Marks & Spencer (M&S) is one of the major UK retailers, that have a great chain of over 840 stores in 30 regions around the globe and they have over 600 domestic and 285 international stores. Marks & Spencer is commonly renowned as the major clothing retailer of the United Kingdom, it is one of the most famous food retailers, and it is declared as the 43rd major retailer around the globe. All of its domestic stores offer both clothing and food retailers and over time, it has also started other ranges like homewares, technology, and furniture. In 1998 it was declared as the first UK retailer which made a tax profit of around £1 billion, later it dived into some crisis which endured for many years. After achieving major growth in past years, amid 2008 it has been observed that share prices immerse deserving well less than 50% of their value of what it was just 12 months ago. M&S struggles hard to reach the top as a credit church. The company faced lots of crises in the past few years and at the height of the crises at the start of the 21st century. Marks and Spencer addresses the whole business majors of women’s wear, kids wear, menswear, food and home, and their services along with IT and store environment and logistics and store environments (Annual Report and financial statement 2008).

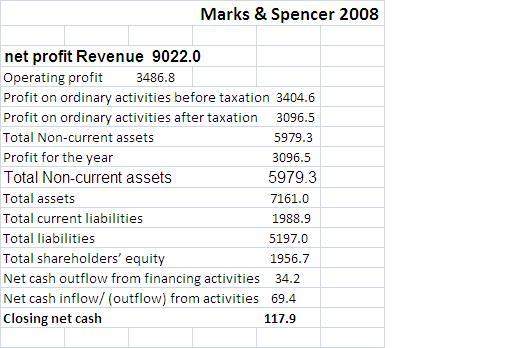

Marks & Spencer profit & losses in 2007 are as follows: Revenue=8588.1, Operating profit = 3341.2, Profit for the year = 2955.2, Total Non-current assets = 4534.6, Total assets = 5381.0, Total current liabilities = 1606.2, Total liabilities = 3732.8, Closing net cash = 47.0.

Strategy & Outlook of Marks & Spencer

Marks and Spencer follow three strategies’ namely Plan A, Plan B, and Plan C. Marks & Spencer focuses on their growth, productivity, and implementing a 100% authentic approach to increase their sales. Plan A includes 100% Own Brand, Improved Segmentation of Clothing, Build on Success in Foods, Develop High-Growth Areas of Home & Beauty, More Intensive Use of Space, Accelerate Store Renewal Programme, Improve the Supply Chain. Financial Services are included in their plans to motivate their employees in return to get their high sales. Plan A is Marks & Spencer five-year ‘eco plan’ for pointing out main key social and environmental objectives facing by M&S. M&S sworn to achieve 100 different Plan A commitments in the upcoming five years, and so far they have achieved around 94 of the 100 commitments (Annual report and financial statements 2008). Plan B is based on Sell or Close loss-making businesses, Closure of Loss-making Businesses, and Value Realization.

Description & key issues-divisional/geographical split, ownership

Every company has some obligations on it, for socially responsible business practices, Marks & Spencer is a company that has been working aggressively with its global supply chain to obtain the commitment of social responsibility, specifical suppliers in developing countries, to do and create more enlightened employment standards and to establish better work environment. A huge, significant investment in processes, training, R&D systems, and for people, the company measures its progress towards a sustainable method – empowering suppliers at the initial and local level to improve the lives of their workforce.

Marks and Spencer accounts can easily be checked by the co-coordinators of the public for investigating the performance of the company. Because of this major, the Competitors are usually able to catch some of the useful information of their advantage. M&S usually publish extra information than other private limited companies for achieving high objectives i.e. good relationship with customers etc…

How the business Works

The main functions of Marks and Spencer are listed below: –

Marketing and Sales, Human Resources, Design and Production, Finance, Packaging, Research & Development, Administration, The human resources module of the company holds the organizing management concern with the people. The personal module is highly engaged to look after the advantages and welfare of given workforce to contribute more productivity, creativity, and establishment of the organization, and is answerable for many tasks like as recruitment, selection, training, health and safety, orientation, payment systems, equal employment opportunities, compensations, and work disputes. The finance department is about accounting and keeping the records of all financial activities including cash inflows and cash outflows that are going on as daily activities. By providing the whole financial report when it is requested by the top management for accountability such as balance sheets, profit, and loss accounts, equity statements, and the records and performance of outstanding shares to evaluate the performance of the company and to keep the track of the money paid into Marks and Spencer and the records of all debtors and creditors and shareholders transactions (McKenzie & Vaitilingam 2004: 23).

