Introduction

Ramsay Health Care is one of the leading Australian healthcare organizations with a global network. The organization was founded in 1964 by an Australian entrepreneur and anthropologist named Paul Ramsay. Within the past five decades, this business venture had expanded to have branches in different regions, including Asia, the United Kingdom, Australia, and other countries of Europe. Some of the key services available in its centers include rehabilitation, surgery, and psychiatric care. Being an organization operating in the global healthcare industry, Ramsay Health Care has attracted a number of stakeholders. The key ones include medical professionals providing a wide range psychiatric and general health services, the identified patients, and investors in different stock exchange markets, government agencies. Additionally, the overall members of the communities where it operate form an integral part of its partners. This medical facility promotes desirable activities and financial reporting practices that resonate with the demands of all these stakeholders.

This report is, therefore, aimed at presenting the results of the investigations focusing on this organization’s financial and non-financial aspects. The purpose is to analyze such findings and provide a set of recommendations for the hospital to implement and overcome most of the challenges associated with the ongoing coronavirus disease of 2019 (COVID-19) pandemic. The notable recommendations from this report include embracing the power of research and development (R&D) and taking the process of forecasting seriously than ever before.

Key Performance Indicators

Ramsay Health Care is one of the positively performing medical institutions today despite the challenges associated with the ongoing coronavirus disease of 2019 (COVID-19). As described in the Annual Report FY21, it is notable that the organization was able to report a profit of 449 million dollars. This was a growth of 58.1 percent from the profit recorded earlier (Ramsay Health Care, 2021). The company’s total revenues obtained from patients and other sources totaled around 12,435 million dollars (Ramsay Health Care, 2021). The report revealed that such a performance represented a growth of around 3.9 percent (Ramsay Health Care, 2021). The company was also able to increase share earnings by 47.6 percent (Ramsay Health Care, 2021). Specifically, individuals and investors were able to receive dividends of around A151.5 centers for every share (Ramsay Health Care, 2021). These attributes reveal that the organization was performing positively in different regions.

The presented report goes further to offer a detailed outlook for the performance of different regions. For instance, Australia’s branch reported revenues of around 5,430 million dollars while those for the UK stood at 606.5 million US dollars (Ramsay Health Care, 2021). From the findings, it was observed that government-related earnings amounted to around 417.6 million dollars (Ramsay Health Care, 2021). This presented an increase of 6.9 percent. From this analysis, it would be notable that the company has been performing optimally. However, the report reveals that the wider European market was characterized by negative performance during the period under investigation. This challenge was largely attributed to COVID-19.

