Lidl is one of the leading grocery discounters in the European and global markets. The retailer’s worldwide volume in sales was €62.7 billion in 2014, which made it the ninth top grocery retailer in the world or number one in Europe (Schmid et al., 2018). The company was established in Germany in 1973 and started its international expansion in 1989. At present, it operates in approximately 30 countries (in Europe and North America). The organization has to face rather fierce competition in Germany and globally, and it chose international expansion as one of the strategies to develop and maintain its competitiveness. This report includes an analysis of the potential benefits of the entry of Lidl into the Mexican market in comparison to its prospects in Norway.

Macroenvironmental Analysis

In order to identify the most appropriate country for further expansion, it is possible to implement a macroenvironmental analysis. The basis of this examination will be the PESTEL model that implies the focus on such factors as political, economic, social, technological, environmental, and legal (Henry, 2018). First, it is necessary to admit that Norway and Mexico are rather different countries as the former is a developed country with a strong economy, while the former is an emerging market from the developing world. It is important to add that Mexico is regarded as one of the rapidly developing and highly attractive markets due to its government’s focus on competitiveness, innovation, and technological development (Stevanovic et al., 2018). As far as political aspects are concerned, Norway appears to be an attractive destination for any business, while Mexican political characteristics lead to quite mixed conclusions.

For instance, Norway rests on the 16th position for the public-sector performance, whereas Mexico is only the 59th country on the list (World Economic Forum, 2019). Norway’s index of corruption is 84.0 (out of 100), while Mexico scored only 28.0. However, the indices related to corporate governance (conflict of interest regulation) are not very different and range between 6 and 7 (out of 10) (World Economic Forum, 2019). Although the government ensuring policy stability index is 3.6 for Mexico and 5.2 for Norway, the difference between the government’s responsiveness to change indices is less pronounced (3.0 for Mexico and 4.5 for Norway). Notably, Stevanovic et al. (2018) emphasized that the government’s preparedness and willingness to change and innovate has become central to countries’ development and competitiveness.

Economic factors are also mixed for the two countries, making Mexico an attractive host country. Norway’s GDP per capita was 81,694.6 U.S. dollars in 2019, while in Mexico, this indicator was only slightly higher than 9,807 U.S. dollars (World Economic Forum, 2019). Clearly, such data demonstrates the economic wellbeing of people in Norway and the lack of economic stability in Mexico, which has an impact on people’s buying capacity. At the same time, the percentage of ten-year average annual GDP growth illustrates a high potential of Mexico (with its 2.6% compared to 1.4% in Norway) (World Economic Forum, 2019).

Social factors influencing organizations’ development are more favorable in Mexico. The Mexican population is over 124 million people, while in Norway, only slightly over 5 million people live (World Economic Forum, 2019). More importantly, population density, which is an important indicator for a discounter chain, is 65 people per square kilometer in Mexico and only 5 people per square kilometer in Norway (World Bank, 2019). This low population density became one of the primary reasons for the failure of Lidl’s entry to the Norway market in 2008 (Schmid et al., 2018). The grocery discounter chain had considerable issues with logistics and customers who reached the stores occasionally, which is unacceptable for a discounter.

The technological development of Norway is overall higher than that of Mexico, but in some areas, the difference is not critical. At that, these areas are essential for logistics, especially when it comes to retailers. The road connectivity index of Norway is 90.3 (compared to 66 in Mexico), but railroad density is 11.3 kilometers per 1,000 square kilometers in Norway and 7.3 in Mexico (World Economic Forum, 2019). The index of the efficiency of seaport services is 5.1 in Norway and 4.3 in Mexico. Mobile-cellular telephone subscription in Norway is 107 per 100 and 93 per 100 in Mexico. It is clear that the gap between the two countries is not as big as it could be.

The environmental factors do not have an overwhelming influence on retail chains’ operations in both countries, but both countries try to encourage companies to increase their consumption of renewable energy. Lidl, with its values and experience, can become one of the exemplary corporate citizens in Mexico. Legal factors that can affect the development of the retailer in both countries are quite favorable in both countries. As the interests of business are safeguarded by the government and the judicial system, but, of course, this security is considerably higher in Norway.

The quantitative PESTEL analysis (see Appendix) shows that Norway could be an attractive market for Lidl as its total score equals to that of Mexico (18 to 18 respectively). Nevertheless, when it comes to the most influential factors for the company’s entry (for instance, population, population density, road connectivity, and road infrastructure quality), Mexico has higher scores. The PESTEL analysis of the prospects of Lidl in Norway and Mexico suggests that the latter is a more attractive option for the retailer.