The administration management’s function is to take care and accountability for all the paperwork of the company. They also provide services with good communication, high inquiries, helpful messages, ready-to-solve queries, and producing paperwork for Marks and Spencer which usually takes place in the head office of the company (White, Sondhi, et.al 2003: 1). Marks and Spencer’s head office is based in Backer Street in London. The management follows the style in the beautiful pattern of conduct that the person demonstrates in holding out a management’s role over a provided time.

The Company follows great leadership strategies and rules to have long-term staff retention and a complete grip on its sales (Weidenfield & Nicolson 1990:1). Marks and Spencer deals in a variety of products and consumers are happily satisfied after purchasing their products which illustrates the company’s success (Research and Markets 2008: 1). There is a probability of this feeling because they are experts and leaders in their field and they know their responsibilities and functions. Marks & Spencer is one of the major companies which shares the lost market share in the clothing sector, the Daily Telegraph, FashionTrak, Marks rose 7 pence, or 2.3 percent, to 317.25 pence (Barclays, BP, HSBC, Marks & Spencer: U.K., Irish Equity Preview, 2009: 1).

This strategy allows the company to run smoothly and achieve its objectives and goals (Penman 2004:1). The company has a customer-driven culture that is customer-oriented to full fill their needs and wants which is a very mature step to meet the objectives.

Economic Outlook

For calculating residual income, profits are shown on sheets of cash flows which are usually fixed to obtain vectors of cash flow statement. Fixed and variable income assets may be derived based on theory beginning from pre-obtained growth ratios for maximizing profit (Holmes and Sugden 2004: 1). In the late 1990s, the sales and profits decreased and fell as Marks &Spencer lost its market share. It has earned a reputation for high prices after developing a policy as a result of its strategy of sourcing heavily within the UK. Two consecutive Acts mentioned in 1856 and 1862 according to which limited liability and shareholder audit are the key factors for calculating a firm’s performance. In the mid-1900 audits were compulsory and financial disclosure was also in the queue (Rees 1995:21). At that time the customers were not intended to come to their stores, it became unattractive; unpleasant the supply chain was inappropriate, and the company was self-satisfied and did not earn any gain during that recession point of a company. Marks & Spencer also hand over many of its non-UK company-owned operations.

The company admitted and visualized many of its grey areas, problems, and queries. M&S used clothing sources 90% from both inside and outside of the country. They use products and raw materials from both inside and outside of the UK. M&S is doing their efforts to improve the task quality, delivery of time and supply chain, and efficiency of the stores and to facilitate the stylish clothing that its core customers need. Marks & Spencer’s weaknesses and powers and value reside in lingerie and in great clothing where it accounts and catches for over a quarter of the UK market. The company is one of the major retailers of the UK which provides wide space to the government for collecting taxes. Customers like Marks and Spencer products for many reasons. The chairman and other members put their best in handling risk management and to make Marks and Spencer effective in the market for a longer period.

Risks-creativity, competition, and management

Marks & Spencer is facing high competitive environment and its sales were in decline in the past few years but last year their sales increased. M&S UK sales are at fall in all its stores for more than a year. Sales were at decline around 5.7% along with its all merchandise decline of 6.2% and food decline of around 5.3%. The loss and competition facing by M&S are influencing a lot on M&S’s share price (Collins and Johnson 2002: 34). Risk handling is the most difficult task for any organization but Marks and Spencer deal with it effectively by utilizing their all labor and source. Marks and Spencer are climbing the ladder of success day by day. Management of Mark and Spencer is effective and they deal with all employees decently to retain their staff in long run. The company is facing a lot of competition as there are several in the market. There are around 27 competitors of Marks and Spencer but it’s also said that the sun never sets on Marks and Spencer. A few of their competitors are as follows: BHS, Debenhams, Derry’s, House of Fraser. BHS, Selfridges, and John Lewis.

Valuation range based on both asset and market basis. Compare valuations based on different models and list your assumptions

“Valuation gets to the heart of how to measure and manage value in a company. Whether you are evaluating an acquisition, restructuring a corporation, or formulating strategy, this book will help you do it well”. John A. Manzoni

Generally, Market values are based on the following:

Restricted cash, Lack of marketability discount, low market leases, extra salaries, and bonuses, Non-operating assets and liabilities, lack of control discount (McKinsey and Company Inc; 2005: 2).