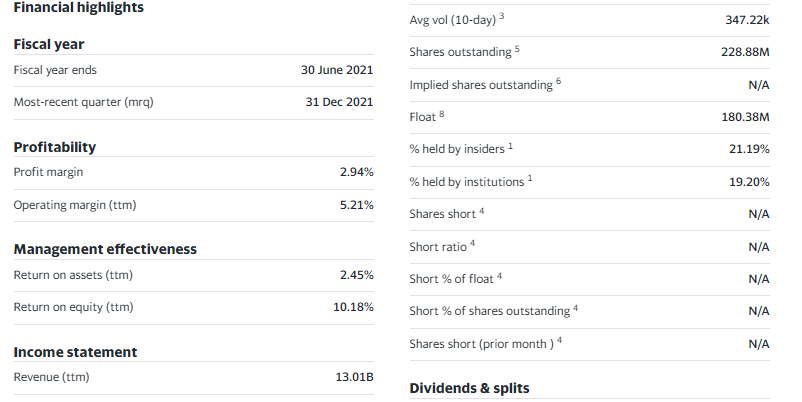

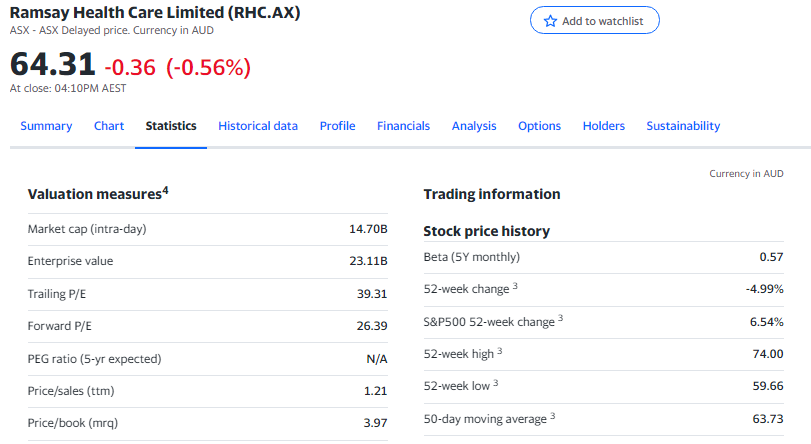

From the presented financial ratios, this organization recorded a price/sales (ttm) ratio of 1.21 (see Appendix 1). The recorded price-to-book ratio for 2021 was 3.97 (Ramsay Health Care, 2021). The reported total cash per share for the same period was 3.08 (Ramsay Health Care, 2021). Additionally, the facility recorded a total debt/equity of around 196.76 (Ramsay Health Care, 2021). The book value per share at the company was 16.27 (see Appendix 1). The recorded return on equity (ROE) for this healthcare facility is 10.18 percent (see Appendix 3). These ratios are essential and provide a proper outlook for learning more about the overall financial health of this facility.

To achieve most of the anticipated business aims, the leaders at Ramsay Health Care have considered various non-financial attributes that resonate with the demands of all key stakeholders. The studied documents support the fact that this organization is focusing on the ability to continue providing sustainable medical services in the long-term. The current board has been keen to implement a number of strategies that resonate with the outlined corporate objectives (Ramsay Health Care, 2021). Individuals are empowered, equipped with appropriate support systems and resources, and properly rewarded. All stakeholders remain involved to support decision-making processes and provide timely insights for improving performance (Bai et al., 2020). These attributes reveal that Ramsay Health Care is keen to remain a responsible corporate citizen.

Currently, Ramsay Health Care is an employer of more than 80,000 professions providing personalized medical services in different parts of the world. To promote efficiency, proper mechanisms have been implemented that resonate with the ideals of safety and quality. The institution’s philosophy is: “people caring for people” (Ramsay Health Care, n.d.). This statement has become the guiding principle that dictates how all actors pursue their goals. These attributes have been linked with the wider organizational mission statement to help deliver desirable results.