Competitive Intensity of Lidl’s Industrial Environment

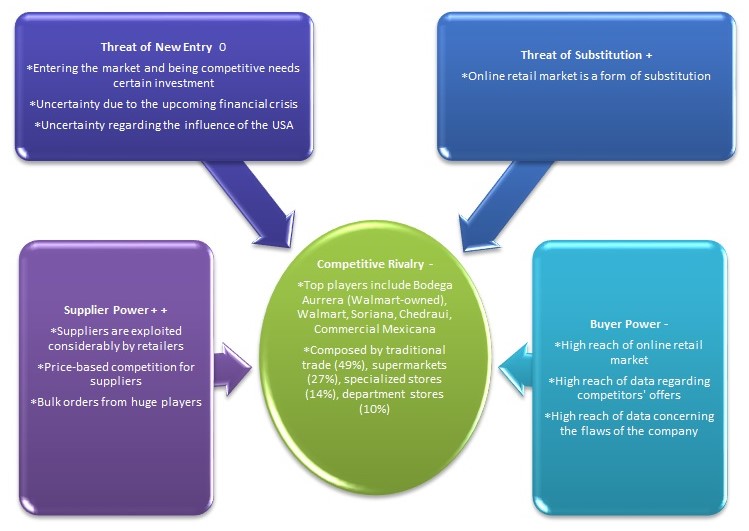

In order to explore the competitive density of the organization under consideration, it is possible to apply Porter’s Five Forces. This instrument consists of the analysis of such aspects as the threat of new entry, the threat of substitution, supplier power, buyer power, and competitive rivalry (Henry, 2018). The prospects of Lidl in the Mexican market are rather attractive due to certain features of the Mexican economy. As far as the threat of substitution is concerned, it is low, which is favorable for the company (see Figure 1). One of the most obvious threats in this respect is the online retail market that is developing rapidly in Mexico, as well as the global market (Castellanos, 2019). Walmart offers the delivery of its products at the customer’s doors, which is gaining popularity among the growing urban population. The development of technology and the growth of internet coverage in the country contribute to the increasing use of such services. However, discounter retail chains have a competitive advantage due to their low prices and well-developed networks of outlets. It is still more convenient for many people to buy products and various items from these sellers rather than buy online.

The threat of new entry is characterized by medium power as new players can enter the market, but to be competitive, they will need quite substantial investment. The retail market is rather competitive; however new players, such as local or international chains and traditional stores, can still enter. Nevertheless, to earn competitive advantage and occupy a niche, they will need to invest substantial funds, which makes entry less attractive for many, especially in the period of upcoming financial constraints (Castellanos, 2019). The influence of the USA on the economic development of Mexico is still significant, so the relations between these two countries may also affect the financial stability of the latter (Stevanovic et al., 2018). Hence, the threat of new entry is low although some players may appear, which should be considered when developing the strategic plan for Lidl.

Supplier power is associated with positive outcomes for retailers because it is low. The suppliers are exploited by retailers, especially when it comes to well-developed chains. Suppliers have to deal with bulk orders and cut prices to win the competition and retail contracts (Castellanos, 2019). Local producers and international manufacturers (over 70% of imported goods come from the USA) provide a wide range of products (Castellanos, 2019). Low labor prices in Mexico, its agricultural potential, as well as the proximity of the United States and the development of logistics and transportation, enable numerous suppliers to reach the market and make their competition over contracts stiff.

Regarding the competitive rivalry in the retail market, it is quite considerable. Such giants as Walmart have a substantial influence on the development of the grocery retail market in Mexico. The company operates in different formats in Mexico, directly and through its chains Bodega Aurrera and Superama (Castellanos, 2019). Local companies, such as Soriana, Chedraui, and Commercial Mexicana, are retailers with well-developed networks of outlets across the country, mainly in its biggest cities. It is noteworthy that almost 80% of the Mexican population lives in big cities (Castellanos, 2019). The market is competitive, but it is steadily growing, which opens up valuable opportunities for retailers. Although almost half of the market is composed of traditional trade, supermarkets’ share is also considerable (25%) (Castellanos, 2019). Moreover, the retail market increased in sales by over 8% in 2018, and supermarkets were the drivers of this growth (Castellanos, 2019). Hence, the competitive rivalry is quite high, but an effective strategy can make Lidl successful in Mexico.

Buyer power is the most challenging force that has a significant impact on retailers operating in Mexico, and similar trends are apparent globally. As mentioned above, online retailing is developing at a considerable pace, so some products are often ordered online. People living in big cities and working long hours, tend to find it more convenient to have certain products delivered at their door (Castellanos, 2019). However, discounters still have a competitive advantage due to their low prices and highly developed networks. Buyers also access and share information easily, so the news regarding low prices different retailers offer or scandals (a controversy or any other negative data) spreads quickly. The buyer power is high, so Lidl will have to develop the corresponding strategies.

