed to other banks that operate on commercial purpose.

In 1970’s, many banks were opened in countries like Dubai, Sudan, and Bahrain. The same bank was opened in Asia and was named Amana Bank. This bank was to help Muslims to manage their finances. Pakistan also opened the Islamic bank, but it did not make it because it was later closed. Similarly, Dubai bank was started in 1975 and the law, which was regulating its operations, allowed it to take on business enterprise. Consequently, 27 banks were opened, and in 1985, there were over 50 banks, some were located in London.

In the year 2000, Hasset (2008) asserts that many Islamic banks were opened and even today, they are still being opened. They still follow the Islamic law (sharia), which forbids getting interest from loans. Additionally, Investment methods that provide goods and services which goes against the Islamic laws is prohibited, but these rules are currently being practiced by the private Muslim banks. The banks have been extended to African countries, but only in regions or countries where Muslims live.

The Operations on Islamic Banking

Islamic banks have been opened all over the world and they have their own unique operations that depend on the rules and regulations of Islamic law. Nomani and Rahnema (2000) argue that operation of Islamic banking focuses on three main issues, which includes investment financing, trade financing, and lending. In investment financing, there is musharaka where banks may come up with a joint venture. In case of a project, the profits are shared among the participating banks and a member may end the partnership after a given time.

Similarly, investment financing involves Mudaraba, where the bank gives a customer the finances and the customer gives back the expertise and labor. Both the bank and the clients shares profits, but in case of a loss, the bank is liable. In other projects, the bank estimates on the amounts of gains. The bank finances a certain project and approximate the rate of return, which it gains after the project is over. If the project gains more profits, it goes to the customer, but in case of lower returns, the bank takes it.

Zurbruegg and Rammal (2007) concur that Islamic bank is also involved in trade financing, and this is done in many ways. The first method is mark up, where a client decides to approach the bank for finances in order to buy a certain item. The bank lends the clients, but under an agreement that he will repay the money with an agreed amount of profit within an agreed period. Another way of trade financing is leasing, where a bank purchases an item as requested by the customer, the item is leased to him within an agreed time. When the client settles the full amount as agreed in the beginning, he becomes the owner of the item. Ownership of the item is not agreed on until the client settles the amount, and if he fails to do so, the item becomes bank property until the balance is fully paid.

Alternatively, in hire purchase, the bank purchases an item for a client and leases it to him/her for an agreed period. The client is supposed to pay money in monthly or quarterly basis in order to complete the payment within the agreed period. When the client completes all the agreed payments, he becomes the owner of that item. However, there are cases where the bank reclaims the ownership of some items, especially when the client fails to settle all the payments. Likewise, there are other services rendered by the bank to the clients. One of the services is when the customer sells his property to the bank with an agreed amount of money payable with the condition that he will repurchase the item after an agreed time and price. There are also letters of credit where a bank agrees to trade in an item for a client using its own money. The bank agrees to share the profit with the client after the sale of the imported item (Saeed, 1996).

According to Kuran (2005), in lending, the bank sometimes lends money without expecting interest, but they charge for the service and the charge amount is according to the laid down rules of the bank. There are also some loans offered without costs and they are meant to help the poor and the needy such as small-scale business owners.

Other services that are given by the Islamic bank include the money transfer, where money is transferred in many countries all over the world, especially in Islamic countries (Khan, 1984). Bill of collection is also offered by the bank, which involves sending of cheques to its different branches to pay clients. The cheques are presented through a clearing house to its branches. It is also involved in foreign currencies where it exchanges the currencies at a low rate. However, Islamic banks have been challenged to introduce new products and services because of the consumer changes and global competition.

The Financial Instruments on Islamic Banking

The instruments of Islamic banking include musharaka, muqarada, murabaha, mudarabah, ijarah, Salam, istisna and bay bithamin ajil (Rammal and Zurbruegg, 2007). Musharaka is a method of a joint venture, which goes on in a given period or in the completion of a project. Both the bank and the clients involved shares the benefits and the risks. Profits are shared according to the laid down rules while the losses are shared depending on the capital contributed.

Muqarada is a method that permits the bank to float its bonds to fund a given project. The clients who invest on the Muqarada bonds have a stake on the profits made by the funded project. Despite sharing the profits, the share holders are also subject to the losses or even low profits. Although the clients are not involved in the project management, they act as shareholders (Banaji, 2007).

Murabaha is a trading technique in which a trader buys items that the consumers ask for and then sells them according to the agreed profits while considering the costs incurred. However, this trade was carried on under the following conditions: First, the transaction was to take place only when the bank customer wanted to buy an item. The item remained the bank’s property until the end user fully bought it. Song (2001) conforms that in case of a delay by the end-user, they were not penalized as compared to other banks. This transaction is of much help to the clients because it purchases the required items; the client will manage the money because the bank makes sure that its finances are based on real assets.