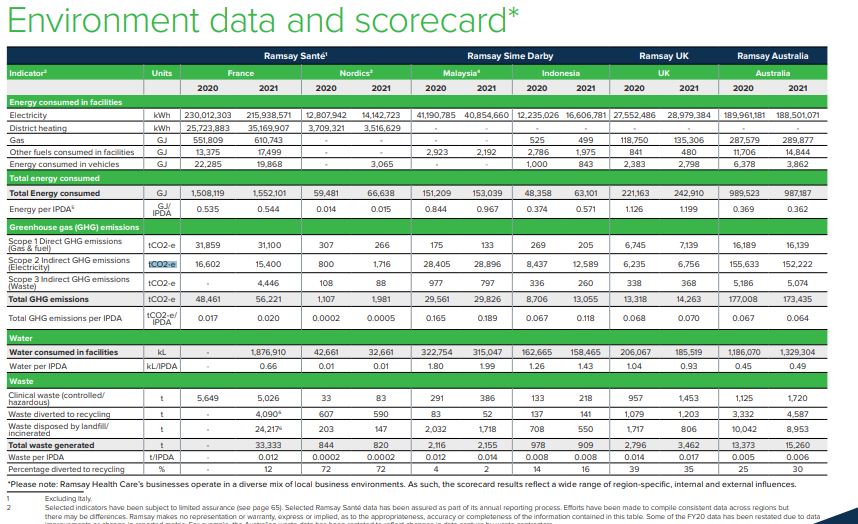

A three-pronged model is in place to guide the organization pursue and promote the notion of sustainability. The first aspect is caring for the people in need of medical services. All activities and care delivery procedures are implemented in such a way that they focus on the wider community, partners, and even patients. The hospitals associated with Ramsay Health Care foster inclusive, caring, and successful cultures. The second one is intended to support actions that have the potential to protect the integrity of the natural environment. The concept of continual improvement is in place to address issues to do with climate change, reduce overall greenhouse gases (GHGs) emissions, and promoting recycling processes (Ramsay Health Care, n.d.). For example, indirect GHG emissions in France stood at 16,602 (tCO2-e) in 2020 and reduced to 15,400 in 2021 (see Appendix 2). The third aspect entails caring for all communities and their respective members. The organization is famous for offering adequate care to persons with diverse backgrounds. Clinical teaching, empowerment, and medical campaigns are usually implemented to support the realization of sustainable goals.

Interpretations and Insights

The above section has indicated that Ramsay Health Care recorded mixed financial results due to a wide range of factors. First, the negative results in Europe could be attributed to the increasing costs and challenged linked directly to COVID-19. Specifically, the level of lockdowns in different countries led to higher operational expenses. The wider environment also triggered additional costs for personal protective equipment (PPE) and other key resources. Despite such issues, the company was able to record additional gains in some of its key areas of strength, including surgical processes. For instance, the institution observed that the percentage of surgical procedures increased by 15.2 percent in comparison with 6.6 percent in 2019 (Ramsay Health Care, 2021). Additionally, the organization ensured that the level of workforce remained undisturbed. It also made local arrangements to ensure that all barriers were kept as low as possible.

From the financial ratios outlined above, it is agreeable that the company’s ROE is positive. This trend means that individuals who consider it for investment will have higher chances of recording meaningful results. The recorded price-to-book ratio of 3.97 reveals that the company’s overall stock relative to the recorded book value is promising (Ramsay Cares, 2021). This scenario presents a unique opportunity for the organization to achieve the much needed results. Additionally, the price/sales ratio outlined above reveal that more people in different parts of the world would be willing to invest in the company depending on the recorded revenues.

The debt/equity ratio of 196.76 gives an impression of what Ramsay Health Care owes in comparison with what it currently owns. The figure reveals that the debt remains manageable and incapable of affecting or disorienting the organization’s future financial performance. Consequently, more people will be in a position to receive high-quality and personalized services from the facility (Ramsay Cares, 2021). Such financial results indicate that the existing business model and the subsequent strategies have continued to support operations. Investors who consider these ratios would acknowledge that Ramsay Health Care is on the right path and capable of meeting the demands of more clients in the future. It would also form a good investment partner for those who want to trade in the stock market.

On top of the financial indicators, it is evident that Ramsay Health Care has strong sustainability and ethical practices that continue to support the implemented business model. From the studied materials, it is evident that the facility has been included in the FTSE4Good Global Index since the beginning of 2011 (Ramsay Health Care, n.d.). This agency is known to rank companies that have been on the frontline in promoting acceptable environmental, social, and governance practices (ESG). These attributes have outlined international standards intended to present desirable and accurate measurements. The inclusion of the facility in this index is a clear indication that it has remained committed and ready to promote the outlined ESG standards at the global level. Additionally, the 2021 findings saw Ramsay Health Care receiving a positive MSCI ESG rating of AA (Ramsay Health Care, n.d.). The same results have been obtained since the year 2017.

Ramsay Health Care continues to focus on the environment, community, and patients to support its ethical objectives. These activities are pursued in accordance with the established codes of ethics and green reporting procedures (Bai et al., 2020). The positive performance in most of the key non-financial areas reveals that this company has increased chances of becoming more competitive in the future. The involvement of its 80,000 employees in such sustainability and ethical efforts has led to the delivery of the much needed results (Ramsay Health Care, n.d.). The business strategy is sustainable and designed in such a way that it integrates key partners to support the provision of high-quality services.

