Introduction

The individual coursework focuses on Rolls-Royce by highlighting its standard industrial classification codes (25300, 25620, and 28110), which helps categorize the firm based on energy and propulsion industry. An understanding of the business structure and organization is illustrated to give a contextual understanding of how the business operates. Further, the coursework presents a steeple analysis, which provides a clear perception of the micro and macroeconomic factors that helps the reader comprehend Roll-Royce’s business environment. The challenges faced by the business are highlighted at the end to show the current issues faced by the organization.

Industry Identification from the UK Standard Industrial Classification

Based on the U.K. standard industrial classification (SIC), Rolls-Royce Holdings PLC.’s nature of business is coded in the following three categories. 25300 steam generators’ manufacturers, except central heating hot water boilers, 25620, machining, and 28110, turbine and engine manufacturers, except cycle and vehicle, and aircraft engines (GOV.UK, 2022). In familiar terms, Rolls-Royce Holdings PLC. is an industrial technology organization responsible for providing integrated propulsion and power solutions. The company was established in 1904, and it is responsible for the distribution, manufacturing, and designing of aviation power systems and other industries (Rolls Royce Plc, 2022). The organization’s primary business is in the energy and marine propulsion sectors.

Structure of the Industry

The business structure used in the energy and propulsion industry is oligopoly where small companies have substantial influence on the market. Based on industry structure, there are few sellers who are in control of the most sales in the market. The barriers to entry ensure start-ups have difficulty to enter, which makes the market to rely on interdependence and prevalent advertising, which is the case in Rolls-Royce. In the industry, cost factors are critical in determining engine price; therefore, repair, maintenance, and operation costs are considered.

Business Organization

Rolls-Royce Holdings PLC. is an engineering firm based in the United Kingdom focused on designing, manufacturing, and distributing propulsion and engine systems. The company has different segments: power defense and systems and civil aerospace. The latter is responsible for developing, manufacturing, selling, and marketing aftermarket services and commercial aero engines (Financial Times, 2022). The control section of the firm involves itself in the growth, marketing and sales, and development of civil power generation systems and returning engines (Financial Times, 2022). Lastly, the defense section is where the firm involves in nautical engines, martial aero-engine creation, manufacturing, and sales and marketing, alongside aftermarket services. The oligopoly structure allows the company to oversee the operation of different functions, including human resources, finance, research and development, and role culture (Rolls Royce Holdings Plc, 2019). Rolls-Royce Holdings PLC. emphasizes performance, processes, routine, and role instead of individual significance. Therefore, the organization establishes its working procedures based on consumer requirements.

STEEPLE Analysis

Social Factor Analysis

Despite being owned by BWM, the Rolls-Royce brand remains a standalone name in the market. Power structure shows an increase in income inequality trends; in the past decades, the firm has experienced changes in its persistence. How the media share information has played a significant role in how the public perceives Rolls-Royce products and services. Both social and traditional media have changed how the company’s products and services are rapidly changing in the U.K. and the world (Rolls Royce Holdings Plc, 2020). That presents an opportunity for the firm to leverage the trend to improve its market position and products.

Technological Factors Analysis

Patent and intellectual property (I.P.) protection, Rolls-Royce constantly works to ensure its rights are safeguarded against fraud. Therefore, the applies for patents in regions where it operates to protect its intellectual property, which creates an opportunity to invest more into research and development to ensure I.P. safety (Rolls Royce Holdings Plc, 2020). Technological maturity has not been achieved in the aerospace and defense industry, so players in this industry are competing for innovations. Rolls-Royce has an opportunity to garner a higher market share globally and elevate its position in the market by developing technological innovations that put it on top of its competition. Intending to go completely electric or hybrid, the organization has developed the 103-EX prototype, and with it presents a vehicle that is a perfect amalgamation of existing and future technologies.

Environmental Factors Analysis

Rolls-Royce has provided subsidies in its manufacturing plants in the U.S., China, and Singapore, enabling it to invest in the renewable sector. Another environmental issue impacting the performance of the organization is recycling. The firm plans to ensure it adheres to the expectations and regulations in the Capital Goods Sector (Rolls Royce Holdings Plc, 2020). Once rolled out in the U.S., the firm intends to implement similar policies in Singapore and China to mitigate associated waste management challenges, which are a constant cause of scrutiny by environmental agencies. Extreme weather contributes to operation costs faced by Rolls-Royce, and with this, the firm is investing to ensure its supply chains are more flexible (Rolls Royce Holdings Plc, 2019). Lastly, the organization is changing how it prioritizes its product innovation. In many instances, it designs its products based on environmental expectations and standards instead of catering to the conventional value propositions.

Political Factors Analysis

Rolls-Royce has experienced a rise in populism in other countries, specifically in China, Europe, and the U.S., which causes market instability (Rolls Royce Holdings Plc, 2019). Another political issue affecting the operation of the firm is the governance system. Compared to the U.K., the U.S., China, and Singapore, Rolls-Royce deals with different governance systems, which must adjust to operate profitably (Rolls Royce Holdings Plc, 2020). However, it must closely monitor industry-wide government priorities to anticipate future trends. Regulatory practices mean the organization must manage diverse market regulations currently operates in. With this, Rolls-Royce must monitor new governments and policies to prepare for changing governance priorities.

Legal Factors Analysis

Environmental guides and laws differ in the different markets the firm operates in; therefore, meeting them is a requirement for the company. Moreover, legal I.P., copyrights, patents, and associated rights protection are critical in addressing privacy issues adequately (Rolls Royce Holdings Plc, 2020). Other legal issues faced by Rolls-Royce are health and safety norms, business laws, and time is taken to handle court cases (Rolls Royce Holdings Plc, 2019). The firm must be consistent with the international institutions when dealing with global issues to meet the requirements of specific member countries effectively.