Ijarah is similar to leasing because it involves putting the assets on a lease. The items leased are imperishable and inconsumable because the aim of the lease is utilization. The lessee benefits from the property according to the agreement between him and the bank. The period of the contract must be clearly defined. The owner incurred all the costs of maintaining the assets and if in any case there is delayed payment for the rental, leasing may be ended.

Salam is a deal that entails the buyer and the seller. The seller agrees to purchase and bring in items to the buyer in a given date in exchange of a value, which is paid as soon as the goods are delivered. The buyer in this case is referred to as Rabu-Us-Salam, and Muslam ilaih is the seller. The value paid is the Ras-ul-mal and the item being bought is referred to as muslam fih. This mode of trade was practiced to help the poor such as small scale traders (Khan, 1984).

Istisna is a method of sale where an item transaction is carried out even before it has been manufactured. The price of that commodity is settled and the manufacturer goes on with the process of producing the good. Istisna as a contract between two parties gives the manufacturer the permission to manufacture. Kaiser (2009) substantiates that if in case the two parties disagree before the manufacture process starts, the contract is canceled, but if already started, it cannot be cancelled. The difference between Salam and Istisna is that in Salam, the cost is paid immediately, but in Istisna, it is not crucial.

Finally, Bay bithamin ajil is a form of murabaha, which is practiced in Malaysia and some parts of Asia. This method involves the bank purchase and delivery of goods. Hasset (2008) contends that the clients make their payments in installments, which may be in quarterly or monthly basis or according to the agreement between the bank and the client. This method enables clients to acquire assets after full payment.

The Risk Management on Islamic Banking

Many banks face risks due to the current economic dynamics. While the Islamic bank is developing everyday, it has its own way of managing risks and crisis. Islamic banking has been able to appoint risk management professionals. The team is charged with the responsibility of risk identification, assessment, and management. Shariah Adviser named Zubair Usmani says that the Islamic bank has not been affected by economic fall in the United States because of its belief of lending and financing through assets. The risk management professionals have observed that Islamic Bank is more prone to operational errors than the other banks.

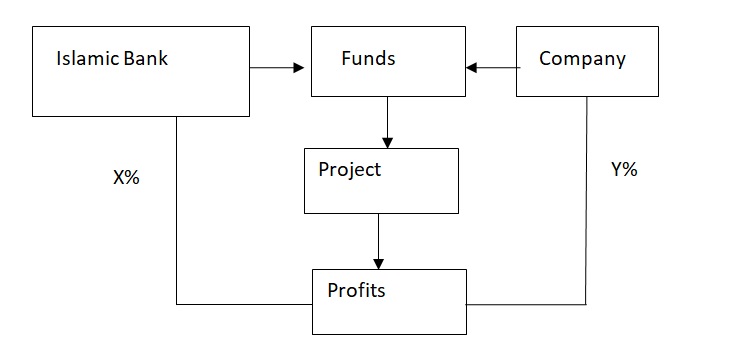

The risks are caused by human, machine, and systems errors. Islam religions have come up with teaching sessions to its followers about risk management. The risk managers also assess cases of forgery in transactions on daily basis. According to Graham and Dodd (2002), the musharakah risk management, which involves joint ventures ensures that the profit and losses are shared between the clients or organizations involved. Figure 1 shows mushakarah agreement where profits are shared.

The Islamic bank management team also manages credit risk by having a feasibility study before it makes contracts and consequently managing contracts such as musharakah and makes sure that last equities are sold with a strategy. The bank also manages liquidity risk by preserving additional asset and capital, which separated.

Barriers to Islamic Banking

Macesich (2000) asserts that one barrier of Islamic banking is lack of understanding because consumers wonder how the bank works and benefits that come along with banking. The non-users claim to be unaware of the banking principles. Other religions think that the Islamic Banking is religion centered and hence, they opt to do financing in conventional banks. In essence, many people prefer to use international banks, which cater for all their needs.

Similarly, Islamic Banks do not have many international branches because they are mainly located to areas where there are many Muslims. Their ATMs are few and hence they are inconvenient to clients. Because of less returns on investments Islamic Banking does not have many customers as conventional banking. Using of Islam names has led to the bank not having many customers. These names include murabaha, which may not be understood by customers from different religions (Rammal and Zurbruegg, 2007).

Furthermore, some countries like the US do not recognize the Islamic banking system, although these banks are there. Many countries have hindered the growth of the industry because they want banks that will bring in high returns in their countries. Only the United Kingdom has declared its efforts to expand Islamic banking. In this regard, Banaji (2007) outlines that local laws and procedures have been set to deal with traditional and Islamic banking. One of the laws that have been set is that of direct investments, business trade, and being involved in real estates. New Islamic banks have fought for changes in the law of finances and they demand for some exemptions.

Comparison Against Traditional Banking

The earlier objective of Islamic banking was to help the poor, but not making profits while other banks main aim is to make profits. In addition, the Islamic Bank is controlled by the sharia law while the traditional banks set their own rules according to the banks aim and objectives.