Lidl’s Internal Environment

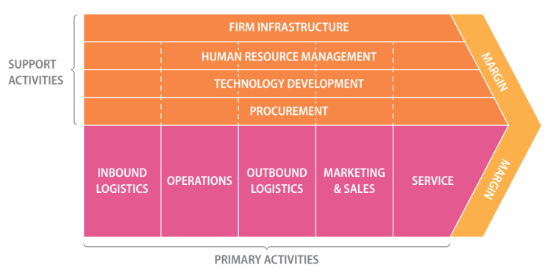

Companies’ internal environment should also be considered when identifying their competitive advantage (Henry, 2018). The value chain model is an effective instrument to analyze this aspect and evaluate the organization’s value-added activities that can support the entry into the Mexican market (see Figure 2). The analysis includes the focus on primary (inbound logistics, operations, outbound logistics, marketing and sales, service) and supportive activities. (infrastructure, human resources management, technological development, and procurement).

As for inbound logistics, Lidl has managed to achieve considerable competitive advantage in Europe and the USA. The majority of the items sold in the stores are Lidl brands, which enables the company to set low prices and attract more customers (Ladd, 2018). The company also establishes close contacts with local farmers and producers in the regions where it operates, which also ensures effective procurement. Lidl’s operations are also characterized by high performance due to the focus on their won production of the delivered goods. This strategy enables the retailer to control the quality of its products. The company has developed effective outbound logistics strategies, and it has warehouses to support its operations. At that, Ladd (2018) states that the company should be more careful with choosing the location of their stores and establishing distribution centers in the most appropriate places. Although the company’s strategy has proved to be effective in Europe, some issues emerged in the U. S. market. Hence, this area needs specific attention when developing a strategic plan to enter the Mexican market.

Marketing and sales effort are building competitive advantage as well. Lidl stores have a similar layout and space, which is convenient for customers. The deviations from this strategy led to certain difficulties in the American market, so the European approach should be used in Mexico (Ladd, 2018). As mentioned above, the discounter offers products at very low prices, which makes other competitors less successful or more focused on prices (Steenkamp & Sloot, 2018). The company also launches numerous campaigns that reach diverse objectives. The products are displayed in their original package, which reduces costs and the time for replenishing the shelves. In addition, Lidl started its “bring your own bag” campaign that helps them reduce their costs related to package (providing customers with bags) (Lidl, 2020). Apart from cost saving, this policy serves as an environmentally-friendly activity, which is positively accepted in the Western society that is environmentally conscious.

The policies mentioned above also instrumental in creating a favorable atmosphere for customers who pay less and receive high-quality products. The staff of the retailer is continuously trained in terms of their human resources management strategies (Steenkamp & Sloot, 2018). The staff is friendly, and people receive the necessary information, so they are willing to buy more. Ladd (2018) admits that Lidl managed to attract a considerable army of American shoppers, so it has high potential in other regions of the western hemisphere as well. The author stresses that local customers’ preferences should be analyzed and the necessary policies and campaigns should be developed.

The analysis of support activities also suggests that the company can enter the Mexican market successfully. As mentioned above, procurement is associated with the use of distribution centers, which makes transportation and logistics effective. Nevertheless, the locations for these centers should be chosen carefully to ensure the reach of the maximum number of stores in a particular area. Long-term contracts with partners ensure control over costs and operations.

Human resources management policies involve various training and development incentives for employees, which has a positive effect on the quality of provided services and customer satisfaction. The use of advanced technology has become one of the priorities that drive the organization’s competitive advantage (Schmid et al., 2018). The above-mentioned “bring your own bag” campaign is supported by the use of appliances that enable customers to weigh products and purchase them comfortably. The retailer also employs effective information systems and equipment, which has a positive impact on its operations (Steenkamp & Sloot, 2018). These strategies should guide Lidl’s entry into the Mexican market. Lidl’s infrastructure has proved to be effective as the company’s global expansion has been successful in the vast majority of countries (Schmid et al., 2018). Nevertheless, the expansion failures in Norway or difficulties in the U. S. market should be considered, and the corresponding adjustments should be made when entering into the Mexican market.

Modes of Entry

Organic Growth

International retailers employ different modes of entry depending on their resources, culture, as well as the target market. The company under study also utilizes diverse strategies for entering new markets (Schmid et al., 2018). For example, Lidl tends to choose organic growth but also resorts to the acquisition of competitors (Zentes et al., 2016). The latter mode was chosen for operations in Romania and Bulgaria, where the organization has gained the necessary popularity among local people.