Based on this organization’s annual report, it is evident that a number of strengths will continue to promote its profitability in the future. Some of them include the presence of highly-skilled medical professionals and the fact that it has a good cash flow (Jeurissen et al., 2021). Others include a dedicated community, presence of automated care delivery processes, good return on investment, and the ability to develop superior products that resonate with patients’ needs (Ramsay Cares, 2021). The established network system promotes distribution of resources, thereby making it possible to meet the demands of more patients.

On top of the identified strengths, Ramsay Health Care can pursue some of the opportunities if it is to continue recording positive outcomes. For instance, the use of the Internet can help this hospital to provide remote services to more psychiatric clients. The governments of the countries where it operates continue to present progressive laws that support most of the key partners (Jeurissen et al., 2021). The presence of a stable cash flow could result in better and timely projects (Ramsay Health Care, 2021). The emerging consumer behaviors associated with various chronic conditions could be an opportunity for Ramsay Health Care to continue offering personalized services. The wave of globalization is setting the stage for streamlined operations and increased revenues.

Despite these issues, a number of weaknesses exist that have the potential to affect future performance. For instance, the hospital is not promoting a wide range of research and development (R&D) initiatives. The facility is yet to position itself more effectively and address the problem of emerging competitors. The absence of proper forecasting mechanisms explains why the occurrence of COVID-19 disoriented some of its functions. The absence of diversification compels Ramsay Health Care to continue pursuing a replicable business model (Ramsay Cares, 2021). The leaders have also failed to integrate emerging and innovative technologies that have the potential to support the company’s overall performance. These key areas can present additional opportunities for presenting specific recommendations to this company.

Conclusion and Recommendation

The results of this analysis reveal that Ramsay Health Care is engaging in desirable efforts and strategies that have led to considerable financial gains. The focus on sustainability is commendable since it has attracted more stakeholders to become part of the business model. The existing model is designed in such a way that it takes into consideration the key demands and expectations of all stakeholders. The ethical approaches have also helped the organization attract more potential clients in different communities where it operates. Such measures have played a significant role towards delivering most of the positive outcomes associated with this organization. However, some weaknesses are notable that could have negative implications on this company’s future performance. The consideration of all key strengths and opportunities could set the stage for a superior strategy that can eventually deliver positive results. All key partners and followers would need to be part of the process and take the company closer to its aims.

Two recommendations are notable that can guide Ramsay Health Care to become more profitable. First, the managers in all regions would need to embrace the idea of forecasting and make it part of the business model. This action will ensure that future events and possible disruptions are predicted before they can affect overall performance. Second, the organization needs to start taking the issue of R&D seriously than ever before. The approach will present new innovations, care delivery processes, and medical products that are capable of transforming the experiences of more patients in the future (Ramsay Health Care, 2021). The involvement of leaders, workers, and strategists will make it easier for the company to implement these suggestions efficiently and in a timely manner. Combined with the current strengths, these recommendations will make Ramsay Health Care more successful and set the stage for opening new branches in untapped markets.

References

Bai, T., Méndez, S., Scott, A., & Yong, J. (2020). The falling growth in the use of private hospitals in Australia. Melbourne Institute.

Jeurissen, P. P. T., Kruse, F. M., Busse, R., Himmelstein, D. U., Mossialos, E., & Woolhandler, S. (2021). For-profit hospitals have thrived because of generous public reimbursement schemes, not greater efficiency: A multi-country case study. International Journal of Health Services, 51(1), 67-89. Web.

Ramsay Cares. (2021). Impact report: 2021. Ramsay Health Care Limited.

Ramsay Health Care. (2021). Annual report 2021. Ramsay Health Care Limited.

Ramsay Health Care. (n.d.). Sustainability. Web.

Appendixes

Appendix 1: Key Valuation Measures

Appendix 2: Ramsay Health Care Environment Data

Appendix 3: Financial Highlights