Manhlknecht (2009) states that traditional banks are also called commercial banks because their main aim is to make profits. These banks have helped many people in the society by giving them loans repayable with profits. These banks have also safe guarded clients’ money and assets. Commercial banks aim to increase production while also developing the area of capital investments so that its clients can get better living standards. They use cheques and credit cards to withdraw money from many places all over the globe. They are also involved with the exchange of foreign currencies due to globalization of trade. Interest rates are of much benefit to the banks together with commissions, which are charges from clients.

Islamic banks on the other hand, have their own banking principles. The bank is based on the Islamic faith and that is why many people prefer the commercial banks, which are not religion based. Islamic banks operate without any interest rate and their aim is to improve people lives and social welfare. They believe in profit sharing rather than getting interest rate. In profitability, both the traditional and Islamic have different amounts of interest rate. In commercial banks, the clients received only fixed interest rate according to the amount deposited in their accounts, but in Islamic banks, the client’s gets a share in the profits made by the bank. In liquidity, traditional banks are expected to be liquid to meet unpredicted withdrawal on deposit (Zurbruegg and Rammal, 2007).

In accounts protection, Kuran (2005) affirms that Islamic banks are known to give protection on the client’s deposits in their savings. It clearly chooses its assets to avoid many risks and thus, get high income. They also put aside an amount to cater for any loss that may be incurred. Traditional banks may not be able to protect the client’s savings. Both banks encourage low earners to deposit even small savings.

Consequently, traditional banks offer many services as compared to the Islamic bank. Islamic banks have not been able to manage complex services, such as letters of credit as the traditional banks. In economic development, traditional banks are far ahead, but Islamic bank have been able to focus on the social development. This is because many people are able to borrow loans, including the low earners and there are projects that aid those who do not earn. This includes buying of assets for clients and then selling it at a profit, which is shared between the client and the bank.

Furthermore, traditional banks have many years of experience, especially in international trade and they score a higher mark. Islamic banks’ experience has not yet matured and its staff requirements are high because they have to be Islamic committed.

Commercial banks have been publicly accepted as compared to the Islamic bank and again, the Islam’s rejects traditional banks claiming that they are unacceptable and sinful.

Conclusion

Islamic banking has gained publicity in the recent years due to the emergence of institutions that advocate for religious banking. Many countries are now focusing on accommodating Muslims in all aspects of economic development. This paper has analyzed the concept of Islamic banking and it is clear that such financial institutions are important in any nation because of religious freedom. Therefore, in order to get many customers, Islamic banks should accommodate other people with different faiths. This will make them expand globally and increase productivity. They should also focus on profit-making to meet its objective in social welfare and benefits and make customers believe that it is an investment institution while focusing on income sharing relative to the interest rate mechanism.

References

Azhar, S. A., 2006, Critical Issues on Islamic Banking and Financial Markets: Islamic Economics, Banking and Finance, investments, Takaful and Financial Planning, Indiana: Author House.

Banaji, J., 2007, Islam, the Mediterranean and the rise of capitalism, Historical Materialism,15 (1), pp. 47-74.

Graham, B. and Dodd, D., 2002, Banking and Finance, International Journal of Bank Marketing, 15 (1), pp. 67-90.

Hasset, K.A., 2008, Economics and Liberty. Journal of Islamic Economics in Arabic Countries, 13 (2), pp. 56-60.

Kaiser, U., 2009, Do Media Consumers Really Like Islamic Banking. New Times Journal, pp. 70-89.

Khan, A. J., 1984, Divine Banking System, Journal of Islamic Banking and Finance, Winter 1984.

Kuran, T., 2005, The Absence of the Corporation in Islamic Law: Origins and Persistence, American Journal of Comparative Law, 53, pp. 785-834.

Macesich, G., 2000, Central Banking: The early years: Other early Banks, Journal of Money, Credit and Banking, pp. 118-120.

Mahlknecht, M., 2009, Islamic Capital Markets and Risk Management, London: Risk Books.

Nomani, F. and Rahnema, A., 2000, Islamic Economic Systems, New Jersey: Zed Books Ltd.

Rammal, H. G. and Zurbruegg, R., 2007, Awareness of Islamic Banking Products among Muslims: The case of Australia, Journal of Financial Marketing Services, 12(1), 65-74.

Saeed, A. (1996). Islamic Banking and Interest: A Study of the Prohibition of Riba and its Contemporary Interpretation. Leiden, Netherlands: E.J. Brill.

Song, M. 2001, An empirical assessment of the role of Banking, International Journal of Bank Organization, 27 (2), pp. 292–301.

Subhi, Y. L., 1969, Capitalism in Medieval Islam, The Journal of Economic History, 29 (1), pp. 79-96.

Zurbruegg, R. and Rammal, H.G., 2007, Awareness of Islamic Banking Services among Muslims, Journal of Financial Services Marketing, 20(1), pp. 65-74.