A combination of the two models mentioned above can be effective in Mexico. Organic growth implies the multiplication of domestic operations in new markets (Zentes et al., 2016). Importantly, the development of strategies and operations are based on the companies’ domestic experience that is transferred with only some adjustments. Zentes et al. (2016) stress that the creation of a completely different model for other countries instead of replicating domestic operations is likely to lead to considerable issues. This approach is also referred to as “greenfield investment” and is associated with the setup of wholly-owned subsidiaries (Zentes et al., 2016, p. 173). This entry mode ensures a high level of control over operations and the process of the establishment of business in the new market. At the same time, it is related to several disadvantages that should be addressed. High costs of the strategy are one of the weaknesses of the model. Another obvious risk is the threat of a failure due to the necessity to operate in an unknown environment. Finally, slow entry is another shortcoming as dynamic growth is often preferable.

If the company fails to adjust its operations to the peculiarities of the new market, the use of greenfield setup results in substantial losses, which can be illustrated by Lidl’s experience in Norway (Schmid et al., 2018). The need to invest significant funds can be a serious burden for some organizations, especially when the company experiences certain financial issues. The US expansion of Lidl can illustrate the point as the company had to allocate considerable funds and change some of its operations in the region to avoid another failure (Ladd, 2018). However, the international success of the retailer shows that the chosen mode (greenfield investment) is effective and leads to successful global expansion.

This strategy is still appropriate for entry into the Mexican market due to certain factors. The region is highly attractive as it is growing at a high pace. The majority of the population of the country is not financially secured compared to other states, so Lidl can appeal to a large cohort. The population and population density of Mexico are significant factors that make the market attractive as the retail chain can develop sustainability and avoid the issues the company faced in Norway (Schmid et al., 2018). Furthermore, Lidl is operating in the USA so it has sufficient distribution centers to support the growth in the Mexican market at the initial stage. In order to mitigate the risks of high losses, the expansion should be fast and research-based. It is important to implement research to identify the major peculiarities of Mexicans and meet these needs. Collaboration with local producers is another important step to undertake in order to ensure lower costs. The establishment of smaller stores can be a successful strategy due to lower costs and the opportunity to open more stores.

Acquisitions

Greenfield investment should be supported by acquisitions that will help the company reduce costs, ensure higher control over operations, and address certain risks. The acquisition is associated with the fast entry and the use of properly set operations, but it requires considerable investment and can also lead to some issues with the integration with the European office (Zentes et al. 2016). Ladd (2018) notes that the acquisition of smaller retail chains in the USA is likely to facilitate the growth of the company in the region. This step can also be undertaken in Mexico, and Lidl can acquire La Comer or a smaller local retailer. La Comer is the tenth biggest retailer in Mexico, having a well-established chain, which makes it an attractive target for acquisition (Castellanos, 2019). As mentioned above, the largest part of the grocery market in Mexico is traditional, so Lidl has an opportunity to gain a part of this share due to its efficient operations and low prices.

The risks linked to the use of this model are comparatively low as the company has been operating in the global market for over two decades. Lidl has sufficient experience for integrating other retailers with its head office. The organization’s operations in the USA equip the discounter with the necessary knowledge to succeed in the western hemisphere. Moreover, since acquisition will be used alongside greenfield investment, the company will be able to explore the Mexican market and establish strong relationships with local companies (as well as producers, authorities, and so on). Therefore, Mexico can be regarded as an attractive market for further international expansion for Lidl.

References

Castellanos, L. (2019). Mexico: Retail Foods: Mexico trends towards E Commerce. USDA Foreign Agricultural Service. Web.

Henry, A. E. (2018). Understanding strategic management. Oxford University Press.

Ladd, B. (2018). Lidl USA: What went wrong and what it can do to recover. Forbes. Web.

Lidl. (2020). About us. Web.

Schmid, S., Dauth, T., Kotulla, T., & Orban, F. (2018). Aldi and Lidl: From Germany to the rest of the world. In S. Schmid (Eds.), Internationalization of business cases on strategy formulation and implementation (pp. 81-98). Springer International Publishing.

Steenkamp, J., & Sloot, L. (2018). Retail disruptors: The spectacular rise and impact of the hard discounters. Kogan Page Publishers.

Stevanovic, A. T., Pavlovic, V., & Dajic, M. (2018). Aldi and Lidl: From Germany to the rest of the world. In K. Hammes, I. Klopotan, and M. Nestorovic (Eds.), Economic and social development: 30th international scientific conference on economic and social development (pp. 419-426). Varazdin Development and Entrepreneurship Agency.

Zentes, J., Morschett, D., & Schramm-Klein, H. (2016). Strategic retail management: Text and international cases (3rd ed.). Springer.

World Bank. (2019). Population density (people per sq. km of land area) – Iceland, Norway, Denmark, Sweden, Faroe Islands. Web.

World Economic Forum. The global competitiveness report 2019. Web.