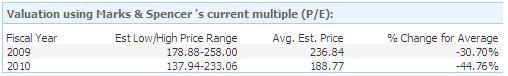

Selecting the right model for the valuation range is a difficult task and to calculate a target price for the current and upcoming years based on beliefs, the P/E method can be applied to find out the earnings estimate of the company in the following periods. Following are the assumptions for the valuation range (Swanson, 2008: 2).

The economic condition of the country should be stable, the company should not face any financial crises, and the cost of production should not increase (Barker 2001: 21). For achieving high peaks in UK Marks & Spencer intends to improve and bring close non-core businesses and assets related to have the best consultation with its employees. Assumptions play a vital role in making all rules and regulations. The comparison between 2009 & 2010 is clear as in the year 2009 average cost is -30.70 and in 2010 it is around -44.76.

P & L

By analyzing the profit and loss account of several years data we conclude that the company is performing in a good condition and the sales in 2008 are increasing by 5535.2 with a certain amount as compared with the last year 5246.9 and the graph of sales are going in the upward direction. And in the coming years as it has been forecasted by applying forecasting calculation that the company production and sales will increase by good amounts if there will be no uncertainty of inflation and other economic uncertainties. This revenue shows that the company has a well-known name in the market and it is efficiently achieving its customer loyalty. In 2008 the company performed well and by forecasting the sales of 2009 will increase with 9473.1while in 2010 it will achieve 9994.121million pounds.

In 2013 it will reach sales up to 11959.335million pounds. After paying the taxation, ordinary activities will be decreased in the coming years and in 2013 it will be 2691.2 million pounds. The profit of the company has been increased from last years such as in 2009 the profit for the year is 3096.5million pounds and after forecasting the profit it will always be there but it is decreasing by 2769.3 million pounds. Shareholders have also a part in the company and the condition of shareholders equity in 2009 is 3097.2 which is a good thing for the benefit of a company. P& L statement helps in identifying the new status of the company in upcoming years, that’s the only reason why big organizations make their P& L accounts at the end of each period.

“M&S’s annual turnover is now more than £9bn. It is a genuinely international business, with more than 285 overseas outlets. And although it has long lost its claim to be either Britain’s biggest retailer or its most profitable (both of those titles go to Tesco), M&S is reckoned to have made £600m or so in the year just ended. Despite its problems over the recent years – and despite the fact that this is still a mile away from the Greenbury-era record – M&S is scarcely on the verge of bankruptcy.” (Laurance, 2009)

Cash Flow

The net cash flow from operating activities in 2008 is 1069.8million pounds and the inflow from operating activities in 2007 was 1292.5 million pounds which means the cash is used in the company. The cash flow of Marks and Spencer shows a satisfactory status for next upcoming years. The company holds a stable position in the market which adds a great benefit to the company’s life.

The financing and investing activities show that the net cash inflow in 2008 is 966.2 million pounds which is an inflow in the company. The closing net cash is 117.9 million pounds which is an inflow in the company.