Ethical Factors Analysis

Rolls-Royce has a worldwide conduct code, which applies to every employee. The code sets out the values that reinforce the organization’s principles and how it conducts its operations. Moreover, the code is responsible for everything the company does in the U.K. and its manufacturing plants (Rolls-Royce Plc, 2022). Breaching any of the principles is unacceptable and results in Rolls-Royce taking action against the offenders, some of which might be dismissal or disciplinary action based on the nature of the breach.

Economic Factors Analysis

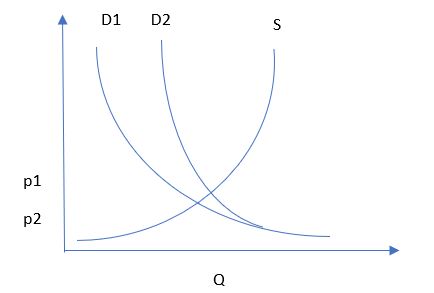

Competition levels in the aerospace and defense industry impact the operation of Rolls-Royce. The media and the public equally play a critical role in the firm’s operations. For example, as already shown, social and traditional media have changed how the company’s products and services rapidly change in the U.K. and the world (Rolls Royce Holdings Plc, 2020). Supply chains and distribution channels ensure the company is constantly innovating to ensure its products and services are available to the market. Additional costs that impact the operation of the business can appear due to such microeconomic factors as insurance purchasing and governmental taxations. Figure 2 shows the shift of the demand curve when specific microeconomics factors are applied.

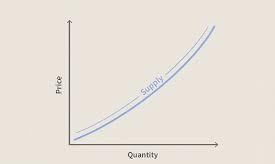

Determinants of Supply

The determinants of supply in the business are price and quantity, as shown in the Figure 1 in the appendix. The possible cause of a rise or fall in the collection of goods is technological innovation, government policies, legal laws governing the operation, and competition. A product’s supply is subject to the relative price of the product, which is factored by considering the price of competing products in the market, alongside quantity, where a surplus of products dictates price.

U.K. Competitiveness

Based on the U.K.’s economic performance indicators, there has been a slight improvement in the global competitiveness index (GCI). However, there is an indication that the overall tendency remains down. These are emblematic of the challenges facing the U.K. economy as faced by the consumer (Figus et al., 2018, p. 106). Since 2008, the Brexit vote, the level of competitiveness in the U.K. and hence for Rolls Royce has been dire. That has contributed to why the company has been experiencing financial challenges in the past three years. The impact on the future shows the company is in a weaker position to compete against its rivals effectively.

Recently, COVID-19 posed a random economic shock resulting in changes in how the U.K. government approached its fiscal policy. The U.K. reported a 9.7 percent decline in its GDP in 2020, which was the steepest since 1948 (Harari et al., 2021). Based on the severe economic impact of the pandemic, Rolls Royce reported its worst-ever loss of £4 billion for the fiscal year ending 2020, resulting in the firm rising by £7 billion to secure its future (Sillars, 2021). The U.K. government countered the impact of the pandemic by implementing the U.K. and pan-E.U. initiatives that helped the region to absorb the shock of the pandemic.

Business Problems and Challenges Faced by Rolls Royce

In addition to economic issues realized with COVID-19, Rolls Royce experienced business challenges with its Trent 1000 engine. The several difficulties that afflict the firm were attributed to its ability issues to restore the Trent 1000 engine (Perry, 2019). The other issue was how the engine problem would damage the company’s reputation, where Rolls Royce enjoys a monopoly position for the Airbus 350 and A330neo (Perry, 2019). A willingness to accept the blame was associated with a diminished engineering excellence reputation. This issue has decreased customers’ loyalty and less people trusted the company causing falls in sales which ruined previous stability of the business. Employees have faced lack of support and specific training making competitors more attracting for those who decided to leave Rolls-Royce.

Conclusion

Rolls-Royce Holdings PLC.’s SIC codes position it in the aerospace and defense industry, where the company is responsible for the development, manufacturing, marketing, and sales of engines. The firm uses the power-by-the-hour business model and hierarchical organizational culture and structure responsible for its management. The steeple analysis of the organization is performed and narrows down to which business environment Rolls-Royce operates. The findings from the coursework show that, in addition to the economic challenges resulting from COVID-19, the firm has been struggling with engine problems, which might diminish the firm’s engineering reputation.

Reference List

Emprechtinger, F. (2018). 3 famous business model innovations and what you can learn from them. [online] Lead-innovation.com. Web.

Figus, G., Lisenkova, K., McGregor, P., Roy, G., & Swales, K. (2018). ‘The long‐term economic implications of Brexit for Scotland: An interregional analysis’, Papers in Regional Science, 97(1), pp. 91-115. Web.

Financial Times, 2022. Rolls-Royce Holdings PLC, RR.: LSE profile – FT.com. [online] Markets.ft.com. Web.

GOV. U.K., 2022. Rolls-Royce Plc overview – Find and update company information – GOV.UK. [online] Web.

Harari, D., Kemp, M. and Brien, P., 2021. Coronavirus: Economic impact. [online] commons library.parliament. U.K. Web.

Rolls Royce Holdings Plc, 2019. Rolls Royce Holdings Plc Annual Report. [online] Web.

Rolls Royce Holdings Plc, 2020. Rolls Royce Holdings Plc Annual Report. [online] Web.

Rolls-Royce Plc, 2022. Ethics and compliance. [online] Rolls-royce.com. Web.

Sillars, J., 2021. COVID-19: Rolls-Royce blames ‘severe impact’ of the pandemic as it dives to £4bn loss. [online] Sky News. Web.

Appendix: Determinants of supply in the business