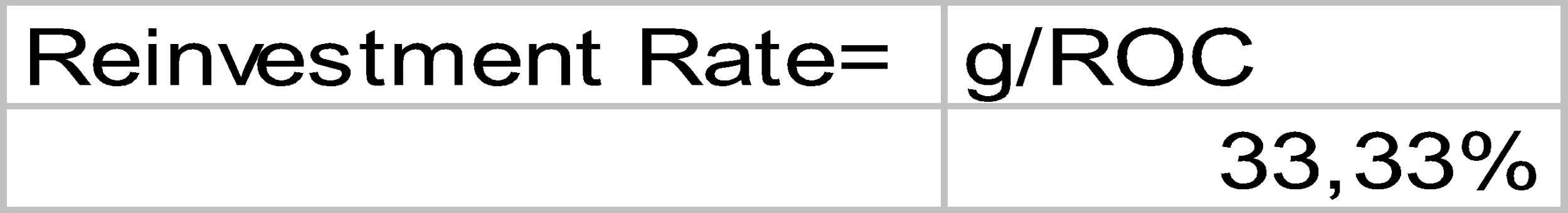

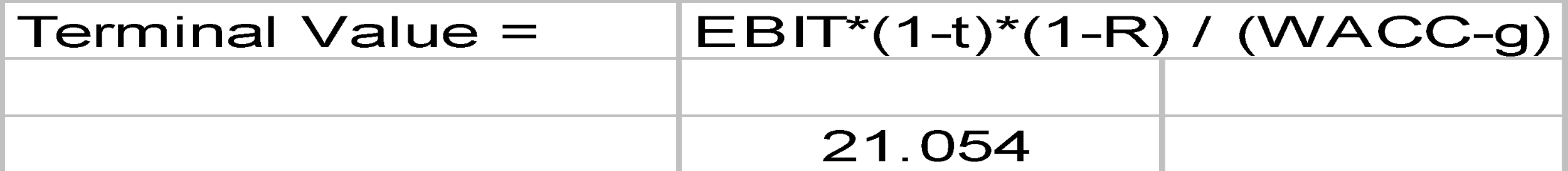

WACC

Post-tax weighted average cost of capital,

WACC = (1-td)*rd*D/A + re*E/A

WACC =0.060*(1-0.33)*0.20+0.0952*(1-0.2) =8.42%

by putting values in the above formula WACC of the previous year can be easily calculated. The weighted average cost of capital is 4.91% which is the weighted average cost of debts and equity in the year 2005.

Balance Sheet

By analyzing the balance sheet we conclude that the company’s performance is better in 2008 total non-current assets are 5979.3 million pounds because the company has fixed assets by 4704.4 million pounds which is good for the long term to save the company. By forecasting the non-current assets it will decrease because the receivables will be collected by the creditors. The current assets of the company for 2008 are in better condition as compared to previous years by 1174.8 million pounds because the receivables have been collected and the cash in 2008 also increased which is 318.0 million pounds. “Britain’s largest fashion retailer reported the steepest sales to decline in about nine years and said it plans to cut about 1,230 jobs. The stock rose 8.75 pence, or 3.8 percent, to 238.75.” (MacAskill, 2009)

The current liabilities have also increased by 1988.9 million pounds because the company has invested in joint ventures and provisions that have also increased by 11.0 million pounds and the company has also borrowed an amount of 878.6 million pounds as the cash has also increased. And in the coming years, the current liabilities are decreasing and the cash is also decreasing so they will pay off their certain liabilities in near future. The total non-current asset of the company in 2008 is 5979.0 million pounds which are enough to pay off the non –current liabilities of 3208.1 million pounds so the company is in stable condition. The shareholders’ equity is also upgraded by 1956.7 million pounds and in the coming years, it is evaluated that in 2013 it will be 1462.3 million pounds. The current liabilities of Marks and Spencer according to the balance sheet is that the company faced bad crises but it can survive in the market as it has earned sufficient profit in the last year.

List of References

McKinsey and Company Inc; (2005) Valuation Measuring and Managing the Value of Companies, 4th edn; John Wiley and Sons, New York.

Joseph Swanson (2008). A Practitioner’s Guide to Corporate Restructuring, Andrew Miller’s Valuation of a Distressed Company page 24. ISBN: 9781905121311.

Barker R. (2001) ‘Determining Value; Valuation Models and Financial Statements; Pearson Education, Harlow, UK.

Revsine L, D.W. Collins and W.B.Johnson (2002) ‘Financial Reporting and Analysis’ 2nd edition. Prentice Hall, New Jersey.

Weidenfield & Nicolson, (1990). Management: The Marks & Spencer Way.

Penman S.H. (2004) ‘Financial Statement Analysis and Security Valuation’ 2ND Edition, McGraw-Hill, New York.

McKenzie W. and R. Vaitilingam (2004) ‘The Financial Times Guide to Using the Financial Pages and Interpreting Company Accounts’ 4th edition, FT Prentice Hall, London, UK.

Rees B. (1995) ‘Financial Analysis’ 2nd edition.Prentice Hall Europe, Harlow, UK.

White G.I, A.C. Sondhi, D. Fried; (2003) ‘The Analysis and Use of Financial Statements’ 3rd edition. John Wiley and Sons, New York.

Barclays, BP, HSBC, Marks & Spencer: U.K., Irish Equity Preview, (2009), Barclays, BP, HSBC, Marks & Spencer: U.K., Irish Equity Preview. Web.

Holmes G. and A. Sugden (2004) ‘Interpreting Company Reports and Accounts’ 9th edition, Pearson Higher Education.

Annual Report and financial statement, 2008, Annual Report and financial statement 2008: Web.

MacAskill, A. (2009) Marks and Spencer Plc Group. Web.

Laurance, B. (2009) M&S marks 125 years on the UK High St.